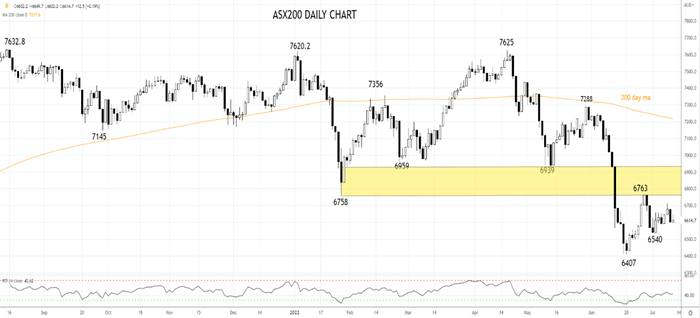

The ASX200 has given back a chunk of its early gains to be trading 11 points higher at 6613 at 2.45 pm Sydney time.

The ASX200’s retreat from its intraday high at 6650 came as U.S equity futures eased ahead of the release of key inflation and Q2 earnings data and as Australian consumer and business confidence slumped in July.

The Westpac/Melbourne Institute consumer confidence index fell another 3% to 83.8 for its eighth consecutive decline, taking it to its lowest level since the GFC. Business confidence declined to 1 from 6 and has now slipped below its long-run average of 5.

The decline in consumer and business confidence reflects fears of a global recession, high inflation, rapidly rising interest rates and cost of living pressures.

The Healthcare sector has been the day’s best performer. Resmed DRC (RMD) added 2% to $32.30, CSL added 2% to $293.65, Cochlear (COH) added 1.2% to $204.81, and Fisher and Paykel (FPH) added 0.86% to $18.87.

The defensive Consumer Staples sector has gained, led by Woolworths (WOW), which added 2.36% to $37.28, Coles Group (COL) added 2% to $18.67, Blackmores (BKL) added 0.1% to $76.26 while Graincorp (GNC) added 0.1% to $8.40. Going the other way, Bega Cheese (BGA) fell 2.5% to $3.56, Bubs Australia fell 4.1% to $0.53c, and Metcash (MTS) fell 2.3% to $4.22.

The big banks have recorded gains despite the nosedive in consumer and business confidence, which will weigh on the economy and house prices. NAB added 1.48% to $28.18, CBA added 1.07% to $93.54, WBC added 0.60% to $20.06, and ANZ added 0.04% to $22.60.

Coal miners have gained as European buyers look for an alternative to Russian gas. New Hope Coal (NHC) added 4.77% to $3.95, Whitehaven Coal (WHC) added 4.14% to $5.28, Yancoal (YAL) added 2.75% to $5.22, Coronado Coal (CRN) added 2.64% to $1.56.

Concerns over fresh covid lockdowns in China have weighed on the price of metal futures in China. In response, Oz Minerals (OZL) fell 3.3% to $16.33, Mineral Resources (MIN) fell 2.33% to $44.93, South32 (S32) fell 1% to $3.60, and BHP fell 1% to $36.63.

A crazy day in the local tech space as the share price of Sezzle (SZL) fell 37.35% to $0.26c after a planned merger with ZIP was terminated. ZIP added 3.50% to $0.52c paring an initial 10% gain. Elsewhere Life360 (360) fell 10.7% to $3.58, Tyro payments fell 6.7% to $0.66c and Novonix fell 6% to $2.05.

Turning to the charts, the ASX200 needs to see a sustained break above the 6750/6950 resistance zone to negate the technical damage caused by the breakdown in June. Until then, downside risks remain.

The AUDUSD is hovering just above its two-year low at .6720 as metal prices slump on concerns over fresh covid lockdowns in China, soft sentiment data and global recession fears.

Source Tradingview. The figures stated are as of July 12th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade