Asian Indices:

- Australia's ASX 200 index rose by 13.8 points (0.21%) and currently trades at 6,616.00

- Japan's Nikkei 225 index has risen by -502.75 points (1.28%) and currently trades at -188.00

- Hong Kong's Hang Seng index has fallen by -255.11 points (-1.21%) and currently trades at 20,869.09

- China's A50 Index has fallen by -209.61 points (-1.45%) and currently trades at 14,260.76

UK and Europe:

- UK's FTSE 100 futures are currently down -27 points (-0.38%), the cash market is currently estimated to open at 7,169.59

- Euro STOXX 50 futures are currently down -25 points (-0.72%), the cash market is currently estimated to open at 3,446.69

- Germany's DAX futures are currently down -91 points (-0.71%), the cash market is currently estimated to open at 12,741.44

US Futures:

- DJI futures are currently down -156 points (-0.5%)

- S&P 500 futures are currently down -77.75 points (-0.65%)

- Nasdaq 100 futures are currently down -21.5 points (-0.56%)

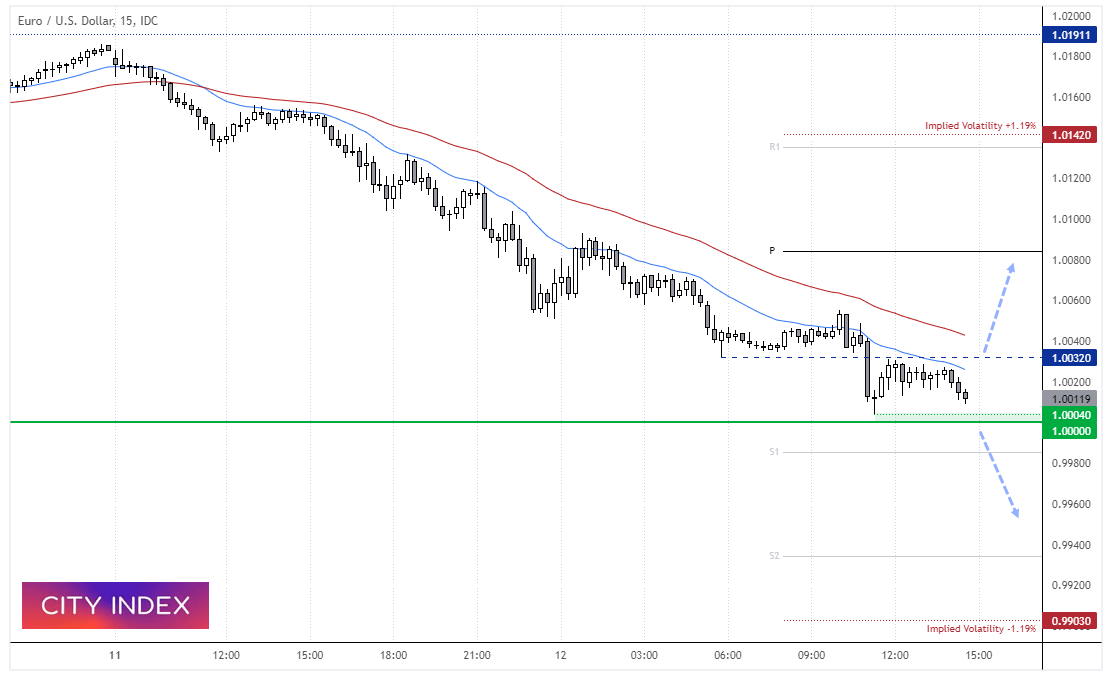

US Treasury Secretary Janet Yellen is set to discuss further sanctions against Russia with Japan’s Finance Minster later today. They’re also set to discuss “currencies” and a price cap for Russian oil. The US dollar index continued its ascent overnight and reached its highest level since September 2002. And that has forced EUR/USD down to just +5 pips above parity – a key level for today’s session, highlighted by rising implied volatility and demand for put options (downside protection).

EUR/USD 15-minute chart

Perhaps today’s ZEW report could be the straw which breaks parity’s back. The sentiment report for Germany is scheduled for 10:00 BST and is unlikely to show a material lift in sentiment. It reached a post-pandemic low of -41 in April, has since risen to -28 since but there’s no pressing reason to suggest it cannot move lower again given the wave of recession headlines of late.

EUR/USD fell to 1.0004 early in the session and now trades around 1.0012. If it can hold above parity then a break above 1.0032 assumes a countertrend move is underway. Whilst a clear break below 1.000 runs the risk of triggering stops and fresh sell orders (and potentially moving the market lower).

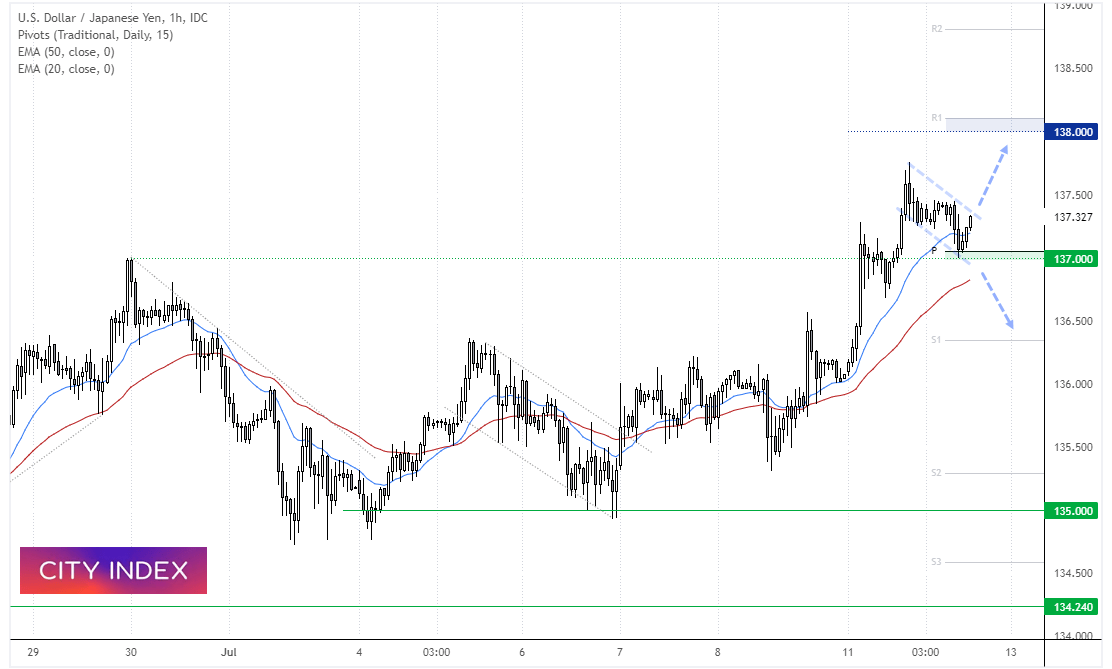

USD/JPY 1-hour chart: