Currency Pair of the Week: GBP/USD

Will the Bank of England (BOE) continue tapering this week? That is the question traders will be looking for the central bank to answer at Thursday’s meeting. At the last BOE meeting on May 6th, the BOE slowed the pace of their bond buying program from 4.4 billion Pounds per week to 3.4 billion pounds per week as they look to end the program later this year. As with most developed countries, inflation has been running high, the UK is no exception. The latest headline CPI print for May was 2.1% YoY vs 1.8% expected and 1.5% in April. The core inflation rate was 2% vs 1.5% expected and 1.3% in April, the highest since August 2018. Similarly, the employment data has been strong. The May Claimant Count Change was -92,600 vs -62,000 expected, the biggest decline since November 1996. In addition, April’s print was revised to -55,800 from -15,100. However, the UK has recently had a surge in coronavirus cases from the delta variant. As a result, the final stop on the roadmap to reopening is a bit further away than originally hoped, now in mid-July. The BOE has plenty of time on its hands and may wait to taper further. However, traders must be ready for comments about the timing of additional tapering!

Everything you need to know about the Bank of England

As you probably already know, Fed Chairman Powell has officially opened the tapering talks at the FOMC meeting last week. In addition, based on Fed officials’ forecasts, or dot plots, a majority of the FOMC now expect 2 rate hikes in 2023 and some even expect a rate hike by the end of 2022! Inflation has been hot lately, with the headline May CPI at 5% YoY! However, employment data hasn’t been fairing as well. Since the last FOMC meeting, Non-Farm Payrolls missed expectations in both April and May. This puts the Fed in a conundrum. Do they announce they will begin to taper sometime soon, or do they wait for employment to pick up before doing so? There are still roughly 7.6 million jobs that have not been recovered in the US since the pandemic began. Federal spending initiatives continue this week as well, with Republicans and Democrats continuing to debate Biden’s scaled back infrastructure plan, which includes core infrastructure needs, but does not address some Democrats concerns regarding climate related issues.

Everything you need to know about the Federal Reserve

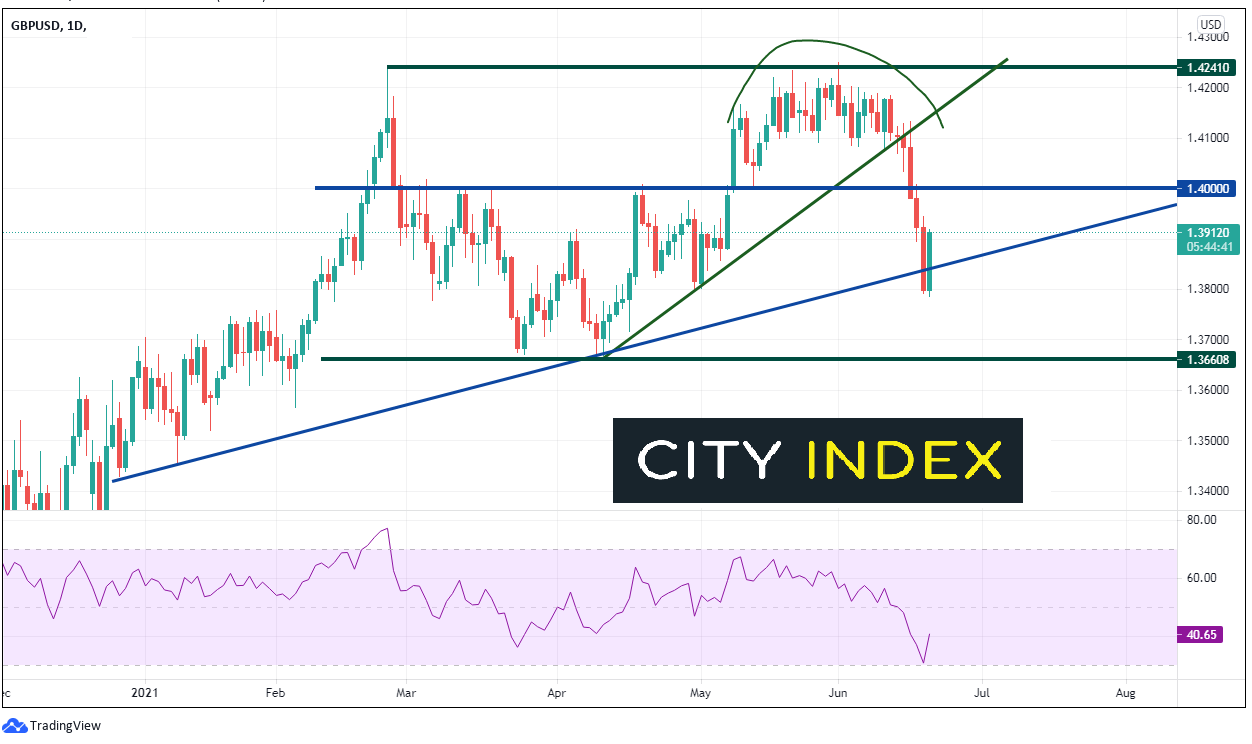

Since mid-February, GBP/USD has been range-bound between 1.3700 and 1.4250. During April, the pair was bid. However, in May, price tried to take out the February 24th highs at 1.4241 and failed. In doing so, GBP/USD formed a rounding top formation. Price traded below the ascending trendline from April 12th, below selling off aggressively after the FOMC meeting last week. Price moved from 1.4080 to 1.3798 before bouncing today.

Source: Tradingview, City Index

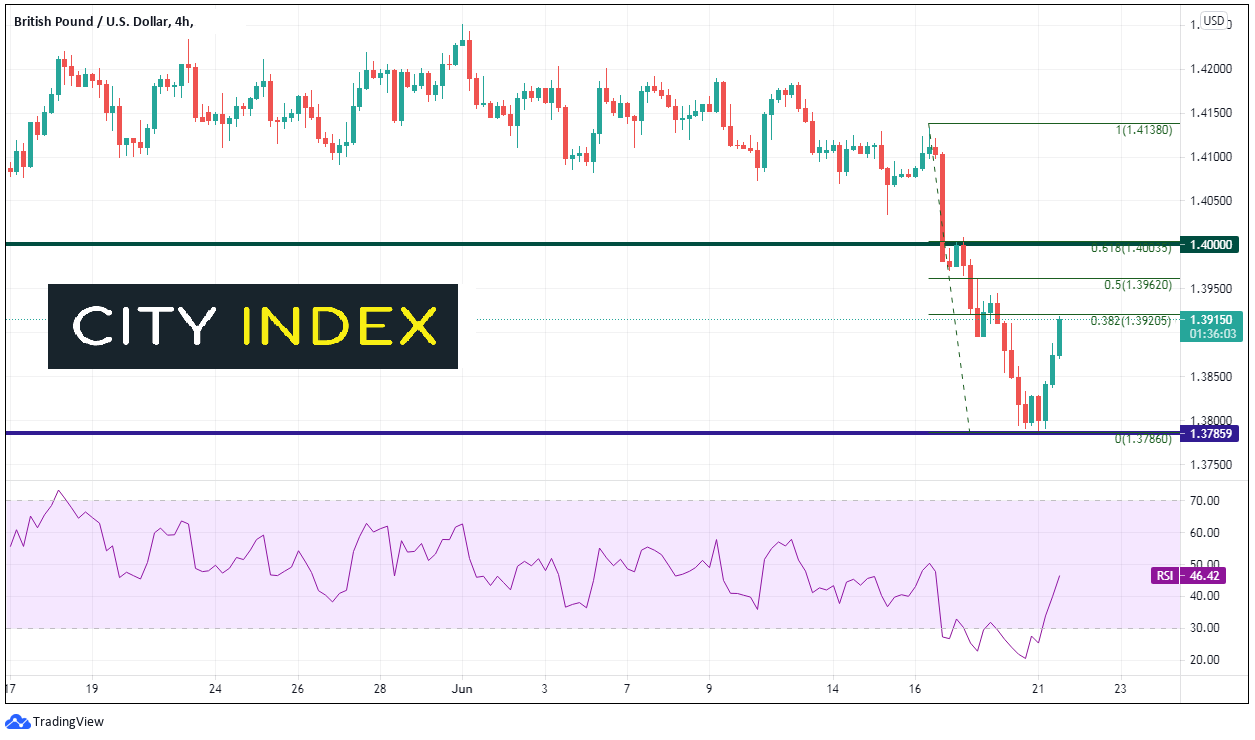

On a 240-minute timeframe, resistance is that the 38.2% Fibonacci retracement level from the highs of June 16th to Monday’s lows, near 1.3920, just ahead of the 50% retracement level at 1.3962. Sellers will be looking to offer at the 61.8% Fibonacci retracement level and the psychological round number resistance at 1.4000. First support is at 1.3786. The next support is at the lows from late March and early April near 1.3660.

Source: Tradingview, City Index

With the BOE on Thursday and the recent hawkish FOMC “dot plot”, both GBP and USD look to be on the move this week. If the BOE continues to taper or talk about tapering, GBP/USD could be in for a ride! Keep an eye on the 1.4000 level, which is a strong horizontal and psychological resistance level. Bears may be looking to offer there.

Learn more about forex trading opportunities