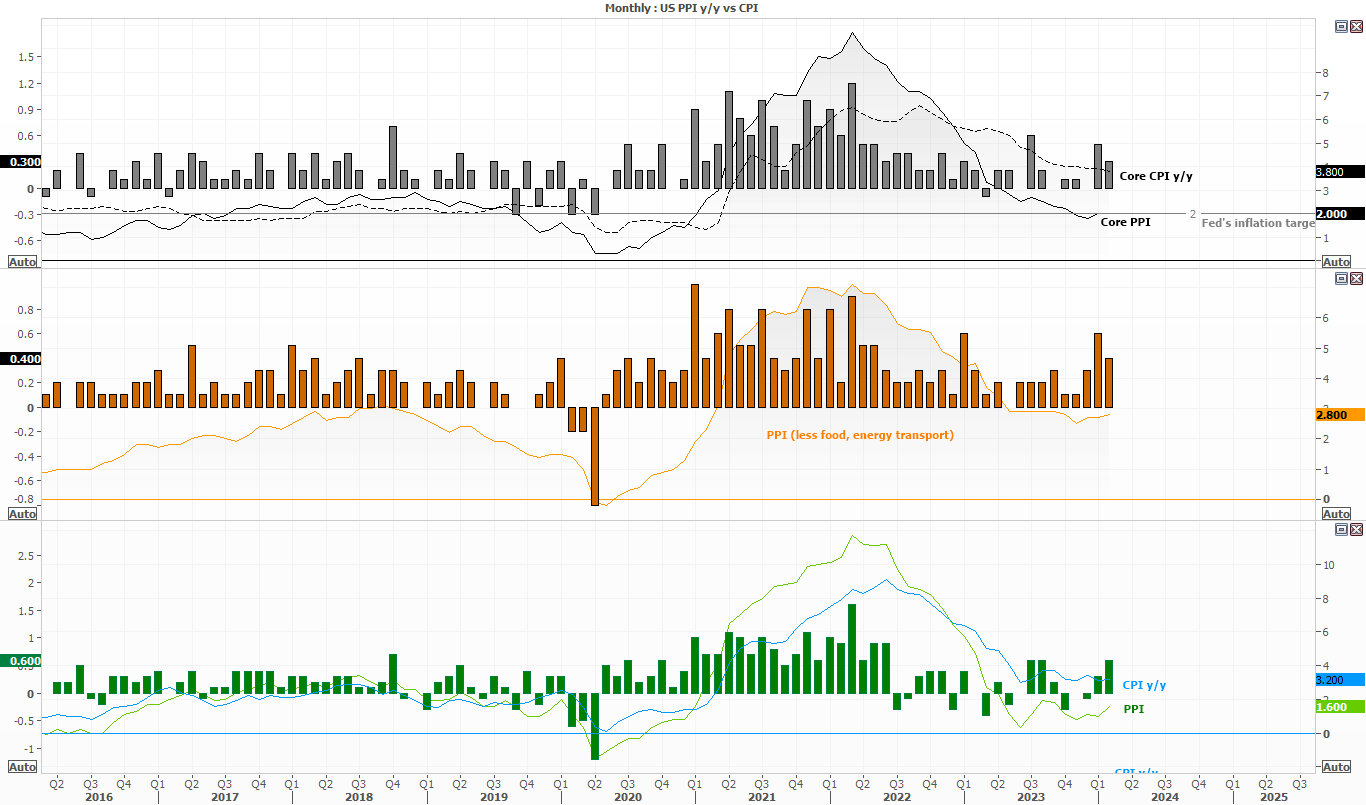

If anyone was sat on the fence regarding Fed policy after the hotter-than-expected CPI report earlier this week, surely Thursday’s hot producer prices tipped them over the edge towards no imminent Fed hike. Not according to Fed fund futures, which are still pricing in a June hike with a 57.3% probability.

PPI rose at its fastest pace in six months at 1.6% y/y, above 1.1% expected and the prior month was upwardly revised to 1% y/y (0.9% prior). Core PPI rose 2% y/y, above 1.9% expected or 2.8% y/y less food, energy and transport. Consumers added insult to hawkish injury with retail sales rising 1.3% y/y, although core retail sales only rose 0.3% m/m compared with 0.5%. Still… Thursday’s data alongside higher levels of consumer inflation, core CPI nearly twice the Fed’s 2% target, a June hike seems unlikely to me.

The Fed meet next week and release updated forecasts. The December dot plot had a median estimate of 3 hikes this year, which seems unlikely. So there is a real chance that the median could drop to 2 or even 1 hikes, and that could light a match under the US dollar’s bull fire.

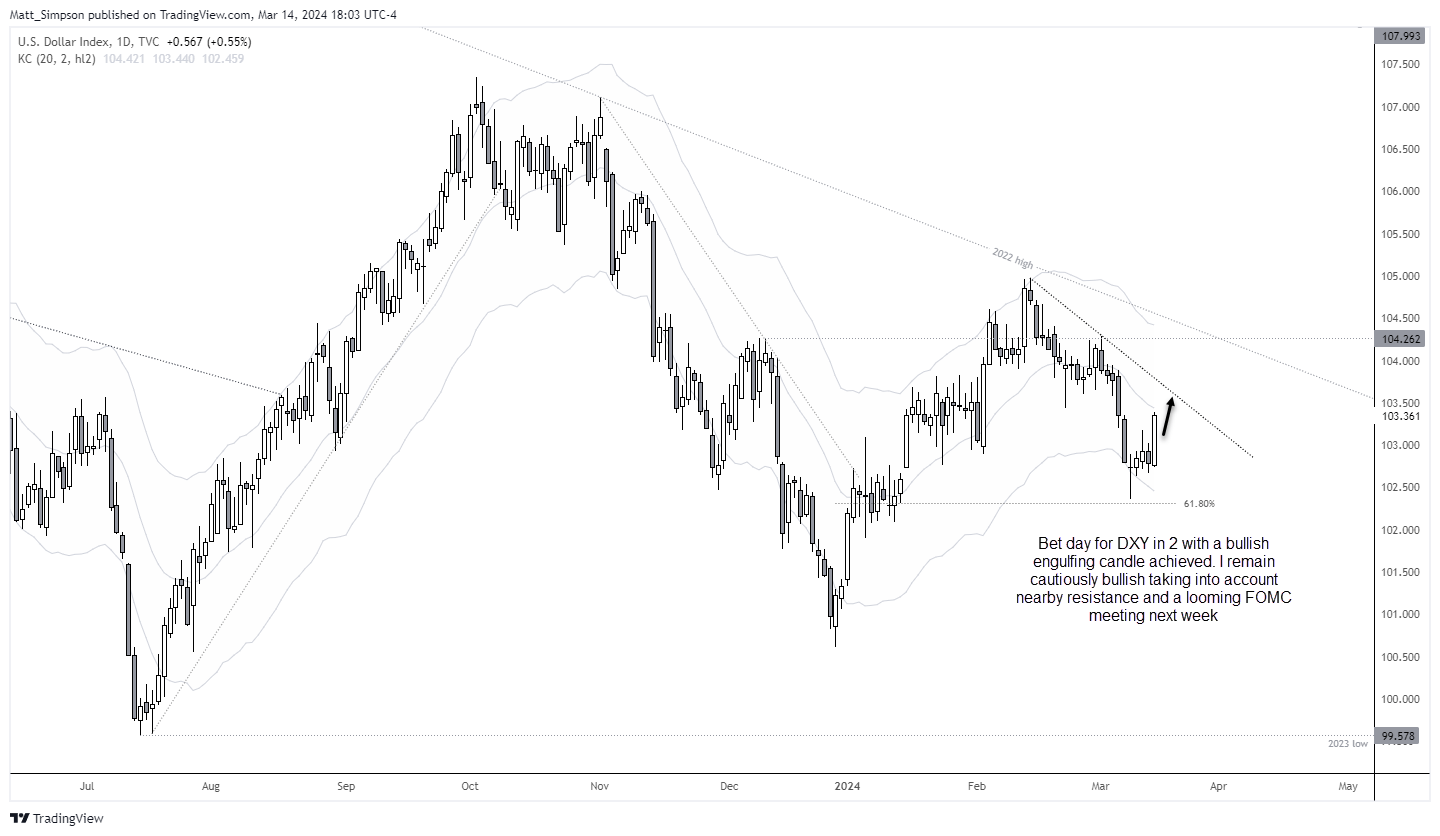

USD dollar index technical analysis:

Bears were quick to scramble when the US data arrived, helping the US dollar index enjoy its best day in 22. Incoming data and the Fed’s tone will ultimately decide how much upside potential there is left for the US dollar bull case, but for now I am cautiously bullish, taking into consideration resistance levels nearby.

Bulls could seek dips within Thursday’s range for cheeky longs, keeping an eye on the 20-day EMA and trend resistance for potential resistance / targets ahead of the weekend. And then we can reassess nest week around the FOMC meeting.

Market Summary:

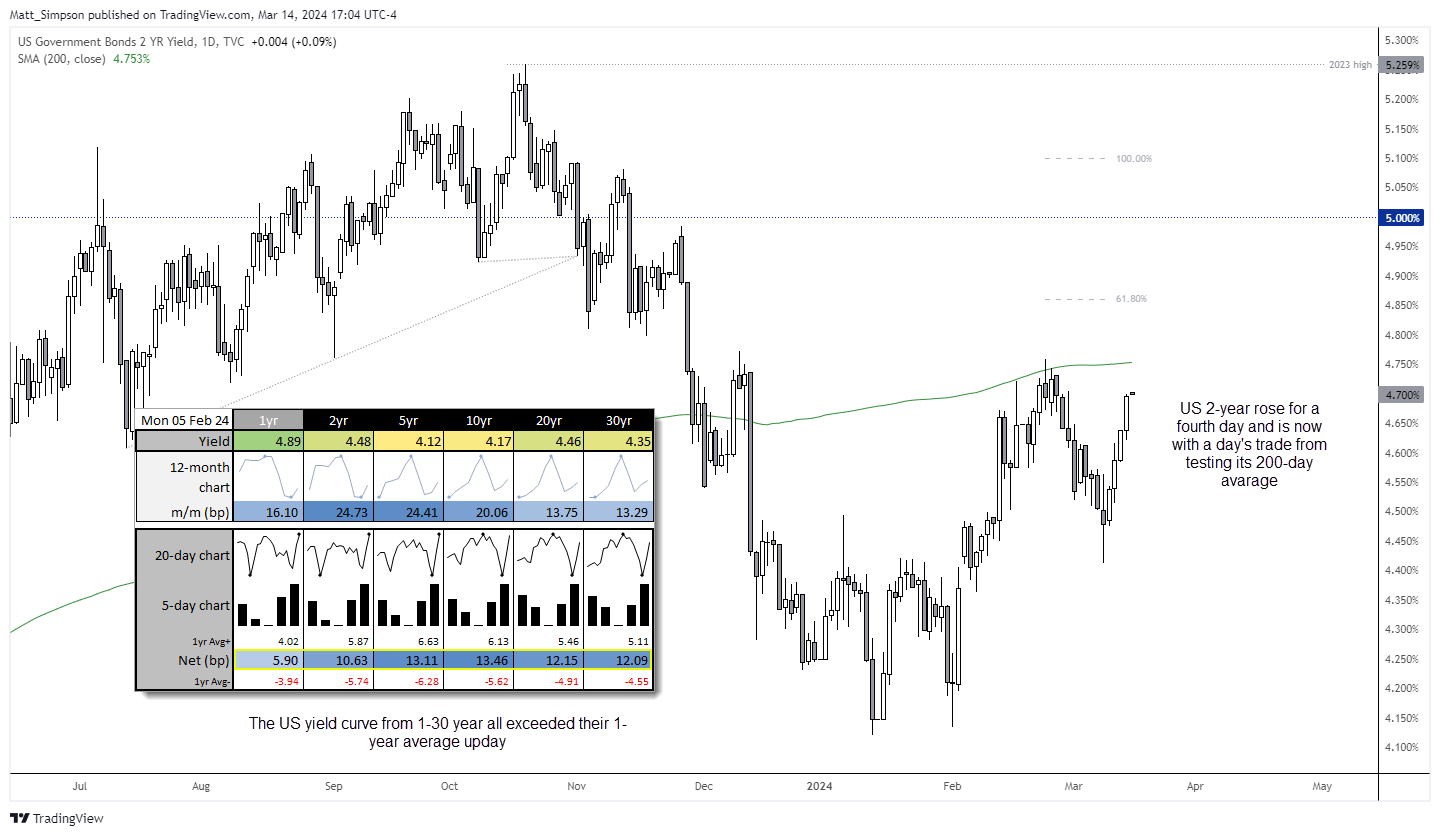

- The US yield curve rose for a fourth consecutive day and the US 2-year is less than a day’s trade away from its 200-day average. The entire curve form the 1-year to 30-year exceeded its 1-year average up day.

- Clearly, this means the US dollar was the strongest of the session whilst AUR/USD and EUR/USD were the weakest.

- GBP/USD reached my bearish target outlined yesterday, to complete the rising wedge formation on the 1-hour chart.

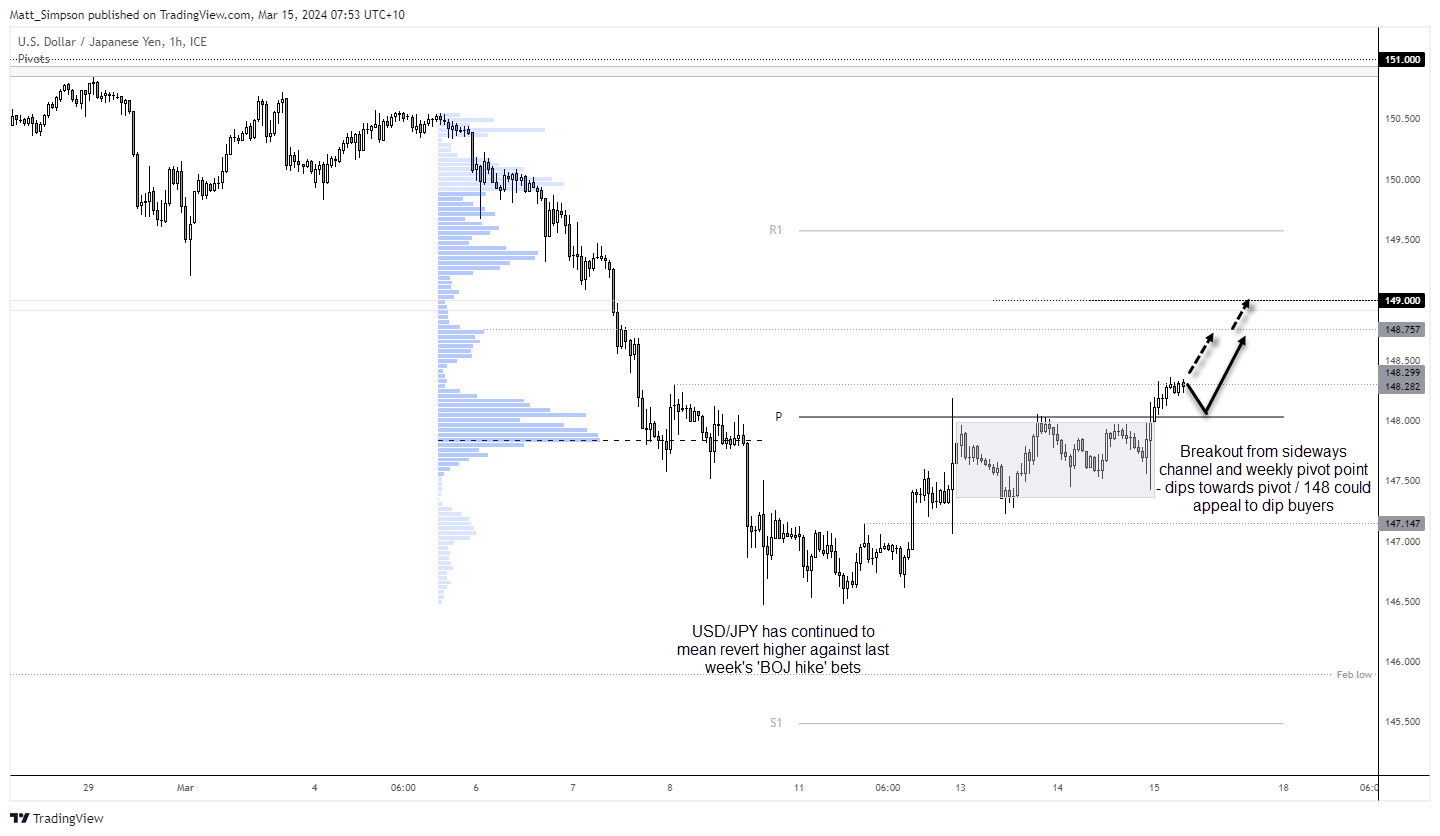

- USD/JPY rose to a 5-day high on route to my 149 target, although it remains debatable as to whether it will have the juice to reach that level by the weekend given FOMC and BOJ meetings are pending (subject to profit taking). But it could see some upside today.

- AUD/USD closed beneath its 200-day EMA and below 66c during its worst day in two weeks

- Gold has held up surprisingly well, and remains above its prior record high of 2146.79. It seems that gold has at least entered a period of consolidation, as things are getting choppy at the top – not a market I’d like to be long at but would be keeping tabs on potential shorts.

- WTI crude broke above $80 in line with yesterday’s bias, despite the stronger US dollar. However, once again we see lower daily volume which makes me feel a tad uneasy.

- Wall Street indices were broadly lower with the Dow Jones and S&P 500 forming a prominent bearish engulfing days, and whilst the Nasdaq was lower it held above its 20-day EMA.

Events in focus (AEDT):

- 08:30 – New Zealand PMI

- 11:00 – Australian inflation expectations (Melbourne Institute)

- 12:30 – China house prices

- 15:30 – Tertiary Industry Activity Index

- 21:00 – China new loans, social financing, M2 money supply

- 23:30 – US import prices, NY Empire State Manufacturing

- 23:30 – Canadian wholesale sales

- 00:15 – US consumer sentiment, inflation expectations (Michigan University)

- 00:15 – ECB Lane speaks

USD/JPY technical analysis:

The stronger US dollar helped USD/JPY continue to mean revert higher against the ‘BOJ hike’ bets of last week. A series of higher lows has formed on the 1-hour chart and prices broken out of a sideways channel and above the weekly pivot point. Resistance was met at the Feb 8 high, but I see the potential for another crack higher today – and if a rally is clean it could reach the 149 target outlined earlier in the week. However, as we approach the weekend be aware of mean reversion as ‘profit taking’ ensues.

Today’s bias remains bullish above 148, so any dips towards it could enable bulls to enter on anticipation of a breakout above 148.30. The volume node and 148.75 and 149 are upside targets.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade