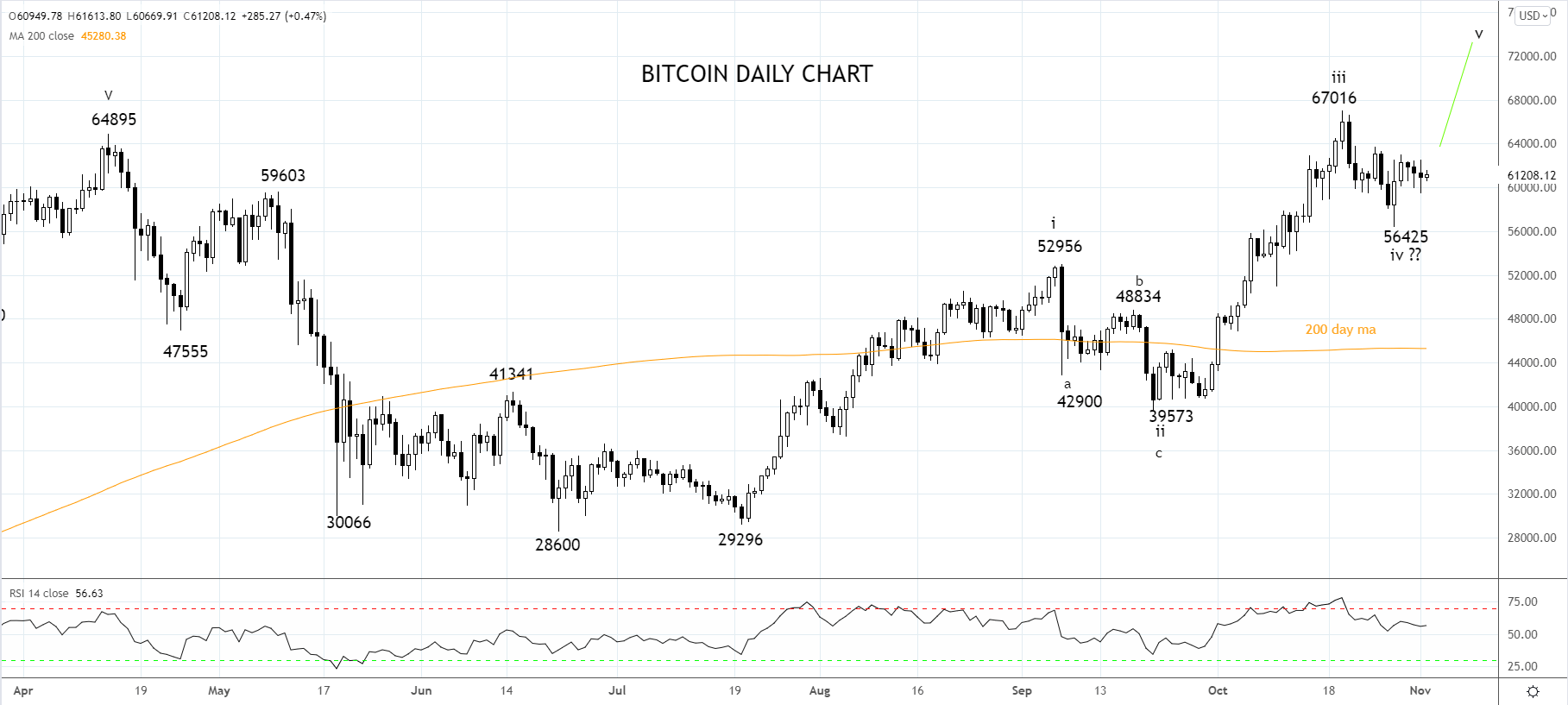

However, after tagging a new all-time high above $67,000, Bitcoin corrected 15% lower. Meanwhile, U.S stocks have defied expectations for a pullback and continued to march relentlessly onwards and upwards.

Behind Bitcoin's underperformance in recent sessions, are two main factors.

This Thursday, the Federal Reserve is expected to announce a tapering of its bond purchases by $15 billion a month, ending some eight months later in mid-2022, followed by a rate hike shortly afterward. Other central banks are looking to or have already started to walk a similar path.

Reduced liquidity at the margin will be a gentle headwind for cryptocurrencies (particularly at the more speculative end), and higher interest rates will lower inflation expectations. Bitcoin is trading like a digital inflation hedge as gold has done in the past.

Secondly, stablecoins designed to keep a stable value mainly against the U.S. dollar and whose circulation is thought to be around $135 billion were the subject of a report from the Biden administration overnight.

The report said that while stablecoins could transform the payments space, more regulatory oversight is needed. Specifically, the report recommended that Congress pass legislation limiting stablecoins issuance to banks, a recommendation that appears to be weighing on the broader market today.

Nonetheless, after holding and bouncing from the support noted in our last Bitcoin article, here a bullish bias remains in place.

"The target for the correction is a band of support between $55,000/$53,000, which encapsulates wave equality, the target for the head and shoulders topping pattern, and the early September El Salvador high at $53,000."

The target is for a rally towards $75,000 into year-end, aware that a break and close below support at $55,000/$53,000 would cause a reassessment of this view.

Source Tradingview. The figures stated are correct as of November 2nd, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade