- Gold analysis: Dollar weakens as focus turns to Powell testimony

- Gold technical analysis suggests metal is about to hit a new high

Gold analysis video and insights into silver, crude oil and indices

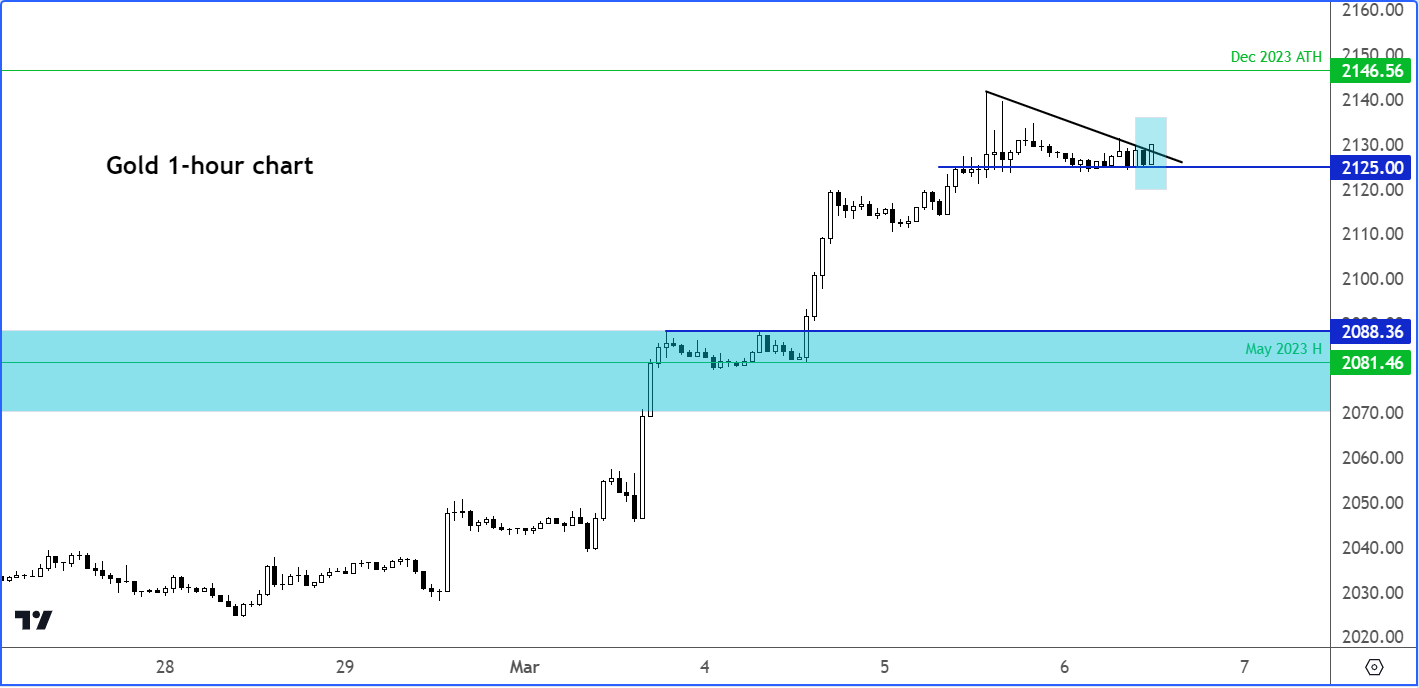

Gold closed at a new record high on Tuesday but stopped short of hitting a new all-time high. It may be just a matter of time before we get there, judging by recent price action, momentum and supportive macro factors. We have a few important macro events to look forward to from the US this week, including key employment data and Powell’s testimony. Unless the Fed Chair is markedly hawkish or we see significantly strong US data, gold could break above December’s high of $2146, and rise to fresh unchartered territories.

Gold analysis: Dollar weakens as focus turns to Powell testimony

Ahead of the ADP private payrolls data and Fed Chair Jerome Powell’s testimony, the Dollar Index had extended its losses for the third week, drifting below the 200-day average at 103.70ish.

Powell recently pushed back against early rate cuts thanks to a slew of stronger-than-expected US data. That didn’t stop investors from pushing asset prices higher. The market is now expecting a rate cut to come by June, instead of March. There has been slight weakness observed in more recent data, although the key highlight is Friday’s jobs report.

The Fed chair is unlikely to pre-commit to anything ahead of key data releases, but the pressure is growing to lower interest rates as the US and most other developed economies’ debt load is rising by an alarming rate. There are concerns that these nations will be unable to maintain high interest rates for long. Governments face spending far more on servicing their debt, while the potential for an economic downturn would require even more borrowing at elevated interest rates.

Perhaps this is part of the reason why the dollar has started to ease back, and more so why we have seen record closing highs for gold, a safe haven asset. Major FX pairs like the GBP/USD and EUR/USD have also started to push higher lately, but not by much as the UK and Eurozone economies also face similar debt issues as the US. Bitcoin hit a new all-time high above $69K on Tuesday, further highlighting investor concerns about fiat currencies that are being devalued by high inflation and record borrowings. US indices weakened on profit taking after rising to repeated all-time highs in recent weeks.

Gold analysis: Technical levels and factors to watch

Source: TradingView.com

Gold is now up for the sixth day, and while it may appear ‘overbought’ price action continues to exhibit bullish characteristics. Take the hourly chart, above, as an example. The metal has spent several hours consolidating its recent gains, allowing it work off its extreme overbought conditions through time than price action. This is bullish. It has now started to push higher again, breaking the short-term bearish trend line. Short-term support at $2125 held. There’s now little in the way of further resistance until the record high of $2146. Even if we were to see a bit of choppiness later in the day, there are stronger and more significant support levels below that could limit the downside. But on this hourly time frame, it looks like a run to a new all-time high is now imminent.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade