Asian Indices:

- Australia's ASX 200 index rose by 77.8 points (1.1%) and currently trades at 7,130.80

- Japan's Nikkei 225 index has risen by 938.22 points (3.8%) and currently trades at 25,655.75

- Hong Kong's Hang Seng index has risen by 151.15 points (0.73%) and currently trades at 20,778.86

- China's A50 Index has risen by 206.66 points (1.51%) and currently trades at 13,851.62

UK and Europe:

- UK's FTSE 100 futures are currently up 31.5 points (0.44%), the cash market is currently estimated to open at 7,222.22

- Euro STOXX 50 futures are currently up 4 points (0.11%), the cash market is currently estimated to open at 3,770.02

- Germany's DAX futures are currently up 35 points (0.25%), the cash market is currently estimated to open at 13,882.93

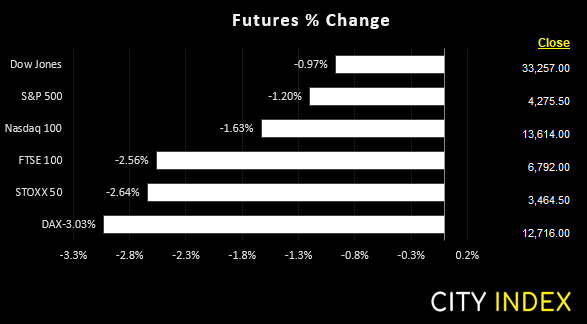

US Futures:

- DJI futures are currently down -58 points (-0.17%)

- S&P 500 futures are currently down -29 points (-0.21%)

- Nasdaq 100 futures are currently down -5.25 points (-0.12%)

Major stock market indices all posted gains overnight, led by Japan’s Nikkei and TOPIX. The ASX 200 touched a 4-day high, and futures for the DAX and FTSE have also posted gains. The same cannot yet be said for their US counterparts, and their rally was not as good as seen across Europe yesterday anyway. So we head into today’s European open cautiously optimistic.

The Democrat-led House approves spending bill for Ukraine

A $13.6 billion spending bill has been approved by the US House of Representatives to aid Ukraine and its allies. They also voted 414-17 in favour of banning the import of Russian oil. It will now go to the Senate for a final vote by early next week.

Carlsberg is the latest business to cull ties with Russia, stating it will no longer sell its flagship beer brand and cease all advertising. With that said, Baltika Breweries (owned by Carlsberg and based in St Petersburg) will continue to operate its eights breweries in Russia.

FTSE 350: Market Internals

FTSE 350: 4029.28 (3.25%) 09 March 2022

- 324 (92.31%) stocks advanced and 26 (7.41%) declined

- 3 stocks rose to a new 52-week high, 8 fell to new lows

- 21.08% of stocks closed above their 200-day average

- 27.07% of stocks closed above their 50-day average

- 17.66% of stocks closed above their 20-day average

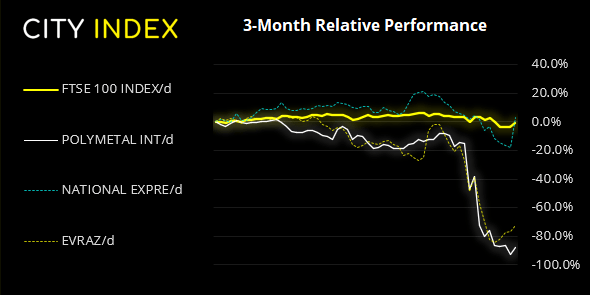

Outperformers:

- + 69.20% - Polymetal International PLC (POLYP.L)

- + 25.55% - National Express Group PLC (NEX.L)

- + 18.70% - EVRAZ plc (EVRE.L)

Underperformers:

- -9.58% - Centamin PLC (CEY.L)

- -7.27% - Fresnillo PLC (FRES.L)

- -6.94% - Endeavour Mining PLC (EDV.L)

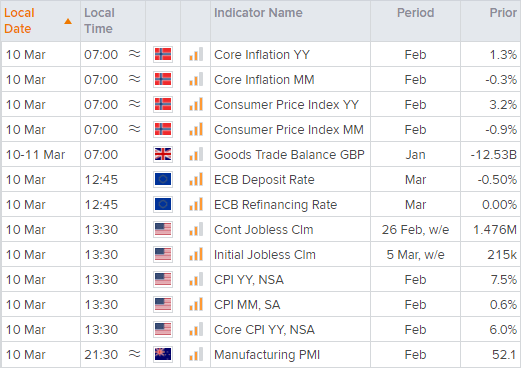

Currency volatility subsides ahead of ECB meeting

Volatility for currencies was lower overnight, and in some ways it has been refreshing given the sheer amount of volatility and price swings we have seen these past two weeks. But we also have an ECB meeting and US inflation data to contend with, even if it is debatable as to how much of an impact they may have on markets, which remain vulnerable to Ukraine-related headlines.

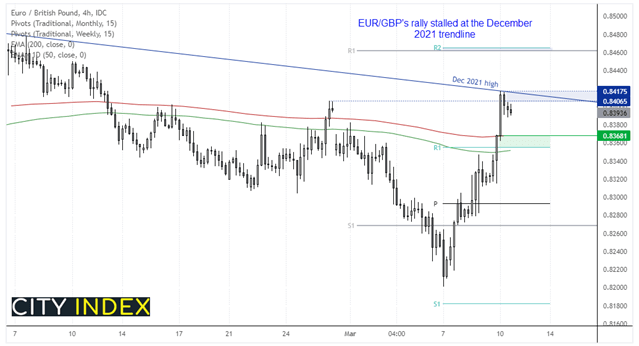

EUR/GBP has rallied around 2.6% from its Monday’s low and in a relatively straight line. Interestingly, that very low found support at the 200-month eMA this week and, at current levels, we are on track for a bullish pinbar week. Given traders remain increasingly net-long the euro, perhaps this is actually the beginning of a decent rebound.

As for today, prices are consolidating just off of yesterday’s highs having met resistance at the December 2021 trendline. The 0.8382 high may provide support, but we also have the 50-day eMA at 0.8368 or the 200-hour eMA around the weekly R1 pivot at 0.8350 for lower support levels. A break above yesterday’s high assumes bullish continuation and brings the 0.8460 into focus, near the monthly R1 and weekly R2 pivot points.

Euro explained – a guide to the euro

Commodities cautiously tread water

Levels of volatility across commodities were at multi-year highs yesterday. The Bloomberg commodity index saw its heaviest single day loss since 2008, WTI fell as much as -22% by the day’s low, and gold handed back all of Tuesday’s parabolic gains. Yet traders appeared side lined overnight and reluctant to commit to either direction. They clearly need a new catalyst, with the optimum outcome being a further de-escalation of the crisis in Ukraine which would likely weigh on commodities further, remove concerns of stagflation and see equity markets extend their countertrend bounces. Yet volatility cuts both ways. So should we see Russia retaliate for the West “intervening”, “accidently” blow up a nuclear facility or generally up the ante, commodities could be set to rally and reignite fears of stagflation – and send equity markets tumbling into the weekend.

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade