In October, employment fell by -46.3k, with the unemployment rate rising from 4.6% to 5.2%. The timing of the survey predated the reopening of NSW, Victoria, and the ACT in Mid-October, explaining the weakness.

The November Labour Force report will capture the full impact of eased restrictions along the Eastern seaboard. Employment is expected to rise by +200k, accounting for 60% of the 333k jobs lost during the lockdown. A surge in the participation rate is expected to limit the fall in the unemployment rate by 20bp to 5%.

As with most Covid impacted jobs data, there is a reasonably wide range of forecasts, starting at +150k and extending to as high as +300k.

The Australian Treasurer will deliver MYEFO, including updated economic growth forecasts and revisions to the fiscal numbers since the annual budget was handed down in early May. The budget deficit for 2021/22 is expected to be revised down from -$106.6bn to -$117bn due to the cost of lockdowns.

Notably, the Government recently bought forward the timing of its next year's annual budget to March 29th, indicating the next Federal Election will be held in May.

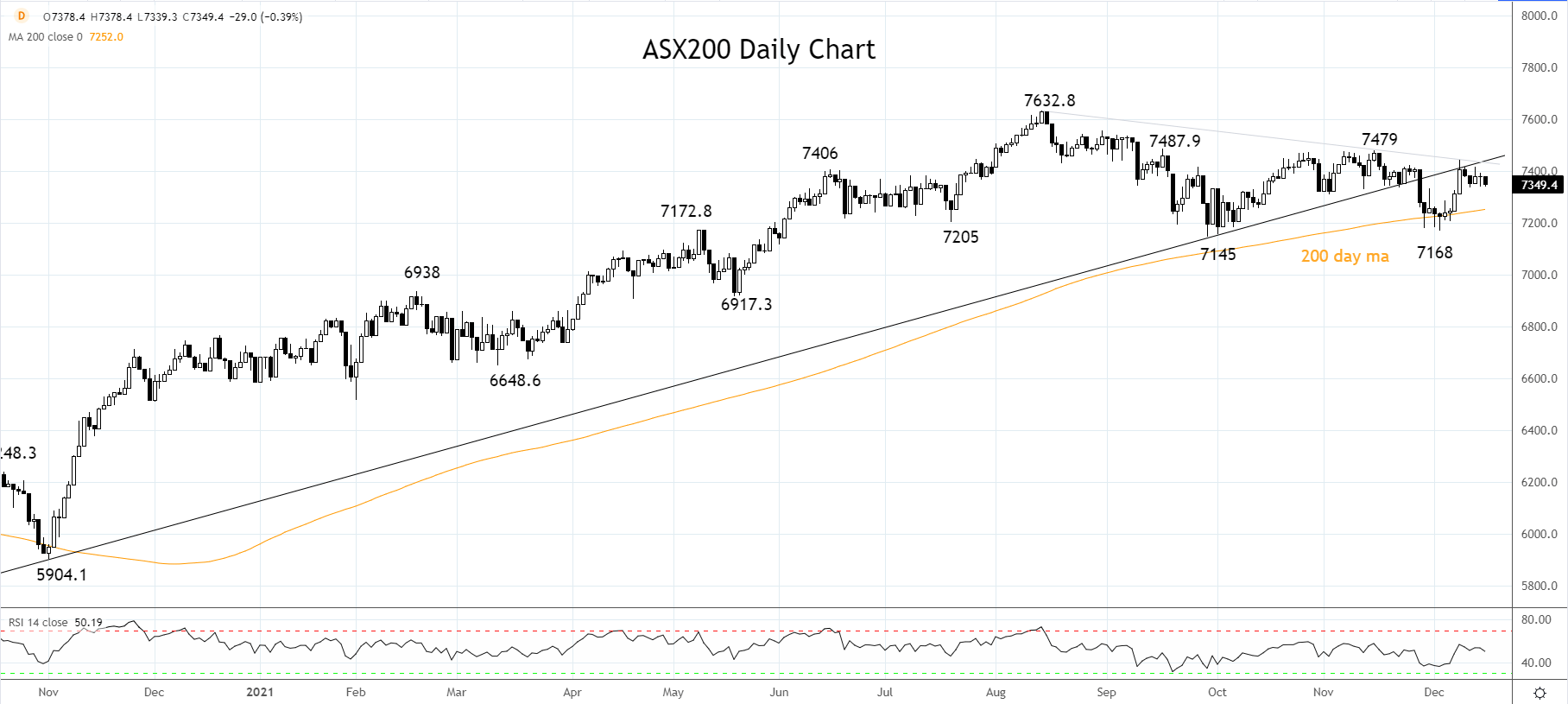

The ASX200 appears to have based near the 200-day moving average as written about here in early December. However, some nervousness ahead of tomorrow’s FOMC meeting has delayed the recovery and the final confirmation of a rally into year-end.

Technically, a move above the confluence of trendline resistance at 7420/40 and the layer of horizontal resistance at 7480/90 is needed to confirm the correction from the August 7632 high is complete and the uptrend has resumed. Aware that should the ASX200 first lose the support 7165/45 area, it would warn a deeper decline towards 7000 is underway.

Source Tradingview. The figures stated areas of December 15th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade