Asian Indices:

- Australia's ASX 200 index fell by -93.7 points (-1.37%) and currently trades at 6,749.20

- Japan's Nikkei 225 index has fallen by -297.44 points (-1.07%) and currently trades at 27,578.47

- Hong Kong's Hang Seng index has fallen by -96.36 points (-0.51%) and currently trades at 18,834.02

- China's A50 Index has fallen by -172.96 points (-1.3%) and currently trades at 13,181.70

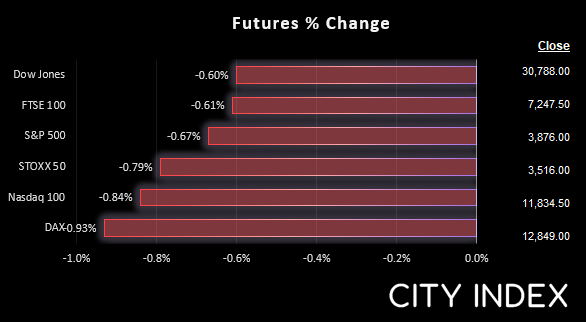

UK and Europe:

- UK's FTSE 100 futures are currently down -44.5 points (-0.61%), the cash market is currently estimated to open at 7,237.57

- Euro STOXX 50 futures are currently down -29 points (-0.82%), the cash market is currently estimated to open at 3,512.79

- Germany's DAX futures are currently down -120 points (-0.93%), the cash market is currently estimated to open at 12,836.66

US Futures:

- DJI futures are currently down -186 points (-0.6%)

- S&P 500 futures are currently down -101.5 points (-0.85%)

- Nasdaq 100 futures are currently down -26 points (-0.67%)

- Stronger than expected data from China, and hints from the RBA governor that it is closer to normalising rates saw NZD and AUD as the strongest majors overnight.

- A BOJ official and South Korean Finance Minister were both on the wires saying they are looking at ways to stabilise their currencies after excessive depreciation.

- Gold remains anchored to yesterday’s low after closing beneath the 2021 low on strong momentum.

- US and European futures are pointing to a weak of open for cash market indices.

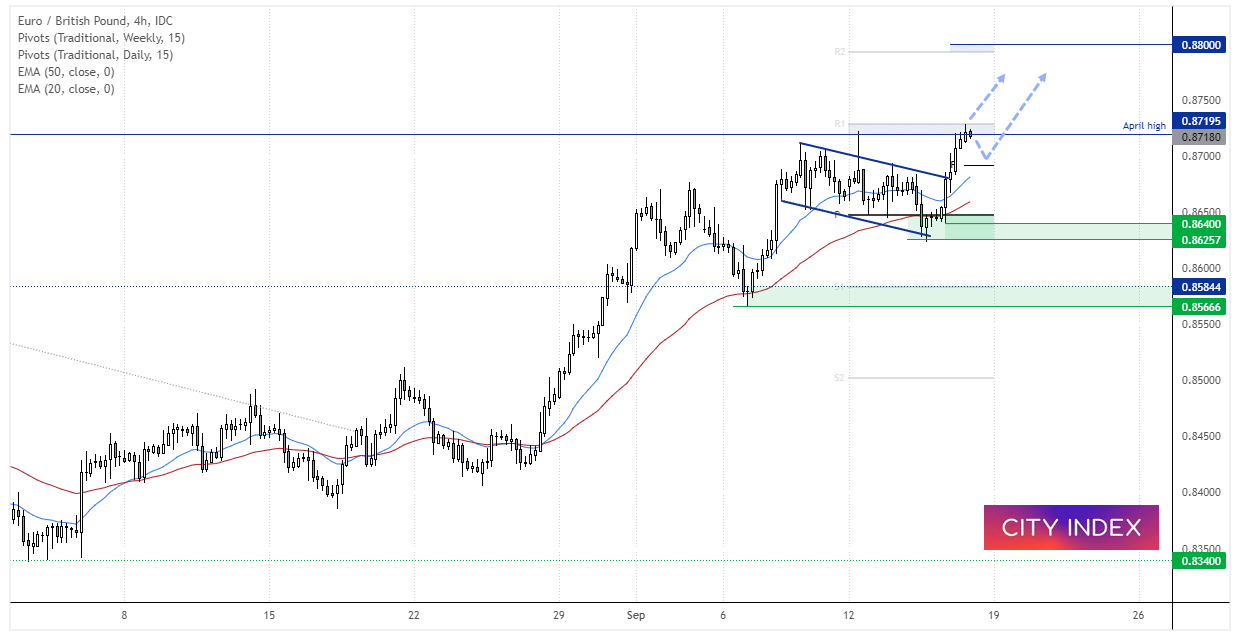

EUR/GBP 4-hour chart:

A strong bullish trend has developed on EUR/GBP, although it has so far struggled to break convincingly above the April high. But a defining rally since September is that the more volatile days are bullish, with yesterday’s rally from the monthly pivot being the most recent example. The weekly R1 pivot

FTSE 350 – Market Internals:

FTSE 350: 4034.88 (0.07%) 15 September 2022

- 188 (53.71%) stocks advanced and 152 (43.43%) declined

- 2 stocks rose to a new 52-week high, 23 fell to new lows

- 24.29% of stocks closed above their 200-day average

- 63.14% of stocks closed above their 50-day average

- 4.86% of stocks closed above their 20-day average

Outperformers:

- + 17.05% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- + 8.16% - Carnival PLC (CCL.L)

- + 6.41% - Redrow PLC (RDW.L)

Underperformers:

- -28.27% - Hilton Food Group PLC (HFG.L)

- -5.28% - Cranswick PLC (CWK.L)

- -4.90% - WAG Payment Solutions PLC (WPS.L)

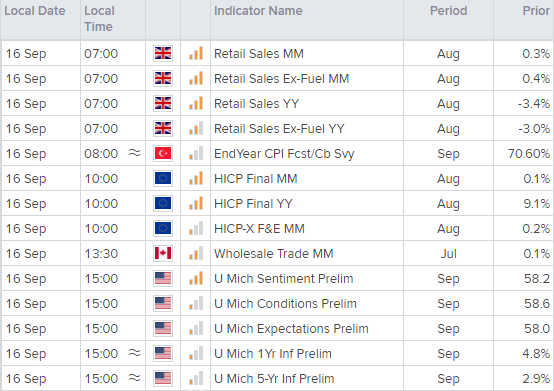

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM