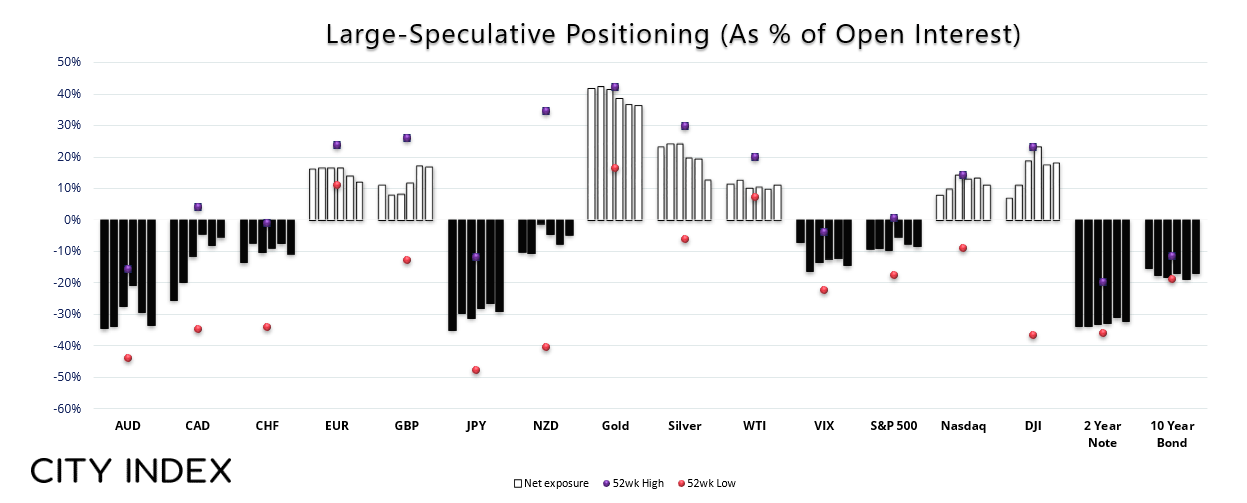

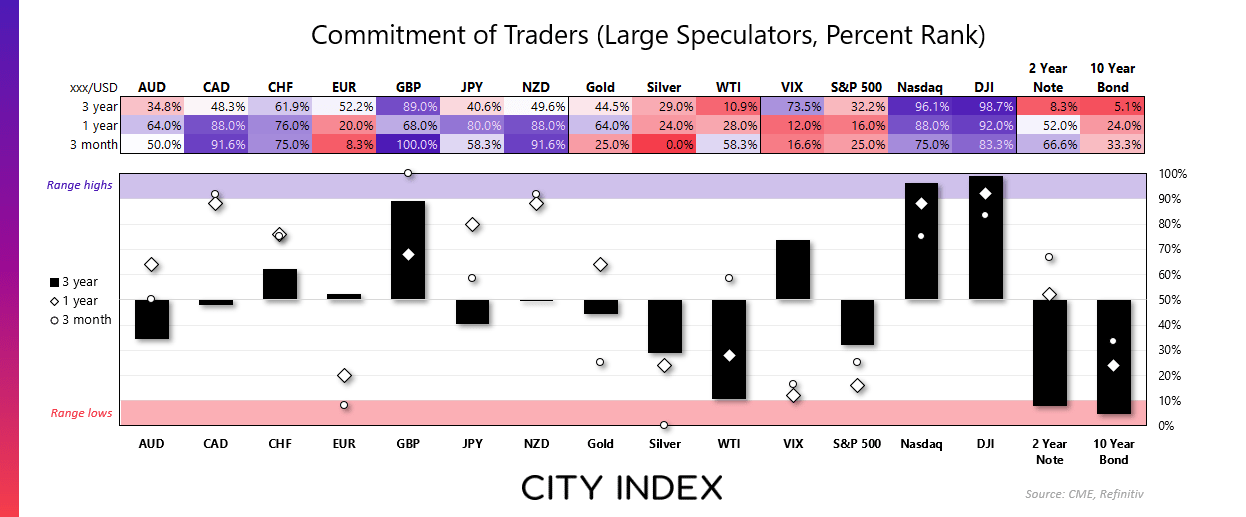

Market positioning from the COT report - as of Tuesday 23, 2023:

- Traders have reduced their short-exposure to US dollar futures by ~50% over the past four weeks

- Asset managers increased their gross short exposure to Japanese yen futures by 28.2%.

- Whilst large speculators increased gross-short exposure by 22.3%, they also increased gross longs by 19%.

- Large speculators continued to pile into the short metal theme, with short positioning to copper futures rising 24.6%, palladium increased by 22.4% and platinum by 9.8%

- Asset managers also flipped to net-short exposure to silver and platinum

- Net-long exposure among large speculators on gold futures fell to a 10-week low

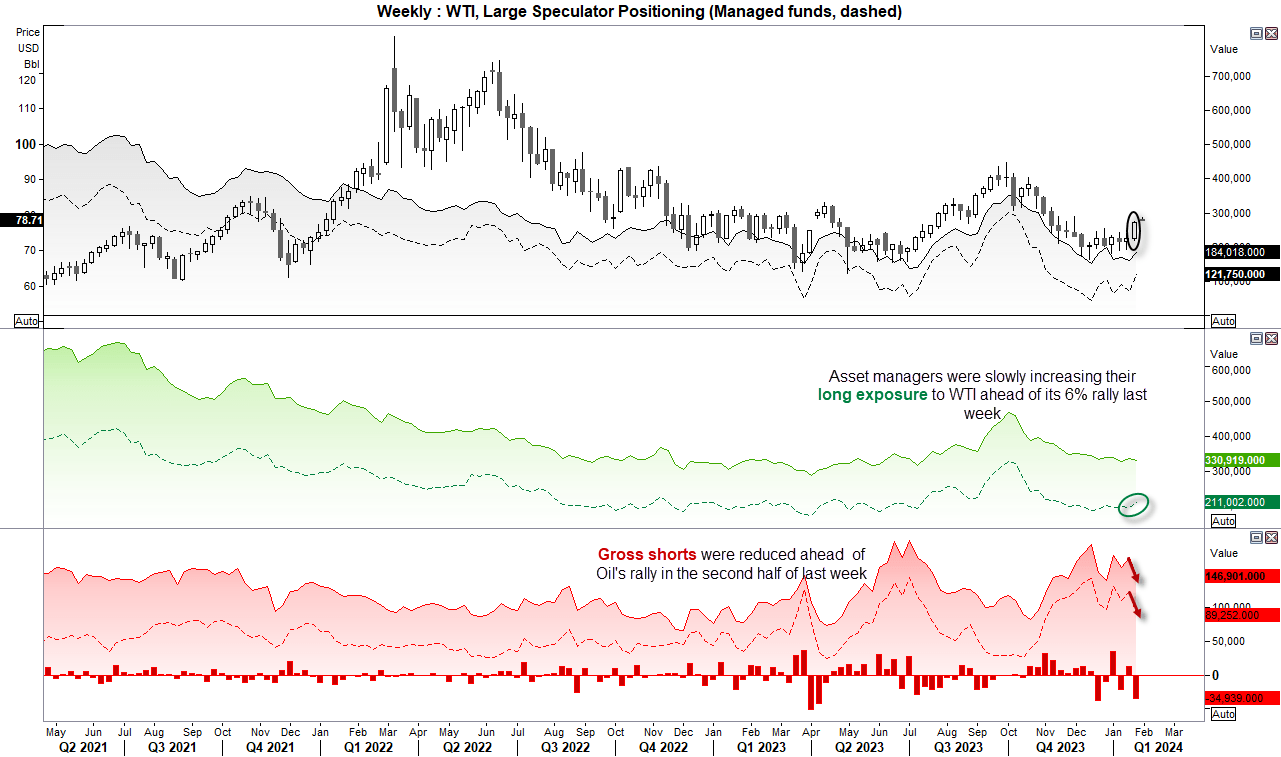

- Traders were reducing their short bets against WTI crude in the weeks heading in to last week’s rally

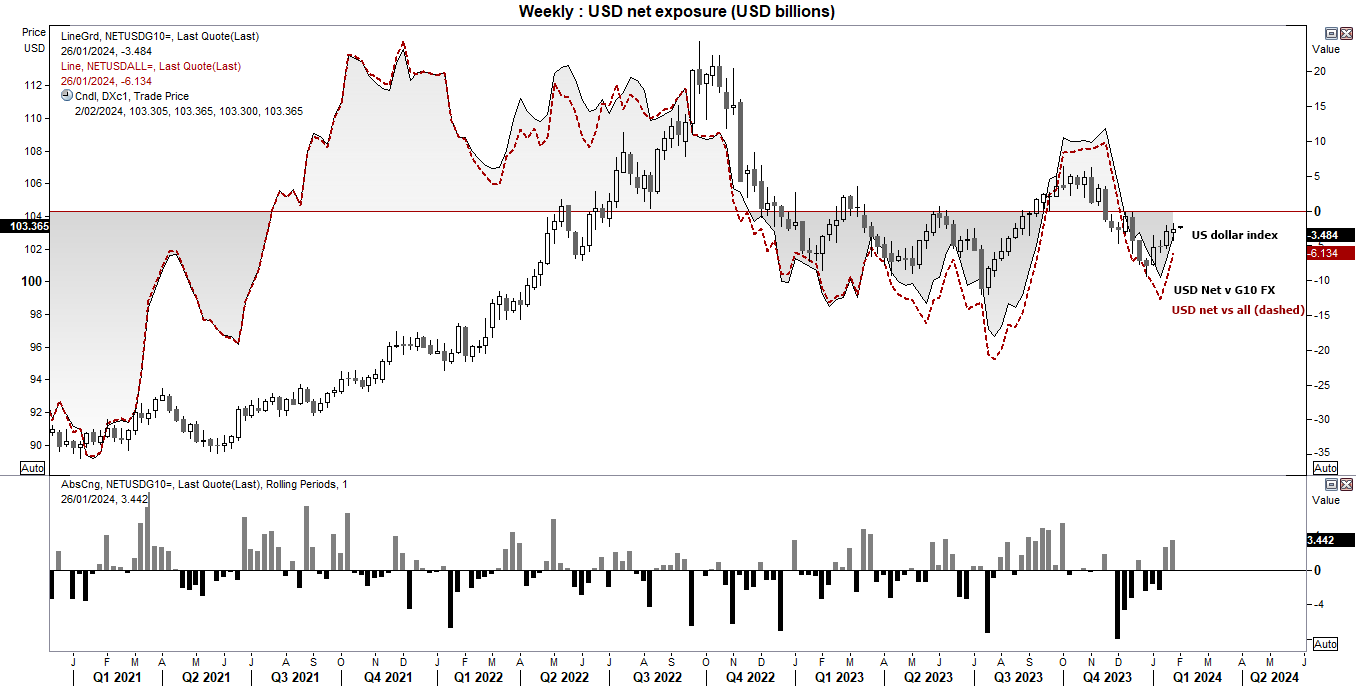

US dollar positioning (IMM data) – COT report:

Traders were net-short the US dollar against all traded futures by -$6.1 billion according to the International Money Markets (IMM). Although that means USD short positioning has been reduced ~50% over the past four weeks and sees net-short exposure against G10 currencies fall to -$3.4 billion – down ~65% from four weeks ago.

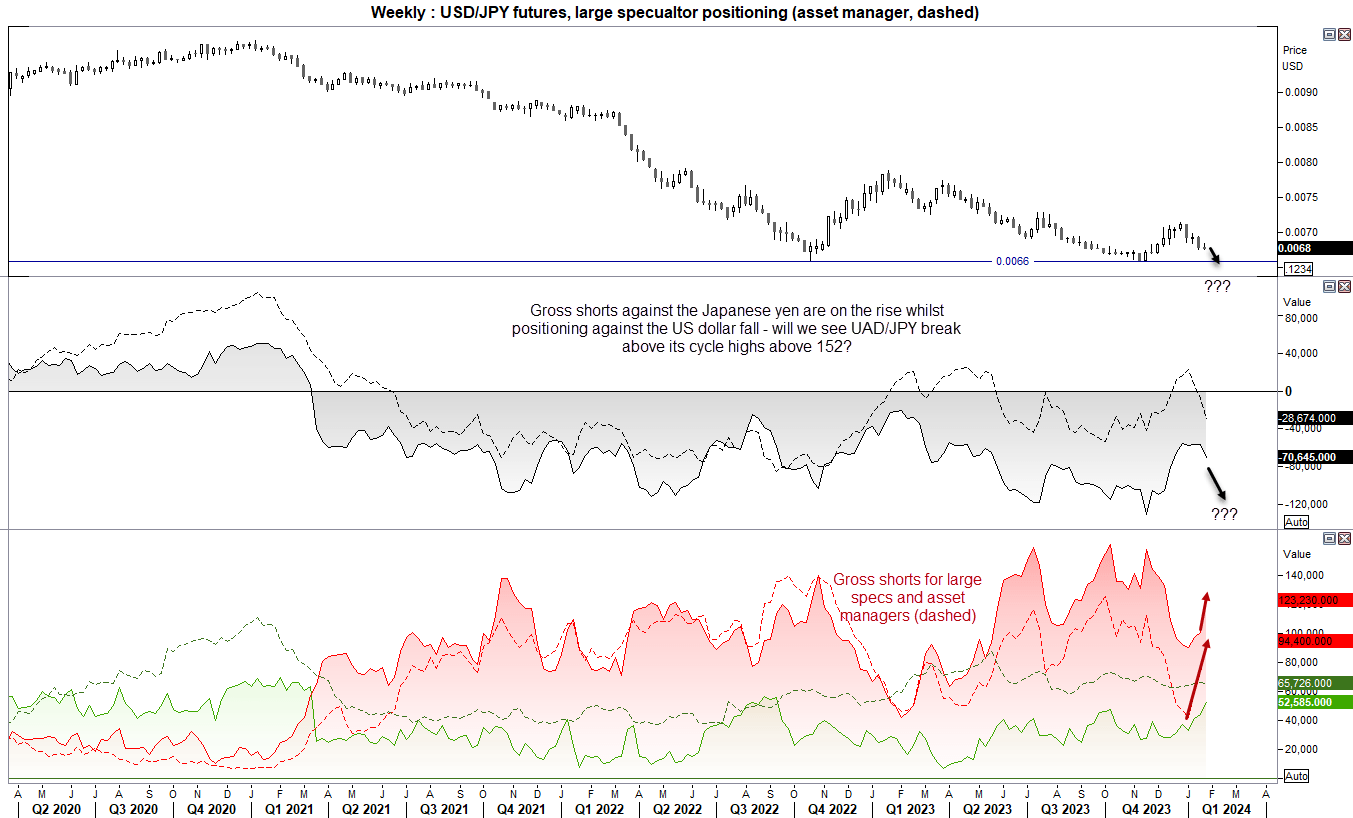

JPY/USD (Japanese yen futures) positioning – COT report:

Short bets against the Japanese yen are on the rise among large speculators and asset managers. Although large speculators also increased their long exposure by similar amount. Asset managers increased short exposure by 28.2% and trimmed longs by -0.8% to show more conviction in betting against the yen, which could be translated as a bullish bet for USD/JPY.

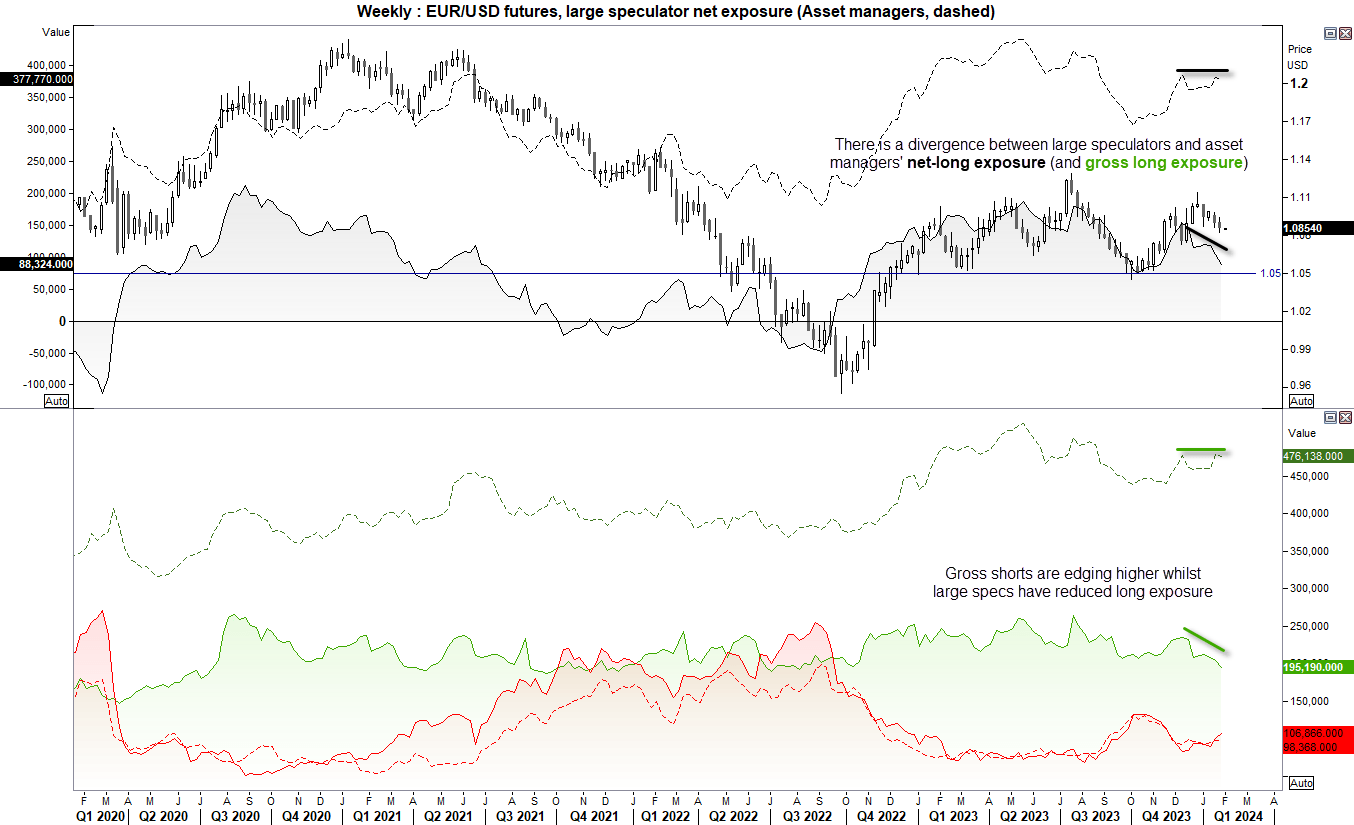

EUR/USD (Euro dollar futures) positioning – COT report:

We’re seeing a divergence between large speculators and asset managers on the euro; the latter are retaining their gross shorts yet increasing shorts, while large speculators are trimming longs whilst increasing shorts. For EUR/USD to move materially lower we’d likely need to see the ECB hint at a pre-summer cut whilst the Fed continue to push back against such a move. But if we see asset managers begin to trim their longs, it could be a signal that large speculators were on to something. However, I suspect we’ll find the ECB are not likely to signal or actually cut before the summer, so perhaps the downside potential for EUR/USD is limited over the coming weeks.

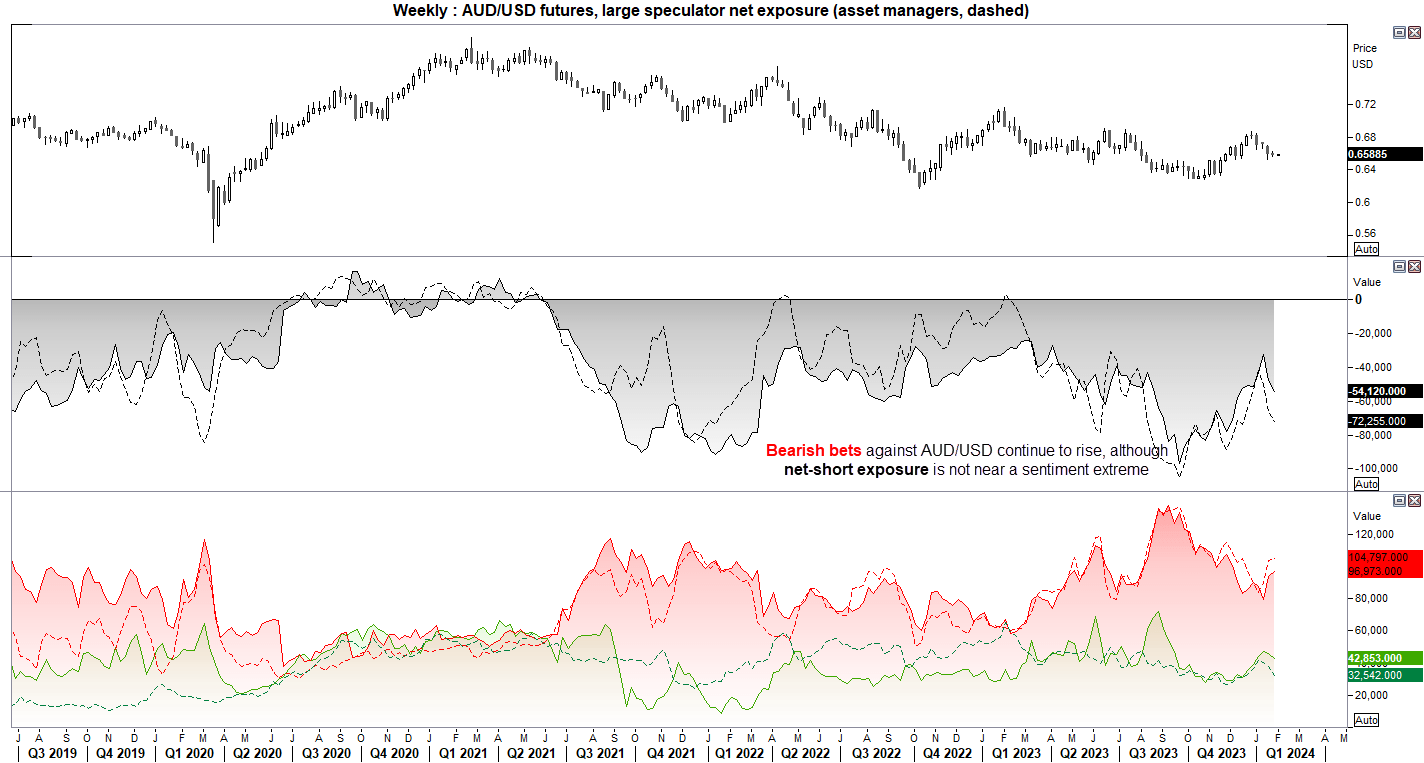

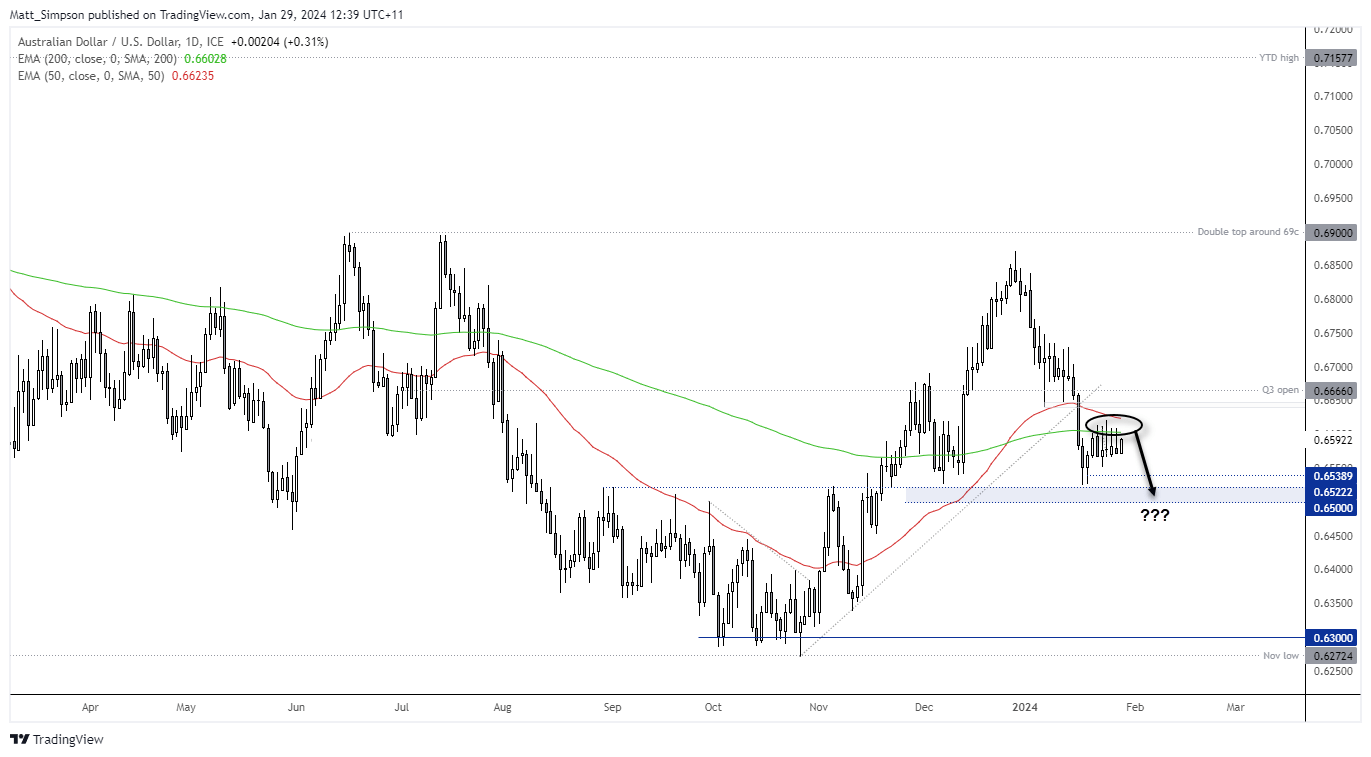

AUD/USD (Australian dollar futures) positioning – COT report:

Futures traders continued to express their bearish view on AUD/UUSD, with asset managers increasing shorts for a third week and large speculators a second. Yet net-short exposure does not seem to be at a sentiment extreme, and if traders continue to trim USD shorts and Australia is treated to a softer inflation report on Wednesday, perhaps we’ll finally see AUD/USD move lower. A series of bearish candles on the daily chart below the 200-day EMA suggest another leg lower could be due.

WTI crude oil (CL) positioning – COT report:

Crude oil rallied over 6% last week, to mark its best week in five months. We can see that short exposure was falling among large speculators and asset managers, although as the rally occurred in the second half of last week we cannot see the change of positioning of the actual rally. However, given the rising concerns of war in the Middle East, one could assume that the rally spurred an increase of bullish bets.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade