Trading with City Index

Guaranteed stop loss orders (GSLOs)

Guaranteed stop loss orders work in the same way as standard stop loss orders, except they guarantee to close your trade at the exact trigger value you set, regardless of underlying market volatility and gapping. This is useful if you want added assurance that your position will be closed out at the precise price you specify.

Why is a GSLO beneficial?

Market gapping occurs when prices literally ‘gap’ between one price and the next, without trading at the prices in between. This usually happens in times of extreme market volatility and while not common it is important that you are aware of the potential implications of sudden, sharp changes in market volatility.

A standard stop loss order doesn’t fully protect you from trading risk as the closing trade is executed at the next available price immediately after the order is triggered. This can be at the same price, a better or a worse price than the specified execution level. In cases of severe gapping, the execution price may be at a substantially worse price than your order price, resulting in a larger than expected loss on your trade.

For added peace of mind, guaranteed stop loss orders can be used. GSLOs are used to ensure that the level at which an order will be executed is the exact level that you’ve specified, regardless of any gapping in the market.

Guaranteed stop losses are most useful:

- If you're trading in volatile markets

- If you don't want to risk more than your initial deposit

- If the market is prone to gapping (remember, markets can gap both ways)

Guaranteed stop loss orders – what you need to know:

-

GSLO premium

You only pay a premium for your GSLO if your order is triggered. -

Amendments

A GSLO can be amended without additional charges and during market trading hours only. -

Minimum distance

Order levels must be placed a minimum distance above and below the current quoted price. -

Availability

Our GSLOs are offered on a large range of our 6,300 markets, providing a safe, cost effective method of managing your risk.

For specific GSLOs on a particular market, please refer to the 'Market Information' tab within the trading platform.

How to use a guaranteed stop loss order

Example

Let's say you've bought 2 Wall Street Index CFDs at 20420, and have highlighted 20370 as your maximum loss level. A $100 loss allowance (20420 – 20370) x 2.

You pay a premium of 4 x your stake for the guaranteed stop loss, 4 x 2= $8

Guaranteed stop loss example

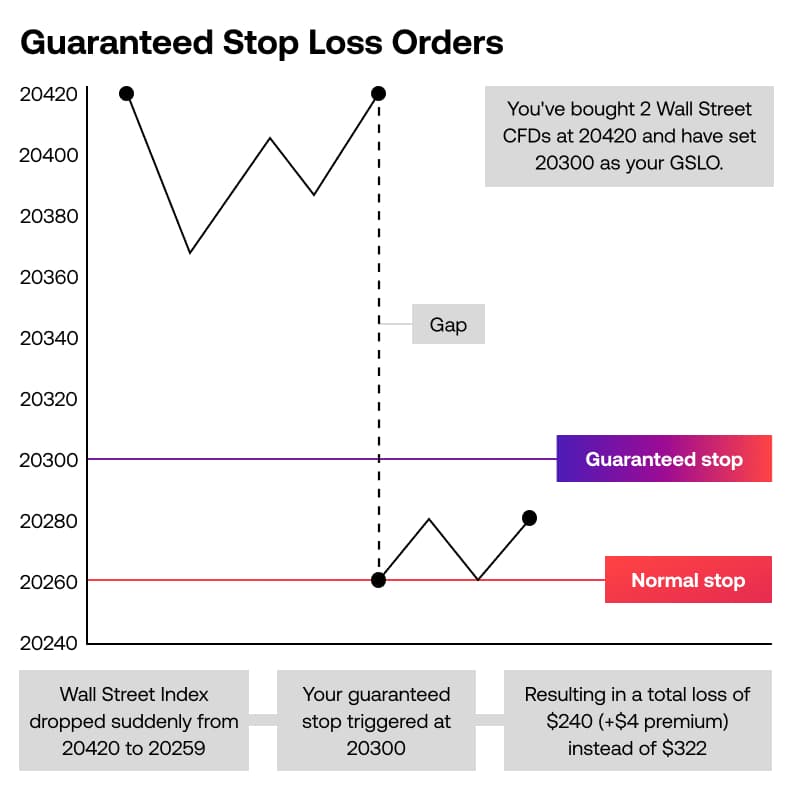

In the example below imagine you had bought 2 Wall Street Index CFDs at 20420 and chosen 20300 as your maximum acceptable loss level which is where you decide to place your Guaranteed Stop Loss.

If triggered this would equate to a $240 loss allowance (20420 – 20300) x 2.

The GSLO premium for Wall Street is 4 x the quantity of CFDs or stake charged in the base currency of your account. In this case the premium is calculated as 4 x 2 = $8 and would be charged only if your GSLO was triggered.

Two days after you have placed your order, the price of the Wall Street Index suddenly drops lower from 20420 to 20259.

With a GSLO in place, your trade has been closed out at the pre-determined level of 20300 for a total loss of $248 ($240 loss on your position + $8 premium on GSLO when triggered) preventing further loss as a result of market gapping.

If you had placed a normal Stop Loss on your position, your losses would have been far greater as you would only have been closed out at the next available price which was 20259.

(20420 – 20259) x2 = $322 total loss