- Gold analysis: What factors have contributed to the metal’s ascend?

- Coming up later in the week: Powell testimony and February jobs report

- Gold technical analysis point higher

Gold extended its rise for the fifth consecutive trading session today and came to within less than $5 of reaching December's record high of $2146, before easing back a little.

Gold analysis: Why has the metal risen so much?

Gold’s rally has been fuelled by speculation surrounding a potential shift in Federal Reserve policy and lingering geopolitical uncertainties that has bolstered demand for the precious metal, seen as a haven asset. There have also been some concerns about a possible downturn in equity markets, especially in the technology sector following the recent eye-watering gains. Investors have also increased their bets that the Fed will be cutting interest rates. We have seen weak US manufacturing data on Friday, while the ISM services PMI today also came in below expectations with the employment component hinting at the risk of job losses in coming months. Another factor supporting gold has been momentum – traders like buying things that go up.

Gold analysis: Can the rally last?

One must caution against the excess nature of the rally, with the metal rising by about $100 in just 5 days. Clearly, some traders have been trying to take advantage of momentum, buying just because the metal has been going higher. With the US dollar holding its own relatively well against most major currencies, and government bond are still providing high yields, gold may not be able to sustain this rally for too long.

Coming up

We will have more data to look forward to later this week, including the all-important monthly jobs report on Friday. What’s more, Fed Chair Powell will testify on Wednesday, which could also trigger a move in the dollar and therefore impact gold prices.

Although the exact timing of the Fed’s rate cut remains uncertain, futures markets indicate a nearly 60% probability of a 25-basis point trim in June. Lower interest rates typically favour gold, which does not generate interest income. This means that if the timing of the first interest-rate cut gets pushed back, say because of strength in data, then that could hurt gold.

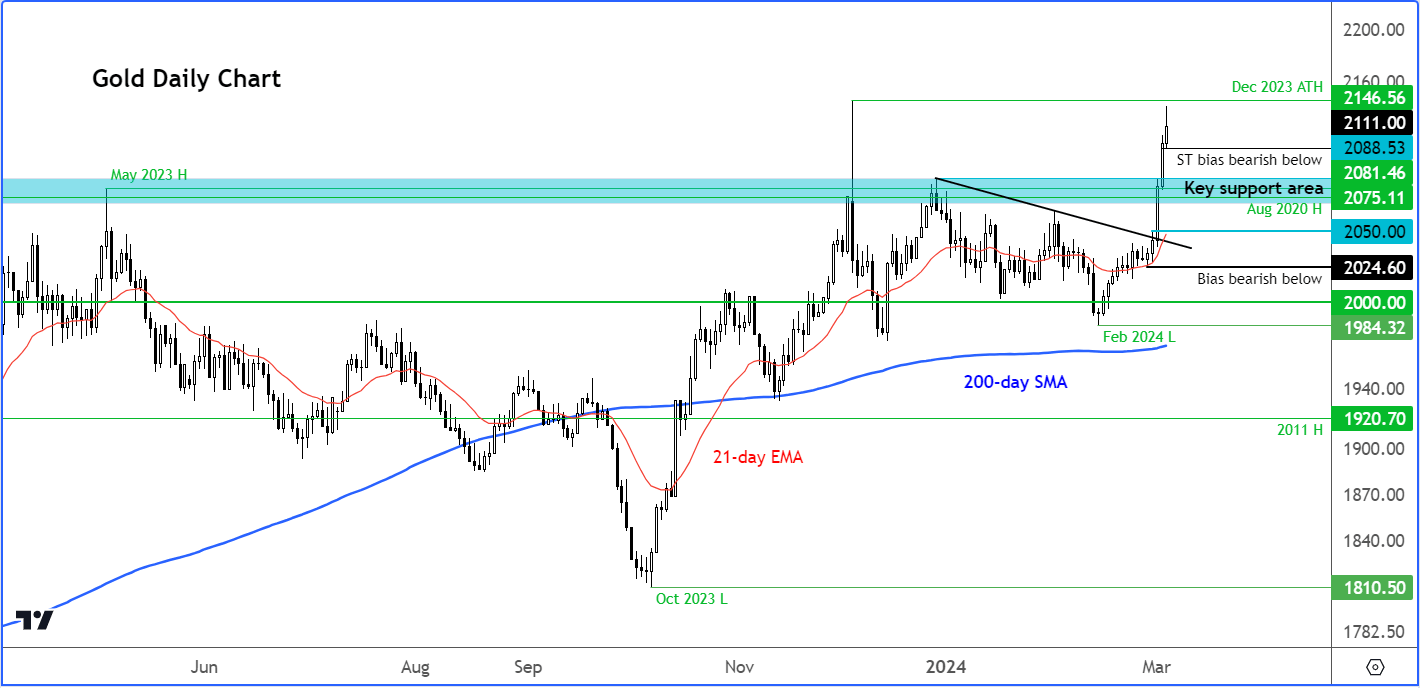

Gold technical analysis

Source: TradingView.com

The momentum is clearly bullish and the XAUUSD chart suggests it may well follow the footsteps of Bitcoin to hit a new high soon. But as we saw with Bitcoin, the rally was short-lived, with BTC falling some 5% immediately after hitting a new record high. Profit-taking alone has the potential to cause gold to move sharply lower from around these levels, and it doesn’t have to get to a new high to trigger withdrawal of bids.

Keep a close eye on short-term support levels including $2120 area, which now needs to hold to keep the bulls in full control of short-term price action. However, if a few short-term support levels break down then we could see another typical rug pull. Specifically, a move below today’s earlier low at $2110 could send the metal plunging back down towards key long-term support area around $2075 to 2088 area.

On the upside, meanwhile, the high from December at $2146 is out only point of reference to guide our trading decisions. If that level breaks, then watch out for Fibonacci extension levels and key round handles like $2150 to potentially offer soe resistance.

All told, the path of least resistance is clearly to the upside, but with prices over-extended, a short-term correction should not come as a shock.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade