EUR/USD holds above 1.0650 as the mood steadies

- Geopolitical tensions calm after Iran attacked Israel at the weekend

- Fed – ECB rate divergence could limit the upside

- EUR/USD falls to 1.0622 YTD low

- EUR/USD is inching higher after falling to a YTD low on Friday of 1.0622.

Improving risk appetite and a subdued US dollar are supporting the pair as the markets weigh up the escalation in Middle East geopolitics over the weekend.

Over the weekend, Iran retaliated against Israel, launching drone and missile attacks. These appeared to be more of a symbolic attack given the advance notice allowing measures to prevent casualties. President Joe Biden has also told Israel that he will that the US will not participate in a retaliatory move by Israel.

Gains could be limited given diverging Fed- ECB rate cut expectations after the ECB signaled to a June cut, whilst hotter than expected US inflation data means the Fed is likely to keep rates high for longer.

Looking ahead, attention will be on eurozone industrial production data, which is expected to increase 1.1% in February after falling 3.2% in January. Stronger-than-expected numbers could help support expectations of an improving economic outlook.

ECB chief economist Philip Lane is also due to speak, and any commentary regarding the path of interest rates or signaling to a June rate cut could impact the euro.

Meanwhile, March US retail sales figures could also influence the Federal Reserve’s path for interest rates. Retail sales are expected to rise 0.3% in March after rising 0.6% in February. Strong retail sales could add evidence to the view that the U.S. economy remains resilient despite high-interest rates.

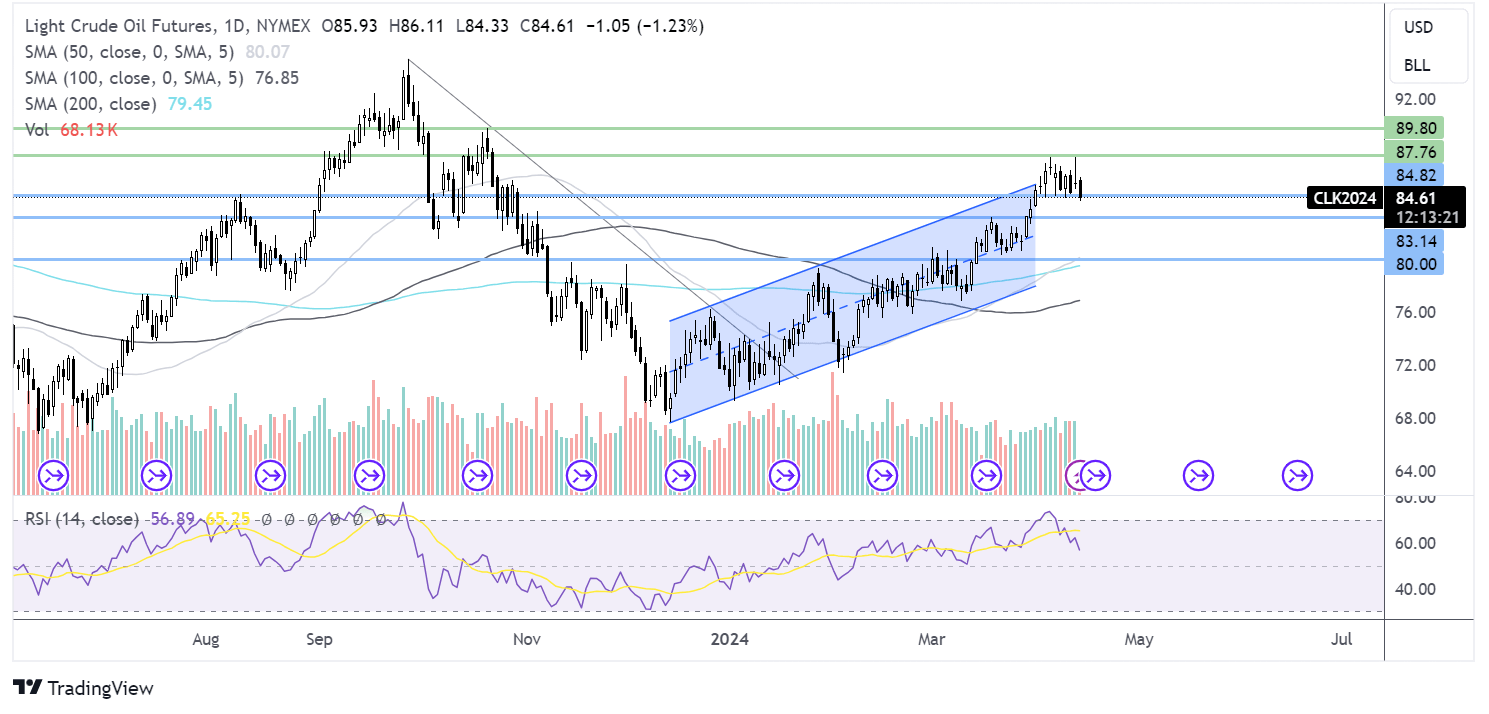

EUR/USD forecast – technical analysis

EUR/USD has fallen to a low of 1.0622, just below the May 2023 low and has steadied just above these levels. Sellers, supported by the RSI below 50 will look to break below 1.0622 to head towards 1.0525 and 1.0450 the October 2023 low.

Any recovery would need to rise above the 1.07 February low to extend gains towards 1.0725.

Oil prices fall as geopolitical tensions steady.

- Iran attacked Israel in a forewarned move

- The US has said that it won’t support a retaliation by Israel

- Oil trades in a holding pattern

Oil prices are falling at the start of the week after booking solid gains in the previous week and as the market reined back risk premiums following Iran's attack over the weekend.

Iran attacked Israel with over 300 missiles and drones but gave plenty of warning regarding the attack, which was in retaliation for an air strike on its Damascus consulate.

The attack caused only modest damage, with most of the missiles shot down by Israel's defense system.

The attack had been largely priced in at the end of last week, which, combined with the fact that there was also limited damage and no loss of life, means that any retaliation from Israel is likely to be limited. The fact that the US is not supporting a retaliation adds to the view that Israel may not respond, although that's not to say a retaliation is entirely off the table.

Iran is a major producer within the OPEC group, so supply risks or more strictly enforced sanctions could be a concern should the conflict ramp up further.

For now, it would appear that the markets are just waiting to see how Israel responds, which could determine whether the escalation ends or continues.

Any sense that the escalation will ramp up further could increase oil prices, which is the last thing that central bankers will want to see as they fight inflation.

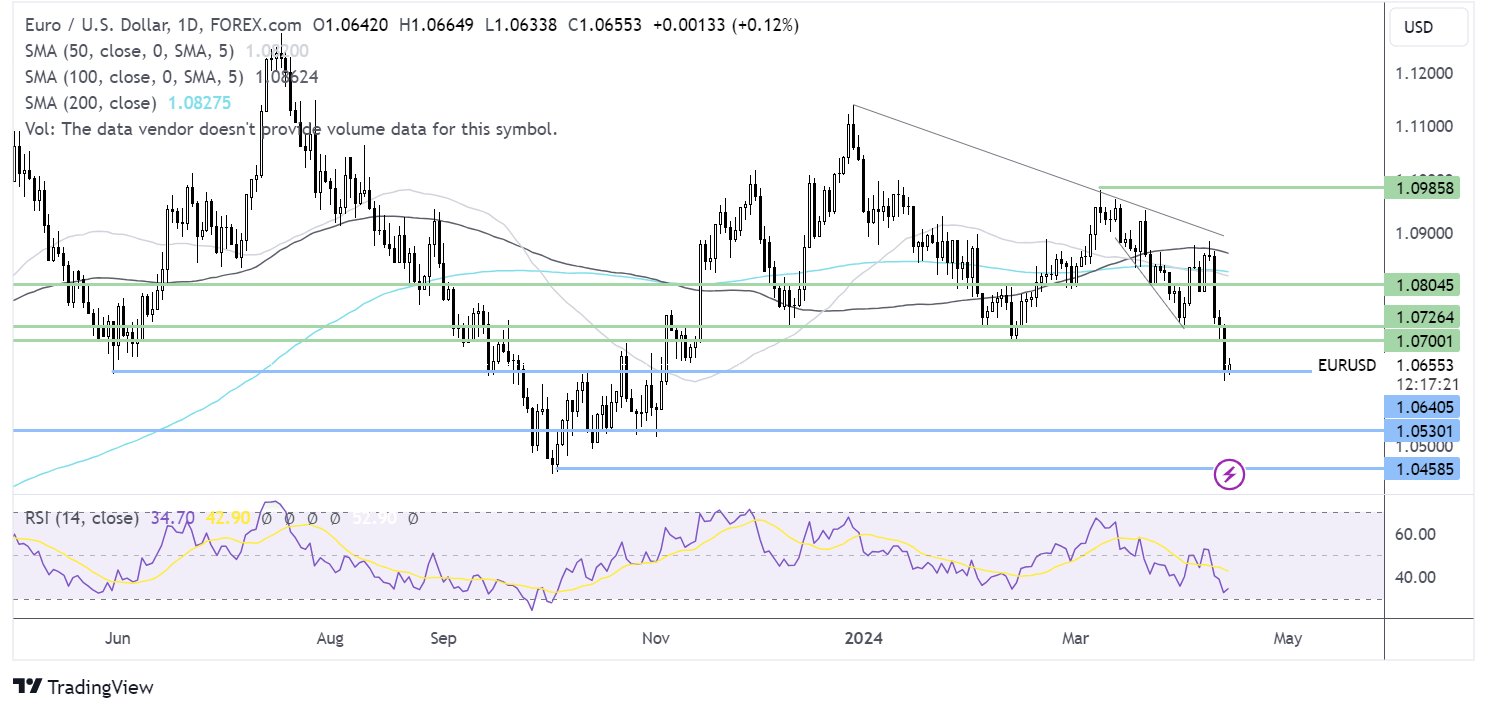

Oil forecast – technical analysis

Oil prices are consolidating after a strong rise across the start of the year. The price is capped on the upside by 87.70 on the upside and 85.00 on the downside.

Sellers will look for a move below 85.00 to extend the selloff towards 83.10 at the March high.

Buyers will look to rise above 87.70 to head towards 90.00 and fresh higher highs.