Market Summary:

- The US dollar suffered its worst week of the year, following dovish comments from Jerome Powell and a relatively weak Nonfarm payrolls report

- Jerome Powell made the first real mention of rate cuts during his testimony to the House Committee, the US unemployment rate rose to a 2-year high of 3.9% and January’s job-growth figure was revised lower to 167k

- Whilst 275k jobs were added in February, the NFP report was furtherer evidence of a potential turning point in the US economy

- The US dollar index fell for a sixth day, although it did print a bullish pinbar as prices recovered ahead of the weekend as bears presumably booked profit

- And with the US dollar literally being thrown overboard last week, it leaves the potential for a bounce unless CPI data this weeks comes in softer

- And gold has more than loved the rally, rising for seven consecutive days and reaching yet another record high

- Crude oil price action is on the ‘fugly’ side, and not a market I feel compelled to pick a direction on tight now given its choppy price action on the daily chart an inability to hold above $80. If I had to pick ‘a side’ then it would be bearish, but it doesn’t make much sense with the fundamentals. Hence the call to step aside.

- The S&P 500 and Nasdaq 100 enjoyed very brief record highs on Friday before forming bearish outside days at their record highs

Events in focus (AEDT):

- 10:50 – Japan’s GDP, capex, private consumption, price index, M2 money supply

- 17:00 – Japan’s machinery tool orders

- 01:00 – US employment trends index (Consumer Board)

- 02:00 – US 1, 3 and 5-year inflation expectations (New York Fed)

- 04:00 – UK member Mann speaks

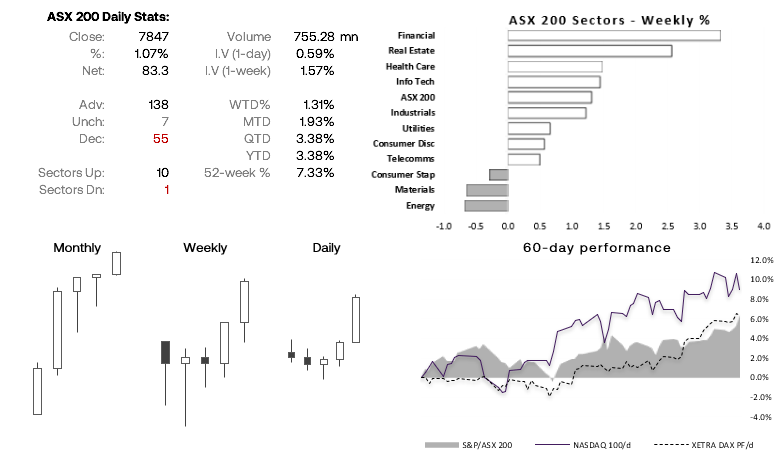

ASX 200 at a glance:

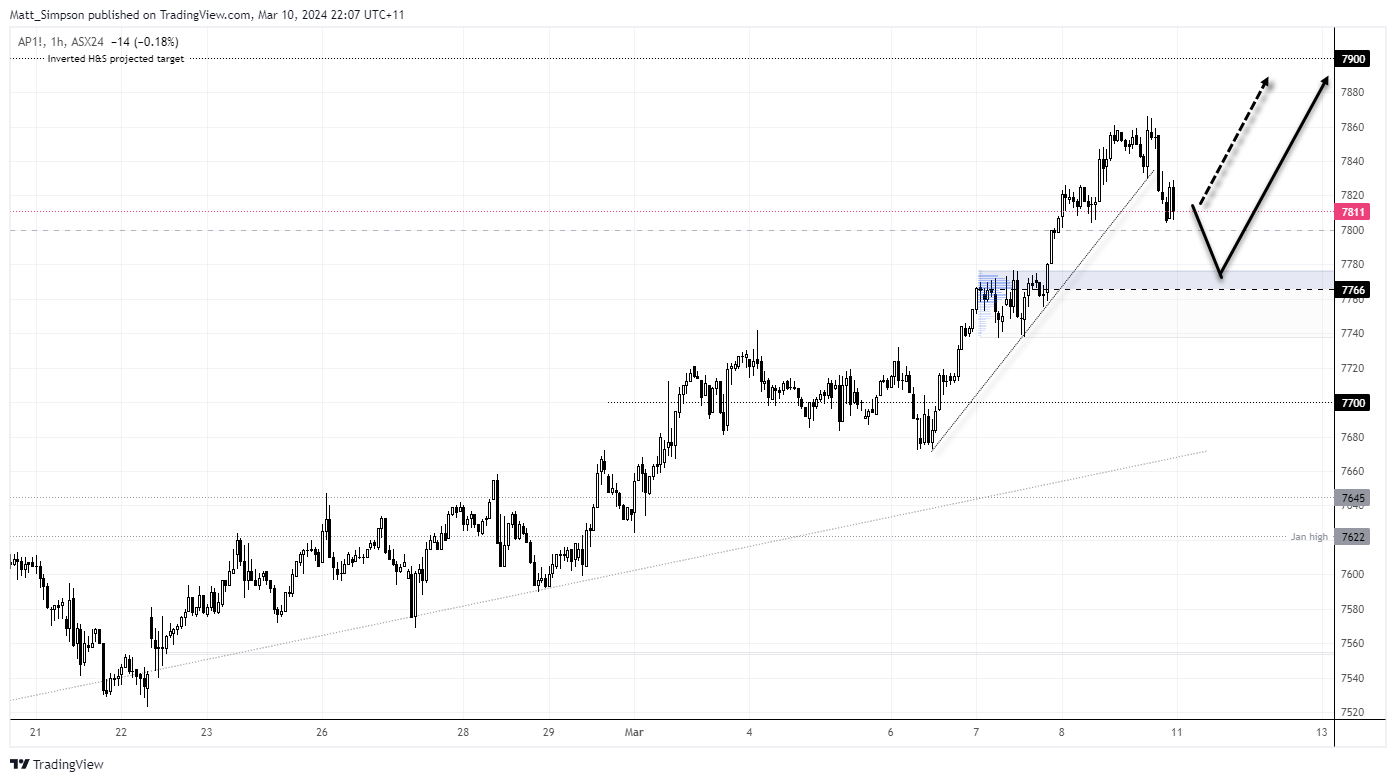

- The ASX 200 cash index rose for a third week and closed at a record high, with 7900 seemingly with easy reach for bulls (the upside target projected from an inverse head and shoulders pattern on the daily chart)

- 8 of its 11 sectors advanced last week, led by finance and real estate – likely given renewed bets of central banks cutting interest rates

- I still suspect a move to 7900 is on the cards for the ASX, although the potential for a deeper pullback on Monday seems feasible

- Should prices retrace lower, bulls could seek evidence of a swing low around the prior congestion zone, particularly if support is found around its own VPOC near 7766

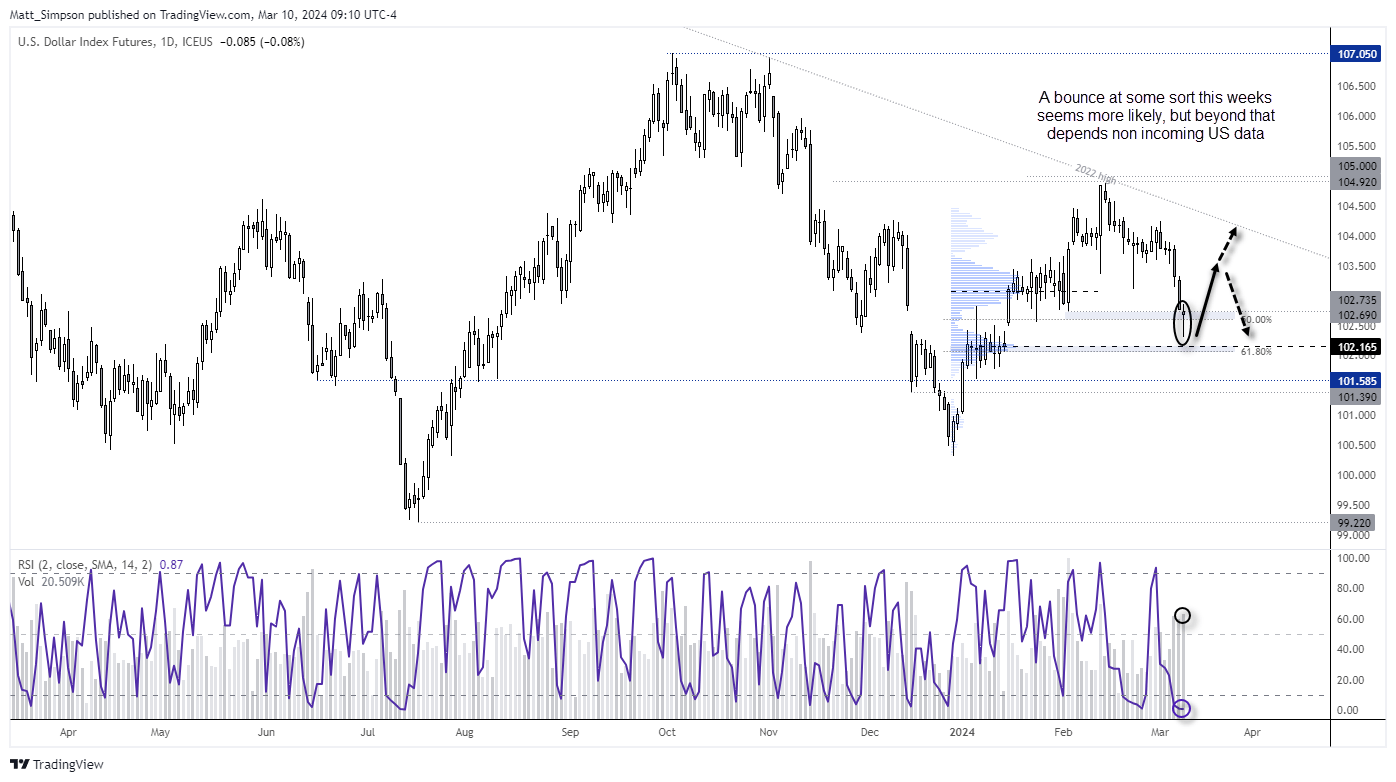

US dollar index technical analysis:

The RSI (2) indicator reached its most oversold level since July 2023 on Friday. That doesn’t necessarily mean it is oversold, but it should at least be considered by those wanting to wade into USD short positions this week. Furthermore, a bullish pinbar formed and its daily volume was the highest in nearly four weeks, so it could suggest a ‘change in hands’ between sellers to buyers. Not bottom picking is neither pretty or always timely. But given Friday’s low formed above a high-volume node, I would personally see any dips towards 102.20 as a reason to at least look for evidence of a swing low. And if buying USD is not the preference, perhaps bears could step aside until evidence of a swing a swing high form on the daily timeframe.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade