The first day of September has been spectacular for traders thriving on volatility, although one to forget for investors. We saw further falls in stocks; more gains for the dollar and pain for everything else – led by the commodity dollars. We also saw the USD/JPY hit 140.00 and GBP/USD plunged to 1.15 handle. Gold fell below $1700 and WTI slumped below $87 a barrel. “Risk off” was written all over the markets today. Will the nonfarm payrolls report help to halt the dollar and yields rally or will investors press ahead? Following the hawkish speech by the Fed’s Powell on Friday, traders have driven expectations for another 75bps interest rate increase from the Fed above 70%. Another strong jobs report could cement those expectations further.

Apart from concerns about inflation and growth-chocking interest rate hikes, concerns over the health of the Chinese economy have also played a big part in the moves we have seen in recent days. The latest sign of weakness at the world’s second largest economy was evidenced by the manufacturing PMI data showing an unexpected contraction in August as the nation’s zero-COVID policy and energy issues hit the sector. In addition, parts of China’s largest tech hub, Shenzhen, had several areas placed under lockdown. Finally, the US has ordered Nvidia and AMD to halt sending AI chips to China (and Russia), which has made the situation worse. My colleague Joe Perry has written more on China HERE. With China being one of the major export destinations for New Zealand and Australia, there’s little wonder why the AUD and NZD have been among the weakest of the major currencies today.

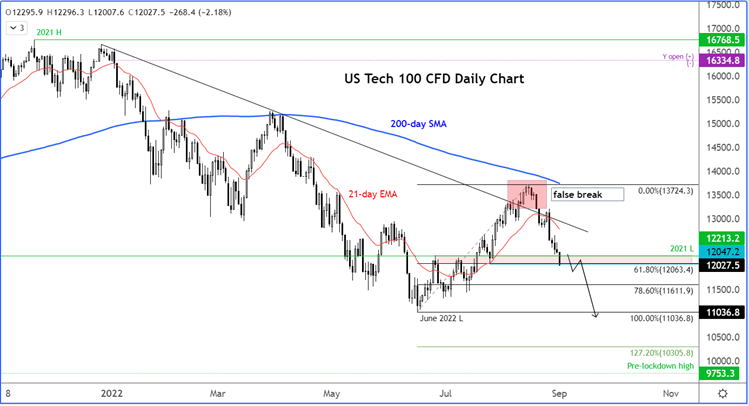

Likewise, China is a big market for German manufacturers and US technology companies, which explains why the DAX and Nasdaq have struggled to find much love. The US tech-heavy index looks poised to fall further as bets over more aggressive rate hikes and hawkish central bank commentary keep bond yields underpinned, and low-yielding assets undermined.

Additionally, the Nasdaq faces technical selling pressure given that it has failed to hold support around 12200, an area which could now turn into strong resistance and lead to more losses.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade