Market Summary:

Any concerns that the ISM services PMI could move closer to (or within) contraction were promptly swept aside with Monday's report, which saw the headline PMI expand at its fastest pace in four months. S&P Global’s services PMI for the US was also above expectations.

Most importantly, ISM employment, new orders and prices paid expanded - and these were the internal indices of concern in from the prior report.

Specifically, prices paid (a proxy for inflation) expanded at its fastest pace in 11 months and the m/m read increased at its highest rate since February 2021.

Fed fund futures still imply a cut in May with a 52.6% probability (good luck with that...) but from there on out, any expectations of a cut are all <50%.

- The USD remained dominant following the better-than-expected ISM services report and of course Friday's bumper NFP, sending the US dollar index to an 11-week high.

- USD/JPY briefly traded at a 10-week high, although the day’s range was less than a third of Friday’s

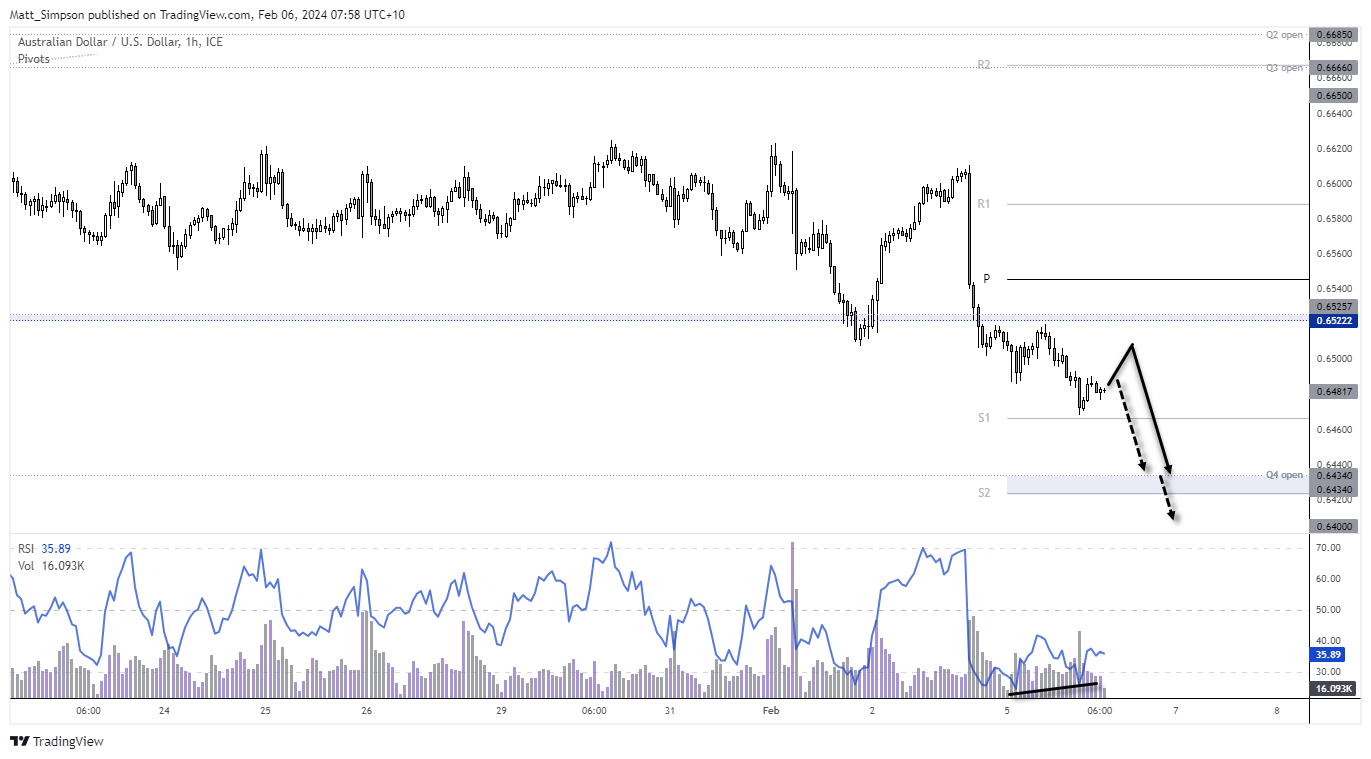

- AUD/USD closed below 65c for the first time in 11 weeks ahead of today’s RBA meeting, where the a dovish statement or press conference could send it lower

- US yields were also higher across the curve whilst bets of multiple Fed cuts this year diminished.

- Wall Street indices were lower but seemed to take it all within stride, with Monday’s small daily ranges remaining within Friday’s range, just beneath their all-time highs.

- Gold fell for a second day ad trades at $2024, but at this stages I suspect it will hold above $2000

- Crude oil looks to have found some stability around $72 with a small-range doji on the daily timeframe. Given its deep retracement over the past week, a minor bounce may be in order.

- The Bank of Canada’s quarterly survey of market participants showed expectations of four BOC rate cuts in 2024 to begin in April.

Events in focus (AEDT):

- 09:00 – Australian

- 11:00 – Fed Harker speaks

- 11:30 – Australian retail sales (final)

- 14:30 – RBA interest rate decision, statement

- 15:30 – RBA press conference

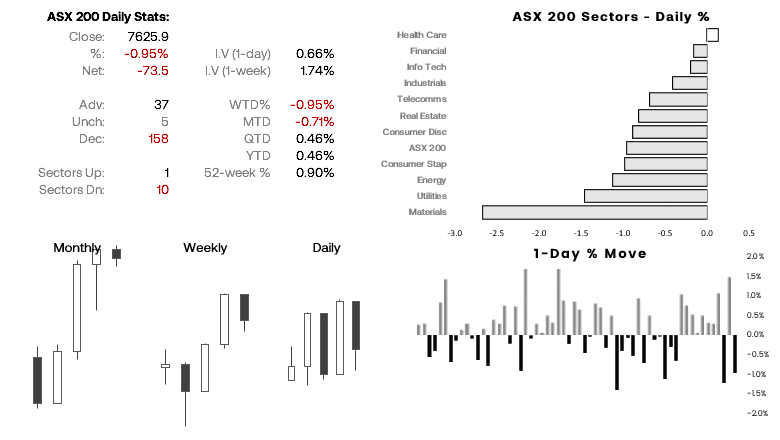

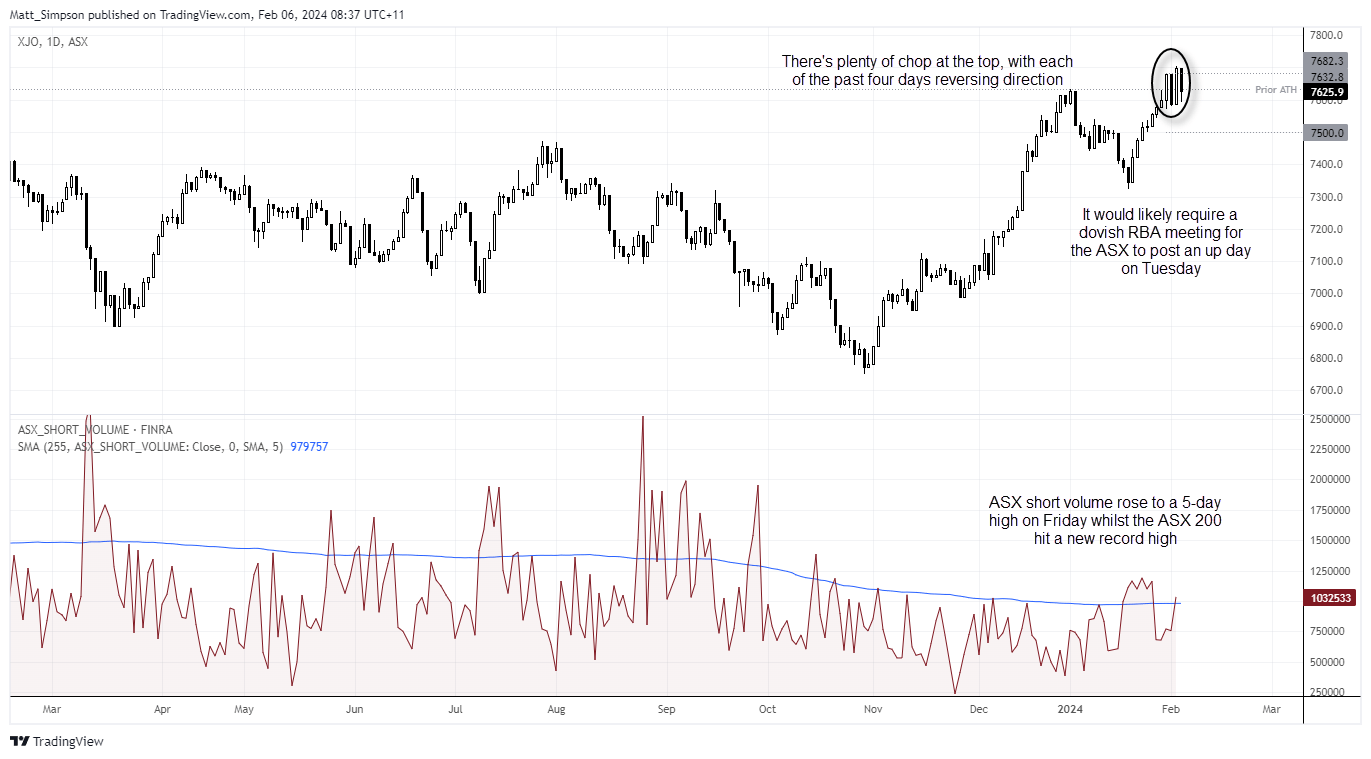

ASX 200 at a glance:

- The ASX 200 cash index faltered at 7700 and handed back most of Friday’s gains

- 10 of its 11 sectors declined, led by mater4ials and utilities

- 158 stocks declined (79%), 37 advanced (18.5%), 5 were unchanged (2.5%)

- Short volume of ASX rose to a 5-day high on Friday, ahead of Monday’s selloff (we can presume short sales would have risen considerably yesterday)

- The daily direction for the ASX 200 has alternated each of the past four days, but with a soft lead from Wall Street and lower SPI 200 futures, a second consecutive down day could be on the cards (unless the RBA’s meeting is more hawkwish than expected)

AUD/USD technical analysis (1-hour chart):

The strength of the US dollar saw AUD/USD closed beneath 65c, although the 1-hour chart shows it found support at the weekly S1 pivot point and a bullish RSI divergence has formed. For us to expect AUD/USD to perform a strong rally today likely requires the RBA to keep the threat of further hikes in the table. Seeing as I see this as an unlikely scenario, I would prefer to fade into any bounce on the assumption it won’t last. Besides, we’ve seen a bear flag breakout on the daily chart which projects a target around 64c. From here, nears could look to fade into moves towards 0.6500 and initially target the Weekly S2 pivot / Q4 open, ahead of the 64c bear-flag target.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade