Market Summary:

The Fed held their policy unchanged as widely expected, and pushed against an imminent hike at subsequent meetings. Whilst money markets had scaled back bets of aggressive tightening this year over the past couple of weeks, they were still trying to price in a March cut. But that is now dead in the water following comments from Jerome Powell. Regular readers will know that this has been my view, and that market pricing was too aggressively priced for multiple cuts given the strength of the US economy.

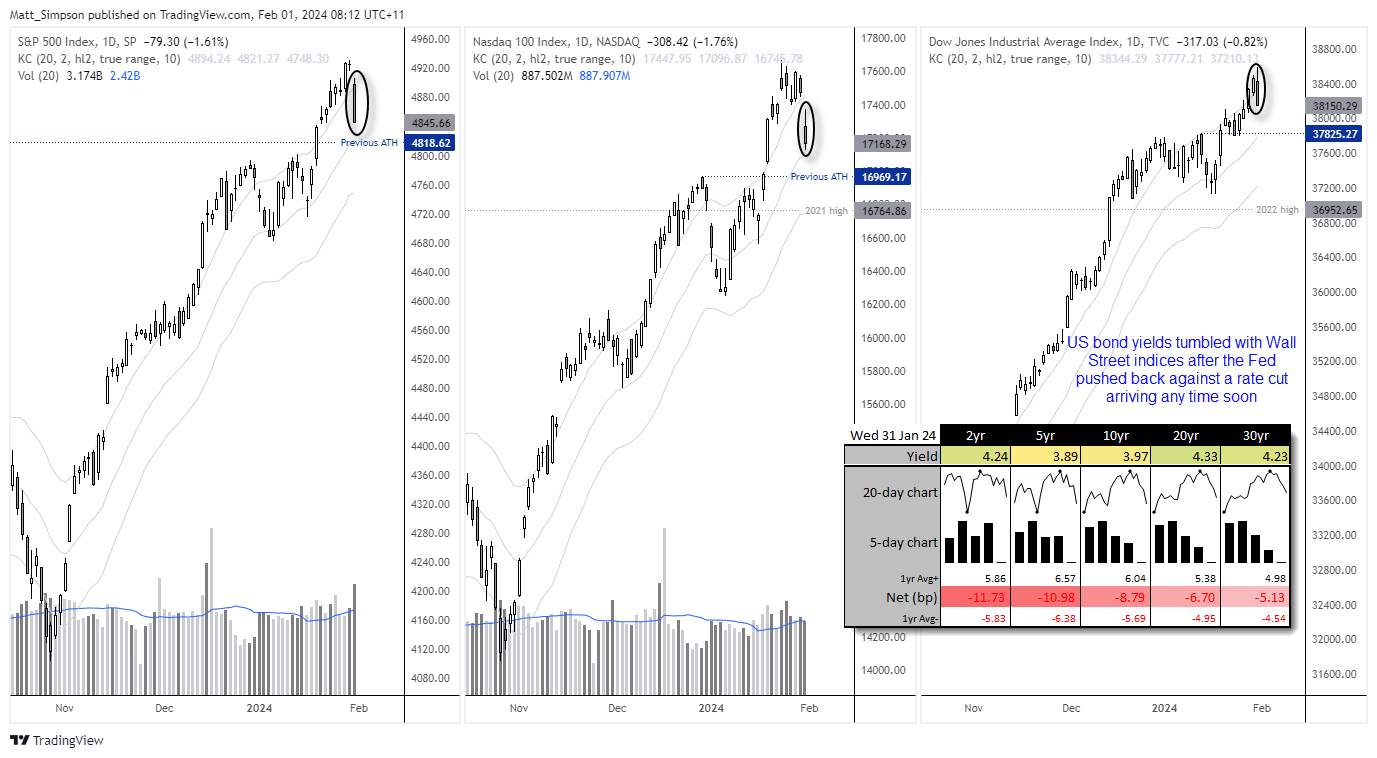

Wall Street indices took this ‘revelation’ quite hard, with the S&P 500 suffering its worst day since September, the Nasdaq 100 falling around -1.8% and the Down Jones forming a bearish outside day at its record high. Gold handed back all of its earlier gains to close the day with an inverted hammer candle.

AUD/USD fell to a 7-day low to confirm the bear-flag breakout I ‘flagged’ a couple of times this week. If we see a decent ISM and NFP report this week and the RBA tip their hat to lower inflation at Tuesday's meeting, a break below 65c seems plausible.

As my colleague David Scutt pointed out, there is now a growing case that the RBA could cut rates ahead of the Fed given Australia’s soft inflation report yesterday. Personally, I am of the view that the RBA may at least hold out until the Fed begin hinting at an imminent cut, given their tendency to simply follow the Fed.

Summary of the Fed statement

- Economic activity has been expanding at a solid pace

- Job growth has moderated but remains solid and unemployment remains low

- Inflation has eased but remains elevated

- Not appropriate to cut rates until the Fed gains greater confidence that “inflation is moving sustainably toward 2 percent”

- QT to continue

Comments from Jerome Powell’s press conference

- We’re not looking for inflation to tap 2% once; we’re looking for it to settle out at 2%

- We’re not looking for inflation to anchor below 2%

- I don’t think it is likely we will have a rate cut in March

- We will be reacting to data

- There are risks that would make us go slower or faster on rate cuts

Events in focus (AEDT):

- 09:00 – Australian building approvals, import/export price index, quarterly business confidence (NAB)

- 11:30 – Japan’s manufacturing PMI (Jibun Bank)

- 12:45 – China’s manufacturing PMI (Caixin)

- 16:30 – Australian commodity prices

- 20:30 – UK manufacturing PMI

- 21:00 – Eurozone CPI

- 23:00 – BOE interest rate decision, meeting minutes, MPC votes to cut/hike

- 23:00 – US Challenger job cuts

- 02:00 – ISM manufacturing PMI

ASX 200 at a glance:

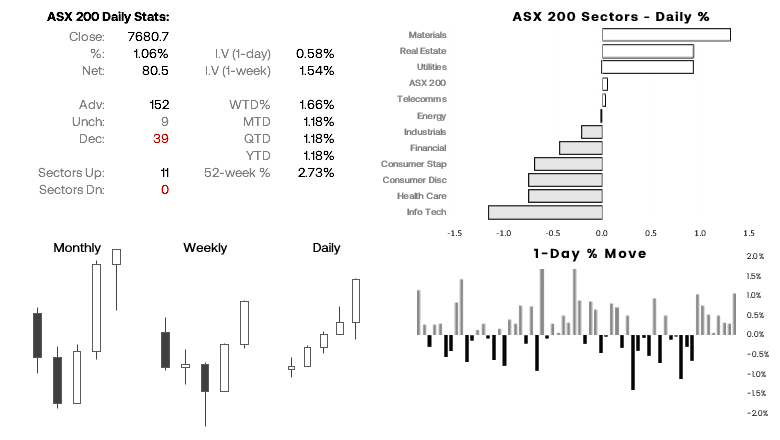

- The ASX 200 rose for an eight day and hit a record high, thanks to soft CPI figures for Australia on Wednesday

- SPI 200 futures rallied for a ninth day and also hit a new all-time high, but it appears to have sobered up and formed a 2-day bearish reversal pattern with a bearish RSI divergence

- The ASX 200 cash index is expected to gap sharply lower given the weak lead from Wall Street

- A move down to 7500 now seems plausible as we head towards next week’s RBA meeting, but it might find some support if the RBA deliver a relatively dovish hold

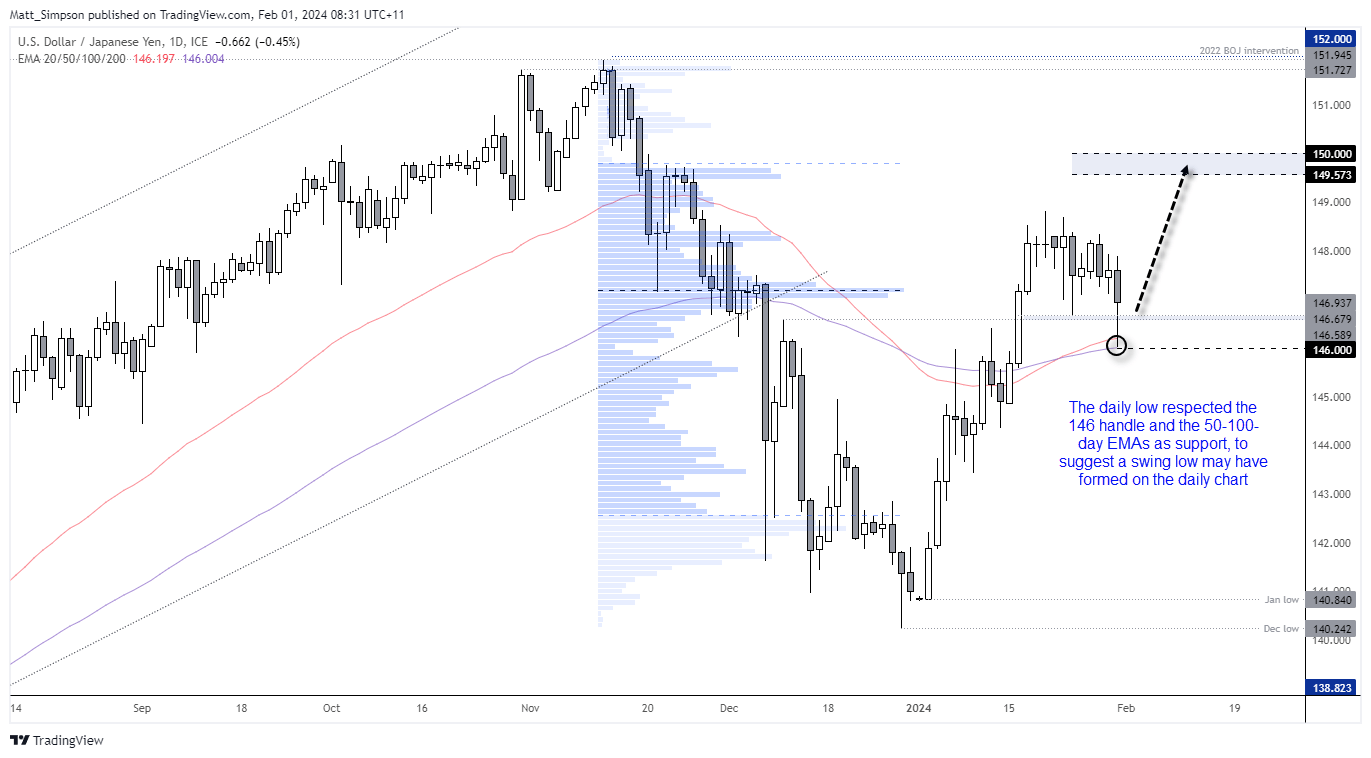

USD/JPY technical analysis (chart):

The daily chart shows that USD/JPY tried but failed to break the 146 handle, and the lower daily wick respected the 50/100-day EMAs before the pair recouped ~half of the day’s earlier losses. I suspect an important swing low has formed and that momentum could now try to turn higher.

The bias remains for a move up towards the 149.50 – 150 resistance zone, and bulls could seek entries around current levels or dips towards support levels. The bias remains bullish whilst prices remain above the 146 handle.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade