Trading with City Index

Corporate actions and dividends

What is a corporate action?

A corporate action is an event initiated by a public company that will affect the shares it has issued.

Some corporate actions, like dividends, will have an impact on the price. Others, like a name change, will not. There are also some corporate actions which have an indirect impact, for example a stock split.

Corporate actions have a number of motives:

- Returning income to investors (e.g. through dividends)

- Influencing the share price (e.g. stock splits, intended to make the price lower)

- Corporate restructuring

At City Index, we aim to reflect the circumstances affecting the share in the public market in your trading account.

Dividends

A dividend is declared when a company pays out money to investors. It is paid on a per outstanding share basis to stock holders. The more shares you own, the more you will receive in dividends.

For derivatives traders, when a company declares a dividend, if you are long that share, you will be credited with the dividend. If you are short, you pay the dividend. This happens before the market opens on the ex-dividend date.

The ex-date is that day on which if you buy the stock you are no longer entitled to receive the dividend. The share price of a company will drop on the ex-dividend date to compensate for the fact that the company is now worth less – after all, it just parted with a large pool of cash. However, if you have an open trade on the stock, then the dividend will off-set this. Such falls in price usually mirror the dividend paid out.

Once a dividend has been declared, that company becomes ex-dividend – to be paid, you must have an open long position on that company on the day before the ex-dividend date.

Rights issues

Rights issues occur when the company issues new shares to existing shareholders. These are usually offered at a discount to the prevailing market price.

Because the market price will tend to drop as a consequence of a rights issue, City Index will book a rights issue at zero to your account, giving you a number of choices when this occurs:

- Sell the rights issue before the deadline at market price

- If you are short the company, you can buy back the rights before the deadline at market price, OR if you leave the rights position open after the deadline, you will be booked a short position at the market price

- Take up the rights resulting in a new position in the underlying stock usually at a discount

Please note: short customers cannot take up the rights issue.

Open offers and entitlements

These are like a rights issue, though they can’t be traded.

Mergers, takeovers and acquisitions

A takeover can take months and years to go through and sometimes may not happen if terms cannot be agreed. During this period, shares in a company will continue to trade and it will still be possible to trade the share price.

Once a deal is complete, and the actual stock stops trading, if you have positions based on the price of the company these will be closed according to the takeover terms. The trade value will remain the same before and after the takeover.

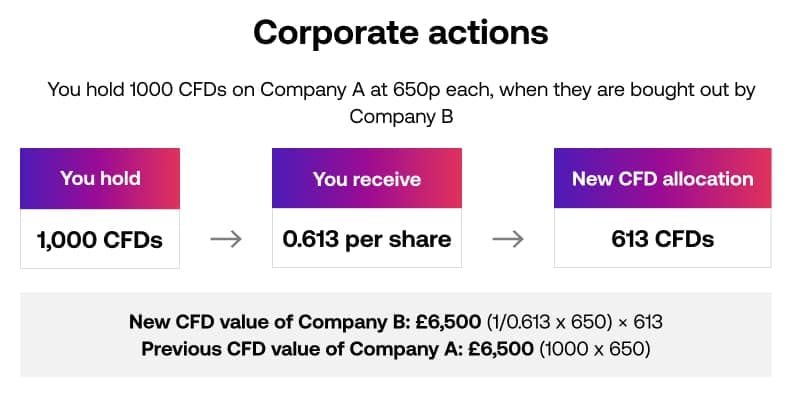

- You hold 1000 CFDs on Company A @650p

- Company A is bought by Company B. Shareholders of A are offered 0.613 in B per share of A they own (this will be based on the eventual price that B agrees to buy A for)

- You would receive 613 CFDs based on the share of Company B (0.613 x 1000)

- City Index will calculate a new price for the CFD - 1/0.613 x 650 = 1060.36 pence

- The value of the trade remains the same, i.e. £6,500

Stock splits and consolidations

If a stock is priced too high or too low, then its liquidity may suffer. Stocks that get too expensive will not be attractive to investors, while those that get too cheap will face the threat of being delisted. A stock split or consolidation will increase / decrease the price by decreasing / increasing the price of shares.

What happens to my trade under a stock split?

In a stock split, your City Index position will be closed, then reopened to reflect the terms of the split. The objective is to reflect exactly the circumstances affecting the share in the public market.

What happens to my trade under a consolidation?

In a consolidation, as the number of shares are being reduced in the physical market, holders of a position in that stock will be compensated with a cash dividend for an amount they are losing as a consequence.