DAX rises to a record all-time high after Nvidia results & despite mixed PMIs

- Nvidia’s quarterly revenue soars on AI demand

- German PMIs are mixed with manufacturing activity slumping

- DAX rises to a fresh all-time high

The DAX and its European peers are starting on the front foot, tracking Asian Markets higher after surging profit at the AI bellwether Nvidia has boosted the market mood.

Nvidia’s results have been the most keenly awaited earnings report, and they didn't disappoint with a surge in quarterly revenue amid soaring demand for its AI chips.

Optimism surrounding the AI rally has fueled risk appetite, helping to push the DAX to a fresh all-time high.

Meanwhile, mixed PMI data doesn't appear to have dented the mood. German manufacturing activity slumped, with the PMI falling to 42.3, down from 45.5. Although the service sector showed signs of improvement, contracting at a slower pace. The PMI rose to 48.2 from 47.7. The composite PMI was slightly weaker at 46.1, down from 47, highlighting the struggles within the German economy and pointing to an ongoing recession at the start of the year.

The minutes of the ECB meeting will be released later today, and we could see central bankers reiterating that it is still too early to start cutting interest rates. However, the market seems to be supported by the view that the next move by the ECB will be a rate cut at some point in the first half of this year.

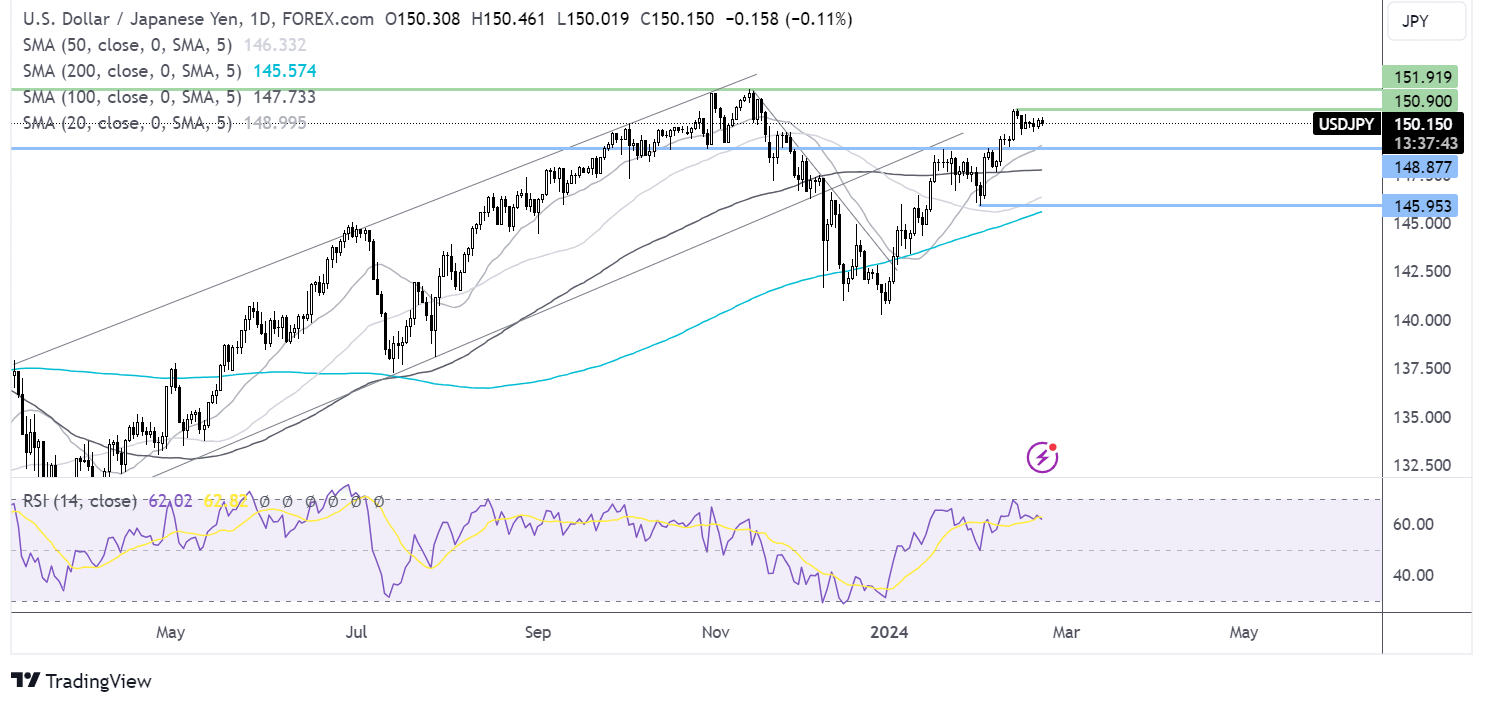

DAX forecast – technical analysis

After a period of consolidation, the DAX is pushing on to fresh all-time highs at 17250. It trades above the rising trendline, and the RSI supports further upside while it remains out of overbought territory, with 17500 now in focus.

Buyers will dominate while the price remains over 17000. A move below here negates the near-term uptrend and could open the door to a selloff towards 16800. Below here, 16400 comes into play.

USD/JPY slips ahead of US PMIs & post FOMC minutes

- US PMIs to show growth eased slightly

- Fed minutes reiterated the Fed is in no rush to cut rates

- USD/JPY consolidates around 150.00

The USD/JPY is consolidating around 150.00 on Thursday as investors weigh up weaker-than-expected Japanese PMI data and as traders look ahead to U.S. business activity surveys and jobless claims.

The flash PMI index is expected to show that the US services and manufacturing sectors grew at a slightly slower pace in February—the services PMI is predicted to be 52, down from 52.5 in January. Meanwhile, the manufacturing PMI is forecast at 50.5, down from 50.7. Both indices remain above the key 50 level, which separates growth from contraction, bringing upside pressure for growth and inflation, supporting the Fed's view that rates will need to stay high for longer.

The figures come after the minutes of the latest Federal Reserve meeting released yesterday reinforced the message that a central bank is in no rush to start cutting interest rates. However, officials still expect rate cuts to begin at some point this year. The minutes offered nothing new for traders to sink their teeth into, which would explain the muted reaction.

Meanwhile, the Japanese PMI's showed that manufacturing contracted more than expected at 47.2, down from 48, and the services PMI eased from 53.1 to 52.5. The data doesn't give The Bank of Japan much incentive to raise interest rates.

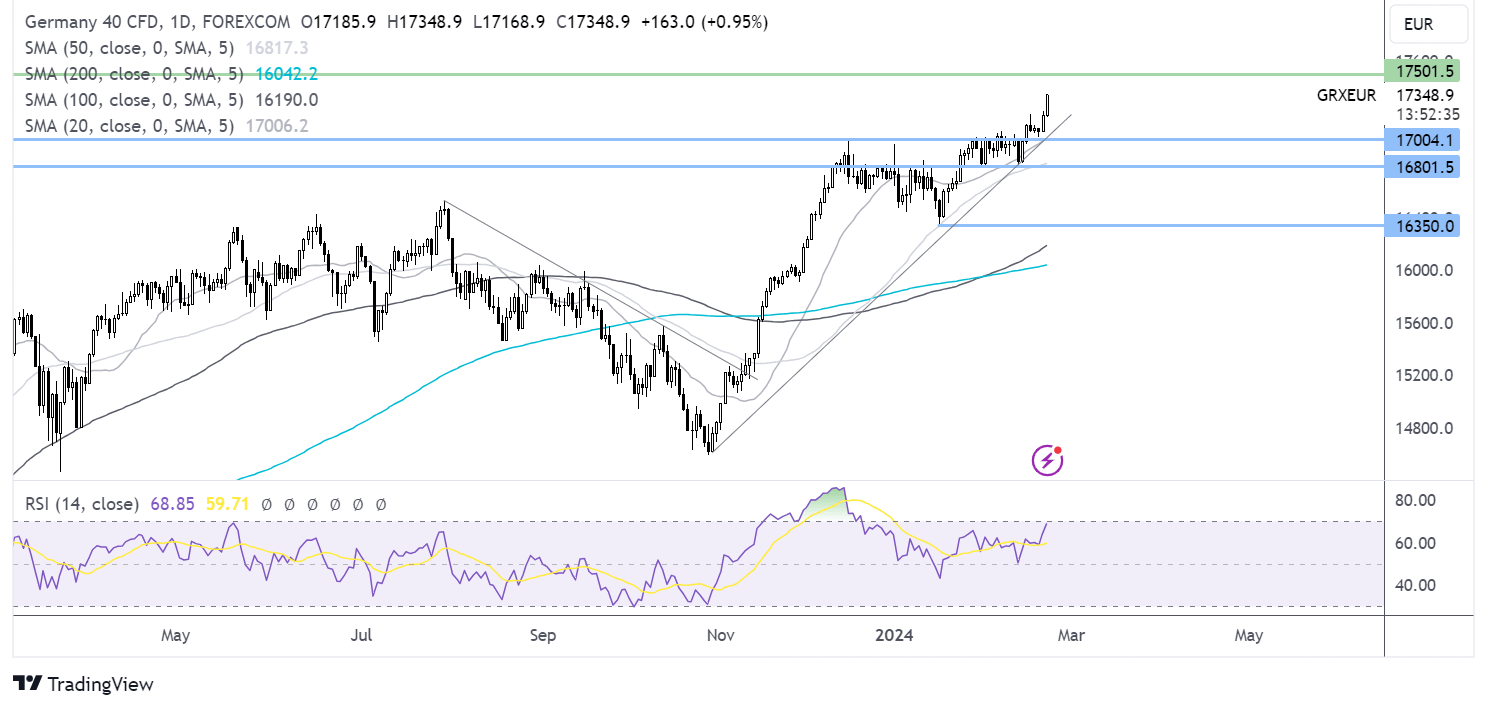

USD/JPY forecast – technical analysis

USD/JPY continues to consolidate around 150.00. Buyers will be looking to rise above 150.90, the February high, to retest 152.00, the November high, and a multi-decade high.

On the downside, support can be seen at 148.00, the mid-January high, and the 20 SMA. A break below here opens the door to 146.00, the February low.