- Gold analysis: Metal not this ‘oversold’ since September 2022

- Drop in yields and crude oil further provide welcome relief

- Gold needs to print a solid bullish reversal candle for confirmation

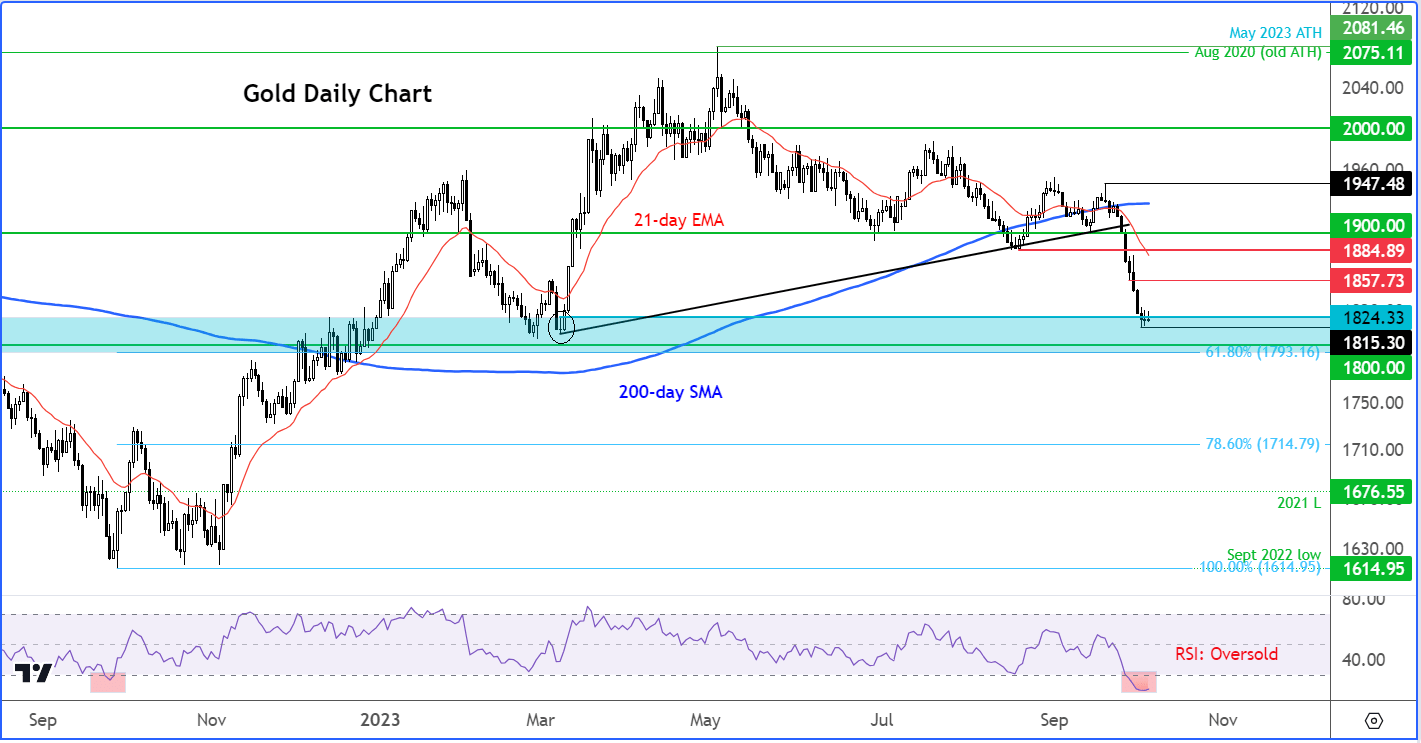

For the first time in many weeks, gold is starting to look relatively attractive again. If you loved gold at $2K+, it is now on sale near $1.8K. But will it find buyers is the key question. The sharp $130 (6.7%) drop in the space of a couple of weeks (from its 21st September high) means gold prices are technically oversold and potentially due a short covering rally from these long-term support levels. With the sharp drop in bond yields on Wednesday, and a bigger sell-off in oil prices this week (which is disinflationary), there are now solid reasons for some potential bargain hunting. So far, however, the bulls are nowhere to be seen.

But what about gold’s long-term outlook?

Well, to me, there are no questions about gold’s long-term bullish outlook. Given how much inflation has further devalued fiat currencies since the start of the year, when gold last staged a big rally, the metal should be shining more brightly anyway, if it truly is as an effective inflation hedge. The fact that it hasn’t, this is almost entirely because of the big falls in government bond prices, lifting their yields to multi-year highs and thereby increasing the opportunity cost of holding the non-interest-bearing commodity. But much of the Fed’s hawkish repricing of interest rates are now done, meaning that the downside for bonds and, by extension, gold should be limited moving forward. That’s not to say gold will necessarily find a bottom imminently. But equally, we are now not too far either, I believe. So, be on the lookout for fresh bullish signals to emerge from here on.

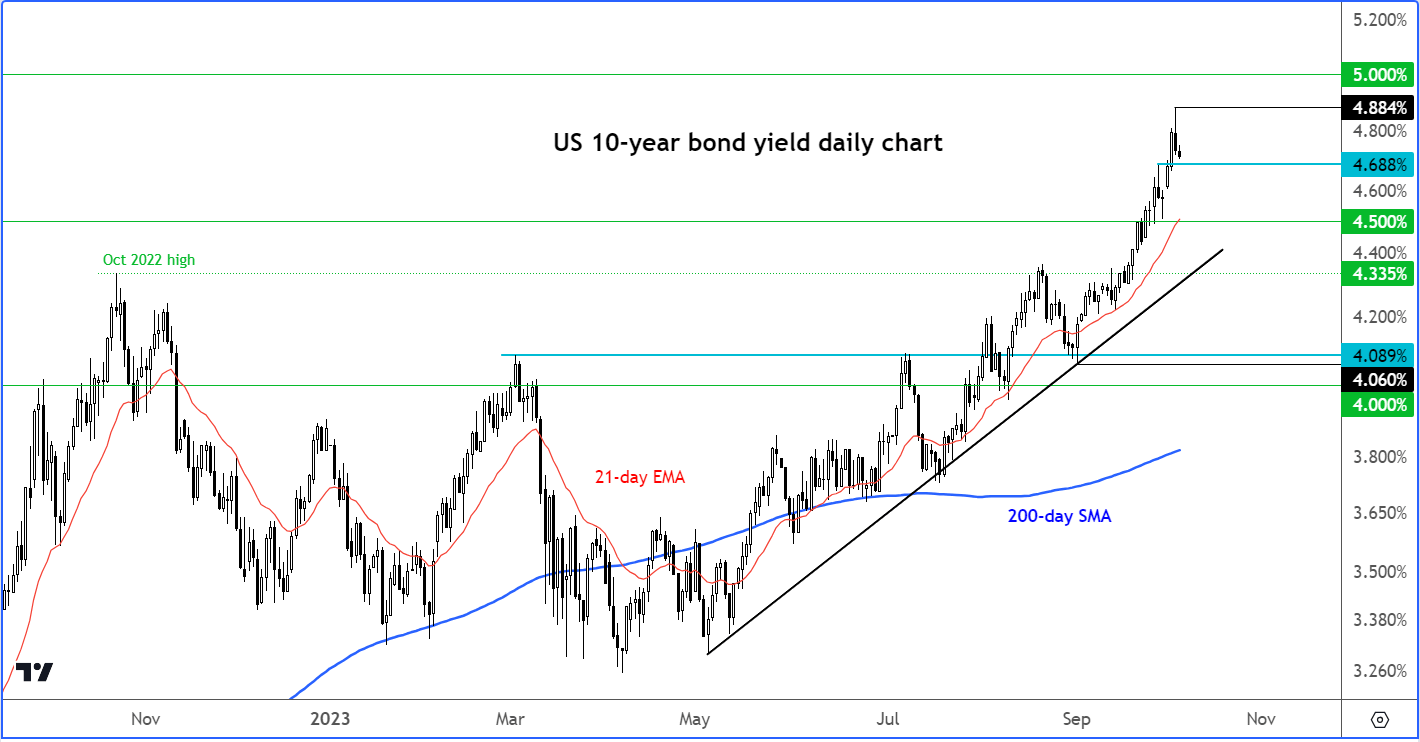

Will yields fall further?

Source: TradingView.com

On Wednesday we saw yields take a nosedive and that caused the dollar to weaken. Though that move has stalled somewhat so far today, there is a good chance we may see renewed weakness start to creep into the dollar moving forward, as global economic weakness starts to catch up with the US. If those ADP private payrolls can be trusted (they haven’t been very reliable, truth be told), employment is finally cooling down, helping to ease inflationary pressures further. The big 5% drop in oil prices we saw on Wednesday, and the additional 2% drop so far today, will have also diminished inflation risks. So, keep an eye on bond yields to see if Wednesday marked a top, or was it just a temporary stop ahead of a move to 5%. This week’s main macro event on the economic calendar is the US nonfarm payrolls report. Expect lots of volatility around the time when the numbers are released. Gold bulls will want to see weaker jobs figures and more importantly, weaker wages growth.

Gold analysis: technical levels to watch

Source: TradingView.com

Interesting, gold is now back in the area around $1805 to $1820, where gold rallied from back in the first few months of the year. Will this zone act as support again, or will the additional gains we have seen in bond yields cause it to break down this time?

Another scenario is we could see a temporary rebound, followed by more losses, before XAUUSD bottoms out. You don’t need to look at any technical momentum indicators like the RSI (Relative Strength Index) to figure out whether gold is oversold or not. But if you must, you will notice that the RSI has not been this ‘oversold’ since September 2022, when gold bottomed out at $1615. After falling so rapidly in recent days, even the bears may now be expecting to see an oversold bounce. So, profit-taking from the bears alone could trigger at least a temporary move higher.

For me to turn decidedly bullish on gold, we now need to see a solid bullish reversal candle on the daily time frame, and this needs to be backed by further evidence that yields have topped out.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade