The ASX200 trades 5 points lower at 6786 at 3.15 pm Sydney time, ahead of what could be a pivotal week for international and domestic markets.

Tucked in between an FOMC meeting, U.S Q2 GDP data, and earnings reports from U.S mega tech is the release of Australian Q2 inflation data. A firmer AU Q2 CPI number on Wednesday, followed by a hawkish Fed on Thursday morning, would raise the chances that the RBA opts for a 65 or 75bp rate hike when it meets next Tuesday.

Reflecting the more cautious start to the new week, the high beta tech sector has been the worst performer. EML payments fell 21% to $0.94c on news the company is facing delays in a regulatory remediation plan in Ireland. Appen fell 13.51% to $5.70, Sezzle fell 10% to $0.27c, Tyro Payments fell 6.54% to $0.71c and Novonix fell 3.5% to $2.47.

Energy stocks have also lost ground as the price of crude oil locked in a third successive week of falls, to be trading near $94.00 p/b. Beach Energy fell 2.8% to $1.74, Cooper Energy fell 2.2% to $0.22, Woodside fell 0.8% to $30.71, Viva Energy fell 0.6% to $2.58, and Santos fell 0.4% to $7.00.

Consolidating after a stellar 4.86% rally last week, the Financial Sector has had a mixed day. Suncorp gained 2.7% to $11.31, and ANZ etched out a small 0.1% gain to $22.66. Elsewhere CBA fell 0.85% to $96.98, Westpac fell 0.40% to $20.98, NAB fell 0.2% to $29.82 and Macquarie Bank fell 0.2% to $173.71.

A 7% rally in the price of iron ore futures on the Chinese futures exchange, along with strong gains for other base metals, has flowed through into resource stocks. FMG gained 1.9% to $18.17, BHP added 1.8% to $37.42, Mineral Resources added 1.7% to $47.58, Rio Tinto added 1% to $97.19 and South32 added 0.85% to $3.56.

Signs of life for gold mining stocks after the price of gold gained last week for the first time in six weeks. $1680 has been strong support for bullion the past two years and held firm again last week as gold closed back above $1725. Evolution Mining added 2.78% to $2.40, Northern Star Resources added 2.6% to $7.31, and Silver Lake Resources added 2.25% to $1.37.

Elsewhere, travel stocks have surged after a trading update from Flight Centre propelled the stock 4% higher to $17.78. Corporate Travel added 3.6% to $18.91, and Qantas added 2% to $4.60.

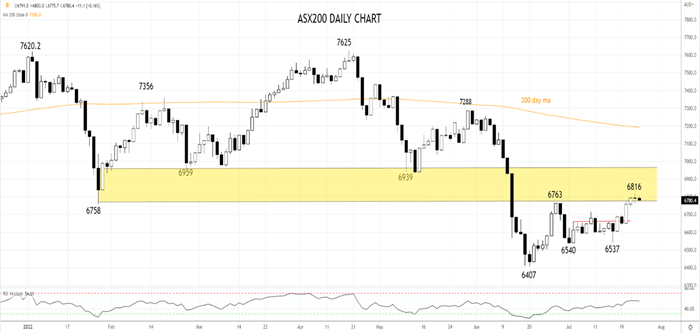

The ASX200 is chipping away at the band of resistance 6750/6950. To negate the technical damage caused by the breakdown in June, a sustained break above 6950 is required. Until this occurs, the rally from the 6407 low is viewed as a bear market countertrend rally.

Source Tradingview. The figures stated are as of July 25th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade