Nasdaq reaches new record high, a week ahead of FOMC: The Week Ahead

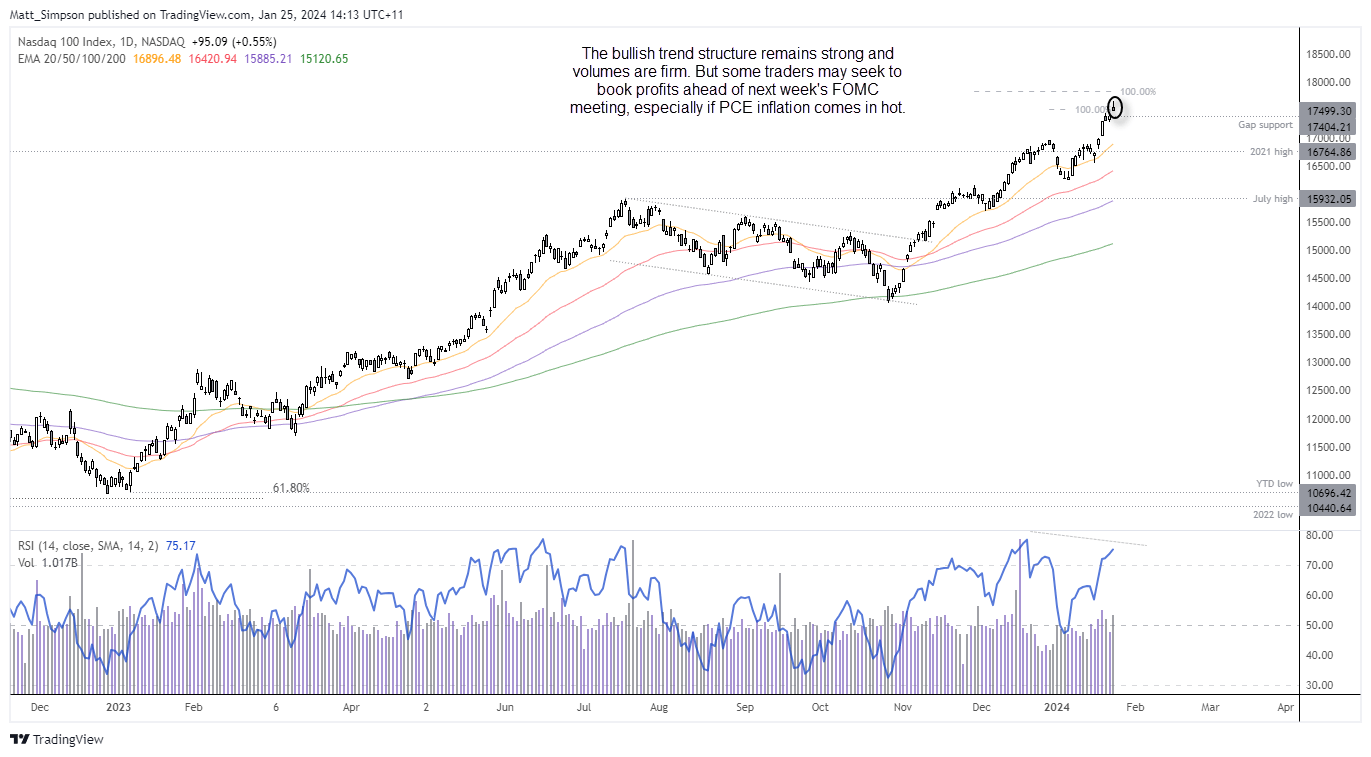

Love it or loathe it, the rally on US indices has been impressive. Traders seem to be focussed on lower yields, slightly reduced bets of multiple Fed cuts and any other morsel of what can be repackaged as ‘good news’. But can it withstand incoming GDP figures, a PCE inflation report and an FOMC meeting without a wobble?

The week that was:

- PMI data generally surprised to the upside, with US manufacturing expanding for the first month in 7 and hitting a 15-month high.

- Wall indices continued to push the S&P 500, Nasdaq and Dow Jones to record highs in the first half of the week thanks to positive earnings and the ‘no landing’ theme

- Wall Street indices reached fresh record highs at the beginning of the week, although their lack of volatility raised flags that the rally was running out of steam

- China announced further stimulus to support the stock market and a cut to their RRR to free up long-term liquidity within the financial system. The latter seemed to be the catalyst which finally saw China’s indices rally aggressively from their lows.

- Japan’s exports surprised to the upside to show growing global demand, particularly from the US

- The BOC held interest rates at 5% for a fourth month, but warned of risks to underlying inflation and pushed back on rate cuts saying it was “premature” to discuss them

- The BOJ held policy unchanged and lowered their FY 2024 CPI target, which further signals the BOJ’s reluctance to dismantle Kuroda’s ultra-dovish stance to hammer home the likelihood of no changes

Nasdaq 100 technical analysis: Daily chart

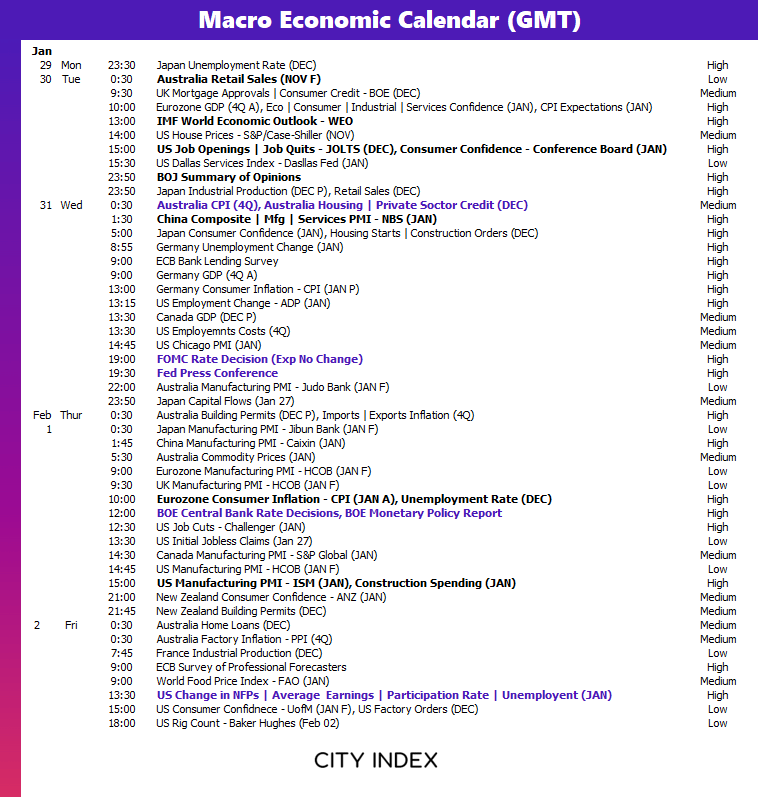

The week ahead (calendar):

The week ahead (key events and themes):

- FOMC interest rate decision and press conference

- Nonfarm payroll report for the US

- BOE interest rate decision

- ISM manufacturing PMI for the US

- Quarterly CPI report for Australia

- IMF world economic outlook

FOMC interest rate decision and press conference

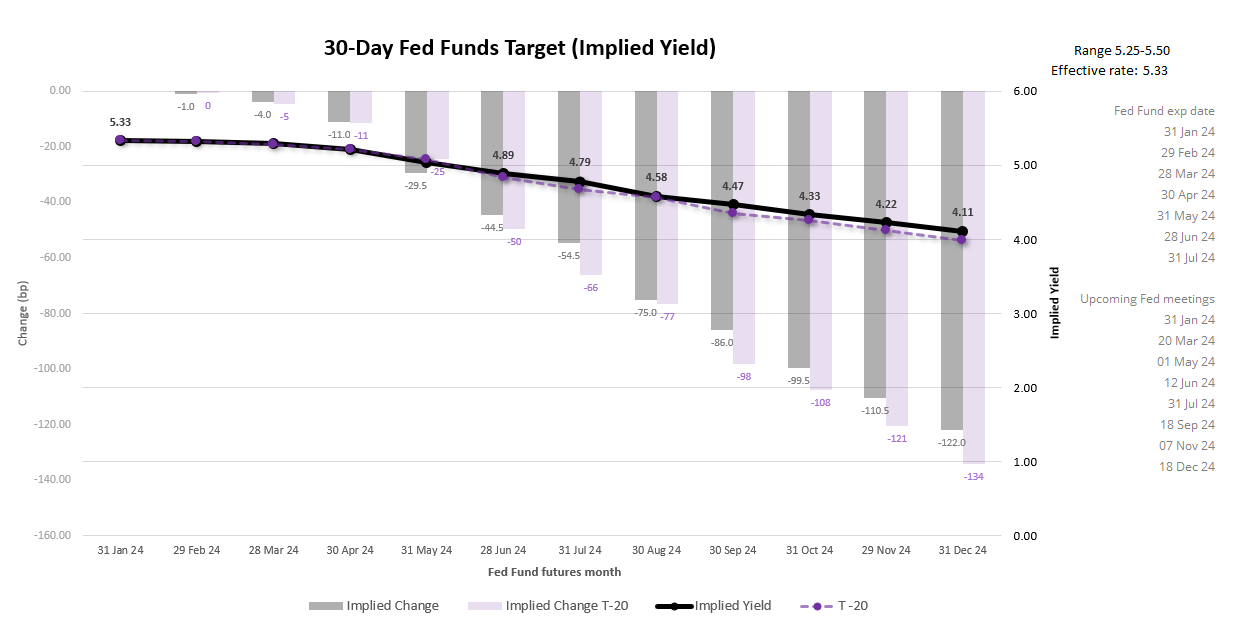

Even though the vast majority agree that the Fed will not change policy next week, it is still the biggest event on the calendar. Fed Fund futures imply ~98% chance of a hold on Wednesday, or a 5*% chance of a hold in March. And whilst that the implied yield curve is less dovish than it was 20 days ago, it still suggests -122 bp of cuts by December which is nearly five full 25bp cuts.

As always, traders will focus on the statement and press conference for any clues for the potential to cut. But if recent comments form Fed officials are anything to go by, it would come as quite a surprise if they delivered a dovish twist in their communications next week. And that means traders will be quick to shift their focus to the subsequent ISM manufacturing and Nonfarm payrolls report.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

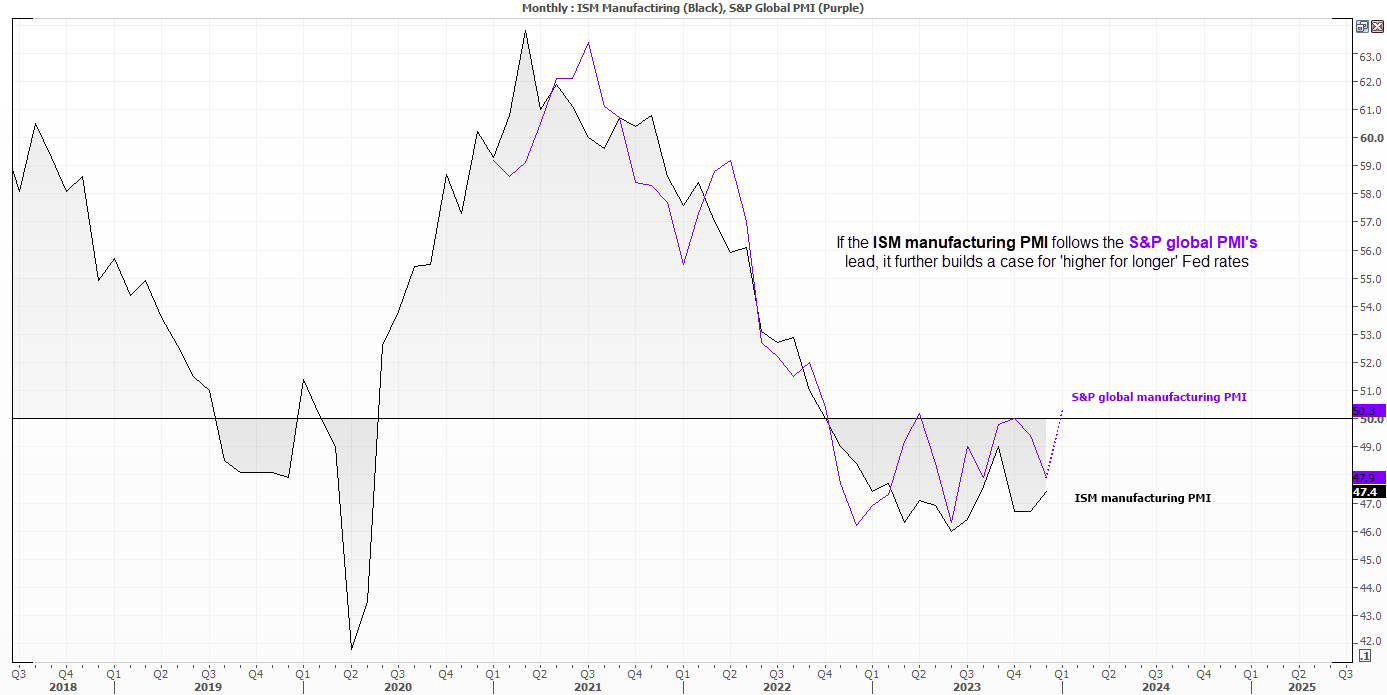

ISM manufacturing PMI for the US

The S&P global flash manufacturing PMI survey estimated the industry to have expanded in January. And it could carry more weight if long-standing ISM manufacturing survey followed suit. The ISM appears to have troughed in June yet remains firmly in contraction levels at 47.4, but if it were to contract at a much slower pace of surprise with an expansion (above 50) then it could spur another round of short-covering for the US dollar.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

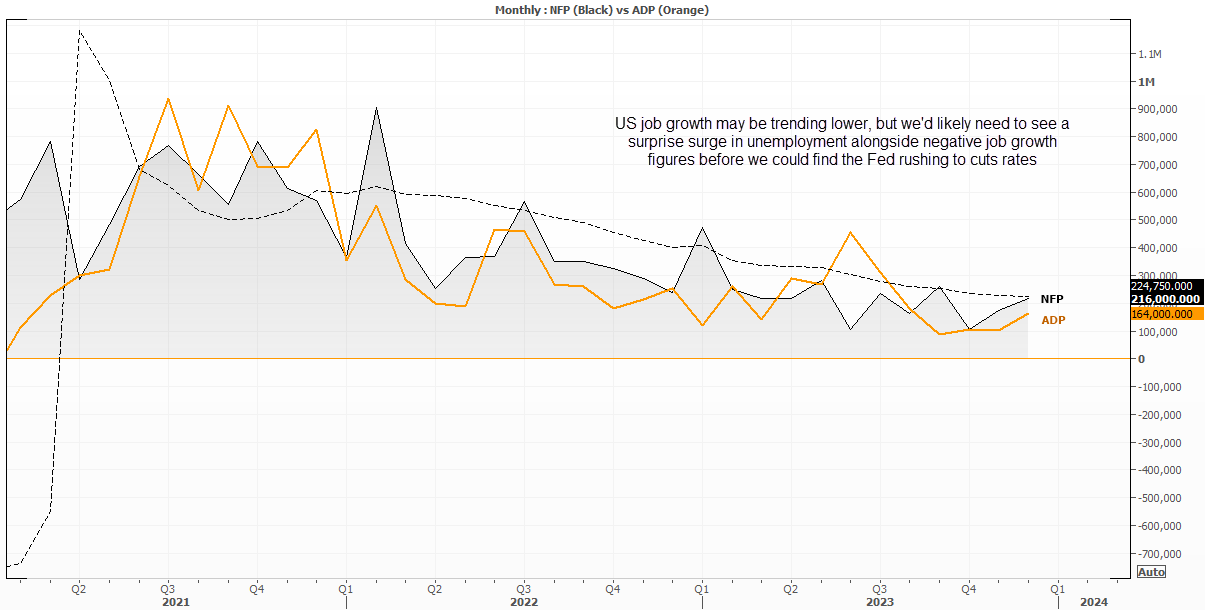

Nonfarm payroll report for the US

As next week’s ISM and NFP reports land after the FOMC meeting, it is really about shaping expectations from the March meeting onwards. And it might take quite a weak set of numbers to convince traders that a cut could arrive as early as March. IN all likelihood, the report will smash another set of okay or better numbers. As we’d really need to see unemployment rise sharply and NFP print negative jobs before we could expect the Fed to simply flick the policy switch.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

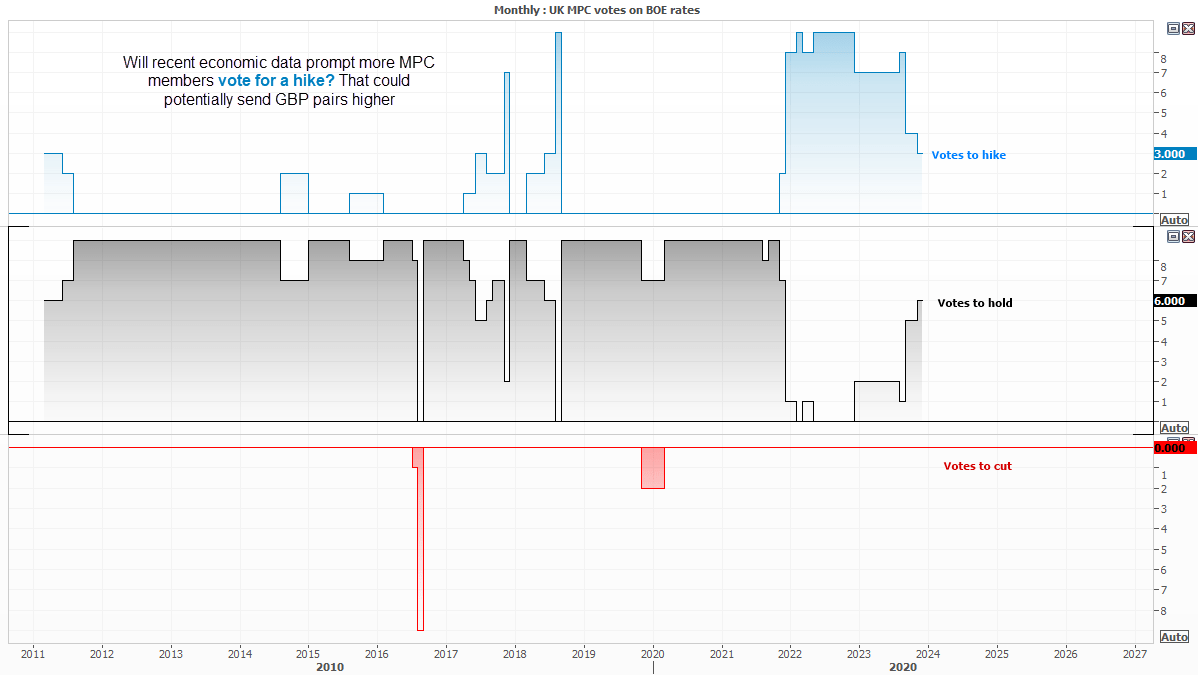

BOE interest rate decision

Recent data has effectively removed any hope of a BOE cut next week, or any time soon for that matter. CPI data rose unexpectedly in December, and PMI data has also surpassed expectations with the added pain of rising input costs.

Traders should keep an eye on any changes among MPC votes to hike or hold. The last meeting saw three vote to hike and six to hold, so if we see four or more vote to hike it indicates that the BOE is more hawkish in the light of incoming data – and whilst this might not necessarily result in a future hike, it almost certainly prolongs rates being held at the current level of 5.25%

Trader’s watchlist: GBP/USD, GBP/JPY, GBP/CHF, EUR/GBP, GBP/AUD, FTSE 100

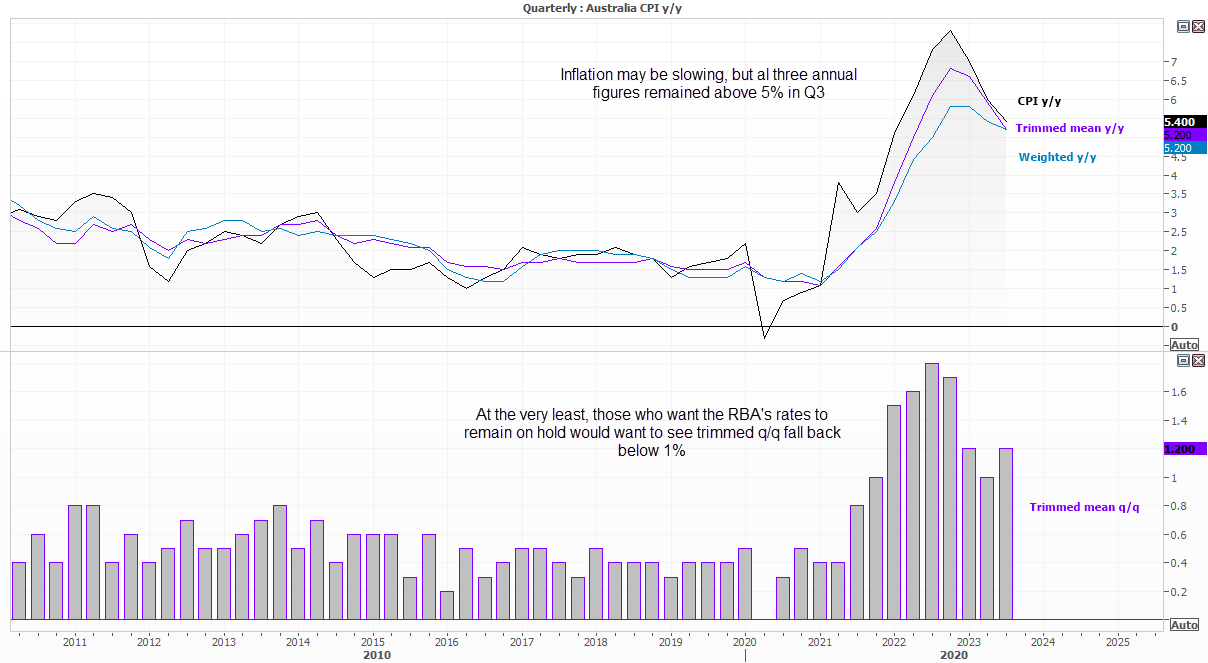

Quarterly CPI report for Australia

The RBA (and therefore traders) pay more attention to the quarterly CPI figures than the newer monthly report, as they are considered to be more robust. And the fact that headline CPI, trimmed ad weighted remained above 5% in Q3, they’ll want to see the rate of these inflation figures fall much faster. At the very least, they’ll want to see the trimmed mean q/q back below 1% to show momentum is waning, or it risks renewed calls for another RBA hike.

Trader’s watchlist: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade