Trading with City Index

If-done orders

What are 'if-done' orders?

Also known as contingent orders, ‘If-dones’ are two-step orders where the second part of the order is activated only if the criteria of the first has been met.

- Part 1 – An order to open a position such as a limit

- Part 2 – An order that is only activated once the first order has been executed eg a stop order, limit order or OCO

If-dones allow you more flexibility and peace of mind, you don’t have to monitor the markets 24 hours a day to protect your position and can cover multiple outcomes to ensure the best outcome for your trade.

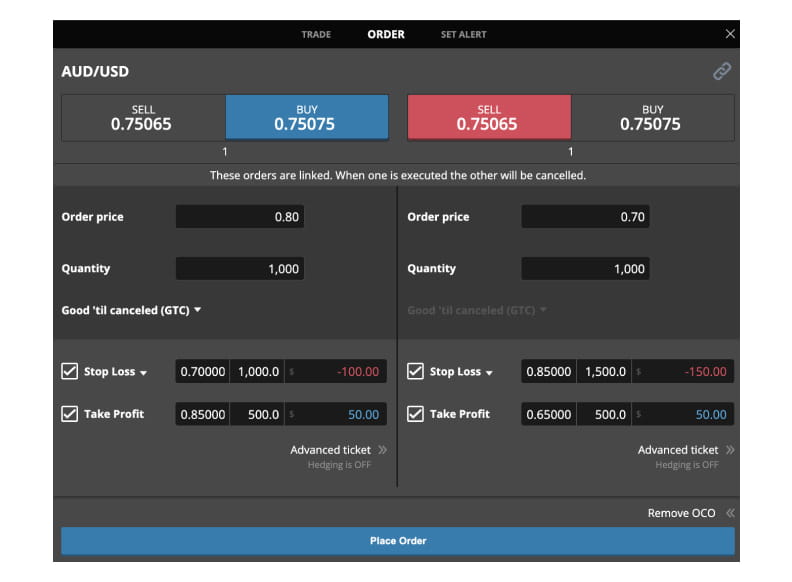

OCO with an if-done order attached

Example

In this example you can see an OCO order to open, a sell and a buy order for Procter & Gamble shares, should the price move approximately 5 points either way.

Each OCO order has an additional OCO order – a stop and a limit attached to both parts of the order.

This part is the if-done. The term if-done is derived from the idea that if one of these orders is triggered (or done), the stop and limit will then be activated and orders on the opposing side cancelled.

This facility allows you to make use of OCO orders, whilst still having the peace of mind that if either side of the order is triggered, you are managing the risk accordingly.