- We arguably saw the most significant dovish central bank pivot since the start of the pandemic last week

- The coordinated move has acted to further loosen financial conditions, adding to the positive backdrop for global equities

- US, Australian and Japanese inflation reports dominate the calendar next week. The remaining events screen as insignificant, including a speech from Jerome Powell

- Nasday 100 and ASX 200 are out featured indices. Both sit near record highs but looked unconvincing last week

Largest central bank dovish pivot since early 2020

Following what was arguably the most coordinated central bank dovish pivot seen since the start of the pandemic last week, it’s hard not to like the look of stocks right now even at these levels.

Traders were essentially given a green light to double-down on taking risk, armed with the knowledge that it will be hard for policymakers to walk back the shift anytime soon even if their inflation outlook proves to be wrong.

With the calendar relatively clear of major risk events

Excluding inflation updates from the United States, Australia and Tokyo, the remaining events calendar screens as being either of little importance to the macroeconomic picture or a largely known quantity, the latter including a speech from Jerome Powell on Friday. What could he add to what he said over an entire hour last week? Not much, you’d think.

That suggests that unless we see an upside surprise from the US core PCE inflation report on Thursday, the greatest risk to the stock market rally may be end of quarter window dressing or simply extreme short-term bullish positioning, increasing the risk that even a small amount of selling could spark an abrupt move lower.

But any sustained decline looks unlikely given the substantial loosening in financial conditions last week, stiffening already strong market tailwinds.

This week’s outlook focuses on two indices that have very different compositions but are both in touching distance of record highs: the Nasdaq 100 and Australia’s ASX 200. Will traders take the invitation to add to already bulging bullish bets or baulk given the risks posed by positioning?

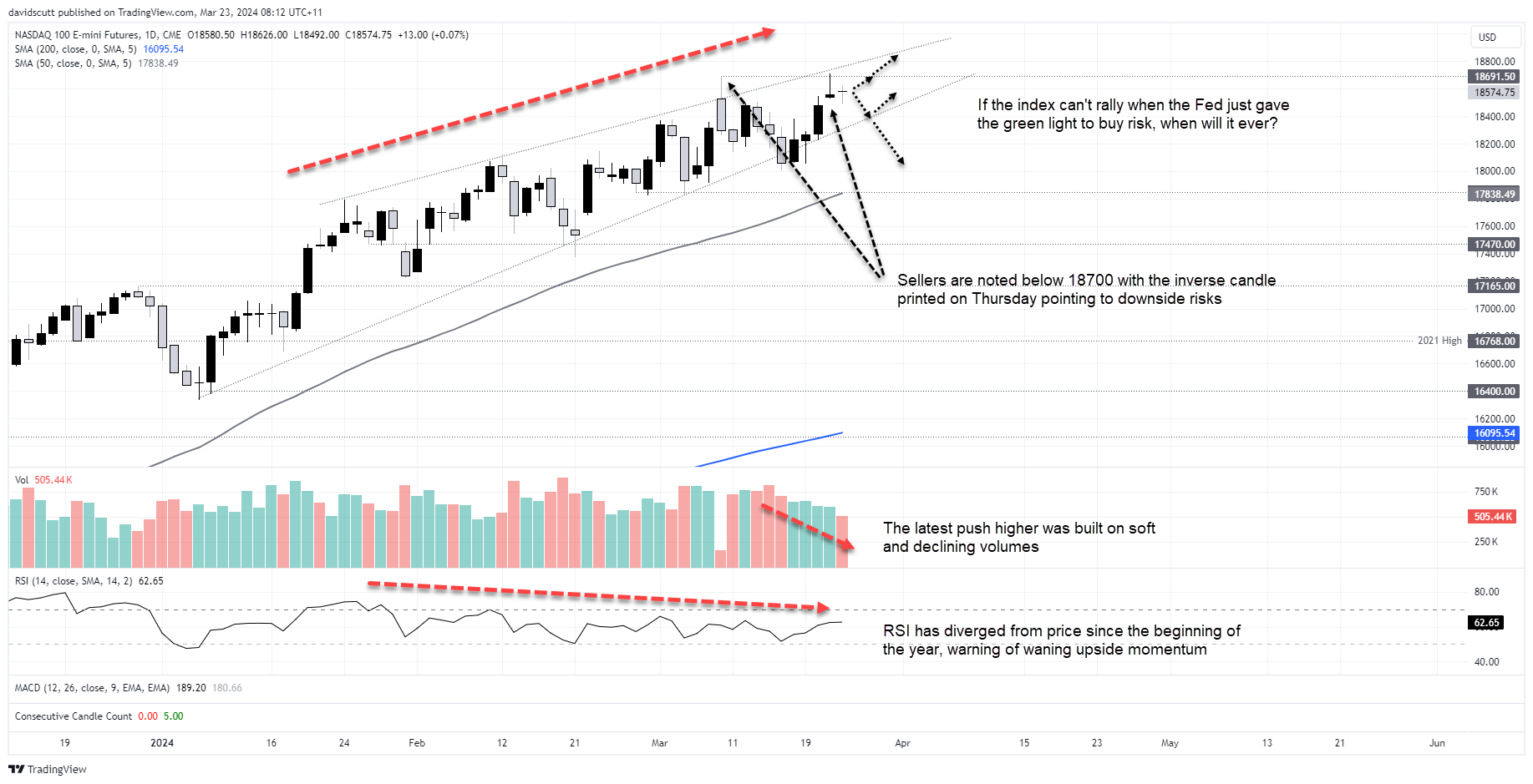

Nasdaq 100 weekly outlook: Upside stifled by abundant bulls?

You’d struggle to find a stronger trending market than the Nasdaq 100 right now. Just look at it!

Since the Fed abandoned rate hikes in late October, it’s been nothing but one-way traffic, constantly bouncing off uptrend support whenever it’s been tested. I’ve lost count how many record highs have already been set this year.

While calling an end to the bull market would be a bold call given the trend and macro environment, given the proximity of the price to the uptrend, it would want to do away with resistance located just below 18700 soon. With price diverging from RSI since the middle of December and volumes from the latest push higher weak and declining, it doesn’t scream rampant upside to come. And when you look at the price action on Thursday, the inverse hammer after touching record highs suggests there are sellers resent. Combined, it suggests we may see another test of uptrend support this week.

Bulls managed to defend it successfully on multiple occasions this year, including earlier this month when it looked like the uptrend was under threat. Looking at the four hourly chart, resistance is located above 18691 and above 18800 with support found at 18500, 18300 with the uptrend kicking in below that. A break of the uptrend would bring the 50DMA into play.

Playing the existing ascending triangle pattern looks to be the play unless we see a bullish or bearish break. Sell rallies towards the highs with a stop above targeting uptrend support, and vice versus.

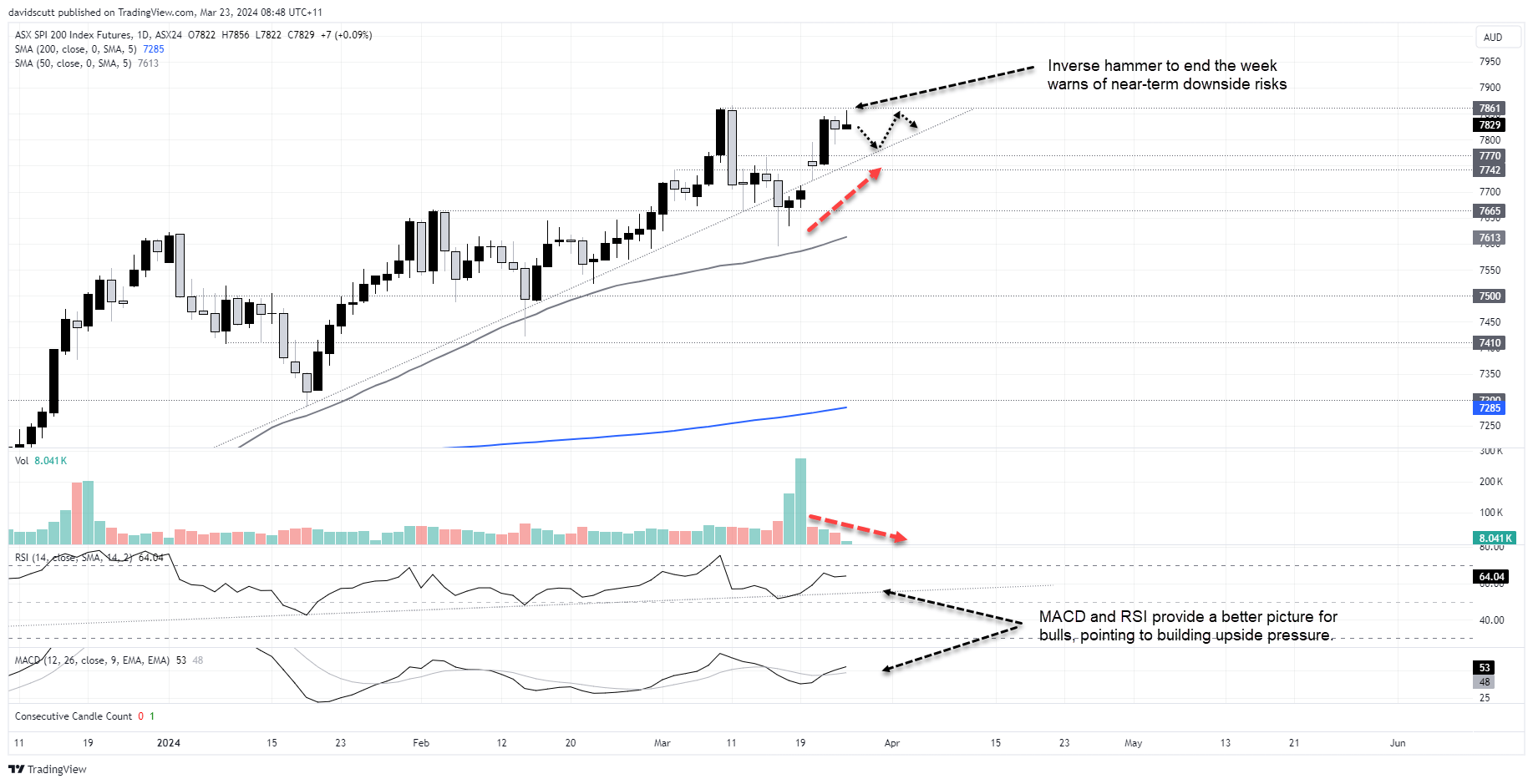

ASX 200: Seeking catalyst for fresh highs with banks looking bloated

Even though they’re very different in their composition, the technical setup for ASX 200 futures is not dissimilar to the Nasdaq, sitting within touching distance of record highs in part of a broader uptrend. MACD and RSI are pointing to building upside momentum, providing one differential between the two.

The fightback from the false break of the uptrend earlier this month was impressive, sending the price towards the record highs, However, the volume spike gives a false impression of strong support as it was driven by the futures contract rolling forward. When you exclude that impact, the rebound was driven by soft and declining volumes.

The price action to close the week was not overly convincing, printing an inverse hammer after contemplating taking out the old highs. While that warns of near-term downside risk, approaching the four-day long weekend in Australia for easter celebrations, the expected decline in market activity may limit the scale of any potential downside. I liken it to a micro Santa rally like period.

It points to playing the established ascending triangle pattern in the week ahead, unless we see a big break in either direction. Bears could sell ahead of the highs, with a stop above, targeting a retracement to uptrend support. Bulls could flip that trade around, buying on dips towards the uptrend with a stop below targeting a push back toward the highs.

From a fundamental perspective, the ASX is struggling with bloated and expensive bank valuations, making it difficult to see a meaningful push higher unless we see the other big weighting in the index – resources – start to rally. With Chinese economic concerns flaring again on Friday, that appears unlikely in the near-term.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade