Excesses that accumulated in markets during the pandemic era are now unravelling, most notably in the US long bond market. It’s been a brutal as a ballooning debt issuance collided with growing expectations that rates will need to remain higher for longer to bring inflation under control, sending yields across the US curve surging to multi-decade highs. The lift in risk-free rates is now flowing through to other asset classes, especially those where their earnings growth is expected to occur well in the future.

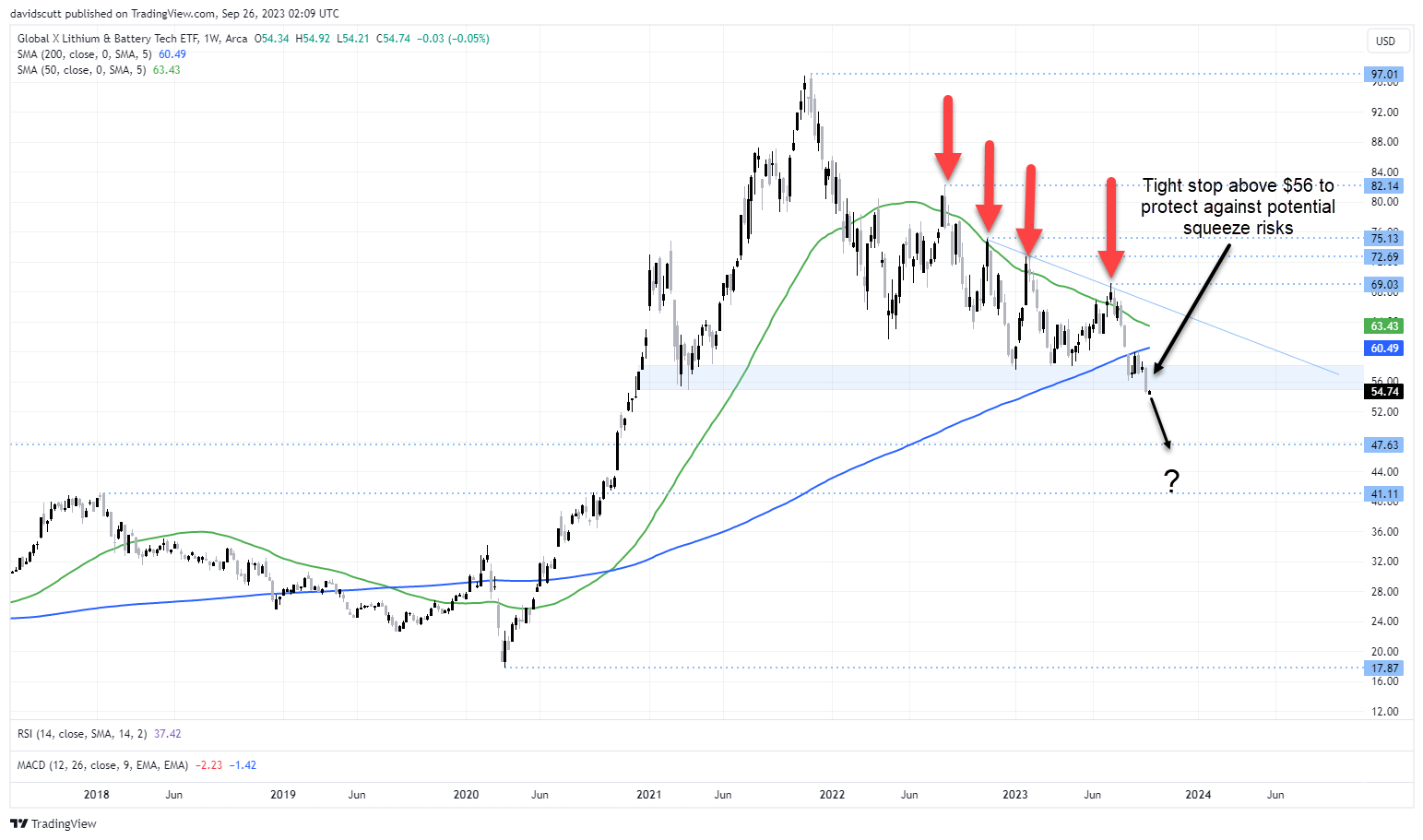

LIT ETF breaks major support zone

Global X’s Lithium & Battery ETF, under the ticker code ‘LIT’, is one of the many victims from the surge in risk-free rates. I flagged the ETF as a potential two-way trading opportunity earlier this month given its proximity to a key support zone at the time. Fast forward to today, with bond yields now significantly higher, the fund containing household names such as Tesla, Albemarle, Rivian and BYD has broken below its key support zone, raising the possibility of further declines on top of those already seen. MACD has also generated a sell signal, adding to near-term downside risks.

Sitting in a long-running downtrend characterised by four consecutive lower highs, those looking for further downside could consider selling around these levels with a stop above $56, the low struck in August prior to this latest leg lower. There is no visible support found until the mid-$47 region, the high hit all the way back in 2011, and then again until around $41.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade