- The VIX suggests a potential low has been seen on the volatility cycle

- Traders heavily net-short the VIX – and that leaves plenty of shorts to cover when the VIX rises. And that’s exactly what we’re seeing now.

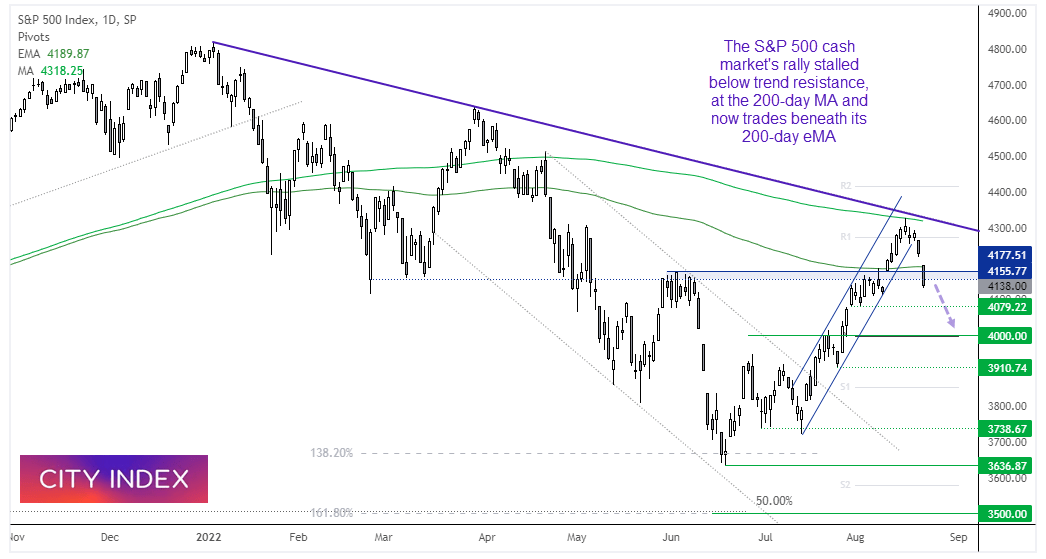

- We know the S&P 500 has enjoyed an extended run from its bear-market lows, much to the dismay of bears. But volatility can rise at key turning points, and we’re seeing the early signs of that this week.

- I very much doubt we’ll see the famous ‘Fed pivot’ many equity bulls were hoping for at the Jackson Hole Symposium, and that could see a much deeper pullback from its current highs.

Volatility is rising ahead of the Jackson Hole Symposium

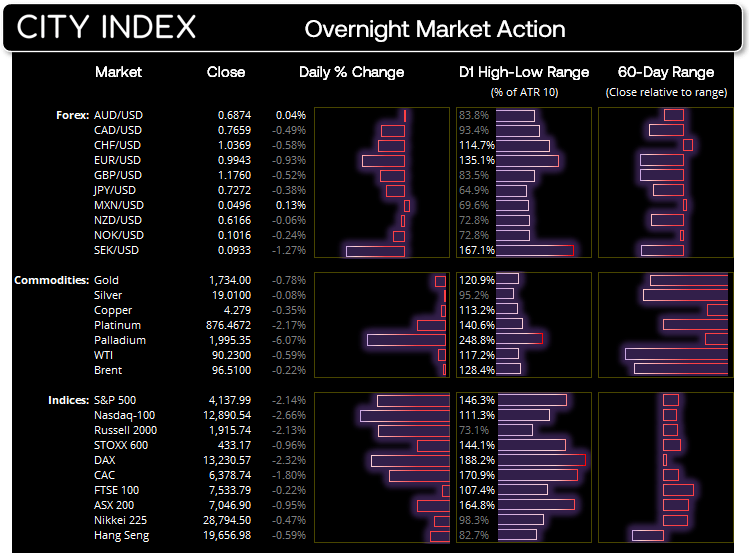

It was a volatile session overnight which saw the US dollar continue to surge whilst global equities and commodities fell. Investors are becoming increasingly concerned that Jerome Powell will deliver a hawkish speech at Jackson hole, whilst warning that the coming months will be hard to navigate (and fan fears of a recession). Public comments from various Fed members have become increasingly hawkish, as they seemingly read from the same script ahead of Jackson Hole – which is an event typically associated with important Fed announcements.

EUR/USD saw a daily close below parity (1.0000) for the first time since December 2002, and global equities accelerated to the downside (with the majority of indices we track far exceeding their average daily ranges). And with falling equities comes a rising VIX (volatility index).

What is the VIX (volatility index)

The VIX measure’s the market’s expectations for volatility of the S&P 500 over the next 30 days. A rising VIX means volatility is expected to increase, whereas a falling VIX means volatility is expected to fall. Whilst its calculation is with the S&P 500 in mind, it is widely used as a proxy for sentiment for global equity markets, and also referred to the fear index as investors use it to measure the level of stress in markets.

Some investors use the absolute level of the VIX to determine the market condition and levels of portfolio exposure, whilst others use its relative direction. As the VIX number is annualised, it means a reading of 20 estimates the S&P 500 could rise or fall by ~20% over the next year.

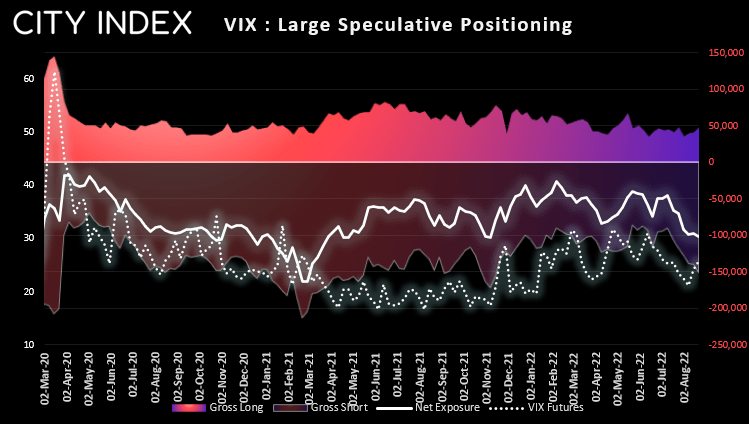

Market positioning on the VIX (volatility index)

As we noted in yesterday’s commitment of traders report, large speculators are increasingly net-short the VIX – which means they are betting that volatility will remain low. In fact their net-short exposure is at its most bearish level since November 2021. Whilst it is not at a historical extreme, the VIX began a multi-week rally when net-short positioning was around current levels. And that means there are plenty of shorts that will want to cover their positions if the VIX rises. And that is exactly what we’re seeing ahead of the Jackson Hole meeting.

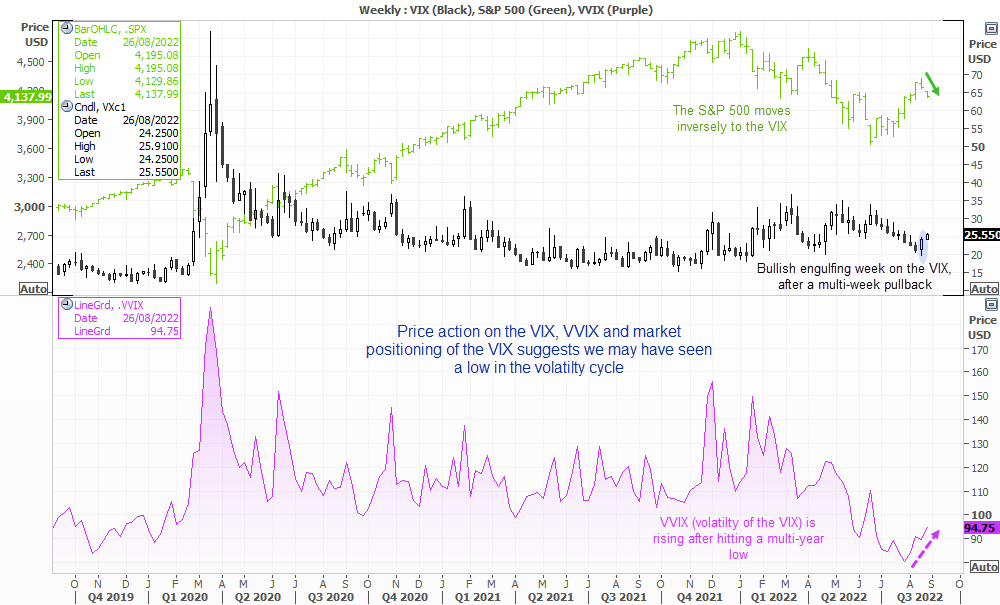

The VIX may have printed an important cycle low

I use technical analysis on the VIX sparingly as the VIX is not a market in its own right - but a complex derivative of the S&P 500. But as volatility moves in cycles (from low to high, and high to low), we can use a common sense approach to try and anticipate where we are within a volatility cycle.

The VIX saw a multi-week pullback lower whilst stock markets rallied form their bear-market lows. Yet VIX futures also closed last week with a bullish engulfing week, which coincided with large speculators being increasingly net-short. Furthermore, VVIX – or implied volatility of the VIX - is also rising. And as volatility tends to increase at turning points, I suspect we saw an important low in volatility last week and implied volatility is set to continue rising. And given that it tends to rise faster than it falls and move inversely to equity markets, it then suggests that equities might continue to accelerate to the downside if this assumption proves to be correct.

What could a rising VIX mean for the S&P 500

As the VIX shares an inverted correlation with the S&P 500, a rising VIX generally means that indices such as the S&P 500 are set to fall. Although take note that the correlation is not fixed and rising volatility can also be seen during uptrends on the index (although it is not the norm). But common sense can (and should) be applied.

We know the S&P 500 has enjoyed an extended run from its bear market lows, much to the dismay of bears. We’re just days away from key inflation data and the Jackson Hole Symposium, and investors are now twitchy over renewed prospects of aggressive Fed tightening. This means many will want to square up their books ahead of Jackson Hole, and shares could be susceptible to further selling if Jerome Powell is even more hawkish (and grim on the economic outlook) as currently expected. So whilst I see the potential for further declines as we head towards Friday’s speech, it really depends on what is said as to how the markets react going forward. But my personal feeling is that we will not see the famous ‘Fed pivot’ many equity bulls were hoping for, and that could see a much deeper pullback from its current highs.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade