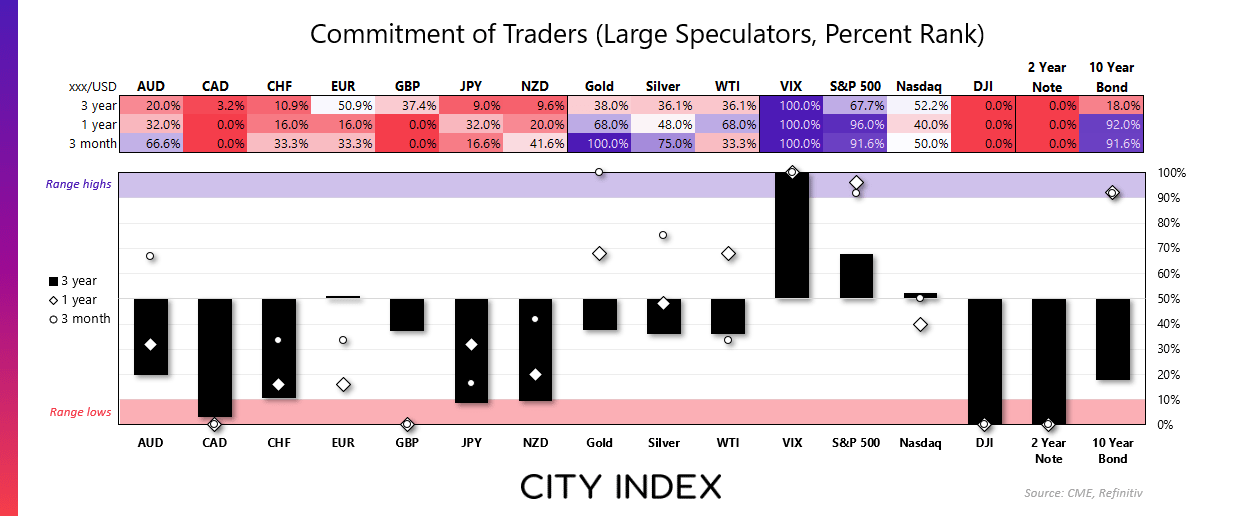

Net-short exposure to GBP/USD futures rose to a 31-week high, although open interest was slightly lower with gross longs and shorts being trimmed.

Traders were their least bearish on VIX futures since January 2019, but if we use the long-term average of -44.36 as the bullish/bearish threshold, we could say positioning was the most bullish since early 2019. And with indices rallying and the VIX comfortably back below 20, perhaps we have seen the peak of the cycle.

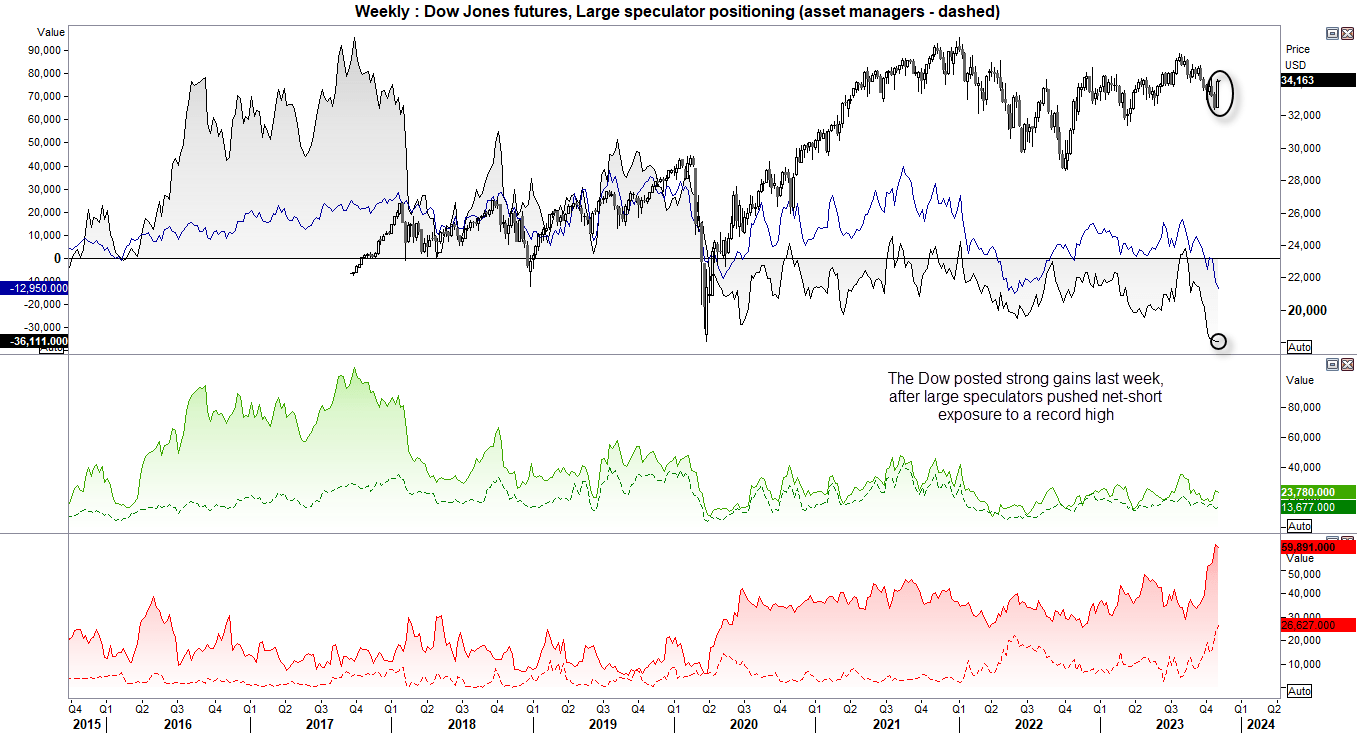

Large speculators pushed their net-short exposure to Dow Jones futures to a record high last week whilst asset managers were their most bearish since June 2022. Both scream sentiment extreme, and the strong gains seen last week means we’re likely to have seen short a short squeeze and new initiation of longs just above 32k.

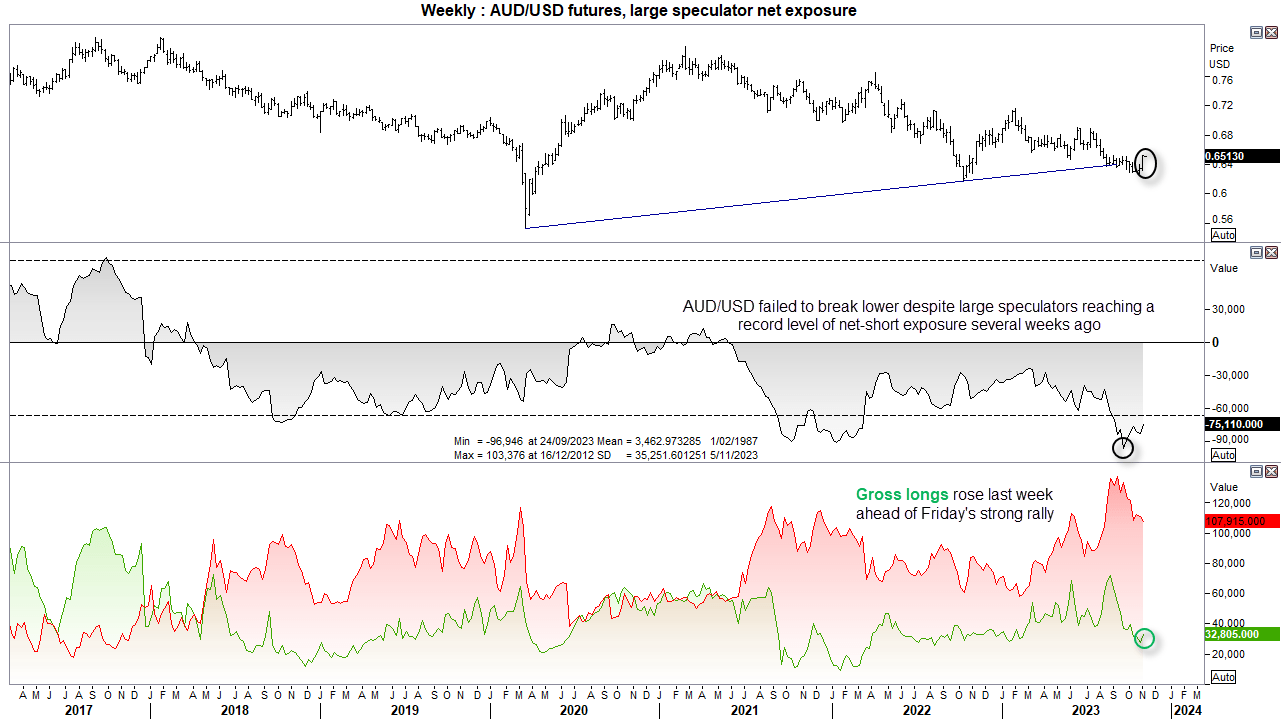

And that also helped AUD/USD achieve its strongest weekly gain of the year, just a few weeks after large speculators reached a record level of net-short exposure.

Commitment of traders – as of Tuesday 31 October 2023:

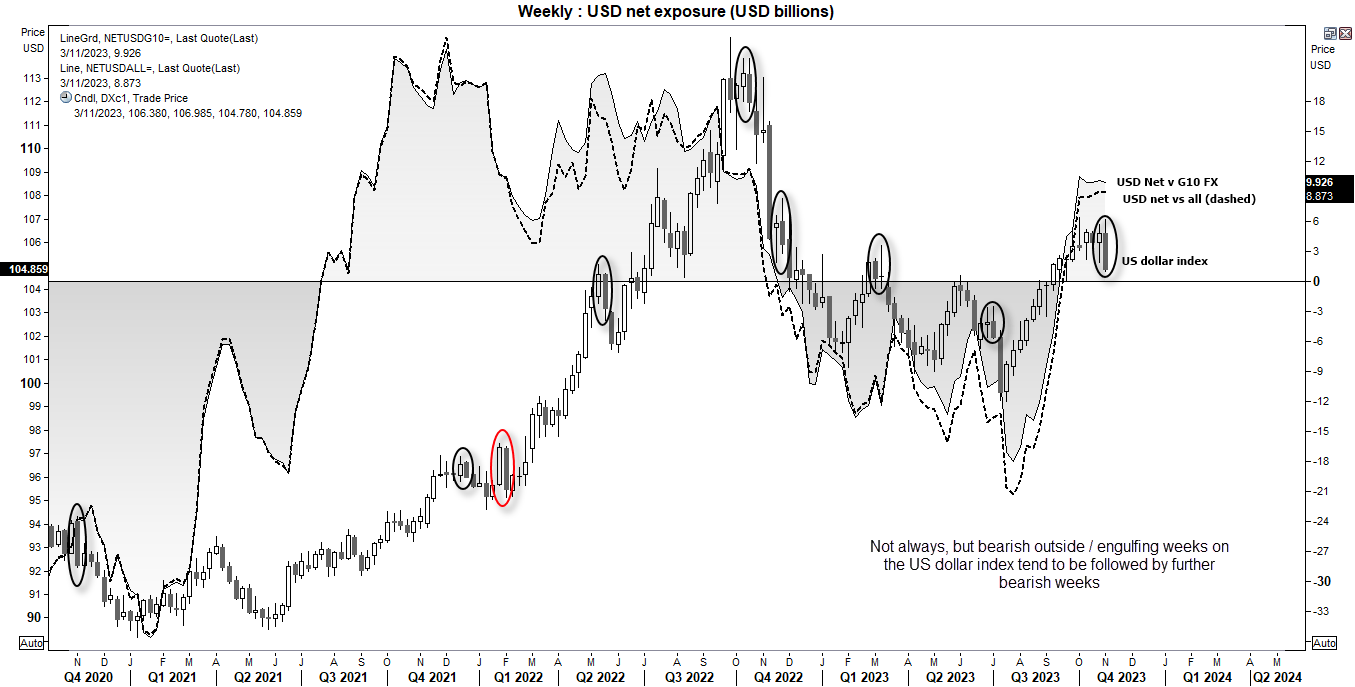

US dollar index futures – Commitment of traders (COT):

In mid-September I warned that traders were on the cusp of switching to net-long exposure to the US dollar, and they certainly did not disappoint. Just three weeks later, traders pushed their net-long exposure to their most bullish level in a year. However, their bullishness plateaued and last week saw a slight reduction of gross longs by large speculators and a small increase of gross shorts by asset managers. And this was ahead of Friday’s weak nonfarm payrolls report, which resulted in a bearish engulfing week for the US dollar index during its worst week in three months.

How the US dollar performs from here is likely down to US yields. Should they continue to retrace, then so should the dollar. A quick eyeball of the US dollar index weekly chart shows that bearish outside/engulfing week’s tend to get followed by a second consecutive bearish week. If history is to repeat, we could be looking at a higher AUD/USD, EUR/USD and GBP/USD etc.

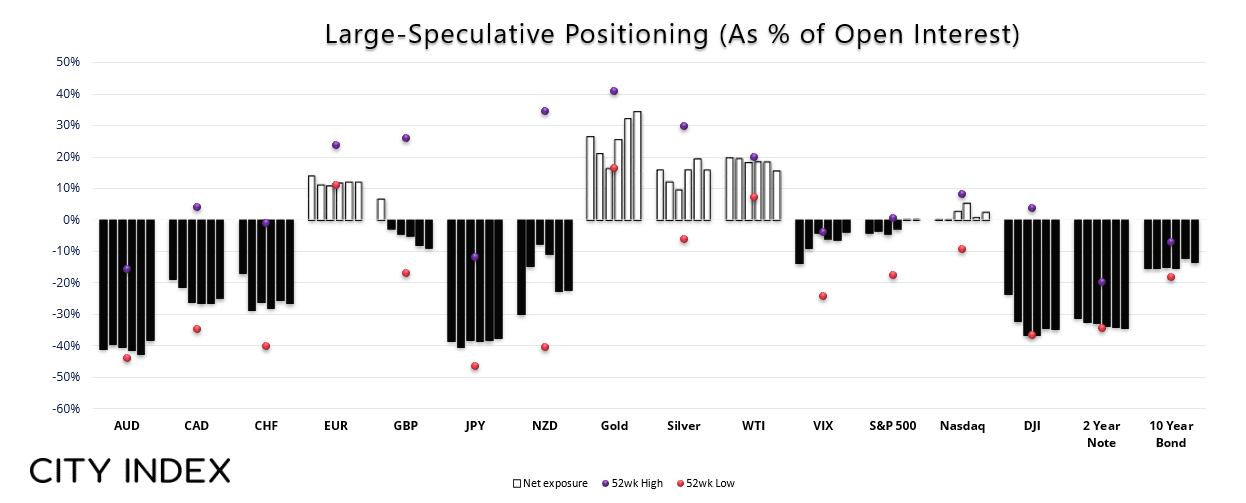

AUD/USD (Australian dollar futures) – Commitment of traders (COT):

Back in September I noted that large speculators had reached a record level of net-short exposure to AUD/USD futures. And that meant that AUD/USD had to break lower or risk a short-covering rally. The latter scenario appears to be playing out following Friday’s weak nonfarm payroll report. But with the RBA likely to deliver a hawkish hike, it is also providing reason for traders to enter long around these lows. In fact we saw large speculators increase long exposure whilst shorts continued to be trimmed last week, in response to a hot inflation report the week prior. And if US yields and the US dollar continue retrace, we may be looking at the early stages of a rally on AUD/USD.

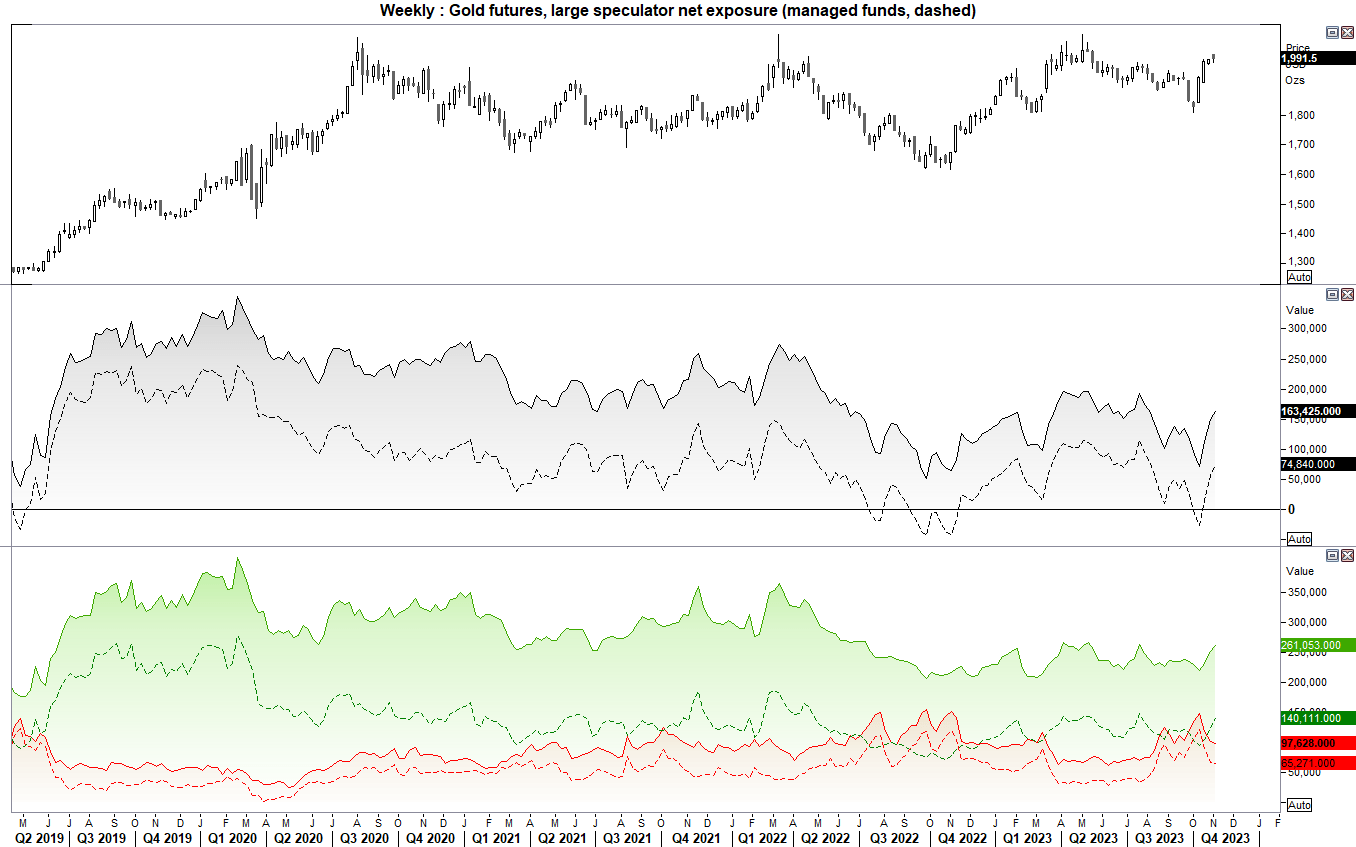

Gold futures (GC) - Commitment of traders (COT):

Large speculators and managed funds continued to favour gold last week, with both sets of traders increasing long exposure and trimming their shorts. Net-long exposure is still not at a historical extreme, although there seems to be a hesitancy for prices to hold above $2000, which is not too surprising given the significance of the psychological level following such a strong run up to it. Ad as Friday saw a failed attempt to close above it and left a higher upper wick, I suspect prices are prone to a pullbacks towards the 1950 area before its next leg higher.

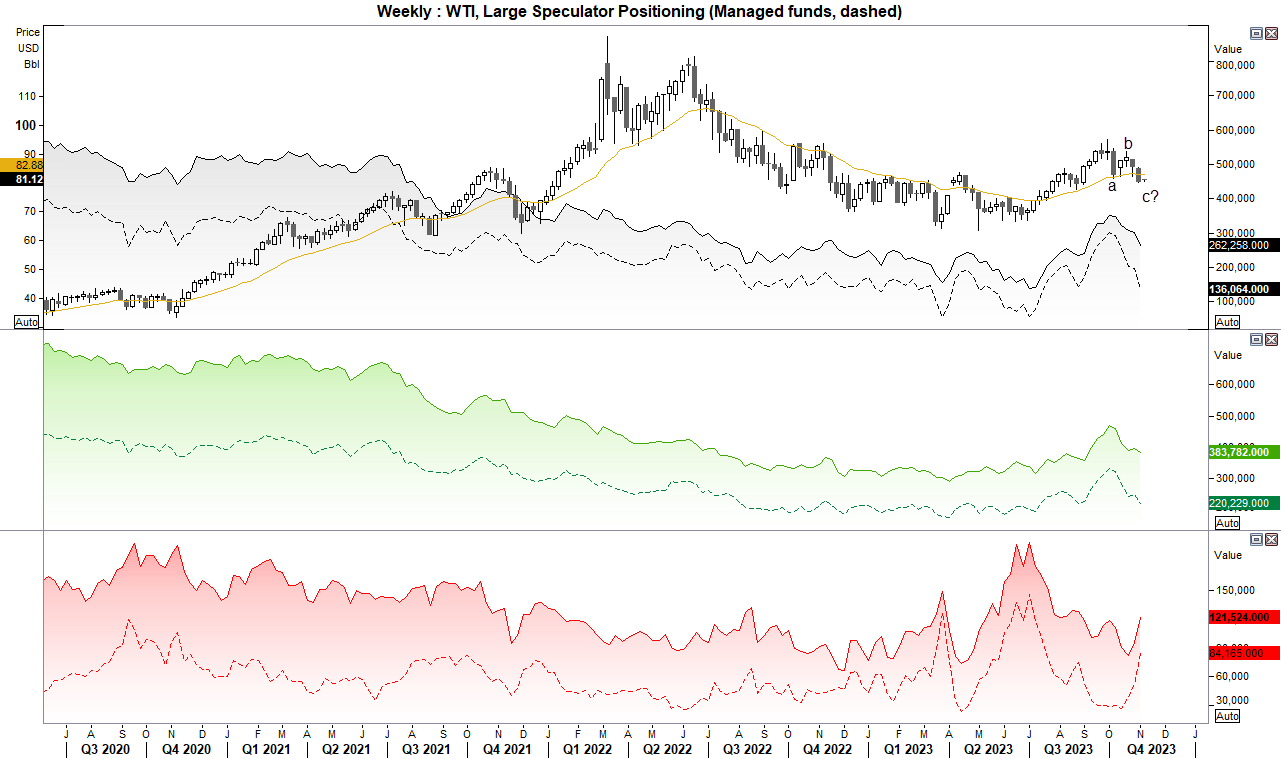

WTI crude oil futures (CL) – Commitment of traders (COT):

Managed funds increased their gross-short exposure to WTI crude oil futures for a third week, large speculators increased theirs for a second. It was also the fastest increase of shorts in a week in 32 and 20-weeks respectively, whilst both sets of traders trimmed longs last week. Whilst WTI managed to hold above $80 last week, a break beneath it seems more likely over the near-term which could bring the $75 handle into focus.

Dow Jones Industrial futures (DJ) - Commitment of traders (COT):

A large bullish engulfing week formed on the Dow Jones futures contract, with much of the week’s gains coming after Tuesday’s COT report was compiled. And as traders had pushed net-short exposure to a record high, it seems likely that much of the rally was a short-squeeze alongside initiation of fresh longs. The question no is whether it can sustain its rally and head back to the highs. And for that to happen, US bond yields need to continue retracing along with the US dollar.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade