- Gold analysis: precious metals again disregard rising yields

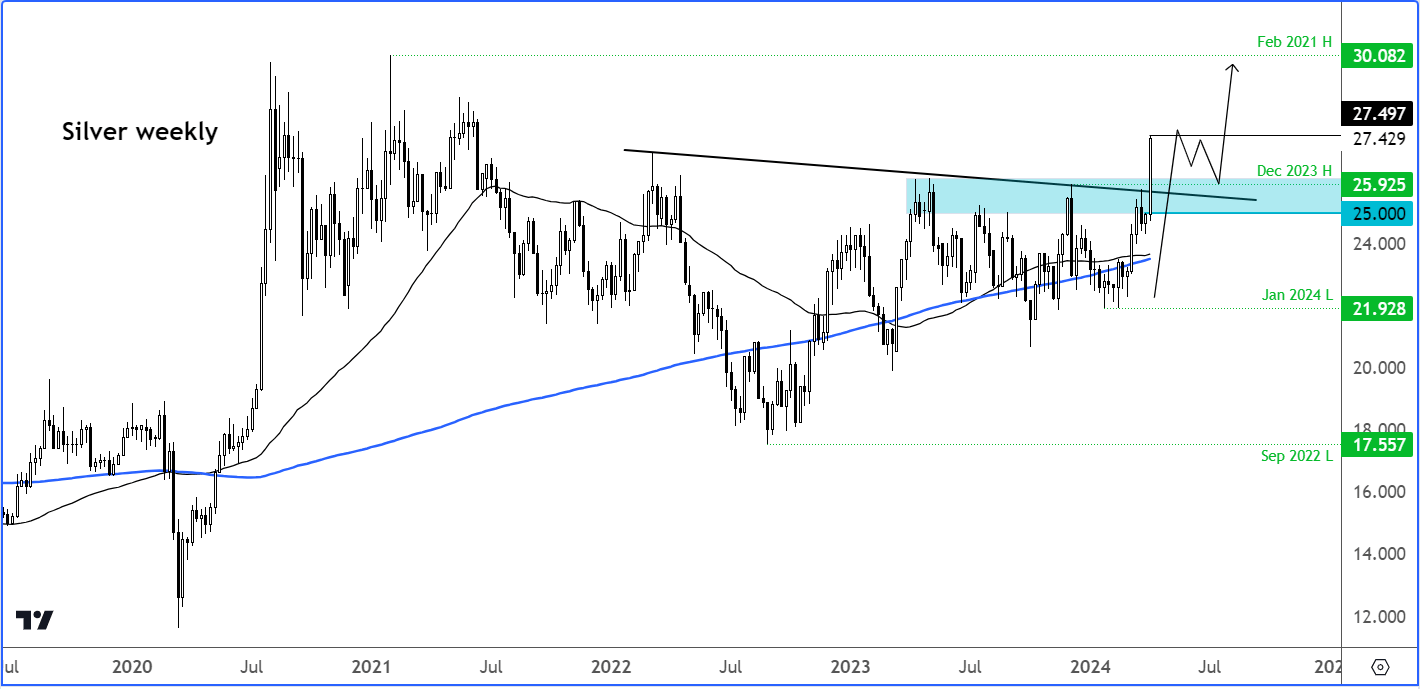

- Silver stages big breakout

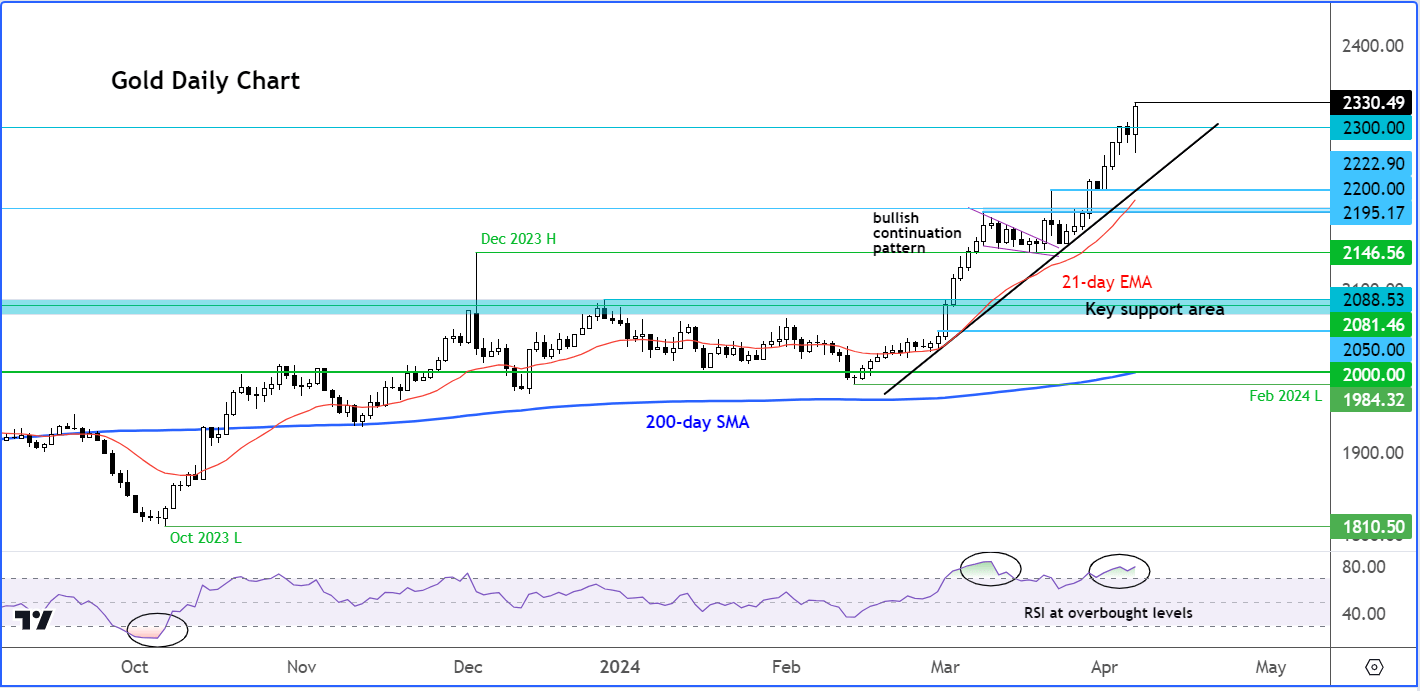

- Gold technical analysis suggests yellow metal is at extreme overbought levels

Precious metals rallied even after the release of a stronger US jobs report on Friday that triggered another hawkish repricing in the bond market. Once again, gold and silver traders ignored the rise in Treasury yields as investors trimmed bets on a rate cut in June and the chances of three Fed reductions this year fell. Gold rallied around $40 to hit a new record high and silver extended its weekly advance to around 10%, ahead of the publication of US CPI in the week ahead.

Gold analysis: precious metals again disregard rising yields

Friday's robust US jobs report came as a surprise with a headline print of more than 300K. Consequently, the likelihood of a rate cut in June dropped to below 60%, causing bond yields and the US dollar to rise. However, these gains were short-lived as the European trading session progressed. Investors likely shifted their focus to the upcoming week, anticipating inflation data. While stock markets were recovering a significant portion of the losses experienced on Thursday, the demand for safe-haven assets amid the geopolitical tensions in the Middle East propelled gold to a new record high above $2330. Additionally, crude oil reached a new peak for the year, with WTI touching $87.00 and Brent reaching $91.00.

Gold analysis: yellow metal hits new records while silver stages breakout

Both metals have been in demand, particularly gold, essentially because of years of high inflation chipping away at the value of fiat currencies, which is the same reason why Bitcoin has also been hitting record levels. Up until a couple of weeks ago, silver wasn’t finding much love. But stronger industrial data from China earlier in the week pointed to stronger demand for industrial materials like copper and silver.

Silver’s rally was also fuelled by a technical breakout above key resistance in the $25 area, drawing in momentum traders who had been taking advantage of the other precious metal – gold – in recent weeks.

But at these levels, both metals appear a little overbought and a bit of a pullback should not come as surprise.

That said, the big breakout in silver means traders will be happy to buy the dips moving forward. So, I am expecting to see more gains for silver this year, particularly because the grey metal has not even neared the highs of its most recent years around $30, let alone its record peak of near $50 that it had hit in 2011. In contrast gold has been hitting repeated all-time highs. Thus, silver has a lot of catching up to do on the upside, and this week’s technical breakout from a multi-year consolidation phase may well be the start of a long bull market.

I would be looking for potential dips back to the $25-$26 area to be supported. Let’s see if silver will ease back from these levels to get to those levels, as undoubtedly many people have missed this big up move.

Gold technical analysis

Undoubtedly, the gold chart is looking quite overbought on almost any metric you use. You can see from the sub-chart, the Relative Strength (RSI) is well above the 70.0 threshold, which may mean we could see some profit-taking or consolidation in the week ahead. The strong bullish trend means any notable dip could find support. Short-term support comes in around $2300 now, followed by a more important zone around 2222, and then the $2195/2200 area.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade