- Australian real retail spending grew 0.3% in the December quarter, helped by a large downward revision to the Q3 number

- Retail prices rose just 0.1% for the quarter and 2.6% over the year, impacted by weakening consumer demand

- The RBA will announce its February monetary policy decision later Tuesday. The main question markets want answered is whether it still see the risk of rate needing to move higher

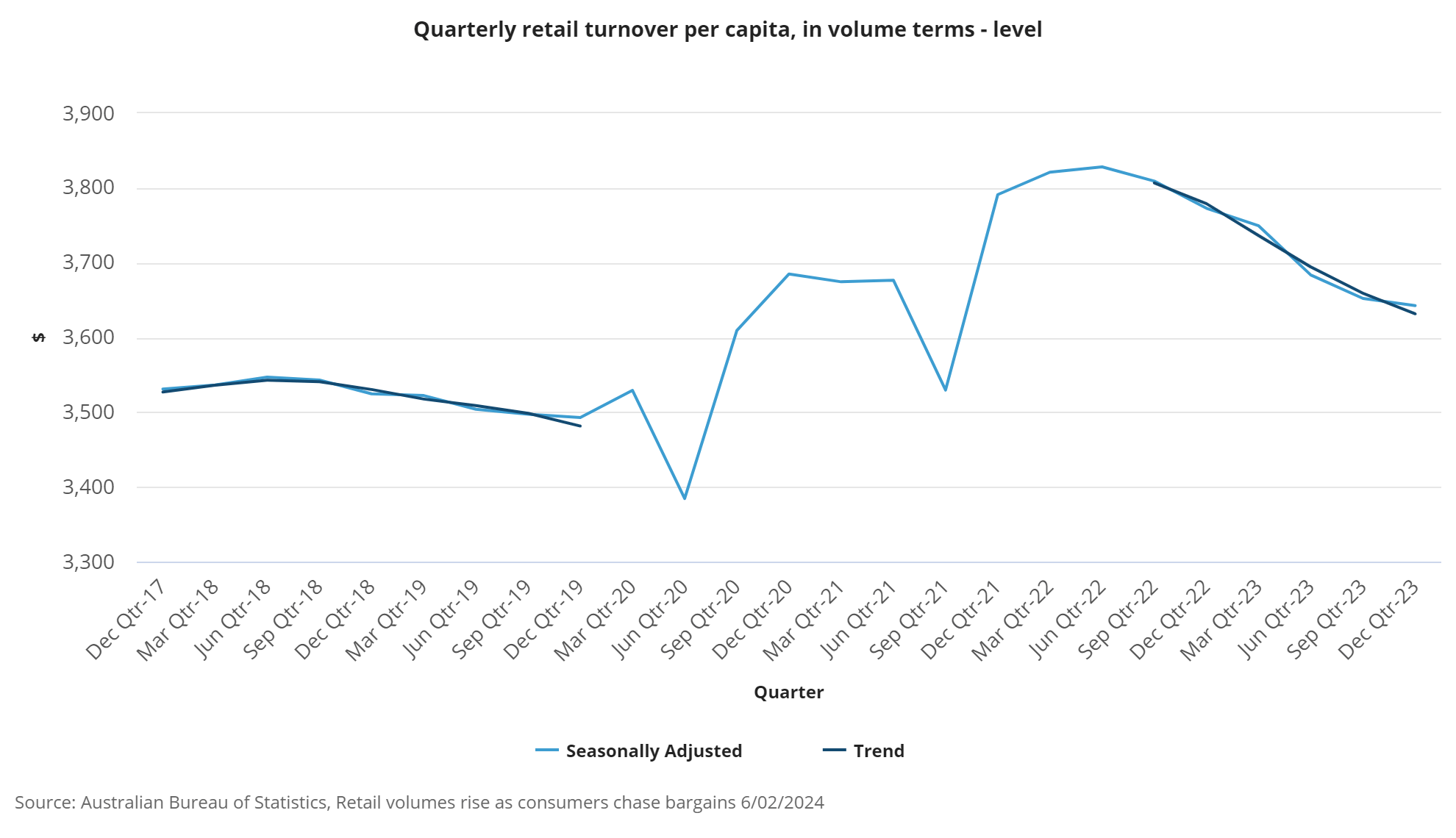

Bargain hunting by cost conscious consumers saw Australian retail sales volumes accelerate slightly in the final three months of 2023, reducing the risk of a negative growth when the December quarter national accounts are released in early March. But when rapid population growth is considered, real per capita retail sales continue to drift back towards pre pandemic levels.

Retail sales "beat" not all it seems

The Australian Bureau of Statistics (ABS) reported sales volumes – which exclude the inflationary impacts – rose 0.3% in the December quarter, rebounding from 0.1% decline in the prior period that was previously reported as an increase of 0.2%. Markets were looking for an increase of 0.1%, so once the revision was considered, the net result was a touch softer than what economists were forecasting.

Relative to services, retail goods spending in Australia accounts for a smaller share of total household consumption at a little over 30%. Household consumption is by far the largest component in the wider Australian economy at around 60%.

Soft demand sparks disinflation

On a per capita basis, volumes slumped by 0.3%, the sixth consecutive quarterly decline, leaving real retail sales down 3.5% on a year ago. Real spending at cafes, restaurants and takeaway food services fell 2.1%. its third straight quarterly fall and largest since the September quarter of 2021. As a read on discretionary services spending, this warn of potential weakness across broader household spending.

As a byproduct of consumer weakness, retail prices rose just 0.1% in the three months to December, down from 0.6% in the September quarter and the weakest increase reported since Q3 2021. Over the year, retail inflation slowed to 2.4%.

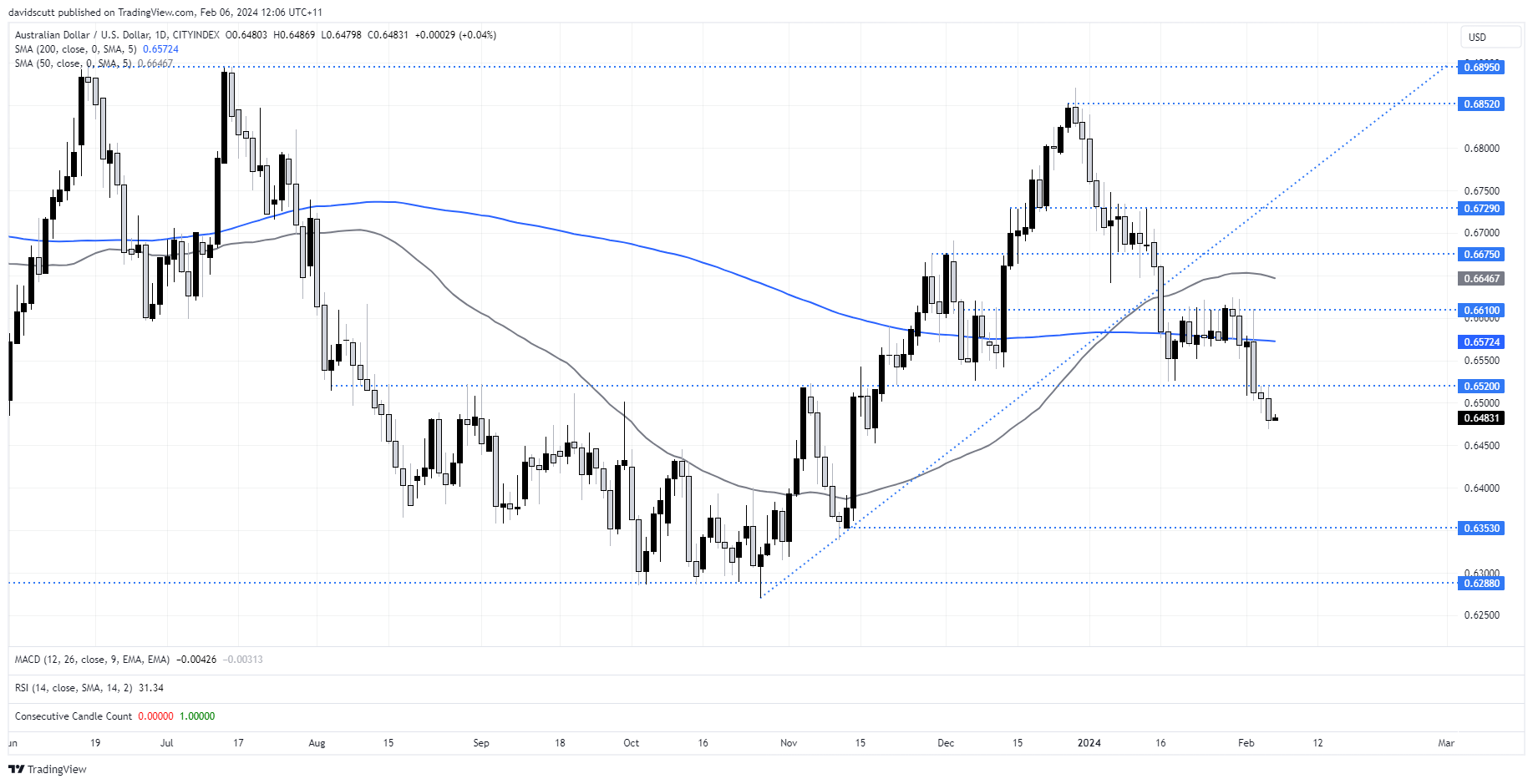

AUD/USD eyeing RBA rates bias near-term

AUD/USD was unmoved on the data, reacting instead to a bout of modest US dollar weakness against other Asian FX names, such as the Japanese yen and New Zealand dollar. The bigger event for AUD/USD arrives later today with the Reserve Bank of Australia’s (RBA) first monetary policy decision of the year. Not only will we find out whether the RBA has chosen to retain a tightening bias, signalling the risk of even higher rates ahead, but markets will also receive updated economic forecasts regarding GDP growth, inflation and unemployment.

I shot a quick video late Monday explaining why I believe the RBA will adopt a neutral bias while pushing back against preemptive rate cut bets from traders. Even though markets and most economists see the next move in the RBA cash rate being lower, the removal of its tightening bias would likely weigh on the AUD and add upside pressure to bonds and ASX 200.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade