While this is a relatively modest decline in the world of digital assets, the lack of any meaningful headline to explain the decline has left some wondering what comes next for Bitcoin.

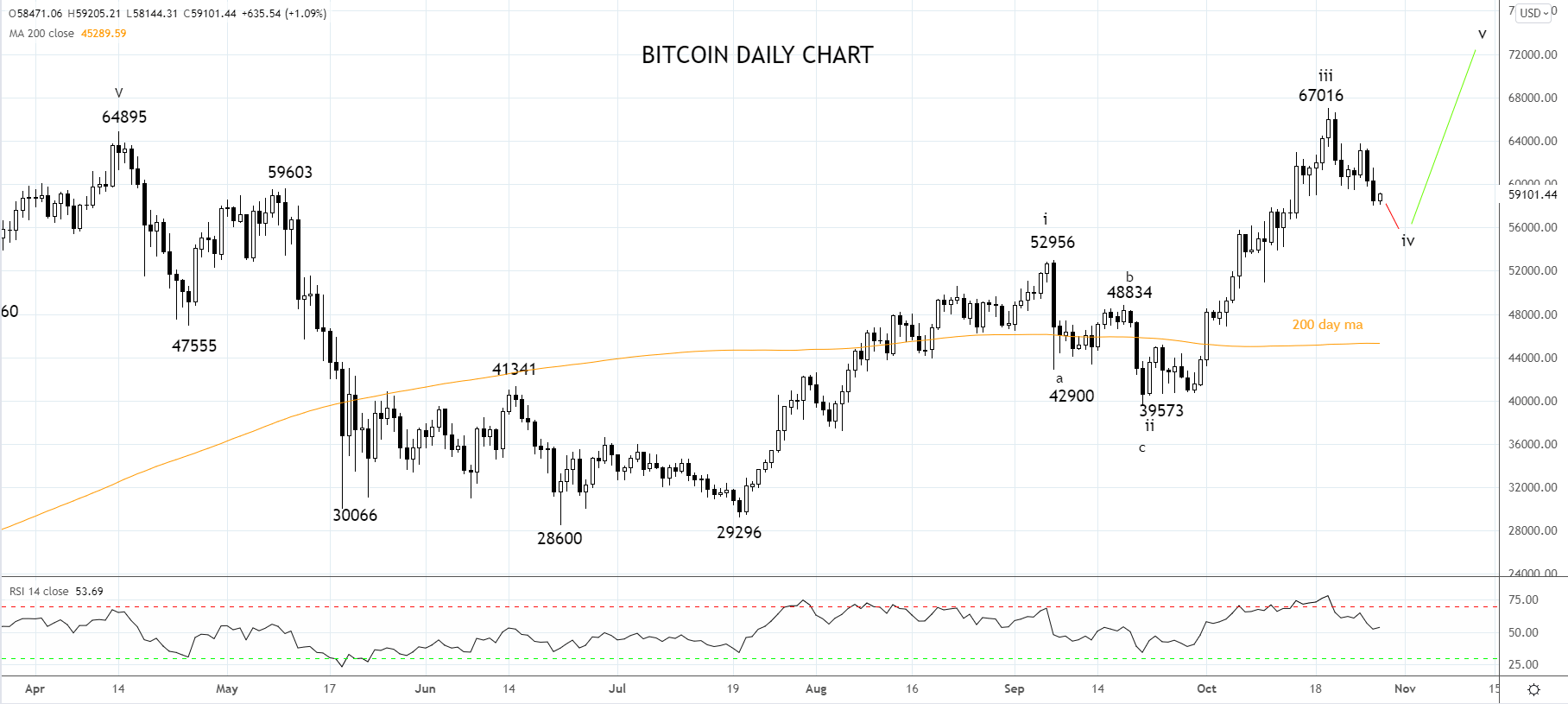

Since trading to a low of $28,600 midway through this year, Bitcoin has rallied ~130% to a new all-time high above $67,000, including a 50% rally in October alone.

Bitcoins rally in October in tandem with an impressive rally in U.S. equities, providing yet another reminder that Bitcoin is in part a risk asset and a high beta play on stocks.

Notably, U.S stocks appear a little tired, and a modest correction before the uptrend resumes would not surprise, reducing short-term support for Bitcoin.

High inflation readings coming in part from surging oil energy prices have been reported in several countries this month. Bitcoin has traded like a digital inflation hedge as gold has done in the past.

Notably, oil prices have fallen 5% this week, potentially helping ease inflation expectations and reducing short-term support for Bitcoin.

Considering the two factors mentioned above and adding into the mix leveraged selling on the break of support at $60,000, the current pullback in Bitcoin appears logical.

Technically, the current pullback in Bitcoin is viewed as the correction alluded to in this article on Bitcoin here

“While we remain medium-term bullish Bitcoin, we are now neutral in the short term and looking to re-enter longs, ideally on a corrective pullback.”

The target for the correction is a band of support between $55,000/$53,000, which encapsulates wave equality, the target for the head and shoulders topping pattern, and the early September El Salvador high at $53,000.

Pending signs of basing in this region look to re-open longs in anticipation of a rally towards $75,000 into year-end.

Source Tradingview. The figures stated areas of October 28th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade