In Europe, attention will turn to the European Central Bank interest rate decision on Thursday. Before discussing what this means for EU stocks and deliberate on other macro themes in greater detail, in my report due to be published shortly, lets quickly have a look at the chart of the DAX.

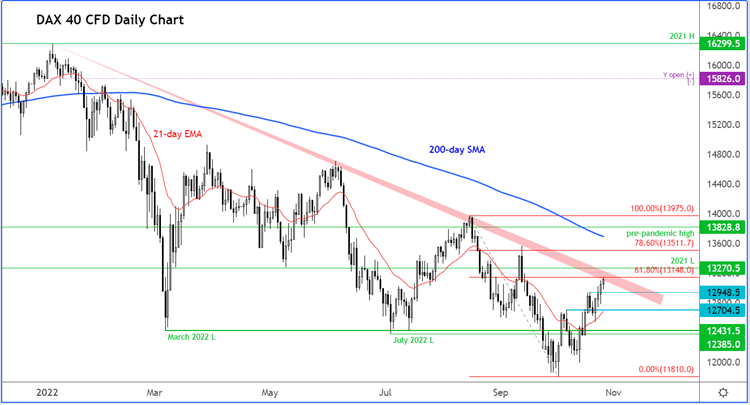

The German DAX has reached its highest level since mid-September after rebounding around 11% off its lows hit in early October. But, as you can see, the German index is now testing a major technical resistance area between 13100 and 13200:

This is where several technical factors come into play, including the bearish trend line that has been in place since the start of the year, the 61.8% Fibonacci retracement level against the August high, and the base of the breakdown in September.

Thus, there’s a good possibility that the recovery could unravel here, and the trigger could be the ECB, US tech earnings or concerns over the global economy.

I will discuss these topics briefly in my upcoming report. Stay tuned.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade