Market Summary:

- The US treasury reduced their borrowing estimate for a second quarter which helped boost sentiment late in the US session

- A rise in bond demand and fall in treasury yields helped the S&P 500 and Dow Jones close to a new record high, the Nasdaq 100 reached a record high on a closing basis but trades -0.36% beneath Wednesday’s intraday record high

- US defence secretary Lloyd Austin vowed that the US will take “all necessary actions” following the death of three US troops and the injury of 34 by Iran-backed militants.

- Gold saw some slight safe-haven demand following the weekend reports of US troops being attacked near the Syrian border. Whilst the buying was not to any degree that we could call it a strong rally, it seems to have found support around its 50-day EMA.

- The New Zealand dollar was the strongest forex major on Monday after the RBNZ’s chief economists hinted at ‘higher for longer’ rates by saying there “we have a long way to go” regarding taming inflation.

- Both NZD/USD and AUD/USD formed bullish outside days and rallied from their 200-day averages, with the US dollar being the second weakest currency behind EUR/USD.

- This development adds a fly into the ointment for a AUD/USD short, as the daily close is just beneath the highs of the daily wicks which hinted at a topping pattern building and a potential bearish swing trade

- USD/JPY retraced back to its 10-day EMA and formed a bearish engulfing day. If it can hold above last week’s low, the bias remains for a bullish move towards 149.57 – 150.

Events in focus (AEDT):

- 09:00 – Australian

- 10:30 – Japan’s unemployment rate, jobs/applications ratio

- 19:00 – Spanish inflation

- 20:00 – ECB Lan speaks, German GDP

- 20:20 – UK mortgage approvals, BoE consumer credit, M4 money supply, BoE consumer credit

- 21:00 – Eurozone GDP, economic sentiment indicator

- 00:00 – IMF/World Economic Outlook

- 02:00 – US JOLTS job openings, job quits

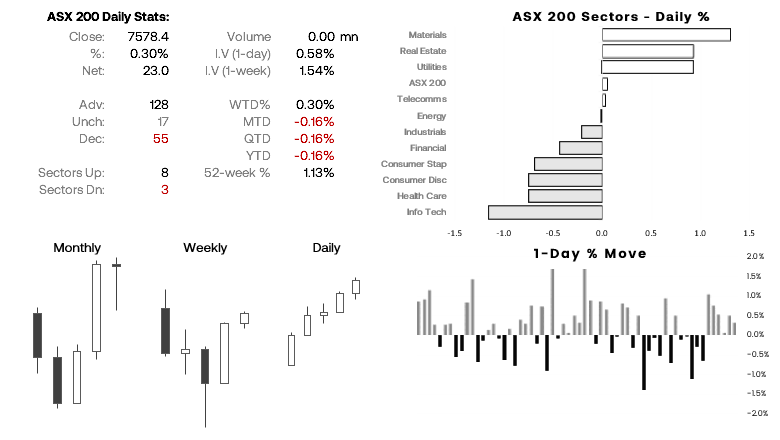

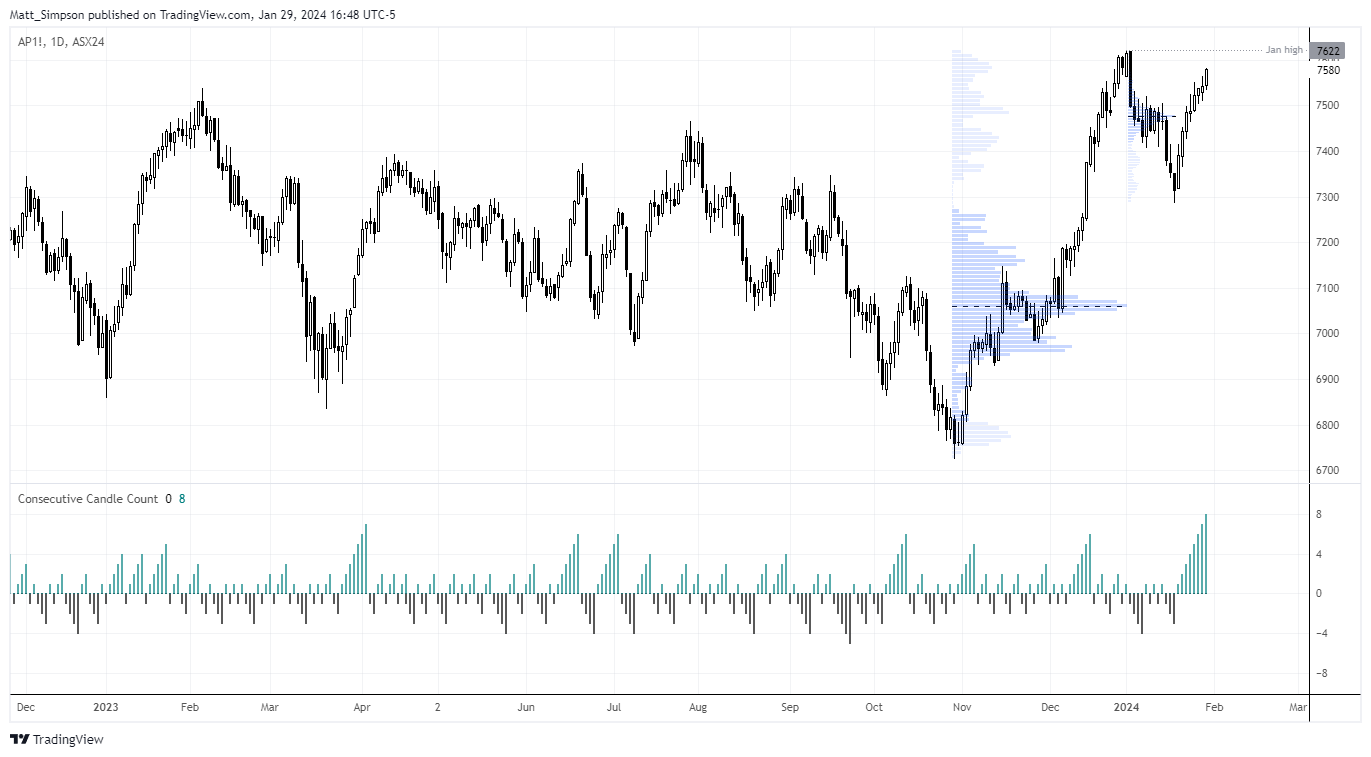

ASX 200 at a glance:

- The ASX 200 cash index rose for a sixth consecutive day – a bullish sequence not seen since mid December

- SPI 200 futures rose for an eight consecutive day, a bullish sequence not achieved since November 2020

- The ASX 200 cash market is expected to open higher today with the late-rally in SPI futures which tracked Wall Street higher

- The question for traders this week is whether the ASX can break and close above its January high, taking into account its extended run of gains

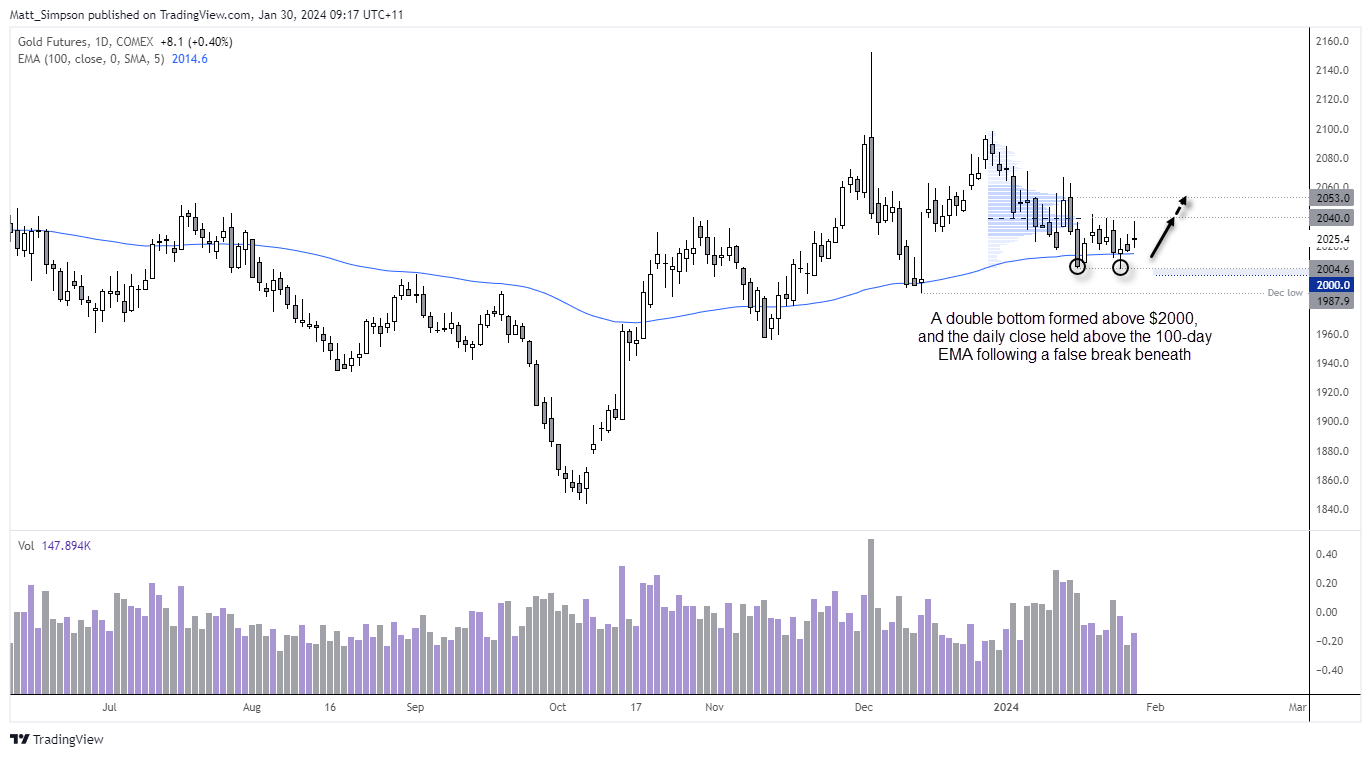

Gold futures technical analysis (daily chart):

The general direction of gold spot and futures prices track one another very closely, but I like to track futures because they include real volume data. And whilst the prices vary between spot and futures, they can be used in tandem to monitor potential support or resistance levels.

In this case, the front-month futures contract has formed a double bottom just above $2000, to show demand around that psychological round number.

The daily close price also held above the 100-day EMA since its false break beneath it last week, so I suspect a bottom may have already formed. Moreover, a cursory glance at the cyclicity of gold prices also suggests upside momentum could be building.

With geopolitical tensions rising, demand for gold could also begin to pick up. Although a key risk for gold bugs if the FOMC meeting, which runs the risk of not being as dovish as current market pricing suggests. Regardless, I like the look of gold for a near-term bullish opportunity whilst futures hold above $2000. Bulls could consider dips towards $2004 or the 100-day EMA, with a move to $2040 or $2053 in mind (high-volume nodes from the prior decline).

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade