EUR/USD falls post US CPI & ahead of retail sales

EUR/USD is falling after two straight days of gains after sticky US inflation and hawkish comments from Fed President Lorie Logan raise concerns of a more hawkish Federal Reserves.

After US CPI cooled by less than expected to 6.4% YoY in January, hopes of a rapid disinflation eased, and Investors are anticipating a 25 basis point rate hike from the Fed in March and May, taking the rate to 5.25%.

Meanwhile, the euro found some support yesterday from GDP data showing that the bloc’s economy grew 0.1% QoQ in Q4, avoiding a contraction. The data comes after upbeat forecasts from the European Commission, which sees the eurozone avoiding a recession this year.

Today, attention will be on US retail sales, which are expected to rebound, adding to the inflation story. Sales are forecast to rise 1.8% MoM, up from -1.1% decline in December. Strong retail sales could lift the USD further.

In Europe, Eurozone industrial output is expected to fall -0.8% MoM in December after rising 1% in January.

ECB President Lagarde is also due to speak.

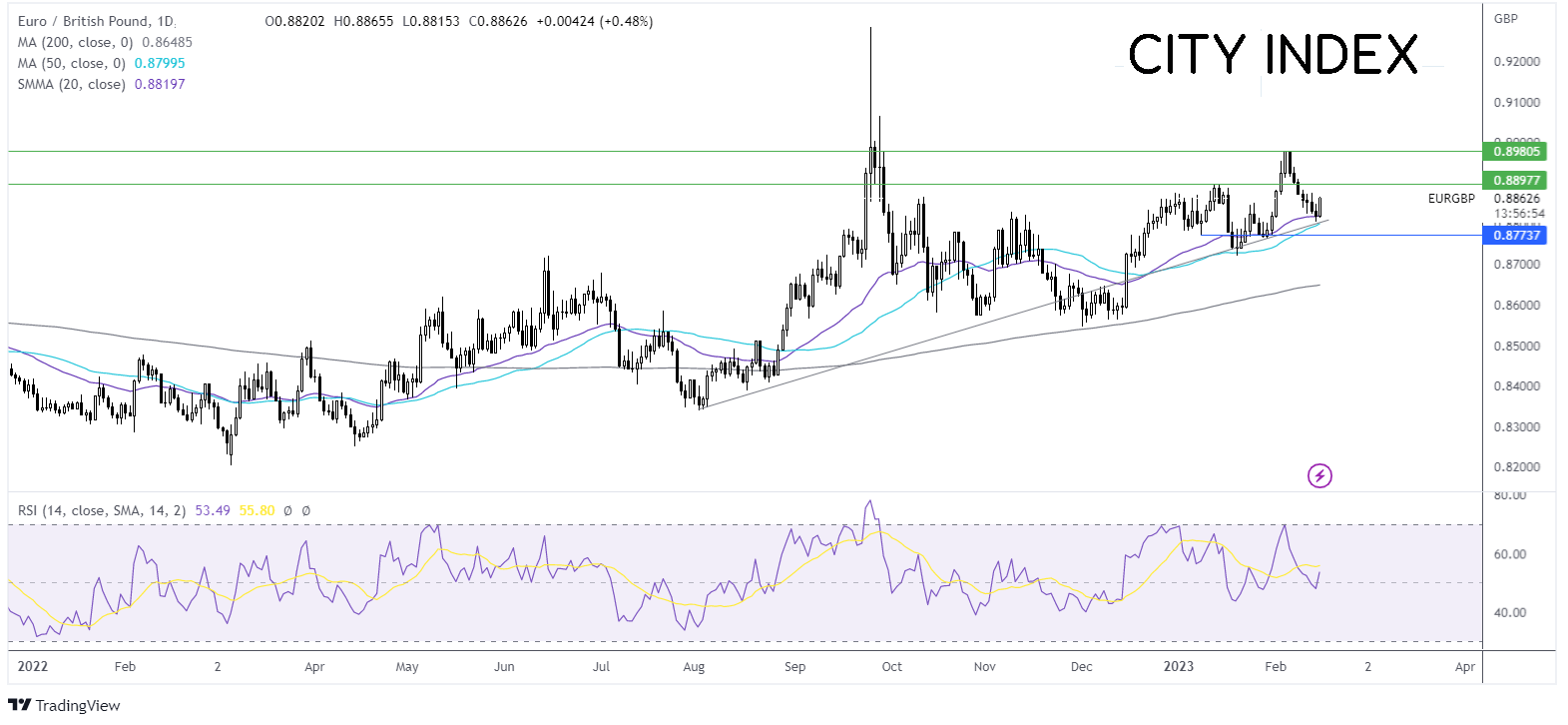

Where next for EUR/USD?

EUR/USD broke out below the rising wedge pattern, dropping to a low of 1.0655. The pair is now consolidating, capped on the upside by 1.08 and on the lower side by 1.0655. The RSI is below 50, favoring sellers.

Sellers could look for a fall below 1.0655, the February low to expose the 100 sma at 1.0525 and the 2023 low of 1.0480.

Buyers could look for a rise over 1.08 to create a higher high and target 1.0930, the January high.

EUR/GBP rises after weaker-than-forecast UK inflation

The pound is falling reversing gains from the previous session after UK's CPI inflation continued to fall in January.

UK CPI cooled by more than expected to 10.1% from 10.5% in December. Expectations has been for a full 10.3%, thanks in part to falling petrol prices.

Falling services inflation (6% from 6.8%) will be well received by the BoE, particularly after yesterday’s stronger-than-expected wage growth figures.

The data raises questions about the March BoE monetary policy meeting. Investors are reining in expectations of a 25 basis point hike, pulling the pound lower.

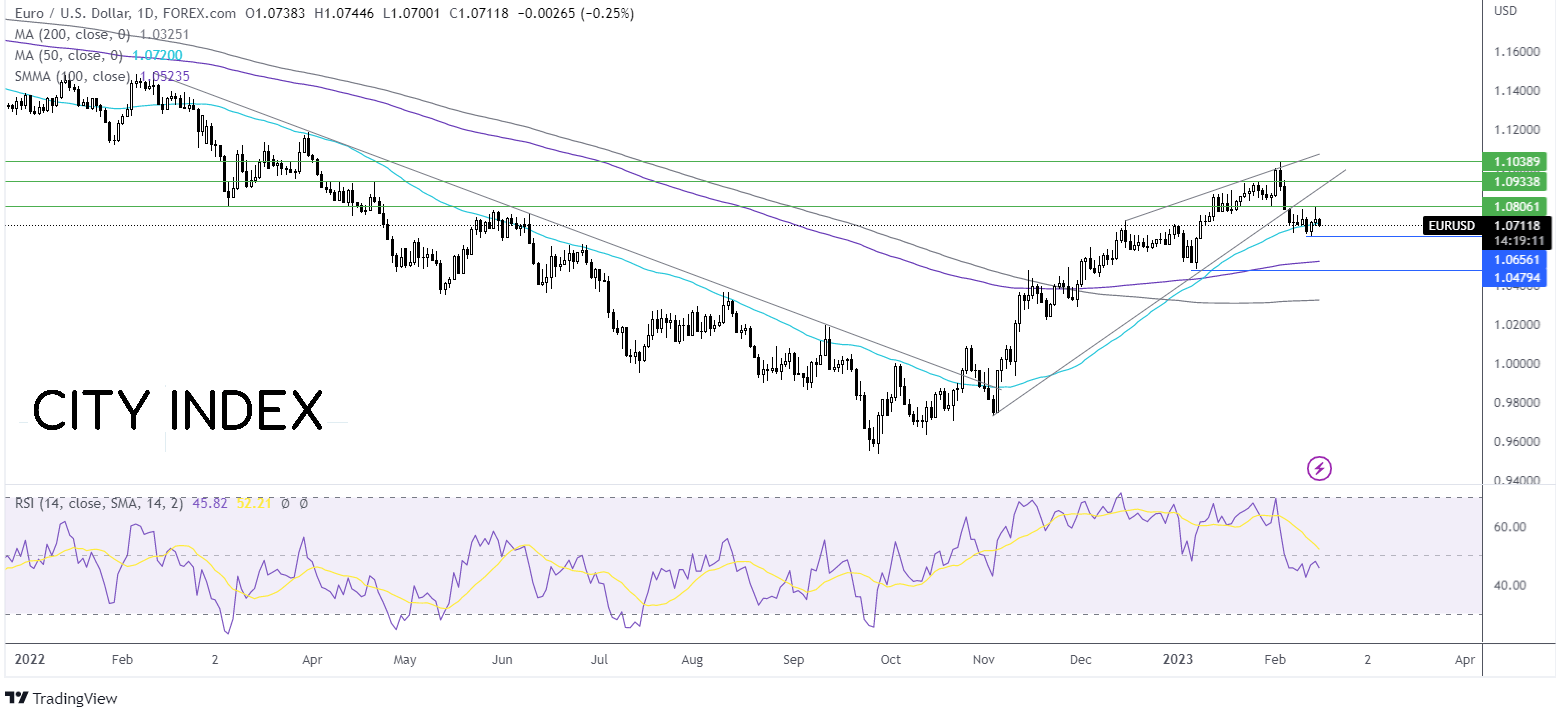

Where next for EUR/GBP?

After finding support on the multi-month rising trendline at 0.88, EUR/GBP has rebounded higher. The rise above the 20 sma and the RSI above 50 keeps buyers hopeful of more upside.

Resistance can be seen at 0.89, the January high, with a break above here opening the door to 0.8980, the 2023 high.

On the flipside, immediate support can be seen at 0.8820 the 20 sma, with a breakthrough here opening the door to 0.88 the rising trendline support and weekly low. A break below here creates a lower low.