Trading with City Index

Entry orders

What is an entry order?

Entry orders can be used to automatically open a position when the market hits a pre-determined level set by you.

This is particularly useful for traders looking to buy/sell at a certain price and who do not want to, or do not have the time to watch the market constantly until this price is reached.

In this article we will cover the various types of entry orders available.

What is a 'buy stop' order?

A buy stop is an order to buy any given instrument on the trading platform above the current market price. This order will be triggered if the market then goes on to reach your specified level.

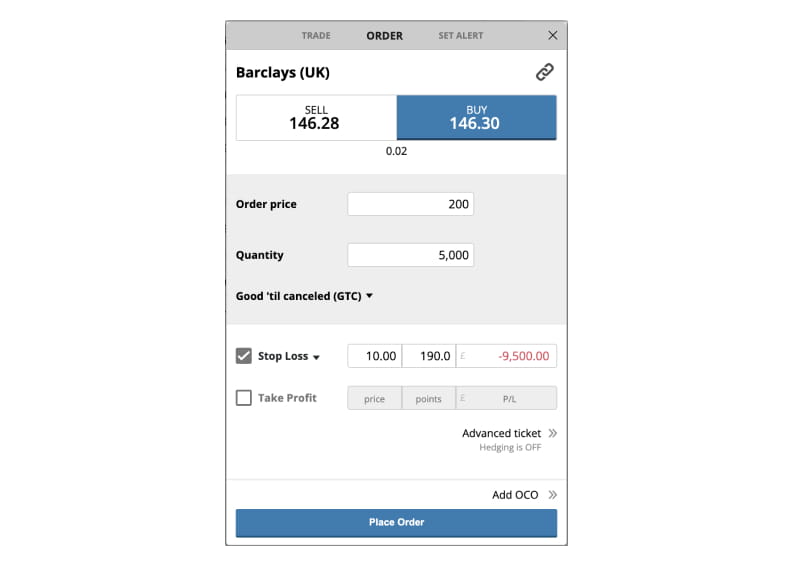

InIn the example you can see how this would be executed on our platform. With Barclays shares currently trading around 146p a share, an order is placed to buy 5,000 CFDs if the price reaches 200p. This order will only be triggered if the buy price then goes on to hit 200.

This technique is very common with traders that use ‘Pyramiding’ as a way to maximise profits. Pyramiding focuses on adding to existing profitable positions, which are already showing signs of strength. Buy stops are also used by technical traders that are looking for a range bound market to break key resistance levels.

What is a 'buy limit' order?

A buy limit is an order to buy any given instrument on our trading platform at or below the current market price. This order will be triggered if the market then drops to your specified level.

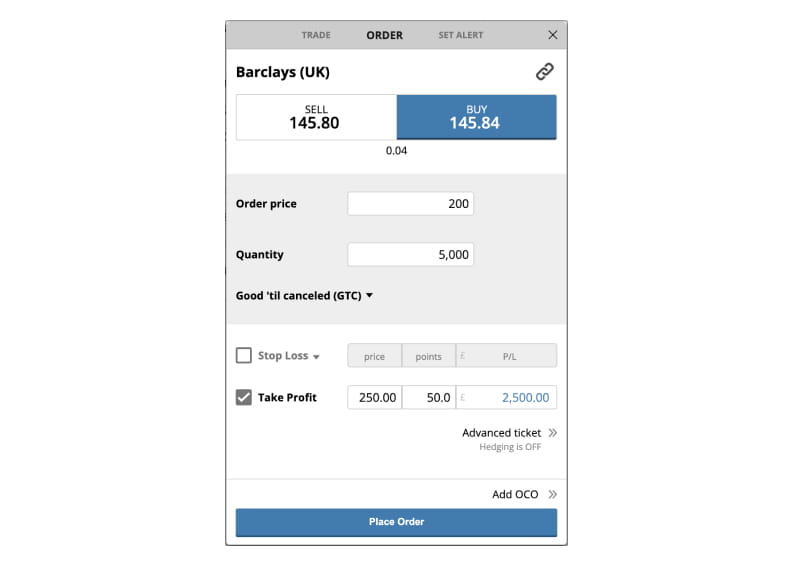

In the example here you can see an order has been set to buy 5000 CFDs if the share prices drops to 100p (£1 a share). This order will then only be triggered at £1 a share, and at that point a buy position would be opened for 5,000 contracts at 100p.

This technique will often be used if a trader believes the market will drop from the levels it is currently trading at. Investors will then hope the order they have placed is triggered, as they are of the opinion the market will strengthen again. This is particularly common with traders that use technical analysis to determine key levels and potential pivot points.

What is a 'sell stop' order?

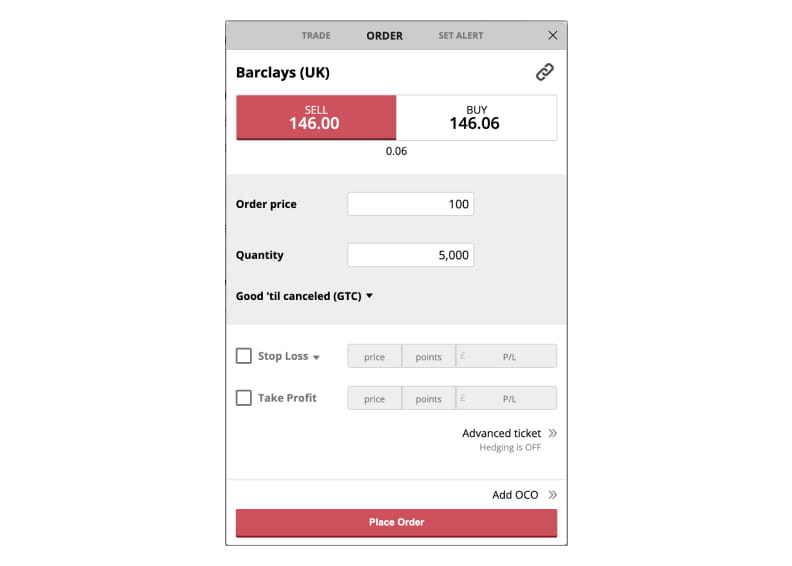

A sell stop is an order to sell any given instrument on our trading platform below the current market price. This will be triggered if the market drops to your specified level.

In this example an order to sell 5,000 CFDs at 100 (£1 a share) has been placed. This order will only be triggered if the price drops to 100, and at that point a sell position will be opened.

Similar to a buy stop, these orders can be used to open a new sell position or add to existing profitable trades at levels below the current market price. Sell stops are also used by technical traders that are looking for a range bound market to break key support levels.

What is a 'sell limit' order?

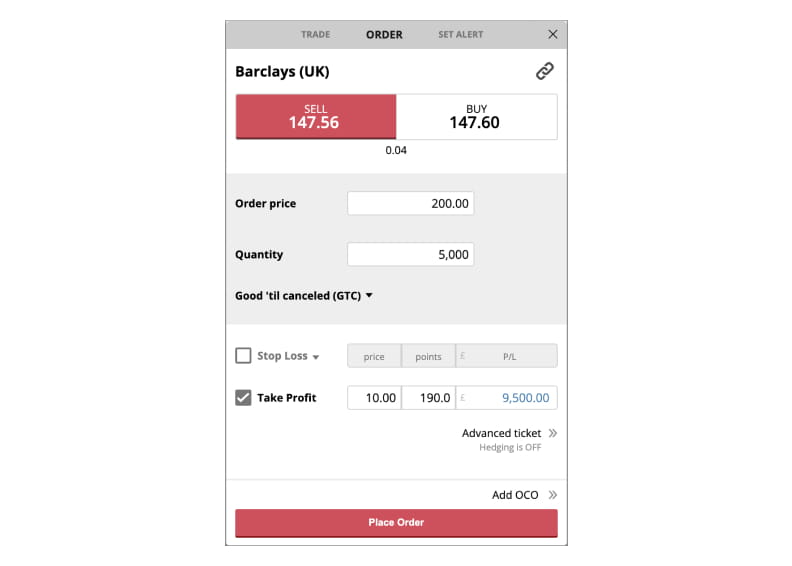

A sell limit is an order to sell any given instrument on our trading platform, above the current market price.

Above you can see an order to sell 5,000 CFDs at 200 (£2.00). With Barclays currently trading around £1.47 a share, the stock would need to rise 53 pence before the order is triggered. At this point a position would be opened, selling 5000 at £2.00.

Similar to a buy limit, these can be used in an attempt to open a position at a more favourable price than the market is currently trading at. This will often be used in technical trading, looking for the market to hit key levels and looking for potential trend reversals.