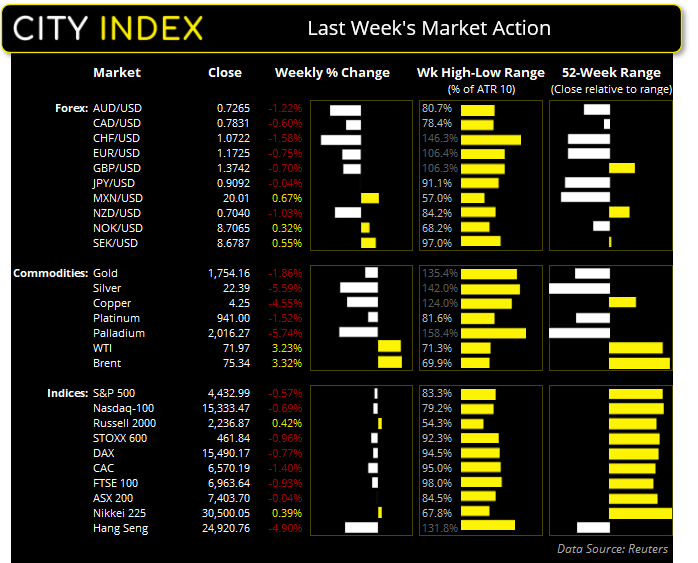

Asian Futures:

- Australia’s ASX 200 futures are down -47 points (-0.635%), the cash market is currently estimated to open at 7356.7

- Japan's Nikkei 225 futures are down 0 points (0%), the cash market is currently estimated to open at 30500.05

- Hong Kong's Hang Seng futures are down -98 points (-0.39%), the cash market is currently estimated to open at 24822.76

European Friday close:

- UK's FTSE 100 index fell -63.84 points (-0.91%) to close at 6963.64

- Europe's Euro STOXX 50 index fell -39.03 points (-0.94%) to close at 4130.84

- Germany's DAX index fell -161.58 points (-1.03%) to close at 15490.17

- France's CAC 40 index fell -52.4 points (-0.79%) to close at 6570.19

US Friday close:

- The Dow Jones fell -166.42 points (-0.48%) to close at 34,584.88

- The S&P 500 fell -40.76 points (-0.92%) to close at 4,432.99

- The Nasdaq 100 fell -182.436 points (-1.18%) to close at 15,333.47

Learn how to trade indices

Indices:

Rising treasury yields saw Wall Street close sharply lower on Friday. The Nasdaq 100 led the declines, falling -1.18%, the S&P 500 fell -0.91% and the Dow Jones Industrial was down -0.48%. Corporate tax hikes and rising delta cases continued to weigh on sentiment, despite strong economic data coming through last week. The S&P 500 closed just above its 200-day eMA and fell for a 2nd consecutive week.

It’s a busy week for markets with the highly anticipated FOMC meeting on Wednesday, BOJ also meet earlier on Wednesday, BOE meet on Thursday and we have a host of flash PMI data to also look forward to.

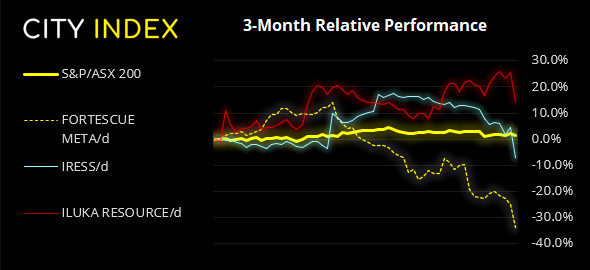

The ASX 200 printed a bearish engulfing candle on Friday and closed below its 50-day eMA. It seems probable that a swing high was seen on Thursday at 7440.1, so we now want to see prices move lower in line with its bearish break of trend support on September 9th.

ASX 200 Market Internals

ASX 200: 7403.7 (-0.75%), 19 September 2021

- 4 out of the 11 sectors closed higher

- 7 out of the 11 sectors closed lower

- 73 (36.50%) stocks advanced, 118 (59.00%) stocks declined

- 68% of stocks closed above their 200-day average

- 60% of stocks closed above their 50-day average

- 44.5% of stocks closed above their 20-day average

Outperformers:

- + 6.30% - Redbubble Ltd (RBL.AX)

- + 6.21% - Pointsbet Holdings Ltd (PBH.AX)

- + 5.89% - Atlas Arteria Group (ALX.AX)

Underperformers:

- -11.4% - Fortescue Metals Group Ltd (FMG.AX)

- -10.7% - Iress Ltd (IRE.AX)

- -8.78% - Iluka Resources Ltd (ILU.AX)

Forex:

The US dollar continued to rise on Friday ahead of this week’s FOMC meeting, where there are some expectations for the Fed to announce tapering. The US dollar index (DXY) rose 0.28% and found support at 92.75 after printing a bullish engulf candle on Thursday.

USD/CHF closed above 0.93 for the first time since April. With bullish range expansion now underway following several weeks of choppy price action, we suspect it could now be heading for 0.94.

GBP/USD broke trend support on the daily chart and is now probing the 1.3727 low, bringing the 1.3600 handle into focus for bears.

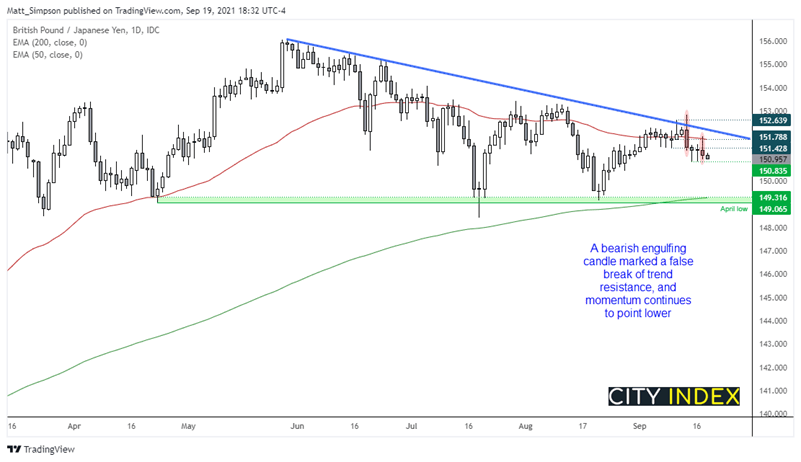

GBP/JPY has fallen for 4 consecutive days, having printed a bearish engulfing candle which failed to close above trend resistance to confirm a breakout. Support has been found around 150.83, although Friday’s bearish candle suggests a lower high is in place so we’re now waiting for a break of support to confirm a resumption of its downtrend.

Learn how to trade forex

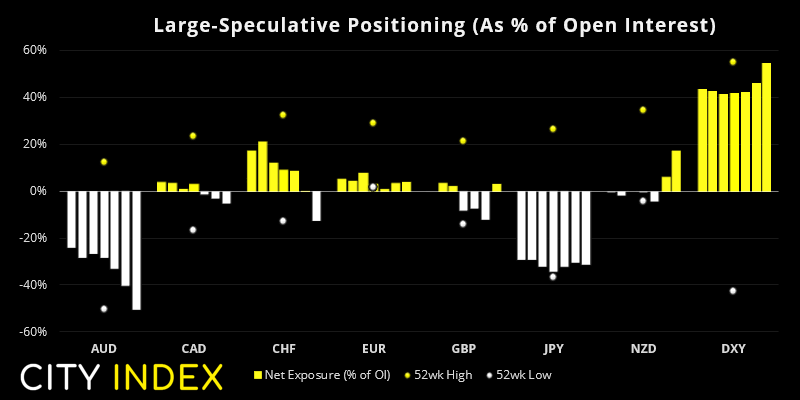

From the Weekly COT Report (Commitment of Traders)

From Tuesday

- Net-long exposure to the USD fell -$1.1 billion, down to $9.55 billion according to calculations from IMM.

- Traders increased their net-short exposure to AUD futures to their most bearish level on record. However, both long and short bets continued to decline with bears closing -6.5k short bets and bulls closing -6.5k longs.

- Large speculators were net-long GBP futures for the first time in 4-weeks, with 14.8k longs added and -14.5 shorts closed.

- Traders flipped to net-short exposure on platinum futures.

- Net-long exposure on NZD futures rose to a 16-week high as traders speculate a rate rise from RBNZ.

Commodities:

Silver continued to fall on Friday with spot prices hitting their lowest level since November. However, volatility on Friday was notably lower so there’s a decent chance the November low will hold as support, at least initially.

Oil prices continued to retrace on Friday, although not at an alarming rate. The trend structure on WTI futures remains bullish above $67 on the daily chart although we’d expect $70 to hold as support of this bullish trend is to be believed.

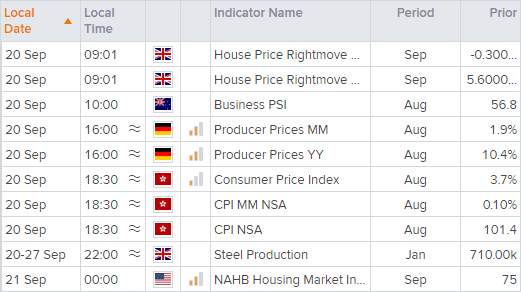

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.