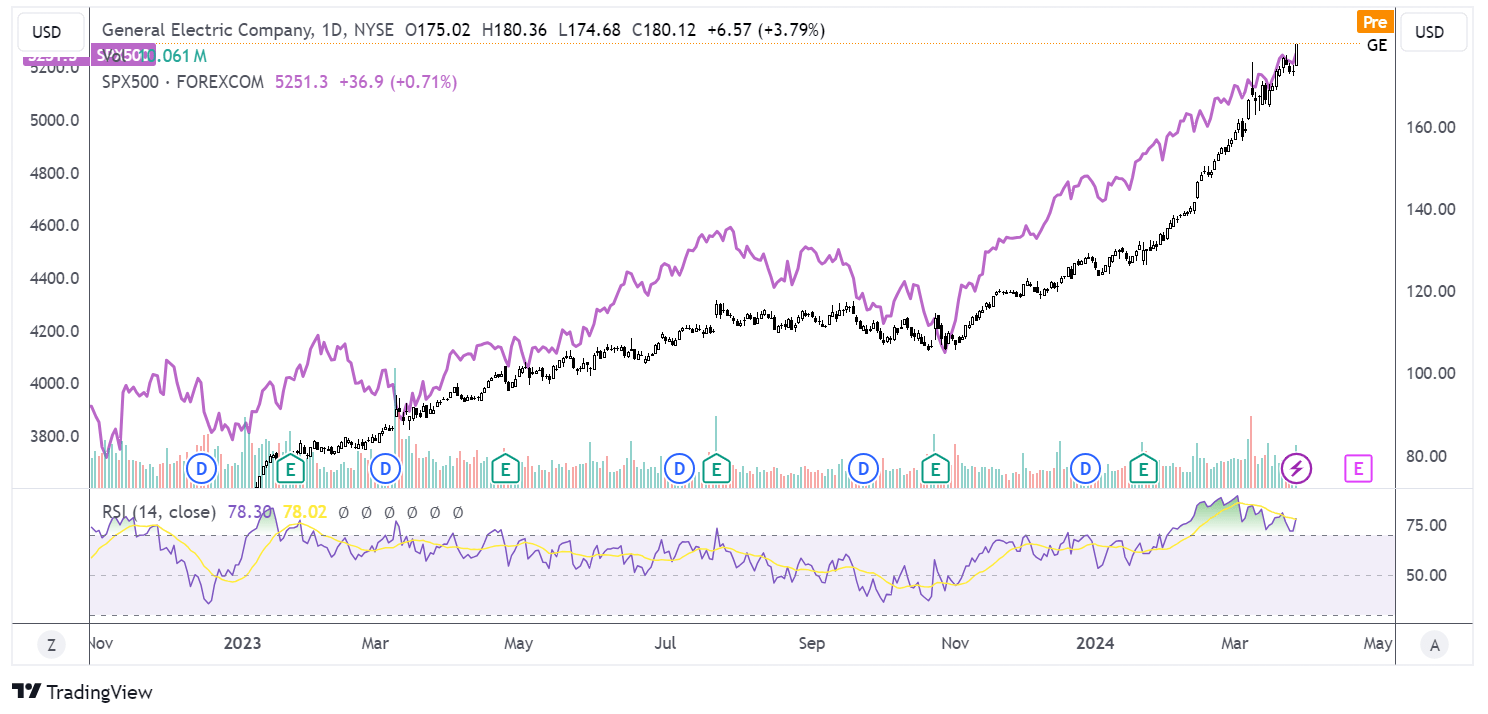

- GE awaits the GE Vernova spin-off

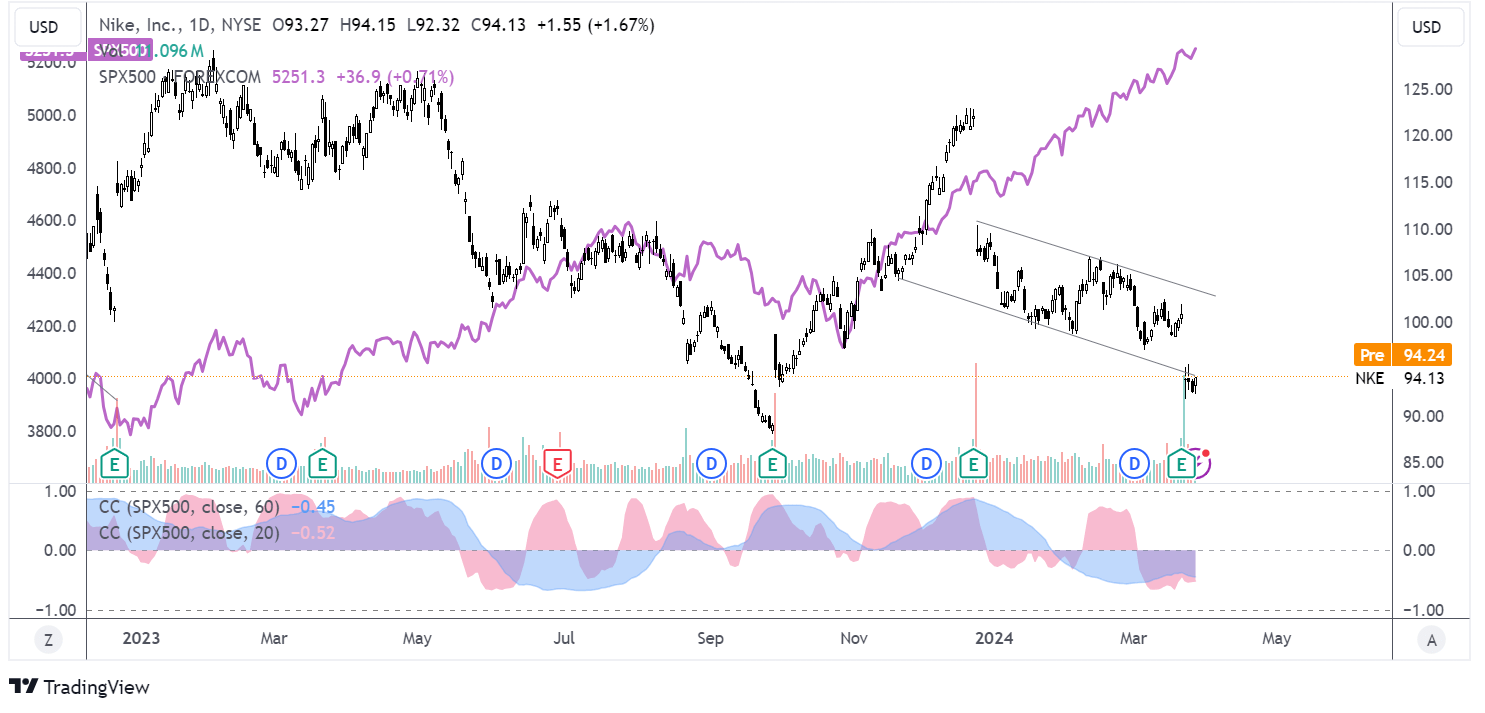

- Nike struggles with eyes on China, Europe data amid concerns over demand in the regions

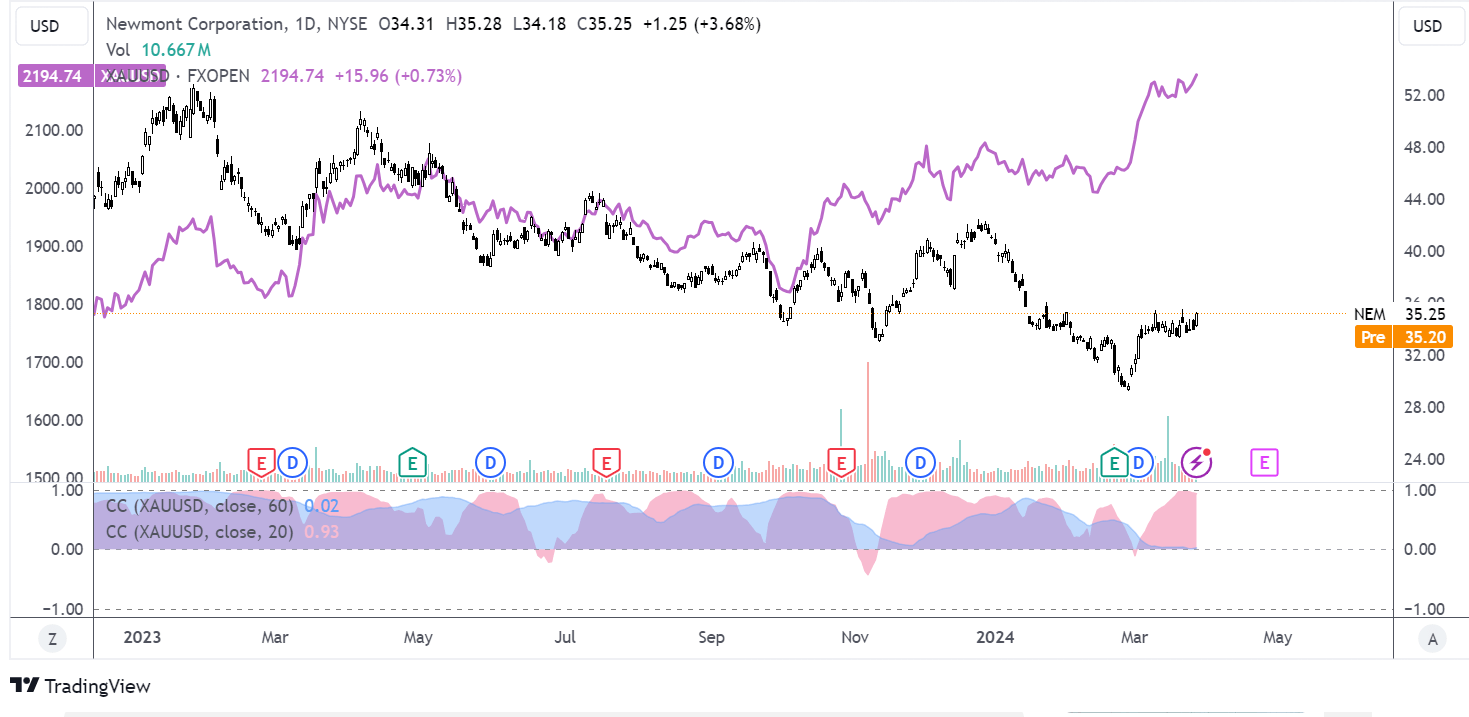

- Newmont Mining looks to Gold prices

The S&P500 rose to a fresh all time high last week, ending its best first quarter since 2019, ahead of US core PCE data released on the Good Friday holiday. Last week, the market had little fresh data to sink its teeth into, and there were diverging comments from Federal Reserve officials. The market seemed unfazed by Christopher Waller and Raphael Bostic pushing back on rate cut expectations, and the market is still pricing at around a 70% probability that the Fed will start to cut rates in June.

Since the US stock market was closed on Friday when the core PCE data was released, the reaction of the stock market will likely be seen on Monday. This could lead to a potentially volatile start to a week that is expected to be filled with economic events. The market will be closely monitoring releases such as non-farm payrolls, ISM manufacturing, and non-manufacturing data for indications of the economy's health and the future direction of interest rates.

GE rises ahead of its spin-off.

The manufacturer has risen 14% in March and is on track for its fifth consecutive monthly rise as it heads towards its corporate split on April 2. The move higher in the manufacturer is in line with the broader S&P index, based on optimism that the Fed will soon start to loosen monetary policy. The stock has managed to power higher even as signs of weakness appear in the US manufacturing sector.

US ISM manufacturing PMI and factory orders figures will be released next week and could shed some light on the sector's health as a whole. The manufacturing PMI is expected to show that the sector contracted at a slower pace, which could help support the stock further.

Still, all eyes are on the move to split GE in two. The company's parent will be GE Aerospace, which will focus on airplane engine manufacturing. The power business will be spun off into GE Vernova. Shareholders will receive one GE Verona share for every four GE shares. There is a strong case that the two stocks separately could be worth more than combined.

Nike looks to China, Europe for clues on demand

After tracking the broader market in the latter part of 2023, Nike experienced a significant diversion from the S&P 500 in Q1, falling 11% YTD against the S&P’s 10% gain YTD. The consumer discretionary stock is benefitting from the resilience of the US economy, which helped sportswear retailers beat fiscal Q3 forecasts. North American revenue was up to $5.07 billion, versus $4.75 billion expected. However, China, a key market for Nike, has experienced slowing sales, and revenue came in below estimates at $2.08 billion. Meanwhile, the European business also underperformed. The subdued macro outlook across the globe is weighing on Nike’s outlook.

This week, global PMI data, particularly numbers from China and Europe, will provide further insight into the health of these economies. Should the data fuel ongoing concerns over the outlook for these regions, the Nike share price could come under additional pressure.

Nike's price has broken below the falling channel, consolidating around 93.00. Continued weakness could bring $88.00, last year's low, into focus.

Newmont Corporation tracks Gold higher

Gold hit an all-time high and is on track to rise 7.5% this month, marking its strongest monthly performance since March 2023. The rise comes after the Federal Reserve maintained its guidance for three rate cuts this year, and the market prices in a 70% probability of the first cut in June. A lower interest rate environment is supportive of non-yielding gold.

The rally in the precious metal helped Newmont rise 12% in March, its strongest monthly performance in 12 months. Gold will remain under the spotlight this week with the release of US non-farm payrolls. Any signs of the softening of the US labour market could increase Fed rate cut expectations, lifting Gold and Gold miners such as Newmont Corporation higher.