After Wednesday’s big A.I.-driven sell-off, the Nasdaq 100 bounced back 1.4% in the first half of the US session. Our Nasdaq analysis shows the index is testing a major resistance zone, which should not be taken lightly, as we are heading into a key macro event next week.

Why have stocks rebounded?

Well, several reasons – not to mention that we are in a bull market and markets have been doing this all year.

But in terms of an individual trigger, paradoxically, it may have been the disappointing US jobless claims data that triggered the move, as bond yields and the dollar both fell. That probably encouraged some dip-buying after the recent tech-sell off. But it is all bout follow-through now. Will the rebound hold or will it fade again, given that we have some key macro events taking place in the week ahead? These include the US CPI on Tuesday, which could be the deciding factor between the Fed hiking or not at the next day’s FOMC meeting. We also have rate decisions from the ECB and BoJ at the back end of the week, to look forward to.

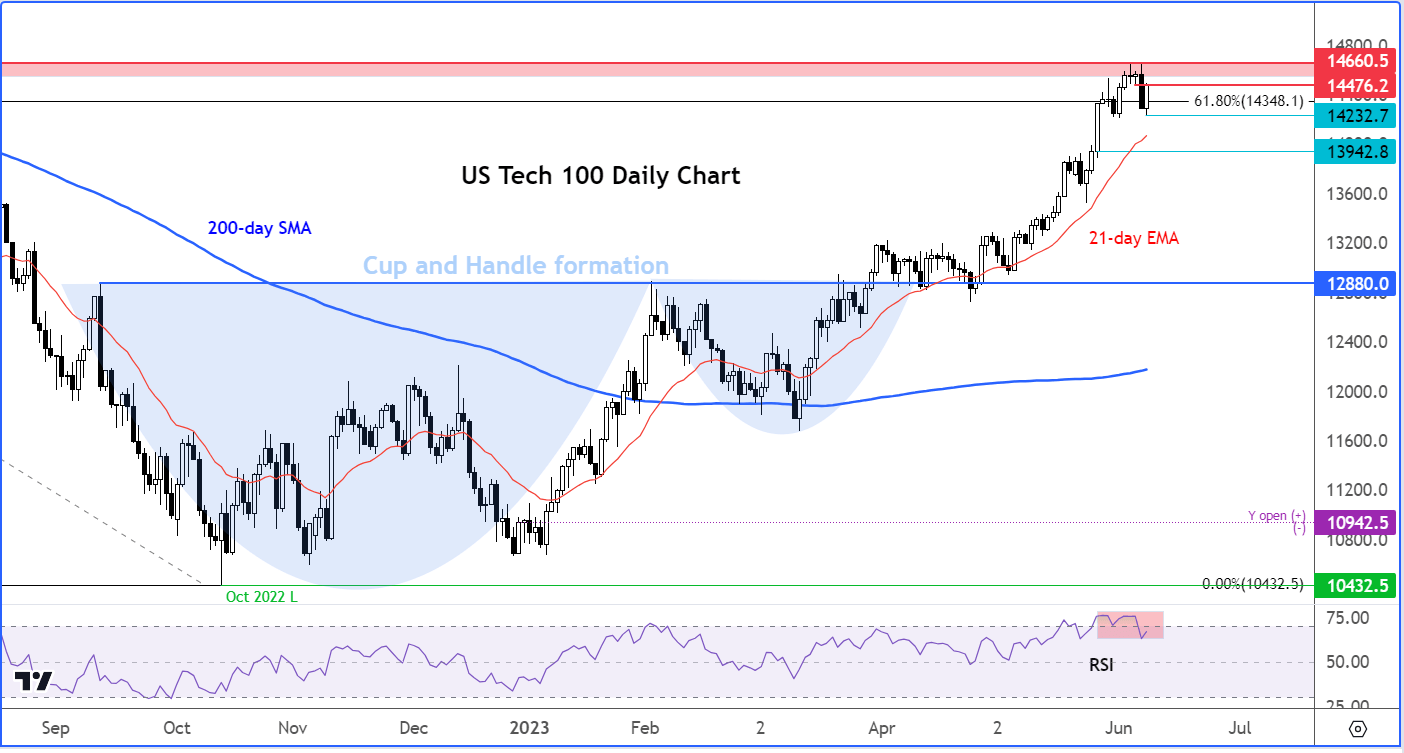

Nasdaq Analysis: Index testing major resistance

Before discussing these events in greater detail, let’s have a quick look at the Nasdaq charts, as the tech-heavy index has now risen back to the base of Wednesday’s breakdown around 14500. Could it find some resistance here, or will the index power through this area, and once again thwart bears’ attempts to push the index lower?

Source: TradingView.com

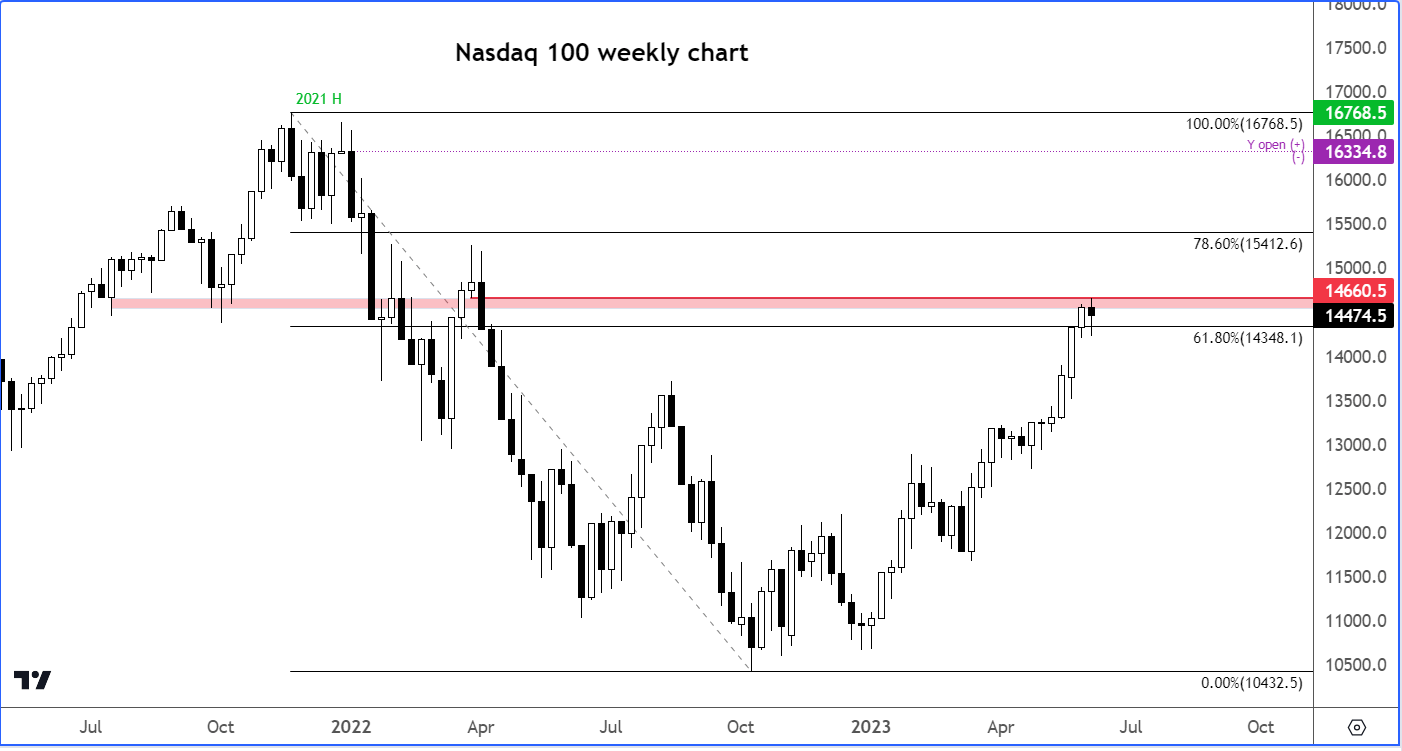

The weekly chart shows the index is also at a historically important juncture here, so I wouldn’t take any potential weakness signs here lightly:

Source: TradingView.com

Source: TradingView.com

That being said, the trend is bullish and so far, we haven’t had any key reversal signs to tell us otherwise. Still, a degree of caution should be warranted given that we are heading into a massive week…

US CPI, FOMC, ECB and BOJ in focus

Next week is a central bank bonanza, starting with the Fed on Wednesday, followed by the ECB on Thursday and then finishing with the BoJ on Friday. But don’t forget that we have the key inflation report from the US, which has the potential to move the needle.

US CPI and FOMC meeting

This particular US inflation report will be very interesting to watch, as it will be published just a day before the Fed concludes its meeting and decide on monetary policy. If we see a weaker CPI print on Tuesday, then this could push the major FX pairs, gold and indices sharply higher as that would underpin expectations of a pause in the tightening cycle. Among the majors, we would favour the AUD/USD and CAD/USD (I know, it is USD/CAD) given this week’s hawkish rate decisions by the RBA and BOC, and the potential for oil prices to rally.

However, if CPI comes in stronger, then this could tip the balance in the favour of a rate hike at Wednesday’s FOMC meetings. In this scenario, we could see the dollar surging again, as clearly a potential hike is undesired in these tough economic times. That being said, comments from some Fed officials, including the Vice-Chair Jefferson, suggests that the Fed may ignore a hot CPI report and pause anyway.

Aside from the CPI and rate decision itself, it is worth noting that we also have the quarterly staff forecasts, updated dot plot and press conference to look forward, too. These have the potential to move the dollar sharply.

ECB set to hike rates by 25bps

We agree with the consensus that the ECB will most likely hike interest rates by 25bp to lift the main deposit rate to 4%, its highest level since 2008. This would be the 8th rate hike in this cycle, with one more likely to be followed next month. It will be interesting to listen to Christine Lagarde, the ECB President, in what the central bank makes of the renewed weakness in German output and signs of disinflation across the eurozone. It could be that we will see a more dovish ECB than we are led to believe with their recent comments.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade