Key takeaways

- The newest companies to have gone public, including Arm, Instacart, Klaviyo and VinFast, have struggled to gain ground since their IPOs, with some now below their listing price.

- We believe the valuations boasted by all four stocks could continue to be tested in the near-term.

- Birkenstock will be the next well-known company to go test the waters, but will its valuation ambitions cause it to follow a similar path?

- Several potential blockbuster IPOs remain in the pipeline – including Stripe, Reddit, Discord and Databricks – but many could push their plans into 2024.

How have the latest IPO stocks performed?

The IPO market had been in a drought for two years as unfavourable market conditions deterred companies from going public, but it has been revived in recent months after a number of big names took the plunge, including Vietnamese carmaker VinFast, British chip designer Arm, grocery tech and delivery firm Instacart and email marketing specialist Klaviyo.

Let’s have a look at how these four have performed since listing…

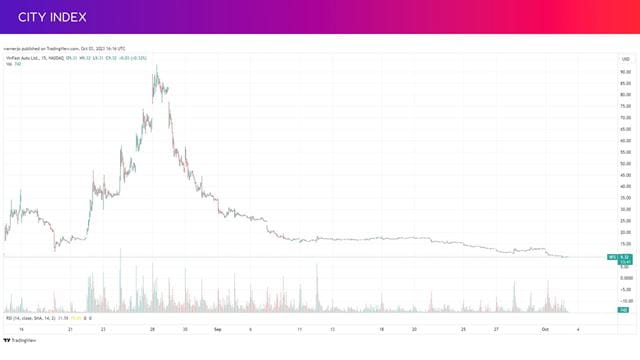

VinFast stock: $140 billion bubble has burst

Vietnamese electric vehicle maker VinFast has given investors a rollercoaster ride since listing in the middle of August, but one that most will have found stomach-churning.

In fact, VinFast’s start to life as a public company has been a textbook example of the worst-case scenario for IPO investors, many of which will have been caught up in the buying frenzy we saw upon listing only to have seen their gains quickly wiped-out. The stock, which went public through a SPAC merger, opened at $22 per share when it went public on August 15 and then swiftly spiked to as high as $93. Today, it is below $10!

That means we have seen the company’s valuation go from $23 billion under the SPAC deal, to $65 billion when it listed, to almost $160 billion when it peaked in late August, back down to less than $22 billion today. That is a mighty bubble that quickly inflated and then burst within just a matter of weeks – and many investors will have been burned in the process.

It is unsurprising that VinFast’s valuation is falling, and there is an argument that the selloff has further room to go. It was briefly one of the most valuable automakers in the world when its price peaked, despite being deep in the red and only producing tens of thousands of electric vehicles each year. It is still boasting a highly lofty valuation multiple even after the recent selloff. It trades at about 32x annual sales based on its most recent annual figures covering 2021 – and revenue was tracking lower year-on-year in the first nine months of 2022. That multiple is higher than most regional rivals and is also elevated when you compare it to a US company like Rivian, which is a very different business but also one producing about the same amount of cars as VinFast right now.

The fact VinFast only has a tiny free float – with the company still ultimately in the hands of billionaire Pham Nhat Vuong – means it is also highly vulnerable to sharp and volatile movements, which we have already seen play out.

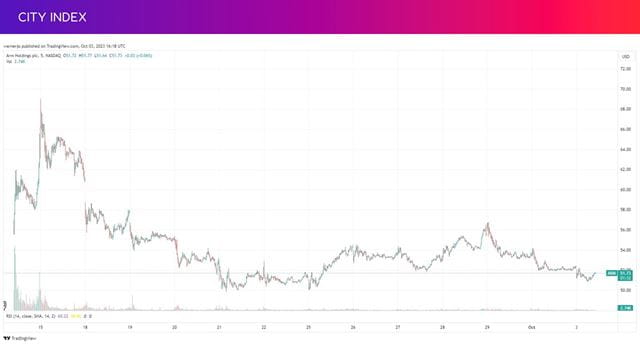

Arm stock: Premium valuation is holding, for now

British semiconductor designer Arm was the most eagerly-anticipated IPO of 2023, having already earned its credentials when it was a public company before it was taken private back in 2016 and operating in one of the hottest spaces in tech. It came to market as a profitable business that dominates in the smartphone market and boasts an impressive customer base that includes major names from Apple to NVIDIA, with growth prospects underpinned by the likes of AI.

That means it should have wide appeal and suggests it is capable of attracting investors that want defensive qualities as well as those pursuing growth. This initially proved true considering the rampant buying we saw when it started trading. However, these early gains quickly disappeared and it has struggled to stay above its IPO price of $51 ever since. That is because the strong demand for shares during Arm’s IPO roadshow encouraged it to list at the top-end of its target range, setting the bar higher, and because it came to market with a very lofty valuation at over 100x earnings!

Arm has tried to justify this valuation with a new strategy aimed at improving growth and profitability by designing custom-made chips that can be used for more advanced applications, like AI, but its valuation remains stretched based on the business today that is centered on supplying more basic chip designs for smartphones and consumer electronics.

As a result, we can see markets have refused to assign too much more value to Arm shares for now, although it has swiftly rebounded whenever it has slipped below its IPO price so far. Plus, with a new strategy comes new risks and Wall Street has been equally cautious about Arm’s valuation. Of the three brokers to have initiated coverage on the stock, as per a consensus compiled by Refinitiv, two have told investors they see limited-to-no upside potential from its IPO price while one has said it is a strong sell. It appears Arm did well to build the hype during its roadshow, but has yet to convince the markets.

You can read our in-depth analysis of the company in Can Arm Maintain or Grow its Premium Valuation?

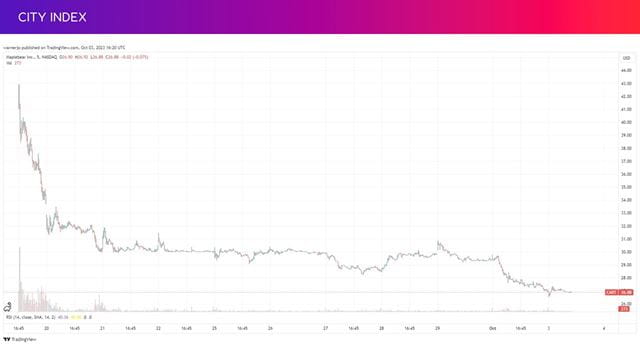

Instacart stock: An early casualty

Instacart has experienced one of the toughest starts to life as a public company despite coming to market with one of the most sensible valuations we have seen in years. It only took seven sessions for the company, which supplies tech and delivery services to the US grocery industry, to slip below its $30 IPO price and it remains below here today, having hit as low as $27.40.

That means investors can snap up shares in Instacart today at a cheaper price than those that invested in the IPO. Sentiment has been hurt by an unwelcoming reception from Wall Street. Of the four brokers that have initiated coverage so far, all of them have given it a Hold rating and warned they see limited upside potential. That suggests markets may struggle to get excited about Instacart until a new catalyst emerges or it releases its first set of results.

It is also worth noting that Instacart’s valuation may have been flattered by the rapid growth it saw during the pandemic and the 18-months of profit it has under its belt. However, the tide is turning as growth slows, competition intensifies and it prepares to sink back into the red, setting a challenging outlook for the stock in the near-term.

You can read our in-depth analysis in Slowdown and Losses Will Test Instacart’s Valuation.

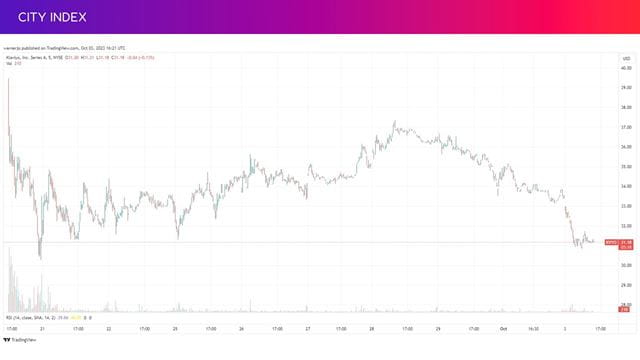

Klaviyo stock: Will it follow the same path?

Klaviyo, the most recent big-name IPO, looked like it was going to be the shining star out of this year’s debutants after a brief rally but it is now looking at risk of following a similar path to its newly-listed peers.

The stock went public on September 20 at $30 and, like others, saw a short-lived buying frenzy upon listing before swiftly reversing. It managed to rebound and climbed over $36, but has now lost ground for three consecutive days and is only marginally above its listing price.

It is the only big-name IPO stock that is yet to flirt with its listing price, although the current trajectory and the sharpness in decline we have seen over the last three sessions suggests that the risk of it slipping below that $30 threshold is rising.

You can find out more about the email marketing company in Everything You Need to Know About the Klaviyo IPO.

IPO market outlook: What to expect in Q4 2023

The IPO market has come back to life over the past month following a flurry of big-name listings. While it is clear companies are becoming more confident about facing the scrutiny of the public markets following a volatile few years, the jury is still out over whether there is appetite among investors, many of which remain haunted by the poor performance seen by so many companies that demanded sky-high valuations when they listed between 2019 and 2021.

We know there is already a strong pipeline of companies that are yet to reignite their listing plans after shelving them because of the uncertain times seen during the pandemic, including payments firm Stripe, discussion platform Reddit, messaging app Discord, software outfit Databricks and financial services firm Chime.

We have also seen news that more companies are also preparing to launch their listing plans now that the market is settling, with speculation circling that online travel management firm Navan and IT services company BMC Software are among those preparing IPOs.

However, we think the uncertain economic landscape and the uninspiring performance by the newest additions to the US markets may keep many companies, especially smaller ones chasing growth, cautious about listing and that many in the pipeline may be pushed into 2024. For now, the IPO market is best suited to larger and more profitable businesses that can shine even during tougher economic times. Those hoping to underpin their valuations with growth prospects are better off waiting as long as they can in the hope of better conditions over the horizon.

You can keep up to date with our latest insights into new listings using the IPO hub.

Still, we haven’t seen the last listing of 2023…

Birkenstock IPO will be next to test the waters

Next up to test appetite in the IPO market is likely to be German sandal maker Birkenstock, which could go public as soon as this week or next after filing plans to list its shares between $44 and $49 per share. The top-end of that range set to value the company at about $9.2 billion (or $9.9 billion on a fully-diluted basis).

The investment case for Birkenstock is that is a brand that resonates around the world and tends to have loyal customers that keep coming back to buy more shoes and sandals, all of which are made in its own production facilities to ensure it stays on top of quality.

That suggests Birkenstock will come to market with a valuation that is equal to about 7.4x annual sales and 49x full-year net income based on its fiscal 2022 results. The fact profits plummeted in the most recent interim period covering the six months to the end of March 2023 suggests the PE ratio would be even higher based on forward estimates. That looks elevated when compared to some other footwear companies on the market. For example, Crocs trades at less than 2x forward sales and Skechers multiple sits at just 1.0x, while Birkenstock’s PE ratio is also about twice as high as powerhouses like Nike.

You can find out more in Everything You Need to Know About the Birkenstock IPO.

How to trade IPO stocks

You can trade Arm, Instacart, VinFast and Klaviyo just like any other stock and will be able to trade shares in Birkenstock and other IPO contenders once they have gone public. You can get started in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the stock you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.