We begin the week with a slight risk-off vibe, with ongoing concerns that the US is heading towards a recession.

Asian Indices:

- Australia's ASX 200 index fell by -3.7 points (-0.05%) and currently trades at 6,787.80

- Japan's Nikkei 225 index has fallen by -213.62 points (-0.77%) and currently trades at 27,701.04

- Hong Kong's Hang Seng index has fallen by -173 points (-0.84%) and currently trades at 20,436.14

- China's A50 Index has fallen by -72.89 points (-0.52%) and currently trades at 13,968.37

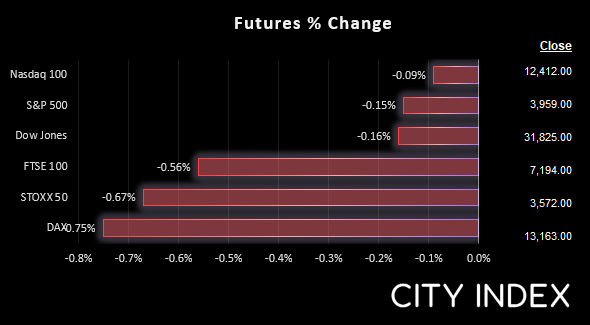

UK and Europe:

- UK's FTSE 100 futures are currently down -39.5 points (-0.55%), the cash market is currently estimated to open at 7,236.87

- Euro STOXX 50 futures are currently down -25 points (-0.7%), the cash market is currently estimated to open at 3,571.49

- Germany's DAX futures are currently down -104 points (-0.78%), the cash market is currently estimated to open at 13,149.68

US Futures:

- DJI futures are currently down -49 points (-0.15%)

- S&P 500 futures are currently down -9.75 points (-0.08%)

- Nasdaq 100 futures are currently down -6 points (-0.15%)

US Secretary of State is doing her best to quash such fears (as it’s part of her job) but markets remain unconvinced. On Sunday she acknowledged that whilst a slowdown is possible the US economy can still bring down inflation without triggering a hard landing, even if this week’s GDP report comes in negative due to solid jobs growth. But as we have pointed out, this is a lagging indicator and several other employment metrics are pointing towards a softer jobs market.

Asian indices traded lower in line with Friday’s performance on Wall Street. Oil prices also continued lower overnight as fears of a recession dented demand outlook. The US dollar is the strongest major with AUD and NZD currently the weakest. Gold is trading flat around 1725 after pulling back from its 1740 high on Friday, but the bias for a move to 1750 remains on the table. US and European futures point to a weaker open for cash market indices.

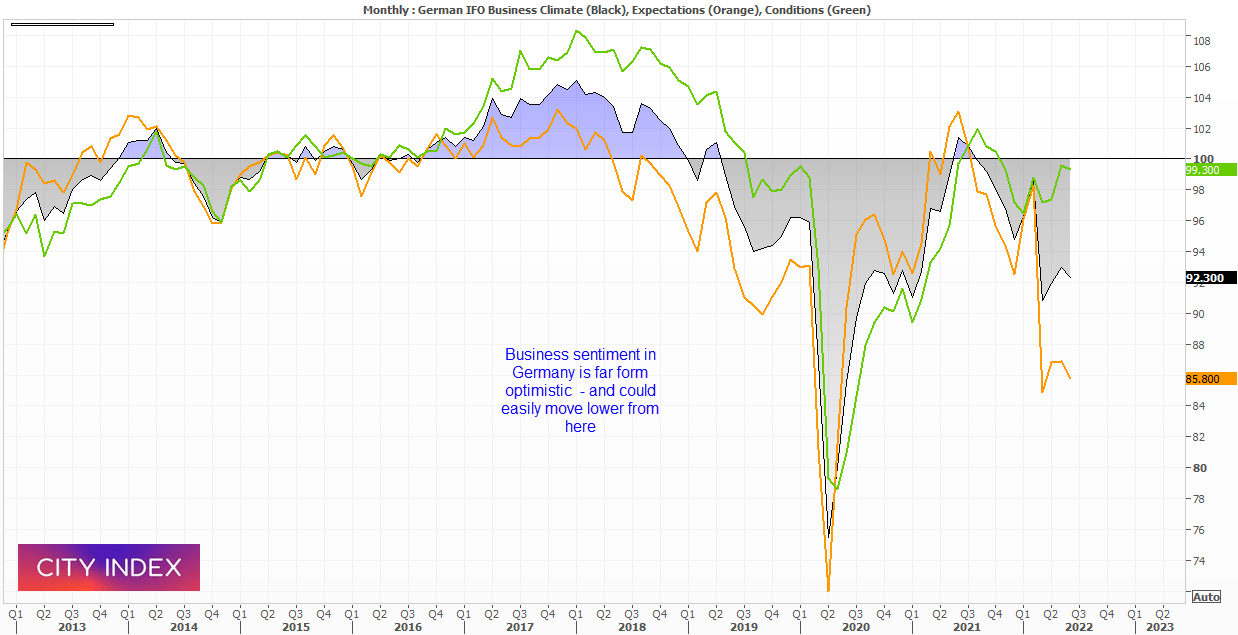

Germany IFO Business climate up next:

The German IFO report is scheduled for 09:00 BST. Just two months ago the report effectively concluded they saw ‘no chance of a recession’, a comment which is not likely to have aged well. June’s report noted weaker sentiment and a grim outlook over the next 6-moth for manufacturing, and we’re on guard for some more pessimism today. And that could weigh further o the DAX which met resistance at its monthly pivot point last week.

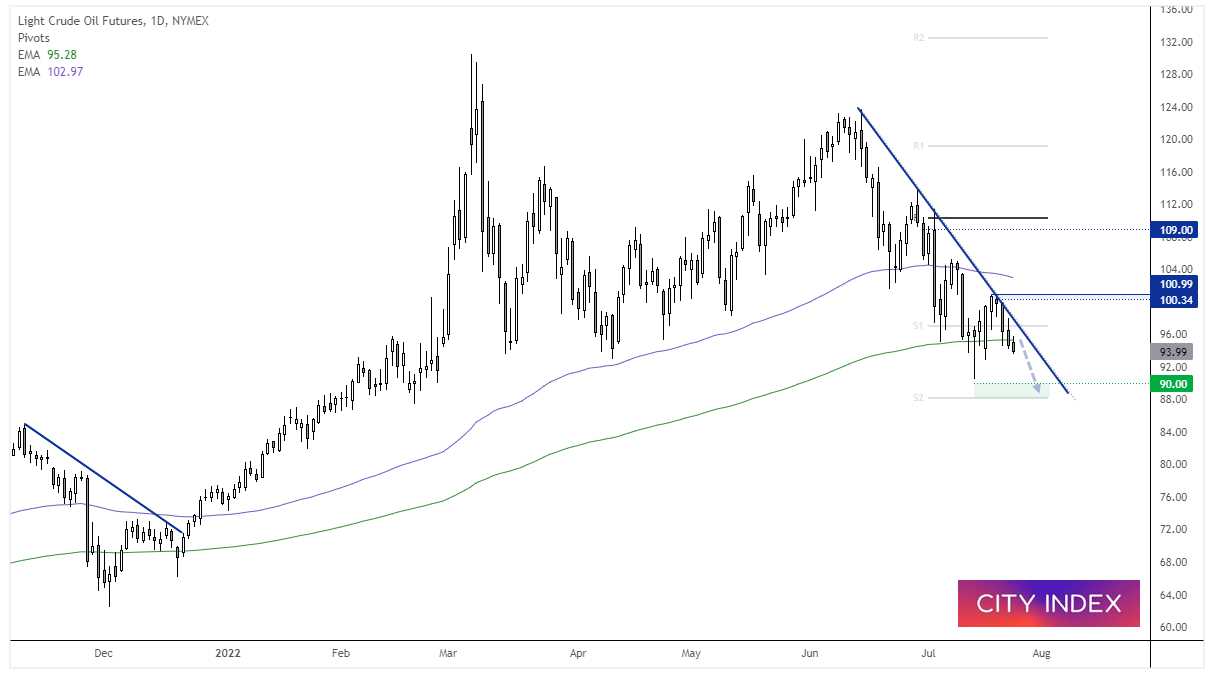

WTI daily chart:

Last week I had been looking for oil to hold above $100 a bit longer than it did. It wasn’t meant to be. With demand outlook dented with recession fears then oil prices are back under pressure, which is good news for consumers and anyone who wants to see lower inflation. A swing high formed at the bearish trendline at 100.99 and prices are back below the 200-day eMA and monthly S1 pivot. From here’s we’d consider fading into moves below these resistance levels and for a move back down to 90.0.

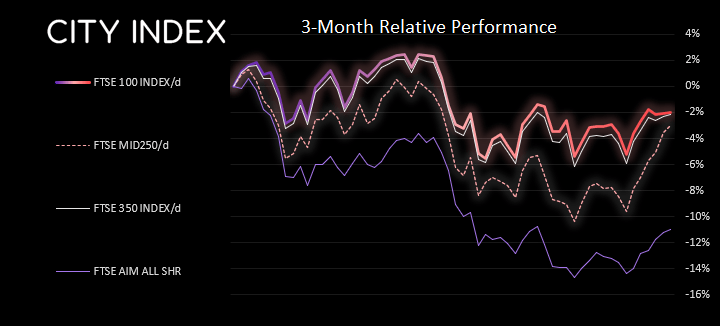

FTSE 350 – Market Internals:

FTSE 350: 4062.26 (0.08%) 22 July 2022

- 218 (62.11%) stocks advanced and 119 (33.90%) declined

- 8 stocks rose to a new 52-week high, 0 fell to new lows

- 28.21% of stocks closed above their 200-day average

- 69.8% of stocks closed above their 50-day average

- 22.22% of stocks closed above their 20-day average

Outperformers:

- + 9.43% - Beazley PLC (BEZG.L)

- + 6.20% - Jtc PLC (JTC.L)

- + 5.24% - 4imprint Group PLC (FOUR.L)

Underperformers:

- -8.69% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- -5.41% - Mondi PLC (MNDI.L)

- -5.16% - DS Smith PLC (SMDS.L)

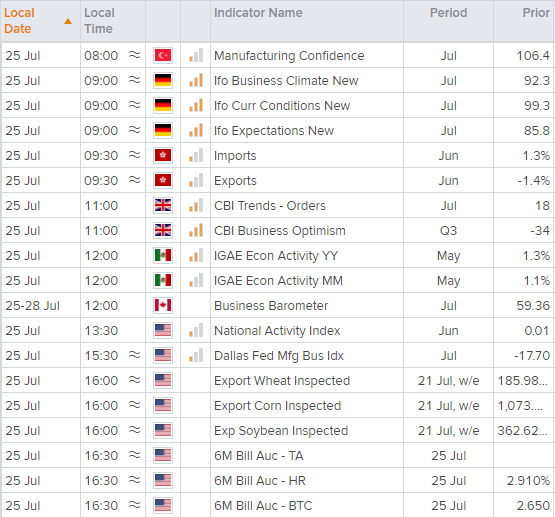

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade