Trading with City Index

Overnight financing explained

What is overnight financing?

Overnight financing is a fee that you pay to hold a trading position overnight on leveraged trades, it is essentially an interest payment to cover the cost of the leverage that you use overnight.

Overnight financing charges are applied to positions that have no set expiry date. Financing charges reflect the cost of borrowing or lending the underlying asset and are charged at 2.5% plus or minus the relevant interest rate benchmark on the total value of the position. These charges are competitive in order to keep the cost of trading low.

When does the charge apply?

The daily financing fee will be applied to your account each day that you hold an open position (including over the weekend).

You will not pay a finance charge on futures trades as they already have the cost of carry built into the spread.

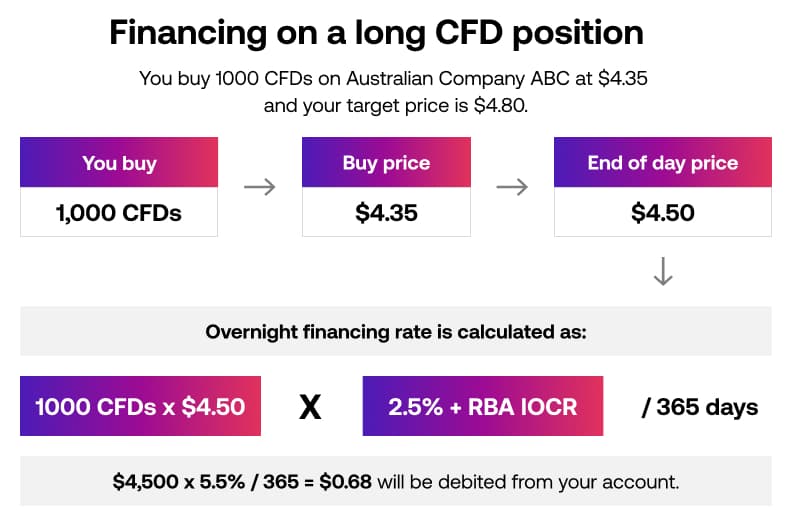

Financing on long positions

You will pay an overnight financing charge of 2.5% plus the relevant rate .

In this example, you buy 1000 CFDs on Australian Company ABC at $4.35. The trade is doing well and the price has increased to $4.50 at the end of the day but it is still some way from your target price of $4.80. You decide to keep the trade open overnight.

As it is a long position, you will pay an overnight financing fee to keep the position open, this fee consists of 2.5% + the current RBA IOCR rate. In this example, the current rate of RBA IOCR is 3%.

The overnight financing is then calculated as:

(1000 CFDs x $4.50 price) x (2.5% + RBA IOCR)) / 365

$4,500 x 5.5% / 365 = $0.68

$0.68 will be debited to your account.

*Note: US and EU stocks are divisible by 360 rather than 365.

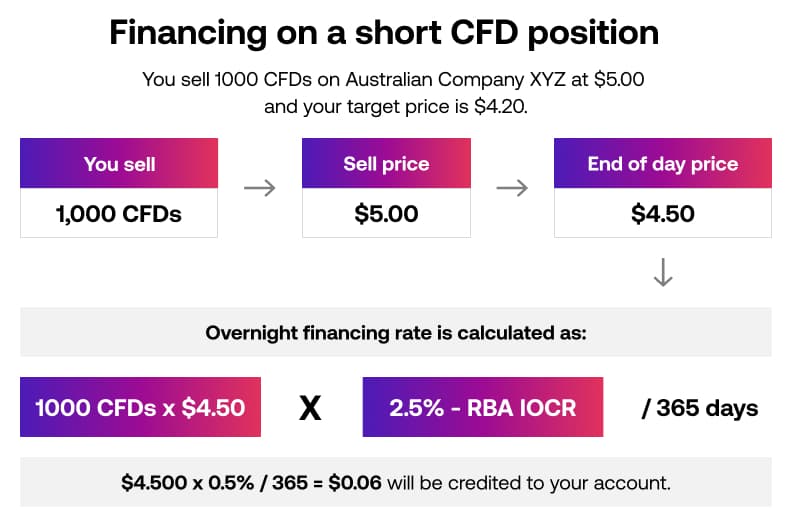

Financing on a short CFD position

On short positions you may receive an overnight financing fee of 2.5% minus the relevant rate. However, please note there may be instances when a financing fee is charged to you.

For example, you sell 1000 CFDs on Australian Company XYZ at $5.00. The price falls to $4.50 at the end of the day, but it is still some way from your target price of $4.20. You decide to keep the trade open overnight.

As it is a short position, you will receive an overnight financing fee to keep the position open. The RBA IOCR rate is currently 2%.

The overnight financing is calculated as:

((1000 x $4.50) x (2.5% - RBA IOCR)) / 365

$4,500 x 0.5% / 365 = $0.06

$0.06 will be credited to your account.