Market Summary:

- Wall Street traded around its record highs and prior day’s small range, showing that neither bulls nor bears are ready to make their mark at these highs.

- That means we didn’t see the gap lower on the S&P 500 to mark a bearish island gap reversal, and that risk seems to be supported - even if it has paused for breath

- This also allowed AUD/USD and NZD/USD to hold their ground despite sending risk-off warning sigals on Monday

- There were no surprises from the BOJ who held policy unchanged yet again, although they downgraded their FY 2024 CPI forecast to further lower expectations of a policy change any time soon

- This resulted in a weaker yen during the Asian session, although we failed to see any breakout on either AUD/JPY or GBP/JPY, with the latter leaving a double top right on the 2015 high around 189

- Reports of a ¥1 trillion stimulus package failed to revive Chinese equity markets to any notable degree, but it did helped AUD/USD pop higher through the 0.66 resistance level before reverting lower to effectively close flat with a long-legged doji (long upper and lower wicks).

- Netflix reported much stronger-than-expected subscriber numbers in Q4,adding 13.1 million subscribers during its best quarter ever

- An inside day formed on WTI crude oil, although its lower wick probed the 73.60 – 74.00 zone outlined in yesterday’s European report – a level I noted as favourable for dips. Hopefully momentum can now turn high and head for the $77 target near the 200-day EMA and MA, and now looking for prices to hold above yesterday’s low.

- New Zealand inflation was above RBNZ’s own estimates, with non-tradable pointing towards a domestic inflation problem and likely pushing back expectations of an EBNZ cut any time soon

Events in focus (AEDT):

- 09:00 – Australian flash PMIs (manufacturing, services, composite)

- 10:50 – Japan’s trade balance

- 11:00 – Australian leading index

- 11:30 – Japan’s flash PMIs (manufacturing, services, composite)

- 19:15 – French flash PMIs (manufacturing, services, composite)

- 19:30 – Germany flash PMIs (manufacturing, services, composite)

- 20:00 – Eurozone flash PMIs (manufacturing, services, composite)

- 20:30 – UK flash PMIs (manufacturing, services, composite)

- 01:45 – US flash PMIs (manufacturing, services, composite)

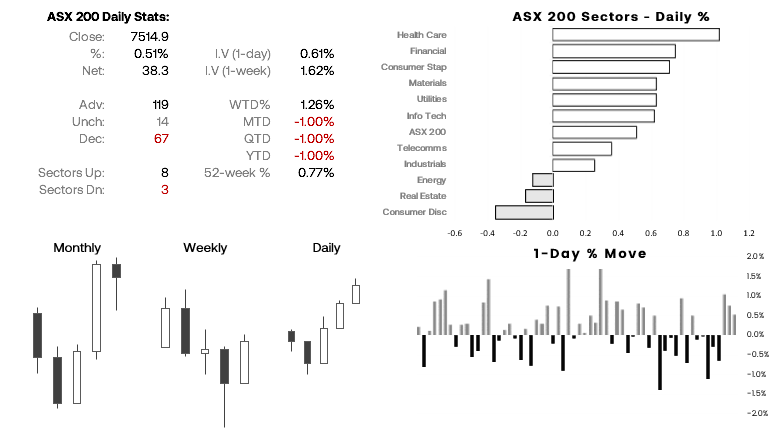

ASX 200 at a glance:

- The ASX 200 rose for a third day, and is expected to open slightly higher with Wall Street and SPI futures ticking higher on Tuesday

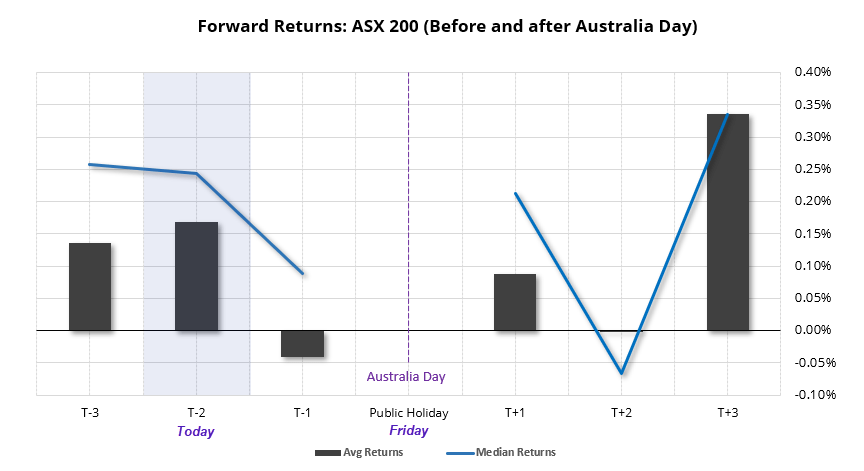

- Forward returns analysis around Australia Day (Friday) shows that the ASX 200 has averaged a return of 0.17% two days prior to the public holiday (today)

- It’s average positive return is 0.84%, its average negative return is -0.9% with a win rate of 61%

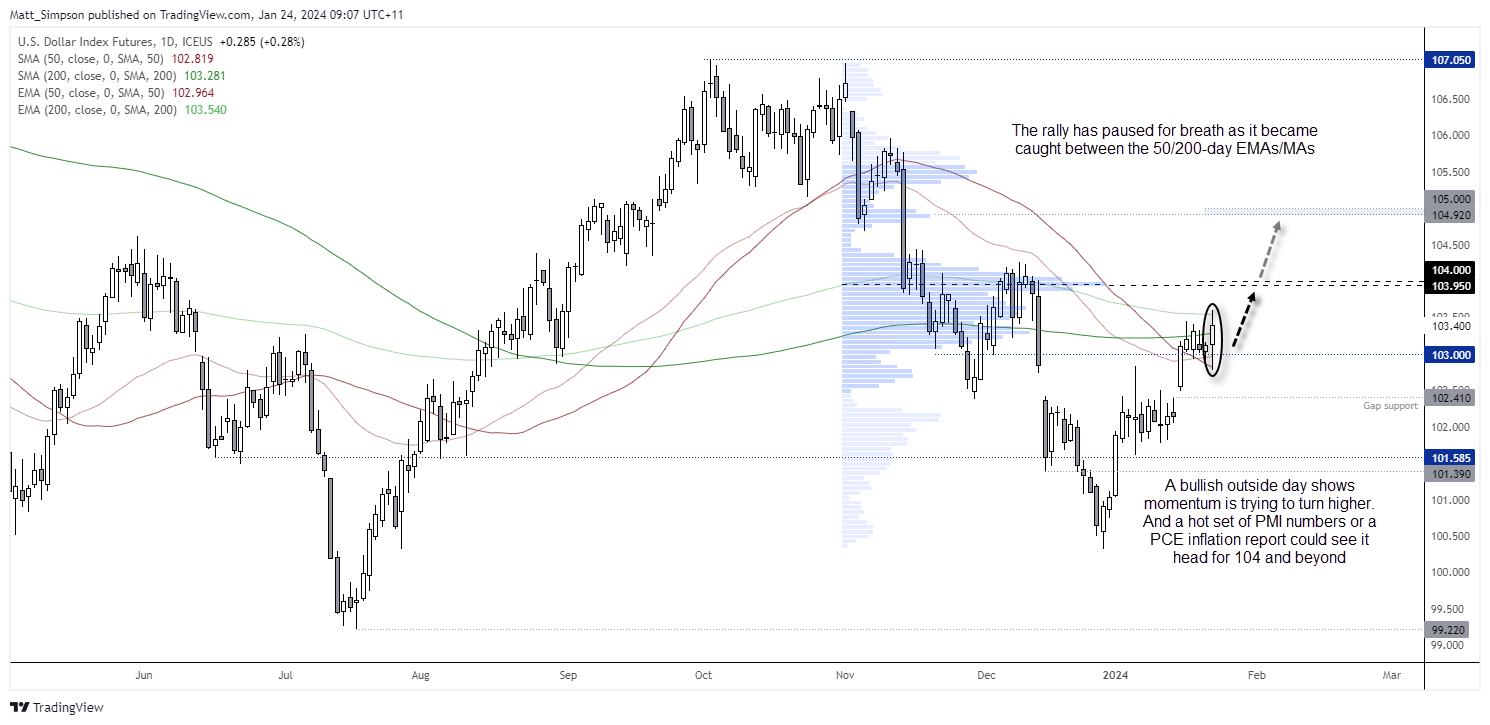

US dollar index technical analysis (daily chart):

The US dollar index formed a bullish outside day, although the upper and lower wick account for around two thirds of its daily range. This may be because the US dollar index is trapped between the 200-day EMAs and MAs, which are key levels for traders to watch. And whilst it closed slightly above the 200-day average, it met resistance at the 200-day EMA. Despite this, the bias is for another leg higher for the US dollar now its trend has paused for breath. I expect Fed members to continue pushing back on imminent rate cuts whenever the opportunity arises. And what could really seal the deal for another bullish leg is for today’s flash PMI data and Friday’s PCE inflation report to be hotter than liked.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade