Market Summary:

- Jerome Powell said what traders wanted to hear during his testimony to the House Committee; rate cuts are coming

- This sent the US dollar broadly lower on renewed optimism that the Fed’s dovish pivot is finally here, although ignored the part where he said cuts would only arrive if further evidence warranted easing

- USD/JPY closed at a 3-week low, EUR/USD rose to a 5-week high and looks set to break above 1.09

- As for the elections, Powell said the Fed would “keep our heads down”, meaning they would not bae their policy to appease any party

- And on that note, Nikki Haly withdrew from the race to the Whitehouse to ensure Trump will be the Republican nominee for the Whitehouse

- The Bank of Canada held rates at 5%, and pushed back against doves by saying that they do not expect to get back to 2% inflation this year and the “clear consensus inside governing council” called for rates to stay at 5%

- Gold closed at another record high on renewed bets of Fed easing

- WTI crude prices rallied over 3.5% by the intraday high as US inventories rose less than expected

Events in focus (AEDT):

- 10:00 – Japan’s wages data

- 10:50 – Japan’s foreign investment in bonds, stocks

- 11:30 – Australia’s trade balance

- 12:30 – BoJ Board Member Nakagawa Speaks

- 14:00 – China’s trade balance

- 23:30 – US job cuts

- 00:30 – US jobless claims, trade balance

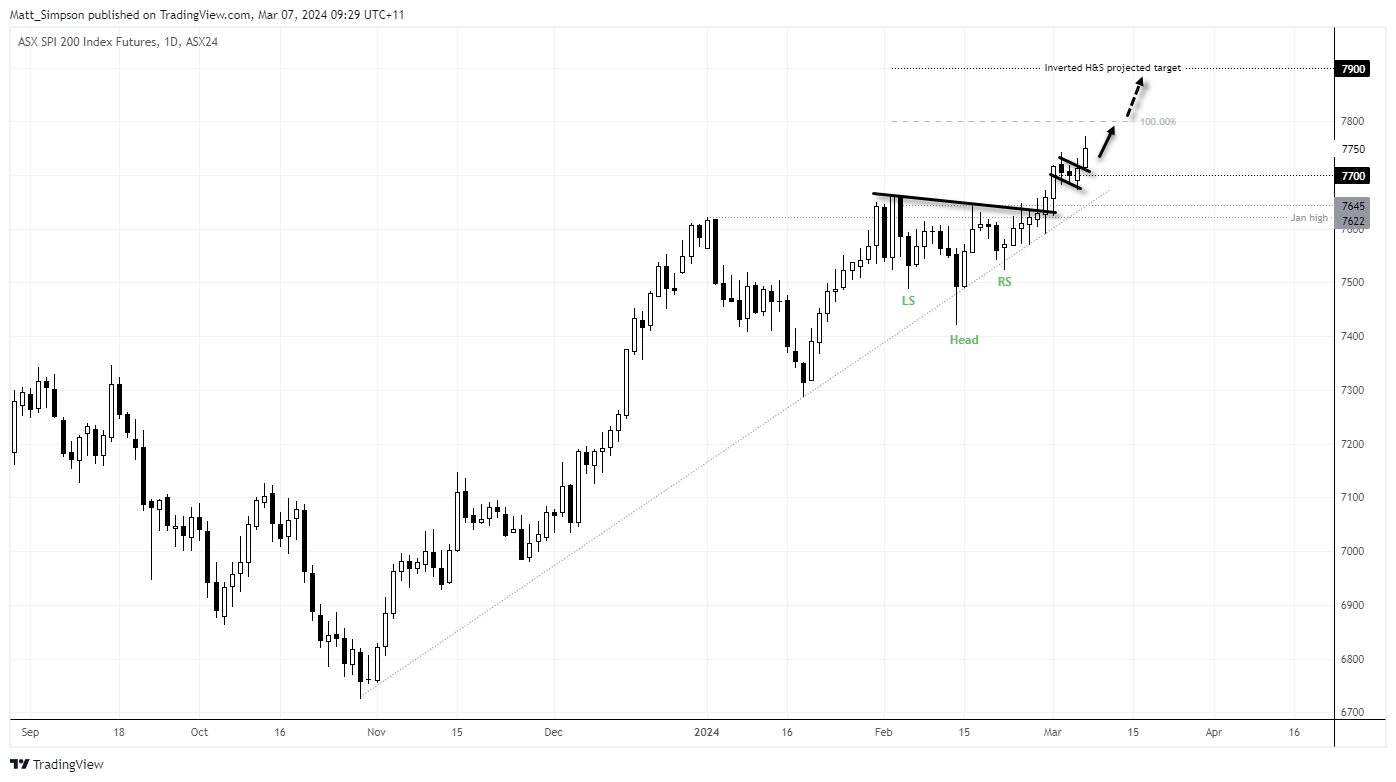

ASX 200 technical analysis:

The bullish bias for the ASX 200 is playing out well. AN inverted head and shoulders pattern (bullish continuation during an uptrend) projects a target around 7900. A bull flag also projects a target around 7285, and the 100% projection of the prior rally sits on 7800. Momentum clearly favours bulls thanks to renewed bets of RBA easing, therefore we prefer to buy dips on intraday timeframes and target 7800 and hopefully beyond.

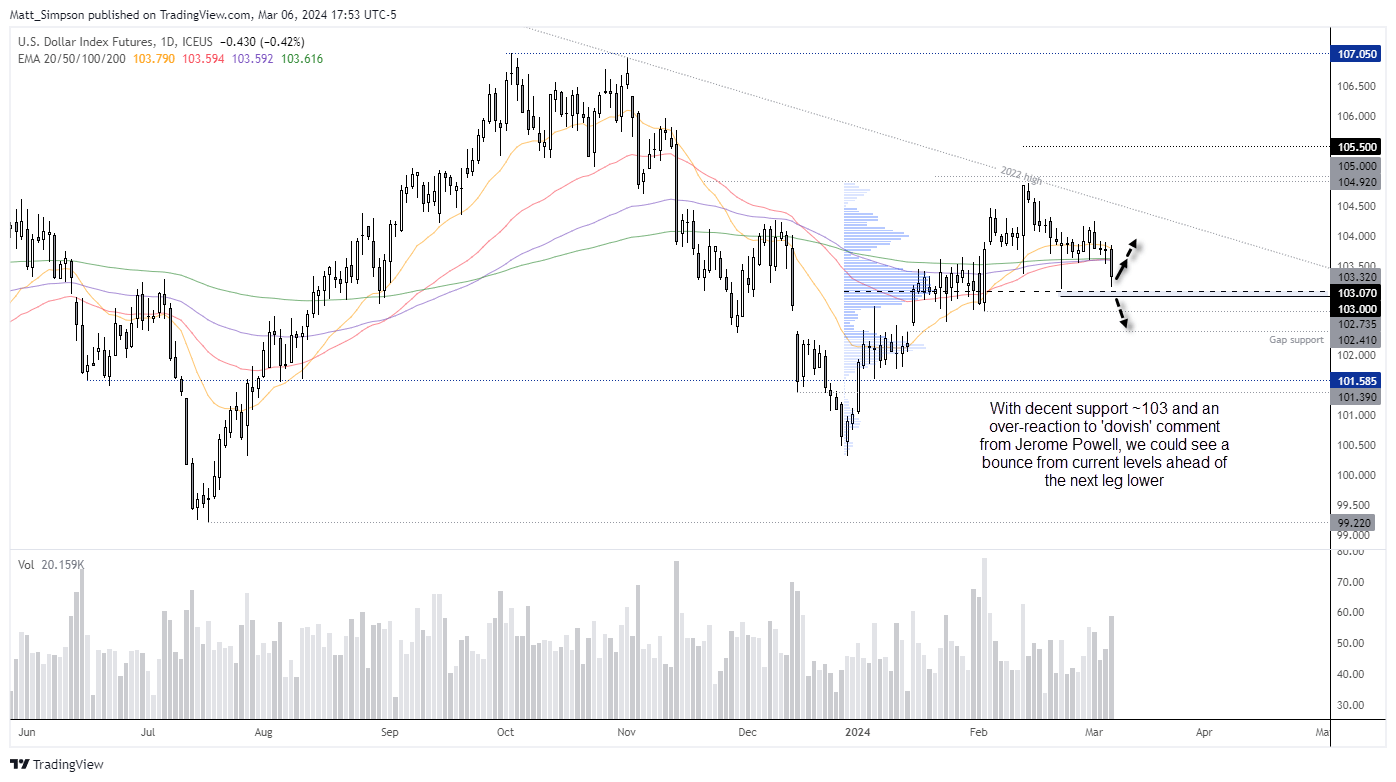

US dollar index technical analysis:

The US dollar index broke convincingly below the cluster of moving averages, but bears could not quite drive it down to 103. There is a high volume node around 103 which makes it a likely support level. And as I suspect traders have placed too much emphasis on Powell’s supposedly dovish comments, I do not expect 103 to simply give way. And that leaves the potential for a bounce from current levels. Bulls could enter long with a stop below 103 and a target around the MA cluster, and allow incoming data to dictate its potential to rally further or eventually break below 103.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade