On Friday, the US released January’s Non-Farm payrolls data. The headline print was 517,000 vs an expectation of only 185,000 and a revised December print of 260,000. Although there were updated season adjustments and benchmark revisions, it still turned out to be a beat of over two and a half times expectations. In addition, the Unemployment Rate fell to 3.4% vs an expectation of 3.6% and a prior reading of 3.5%. This was the lowest reading since 1969! As a result, markets took this as a cue that the Fed isn’t done hiking rates yet and traders sent the US Dollar soaring, taking USD/JPY along for the ride. However, on Monday, USD/JPY gapped higher for a different reason. Talk over the weekend was that BoJ Deputy Governor Amamiya would be selected to replace BoJ Governor Kuroda when his term expires in April. Amamiya is seen as one of the more dovish candidates for BoJ Governor and would likely continue with easy monetary policy. There have been some lately who have suggested a complete review of the way monetary policy is conducted in Japan. However, if Amamiya were selected as BoJ Governor, the review may not matter. As a result, Yen moved even lower on Monday’s reopening.

Everything you need to know about the BoJ

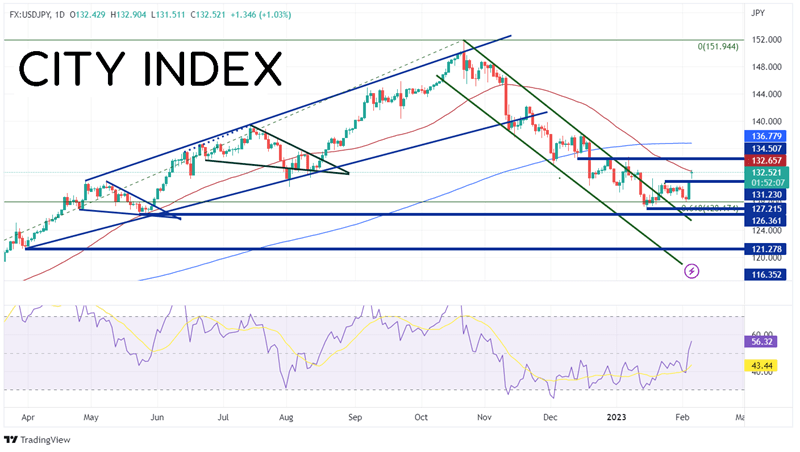

USD/JPY had been moving lower since reaching 20-year highs on October 21st at 151.94. The pair fell in an orderly channel but ran into support at the 61.8% Fibonacci retracement from the lows of 2022 to the highs of 2022 near 127.22 on January 16th. Since then, USD/JPY has been trading in a sideways range between 127.31 and 131.57. However, on Monday’s reopening, the pair gapped higher above the range to 132.42 and is trading near the 50 Day Moving Average at 132.65.

Source: Tradingview, Stone X

Trade USD/JPY now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

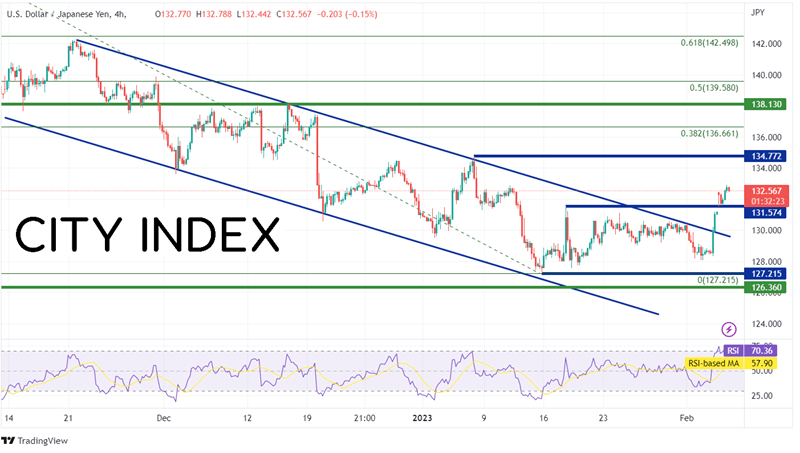

On a 240-minute timeframe, USD/JPY formed a tighter downward sloping channel of its own. However, notice on Friday that the pair moved above the top trendline of that channel. USD/JPY closed the day at 131.18 and gapped higher on Monday to 132.43. The pair tried to pull back and fill the gap, but was held at the highs of the previous range near 131.57. If USD/JPY continues to move higher, the first level of resistance isn’t until the highs from January 6th at 134.77. Above there, price can move to a confluence of resistance at the 38.2% Fibonacci retracement from the October 2022 highs to the January 16th lows and 200 Day Moving Average (see daily) at 136.66/136.78, then prior support/resistance at 138.13. However, notice the RSI on the shorter timeframe is in overbought territory and turning down. This is an indication that price may be ready to pull back. First support is at Monday’s low of 131.51. The next support is the gap fill at 131.20, then the top trendline of the downward sloping channel near 129.85.

Source: Tradingview, Stone X

Over the course of the last 2 trading days, USD/JPY has moved from a low of 128.33 to a high of 132.90, a move of 457 pips. Will the pair continue to move higher? As long as the Fed is seen as hawkish or the BoJ is seen as dovish, the pair should continue to move higher. Fed Chairman Powell is due to speak on Tuesday at the Economic Club of Washington. Watch for any clarifications from the recent FOMC or from the Non-Farm Payroll. Manage risk accordingly.

Learn more about forex trading opportunities.