A multinational mining and metals company, BHP is headquartered in Melbourne and is the largest listed company on the ASX with a market capitalisation of $195bn.

After consolidating its dual-listed structure earlier this year, the company accounts for about a 10% weighting in the ASX200. BHP will report its Full Year numbers on Tuesday, August 16th, at 8.30 am Sydney time.

For the first half of the year, BHP announced an underlying profit of US$9.7 billion and a $US1.50 per share interim dividend. The bumper result came from surging prices and demand for its key commodities, including iron ore, copper, coal, and nickel.

However, since April, commodity prices have slumped, including a 35% fall in the price of iron ore, and similar for copper. Zinc prices have halved, as have coking coal prices. On the other side of the ledger, the company faces higher costs from supply chain constraints and a tight labour market. Compounded by the deepening woes in China's real estate sector.

The mixed outlook for commodities has already seen rival mining heavyweight Rio Tinto disappoint investors this earnings season as it declared a smaller dividend than expected and no special dividend at all.

Earlier this week, BHP launched an $8.4bn bid for copper miner OZ Minerals. The $25 per share bid was pitched at a 32% premium to OZ Minerals' last traded price at $18.92, a signal that the Big Australian holds an optimistic view of the global economy. The OZ Minerals board rejected the bid, and the market now waits to see if BHP will come back with a revised offer.

For the record, the expectation is for BHP to report an underlying net profit of US$20.4bn, up 19.3% for Full Year 2021.

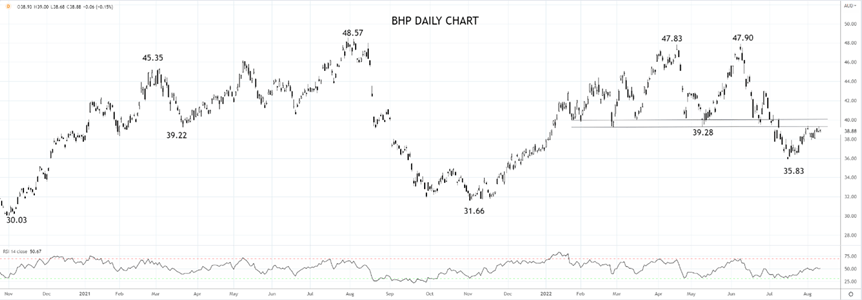

In early July, the share price of BHP extended its decline from the April double top (at $47.90) to more than 25% as it breached a band of solid support between $40.00 and $39.00.

The break of support at $40.00/$39.00 leaves the share price vulnerable to a retest of the July $35.85 low and needs to reclaim $40.00 to provide a more favourable backdrop.

Source Tradingview. The figures stated are as of August 10th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade