Market Summary:

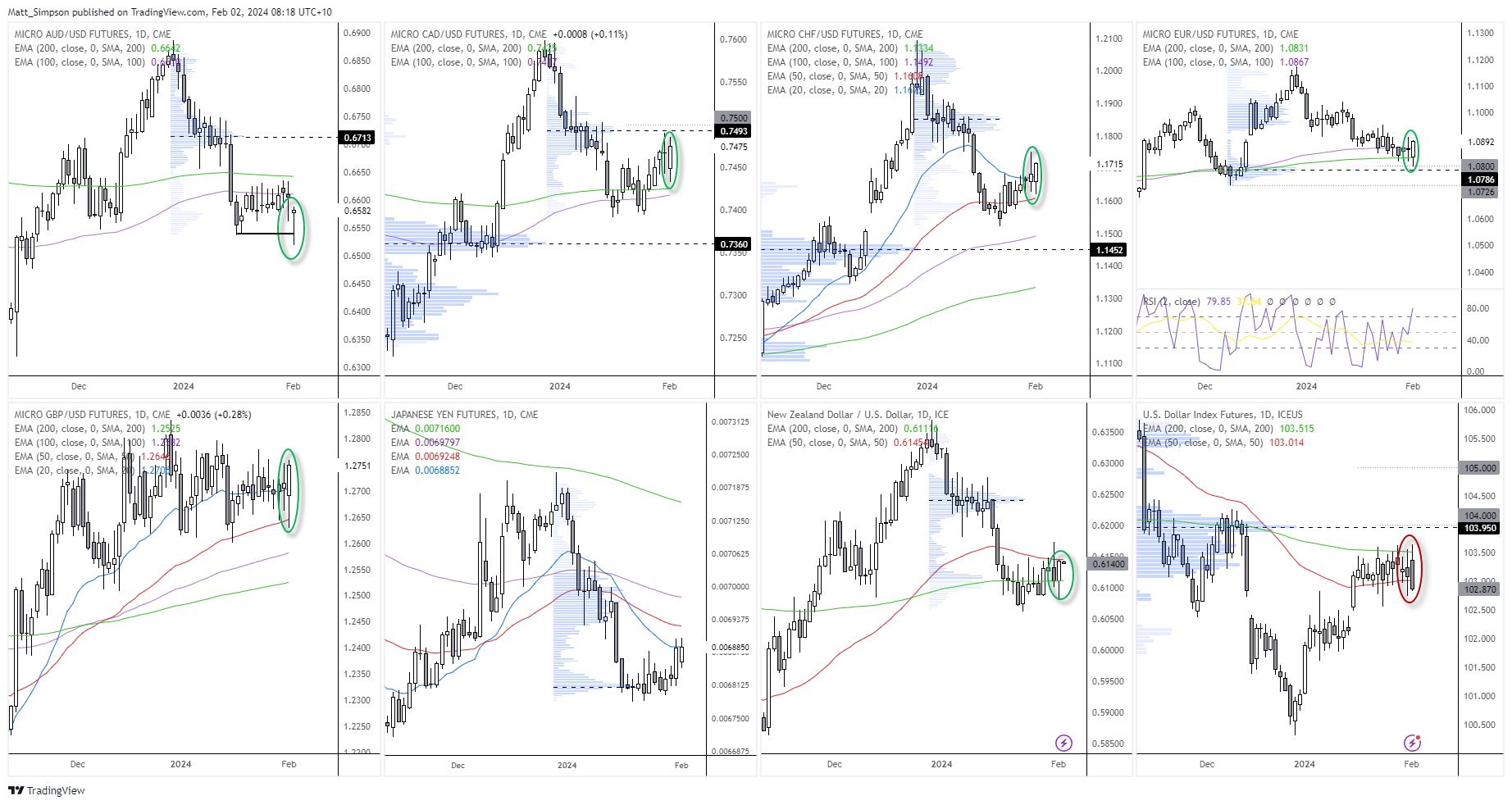

- The US dollar was lower across the board after traders digested the latest Fed meeting and are now focusing on four cuts this year, beginning in May. EUR/USD is just one of several pairs to rise from key support levels.

- AUD/USD printed an elongated bullish pinbar following a false break of the Jan 17 low. As the rally was driven by a weaker US dollar, I remain sceptical of any runaway gains – especially if we’re treated to a soft set of producer prices today

- Wall Street rebounded on Thursday ahead of key earnings reports expected after the close

- Positive earnings reports from META, Amazon and Apple helped Nasdaq futures rally over 1% after the close

- Gold rose for a fourth day and reached a 19-day high before pulling back but still closing above $2050

- Crude oil futures fell for a second day with the front-month contract seeing its largest daily volume since last November and closed below $74

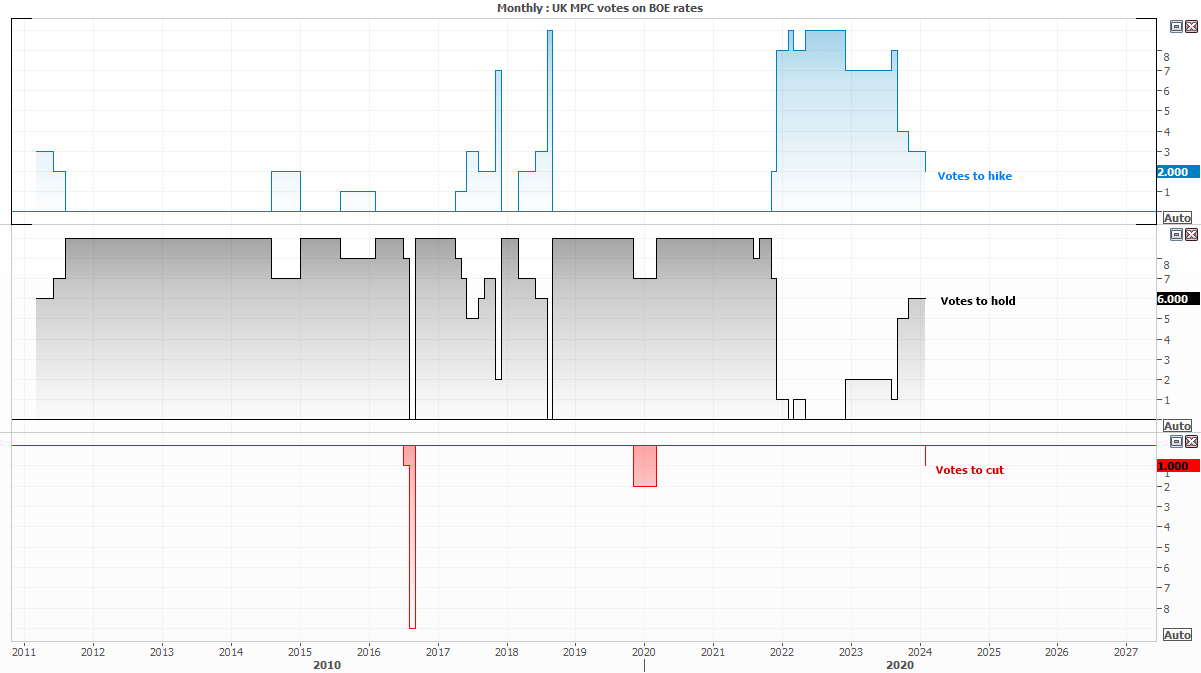

The BOE tread carefully over timing of first cut

This Bank of England struck a similar tone to the Fed where central banks are treading very carefully as not to over promise and under-deliver the rate cuts markets so desperately want. The BOE held their interest rate at 5.25% as expected, although one MPC member voted to cut for the first time since January 2020 and one less voted to hike. Six voted to hold, two to hike and one to cut.

Whilst this is a subtle but important shift towards their first cut, the BOE were careful not to overpromise on such action, with Governor Bailey saying the current level of rates is appropriate and it is not yet the time to lower them. He also warned not to expect further big falls in energy prices and that the continuation of trade disruptions are an upside risk to inflation. And that it is not as simple as saying “inflation returns to target and spring and job done”.

GBP/USD was the second strongest FX major of the session and formed a bullish outside day after finding support at its 50-day EMA. Whilst prices remain on the choppy side, it looks as though it may at least want to have another crack at 1.28.

The USD dollar was the weakest FX major a day after the FOMC meeting, where traders are now focussing on a May cut despite the Fed pushing back on rates for march. Fed fund futures imply a 60% chance of a 25bp cut in May, with June, July and September all showing >50% chance of another 25bp for a total of four.

Events in focus (AEDT):

- 11:30 – Australian home loans, producer prices

- 23:15 – BOE chief economist Pill speaks

- 00:30 – US nonfarm payrolls

- 02:00 – Michigan consumer sentiment

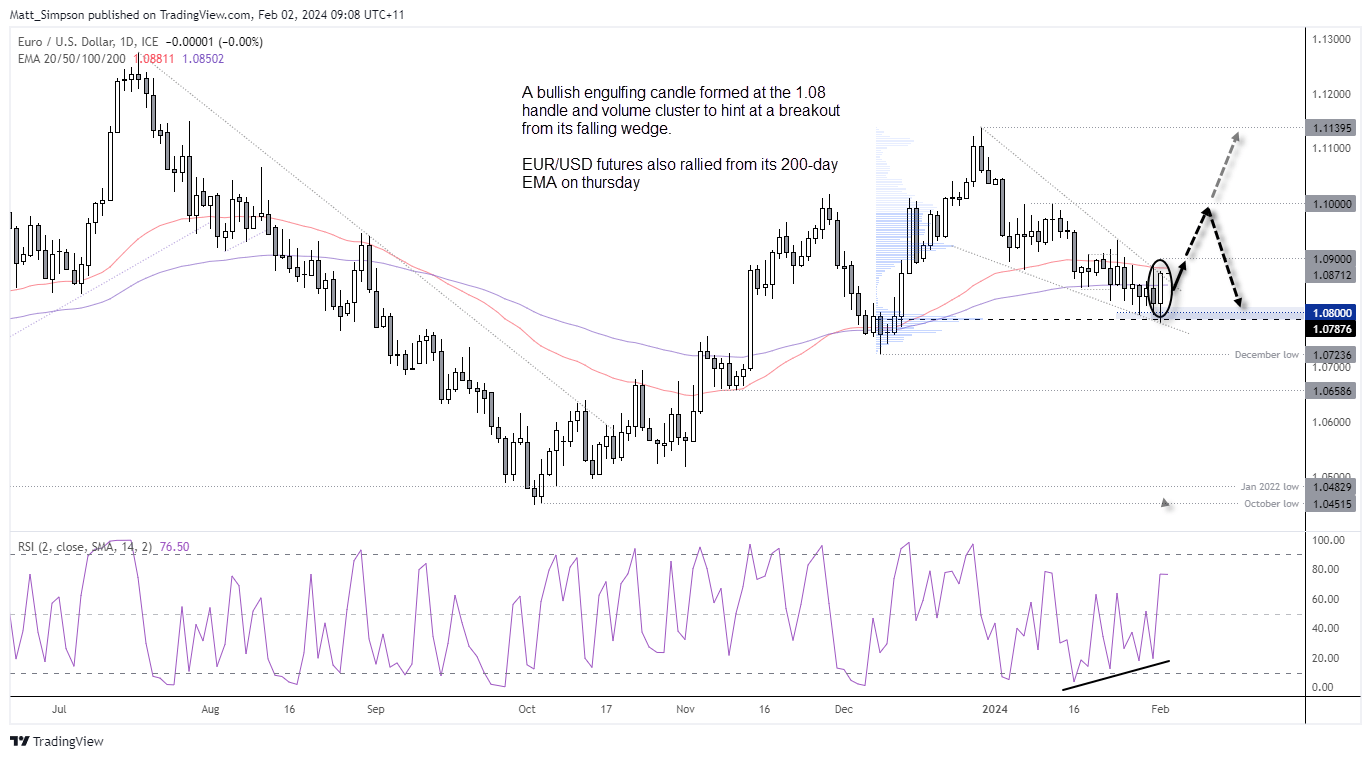

EUR/USD technical analysis (daily chart):

A prominent bullish engulfing candle formed on the spot EUR/USD daily chart around the 1.08 handle, which also landed on a volume cluster from the previous rally. The fact that EUR/USD futures also rallied from its 200-day EMA adds another layer of conviction that the euro may have just printed a key swing low.

A falling wedge has also formed on the daily chart, which projects a target back at the base of the wedge just above 1.11. Whilst I remain sceptical that the US dollar will simply collapse from current levels, I do see the potential for further gains on EUR/USD should we be treated to a softer set of nonfarm payroll figures and the ECB continue to push back on rate cuts in H1.

Bulls could seek dips within Thursday’s range and simply target the 1.09 and 1.10 handles. We can reconsider its potential to continue higher as the story evolves.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade