Market Summary:

- The Japanese yen was the strongest forex major on Wednesday on bolstered bets on BOJ tightening following Japan’s slightly hotter CPI data, and safe-haven flows ahead of key economic data

- USD/JPY initially broke to a 3-day low before finding support above 150, and after recouping two thirds of the earlier losses closed the day with a hanging man reversal candle

- AUD/JPY retraced for a second day after a bearish reversal candle formed at the 99 handle on Monday, suggesting a corrective phase is now underway

- Headlines that OPEC+ are considering extending output cuts saw WTI crude oil rise for a second day and probe the January high

- Wall Street indices seem to be holding their breath ahead of the key US PCE inflation report later this week, with the S&P 500, Nasdaq and Dow Jones trading in tight ranges just off of their record highs

- Improved consumer sentiment for Germany saw the DAX hit a fresh record high and stop just shy of 17,600

- Business investment in the US appears soft according to the US durables orders report, with goods orders slumping -6.1% - its fastest pace on data going bac to the early 90s.

Events in focus (AEDT):

- 11:30 – AU monthly CPI report, construction work done

- 12:00 – RBNZ interest rate decision, statement, economic outlook

- 13:00 – RNBZ press conference

- 16:00 – Japan leading and coincident indicator

- 21:00 – Eurozone economic sentiment index (ESI)

- 00:30 – US Q4 GDP (preliminary), corporate profits, PCE prices, retail inventories

- 00:30 – Canada average weekly earnings

- 01:00 – ECB McCaul speaks

- 02:30 – BOE/MPC member Mann speaks

- 04:00 – FOMC member Bostic speaks

- 04:15 – FOMC member Collins speaks

- 04:45 – FOMC member Williams speaks

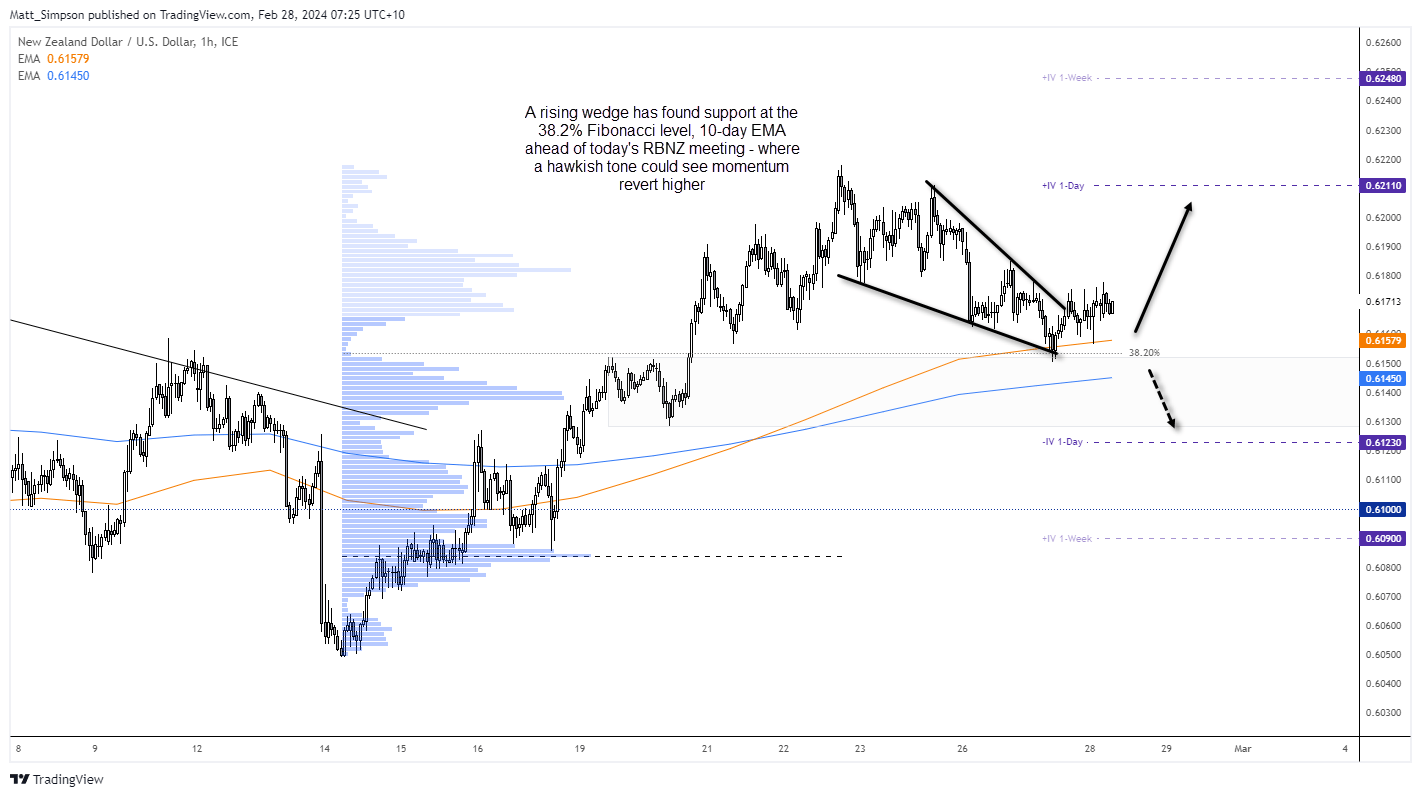

NZD/USD technical analysis:

The Kiwi dollar formed a double bottom above 60c earlier this moth before rising 2.7%. Prices have since retraced around 38.2% of that rally, and its 2-day bearish sequence closed with a doji to show the pullback is losing steam on the daily chart. Prices also found support at the 10-day EMA, so perhaps the corrective low is in already.

The 1-day implied volatility band implies with a 68% confidence that prices will close between 0.6123 – 0.6211. A hawkish RBNZ meeting could help momentum revert to its bullish rally towards 62c. It really depends on how the RBNZ are relative to expectations as to whether it can simply head for (and break above) the cycle highs.

Of course, a downside risk or NZD/USD is if the RBNZ surprise without adding a hawkish bias to their meeting today. And that could see it breaking lower – with further downside potential ahead should US inflation come in hot later this week.

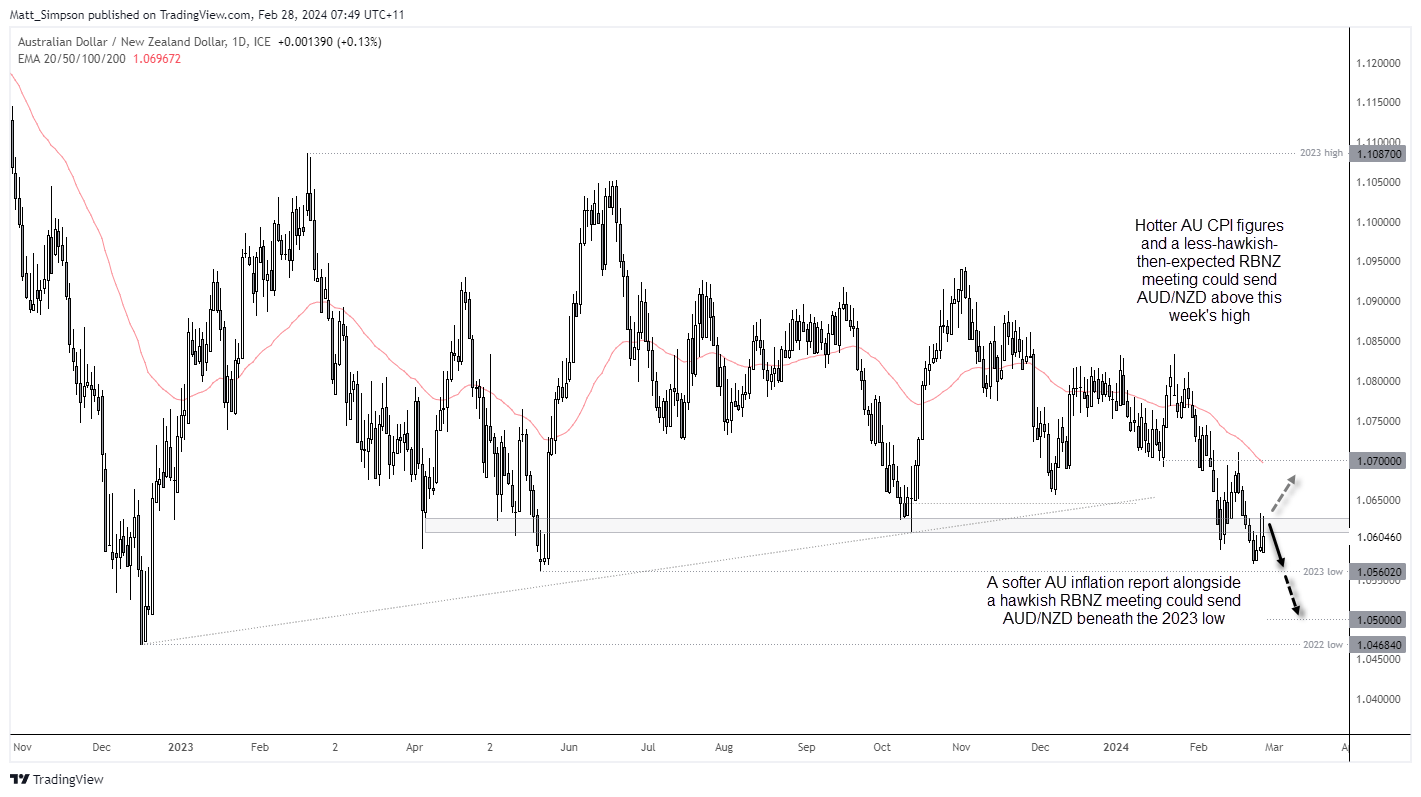

AUD/NZD technical analysis:

The daily chart shows that AUD/NZD remains in a downtrend, although it found some stability above the 2023 low which prompted a 3-day pullback. Prices remain trapped in a small range between key levels, and a divergence of monetary policy implications between AU CPI and the RBNZ meeting are likely required to break it convincingly out of range.

- Should AU inflation data come in soft ahead of a hawkish RBNZ meeting, a break beneath the 2023 low / 1.0550 handle opens up a run for 1.0500 or even the 2022 low.

- The most bullish scenario today for AUD/NZD is if we see hotter inflation figures from Australia, before RBNZ surprise without adding a hawkish bias to their meeting

- The least interesting scenarios for direction are if we see hot AU CPI coupled with a hawkish RBNZ, or soft inflation figures alongside a relatively dovish RBNZ

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade