- The Federal Reserve has surprised most market participants by signalling it expects to cut rates three times in 2024

- This early dovish pivot is likely to flow through to similar moves from other major central banks

- A pre-emptive shift towards looser policy setting may reduce the risk of a hard economic landing, benefitting cyclical assets such as the ASX 200 and crude oil.

The Federal Reserve is seeking to achieve a soft economic landing, whether you believe that’s realistic or not. In the wake of the pivot from at its December FOMC meeting, where the median member forecast penciled in 75 basis points of rate cuts next year, it’s a safe bet other major central banks will adopt a similar view, likely starting with the ECB and Bank of England later today.

For more on the Fed decision, this recap goes through the important details.

This preemptive dovish signal arrived far sooner than many market participants expected, reducing the risk the global economy may experience a hard economic landing next year. For cyclicals such as the ASX 200 and crude oil, this is good news, creating potential tailwinds for both economic activity and market liquidity.

ASX 200 about as cyclical as it gets

For an index with nearly 60% market capitalisation in financial and mining companies, improved prospects for the global economy, including emerging markets heavily exposed to fluctuations in the US dollar and interest rates, may provide fuel to extend the rally further, putting a retest of the record highs set in 2021 back on the radar.

Nearer-term, the ASX 200 is entering what’s traditionally been a strong seasonal period with the index rising in 11 of the past 14 March quarters, registering an average and median increase of 4% and 3.1% respectively.

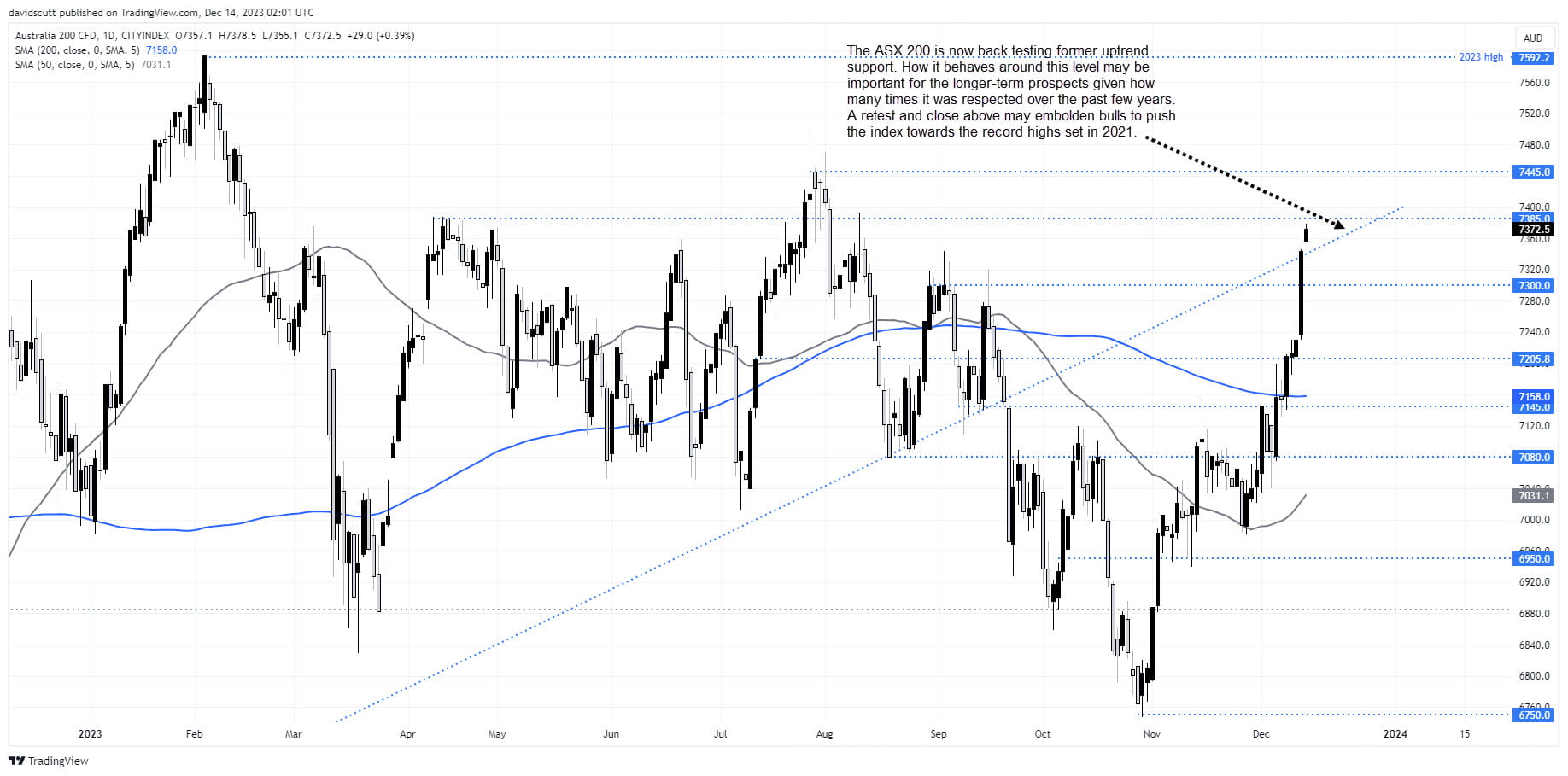

Looking at price action, the index has pierced former uptrend support on the latest bounce, hitting multi-month highs in the process. How the index interacts with this trendline will be important in the near-term considering how many times it was respected before being broken earlier this year. With RSI overbought on the daily, it would be nice to see a retest and bounce to provide confidence about the sustainability of the move. If it can’t, it will provide an opportunity for traders to enter shorts at levels where the index has traditionally struggled in recent years. Either way, the trendline can be used for protection, allowing stops to be put on the opposite side to where the price moves.

On the topside, 7385 and 7445 repelled multiple probes higher earlier this year. Beyond those levels, we’re talking a potential test of the triple-top highs above 7600, a major hurdle for bulls to overcome. On the downside, 7300 would be the first stop below the trendline.

Improved global growth prospects may ease crude demand gloom

Like the commodity heavy ASX 200, crude oil is another cyclical that may benefit from the Fed’s early dovish pivot, helping to alleviate some downstream demand concerns that have ultimately undermined the bullish case for crude this year despite significant supply cuts from OPEC+ member states and escalation in geopolitical tensions in the Middle East. With the latter two fundamental supply factors likely two remain in place for some time yet, any improvement in the outlook for global activity should filter thorough to demand expectations for energy products.

While it’s been ugly over the past few months, what the pullback in crude has done is move the price back towards levels where if found plenty of support earlier this year, providing a potential decent long trade setup for those with a longer-term trade horizon.

Given the proximity, dips towards support starting from $68 could be used to reset longs, with a stop below $67 for protection, targeting a move back towards the low $70. Minor resistance is located around $72.14 with a sterner test likely at $72.80. $74 is another minor level before the 200-day moving average – where crude struggled earlier this year – will enter the conversation. Below $67, $64.35 is where the price found buyers twice earlier this year.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade