- US ISM services PMI, US Non-farm payrolls & Federal Reserve Chair Powell testifies before Congress.

- ECB is expected to leave interest rates unchanged

- Nasdaq 100, Dow & Dax are around all-time highs

- Equity markets are hyper-focused on rate-cut expectations

Global stocks have been on a tear this week, with the likes of the Nasdaq 100, Down Jones and S&P500 pushing to fresh all-time highs on AI optimism, and as inflation continues to cool, fueling bets that the Federal Reserve may start to cut rates in the coming months.

Recapping this week, the Fed’s preferred inflation gauge cooled to its weakest level in three years in January, building expectations that the Federal Reserve will start to cut interest rates at the June meeting and boosting stocks higher.

Meanwhile, AI optimism returned with vigor as earnings continued to highlight the impact that AI was having on company results and revenue streams. Dell Technology surged 28% following upbeat numbers related to AI. AMD and Nvidia also rose to fresh all-time highs amid insatiable demand for stocks linked to AI.

Looking ahead, the coming week is a busy one for US data with ISM services PMI and the keenly watched non-farm payrolls, which could help shape interest rate expectations. Job creation is expected to remain solid at 188,000 in February, although this is down from the very strong job January report. Average earnings are expected to cool, which would be well-received news for the Federal Reserve.

In addition to jobs data, the other main focus will likely be on Federal Reserve Jerome Powell, who testifies before Congress for two days in a biannual event. The market will be closely scrutinizing his comments regarding inflation and the possible timing of the first interest rate cut. A hawkish-sounding Powell could see the market push back rate cut bets and pullback from record highs.

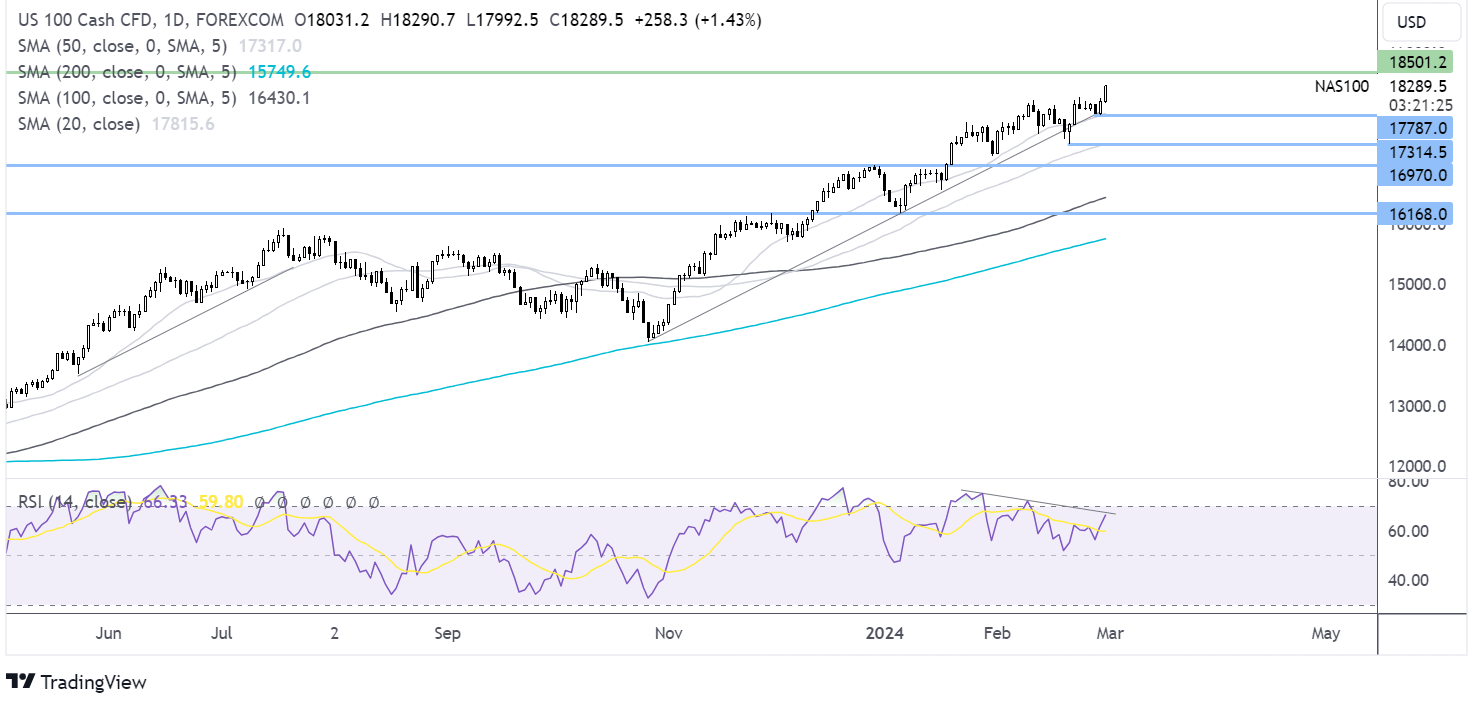

Nasdaq 100 forecast – technical analysis

The Nasdaq has risen to a fresh record high above 18300 in an aggressive move higher on its way toward the next minor resistance at 18,500. The bearish RSI divergence could suggest that the run higher may struggle from here, although the aggressive rise higher put this into question. Sellers look to support at 17787, the weekly low. Below here, 17315 comes into play.

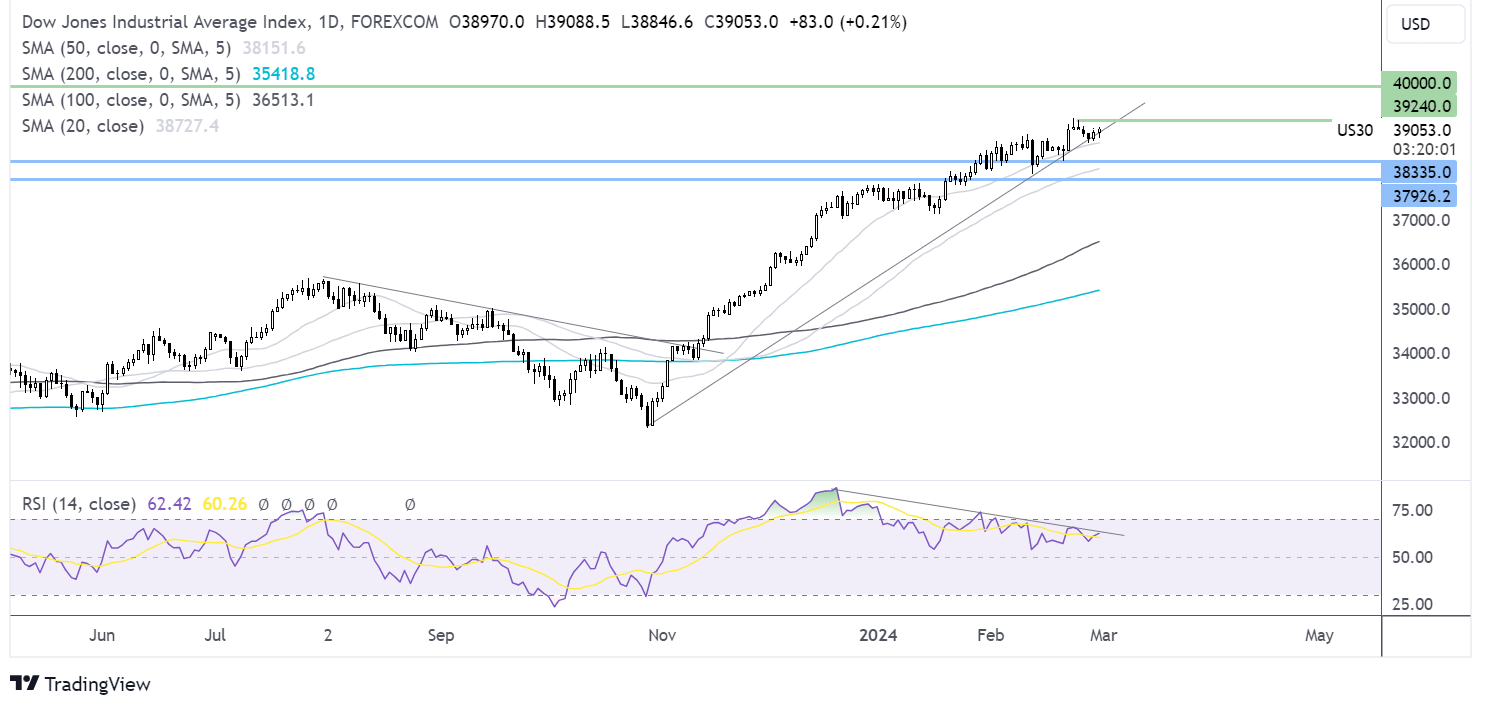

Dow Jones forecast – technical analysis.

Dow Jones has eased back from all-time highs reached at the start of the week at 39241. The price is hugging the rising trendline and the 20 SMA higher. RSI bearish divergence could mean the price struggles to carve out a higher high. Buyers would need to rise above 39240 to reach fresh all-time highs towards 40,000. Support could appear at the 20 SMA 38,730, which is also the weekly low, below here 38335; last week’s low could come into play ahead of 38000, the February low.

Will DAX reach a fresh all-time high in ECB week?

The DAX rallied higher across the week amid continued expectations that the ECB and the Federal Reserve will start cutting interest rates soon. The question is when rather than if.

German inflation cooled, as did eurozone-wide inflation, which will be well received by the ECB, which is keen to see CPI fall closer to the bank's 2% target before they start cutting interest rates.

The ECB interest rate decision is the main focus for DAX traders in the coming week, where the central bank is expected to leave rates unchanged. While ECB president Christine Lagarde has acknowledged cooling prices, she also says that more evidence is needed that the 2% target can be reached. In recent speeches, Lagarde has highlighted concerns over wage growth, which is expected to become an increasingly important driver of inflation in the coming months.

A hawkish-sounding Christine Lagarde, who continues to push back on rate cut expectations, may dampen demand for equities and pull the DAX off record highs; however, if the ECB becomes more divided, with the dovish calls increasing, the DAX could get a fresh leg higher.

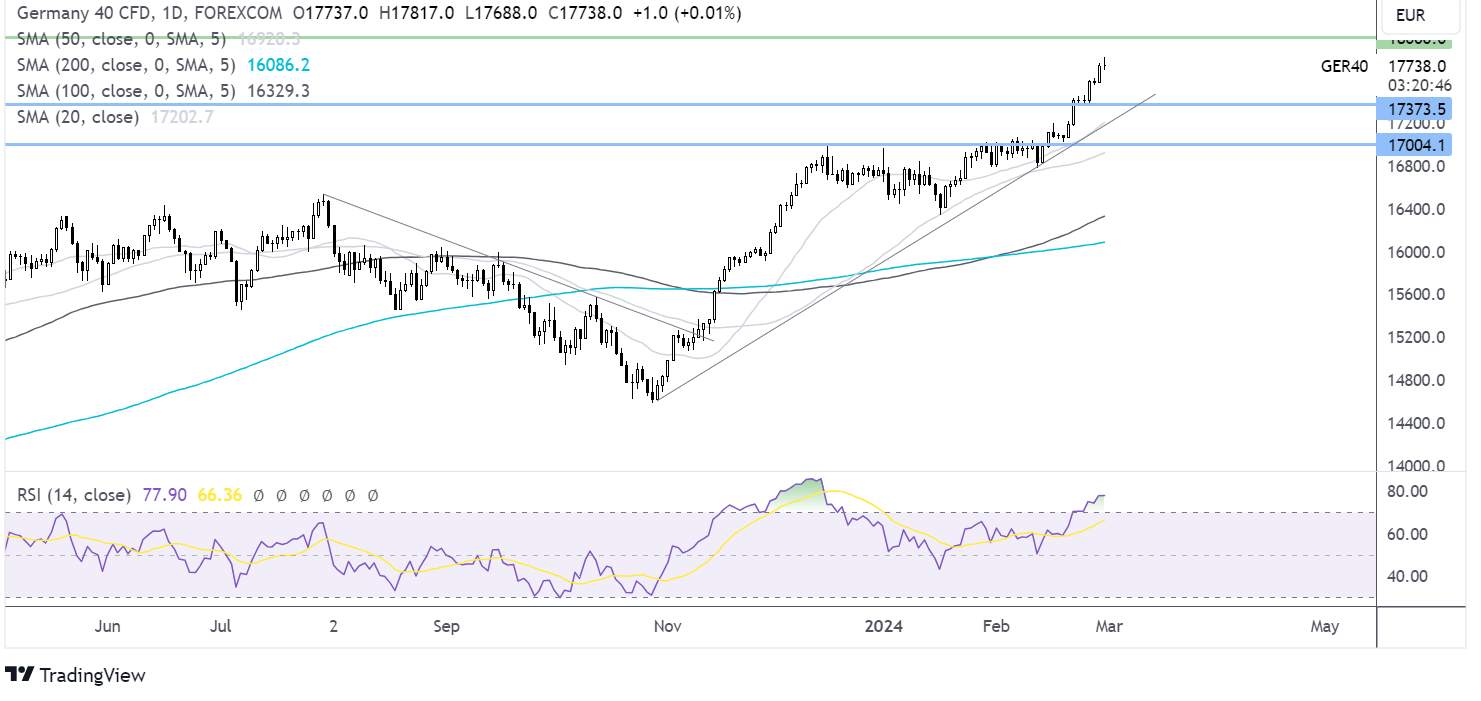

DAX forecast – technical analysis

DAX rose to a fresh all-time high above 17,800 as it grinds toward 18,000. The doji candle and RSI in the overbought territory should warrant some caution as a pullback, or at least a period of consolidation, could be on the cards.

Support can be seen at 17375, the weekly low, with a break below here opening the door to 17000, the round number, and the early February high.