- DAX analysis: German index hurt by Chinese and domestic weakness

- CNH and RUB among EM currencies selling off, reducing risk appetite

- US retail sales and Canada’s inflation report up next

- DAX technical analysis point lower

Risk off is the key theme in the markets right now and we are seeing stock averages continue to struggle. Despite yesterday’s tech-fuelled rally, US futures have been dragged lower by weaker European and Asian markets. The FTSE 100 fell 1.4%, while the German DAX was off by around 1% at the time of writing by mid-morning EU trade.

EM currencies struggle, led by China’s yuan

The loss of risk appetite is also evident in falling emerging market currencies, led by China’s yuan with the USD/CNH (0.5%) reaching its highest level since November 2022 today. The US dollar continues to find support amid haven flows – albeit the likes of the EUR/USD and GBP/USD were trading slightly higher at the time of writing, with the latter being boosting by surprisingly strong UK wages data.

Still, the fact that copper and crude oil prices have weakened also reinforces the view that China is struggling, where private sector demand remains rather weak, even if air travel has picked up slightly.

So, it was hardly a surprise that the PBOC cut two key wholesale interest rates overnight, following the release of softer-than-expected inflation and credit data last week. And that decision was justified as retail sales, industrial production and fixed asset investment, all undershot expectations by some margin today.

It is not just the yuan. We have seen several other EM currencies weaken, helping to keep the dollar bid, with the greenback supported further by US bond yields remaining high. Market continues to see US dollar as a worthy safe haven asset.

One other currency to watch is the Russian rouble with the USD/RUB crossing the 100 level yesterday, before easing back somewhat after the country’s central bank hiked interest rates to 12% from 8.5%. They clearly do not like the fact the rouble fell to its lowest value in 16 months, which is helping to keep inflation high. The rouble’s recent weakness is mostly to do with the growing squeeze on Russia’s economy from Western sanctions, as well as a drop in export revenues. You also have a strengthening US dollar, with the Dollar Index now up for the fifth consecutive weeks, owing to the strength in the US economy and expectations the Fed will keep interest rates high well into 2024.

German economy stagnating

Domestically, the German economy is struggling. The nation’s economic ministry on Monday said: “…the expected cautious revival of private consumption, services and investment development are showing the first rays of hope, which are likely to strengthen over the course of the year. At the same time, the still weak external demand, the ongoing geopolitical uncertainties, the persistently high rates of price increases and the increasingly noticeable effects of monetary tightening are dampening a stronger economic recovery.”

ZEW survey bodes ill for DAX

Indeed, a leading survey of about 300 German institutional investors and analysts revealed that current conditions have deteriorated further, even if they are less pessimistic about the future. The German August ZEW survey current conditions printed -71.3, its lowest level since October. A reading of -63.0 was expected compared to the last print of -59.5. A reading below zero indicates pessimism. So, the fact that we saw a negative seventy-one reading goes to show how pessimistic investors are, which bodes ill for the German DAX index. That said, there was some improvement in the Expectations index to -12.3 vs -14.7 expected and -14.7 last. However, it too continues to remain in negative territory.

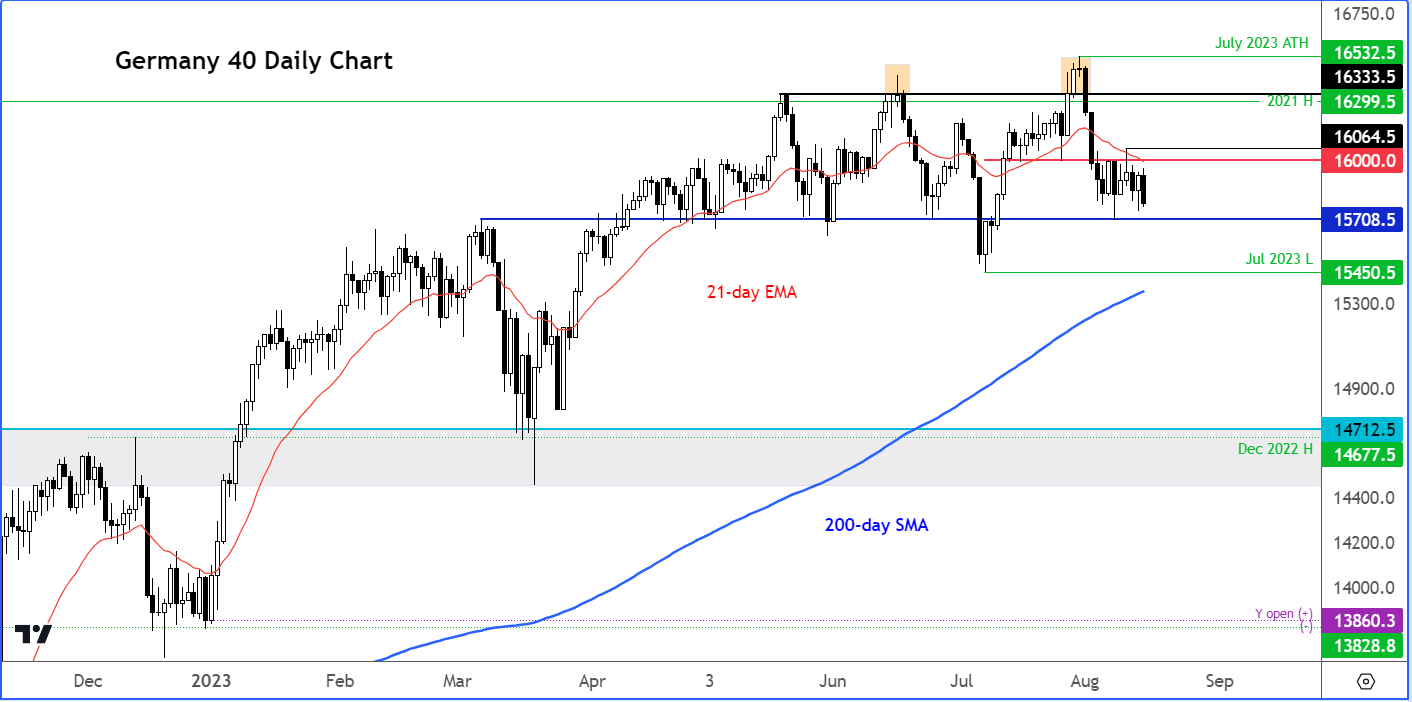

DAX technical analysis

With the DAX failing to climb back above the broken 16K support level a few days ago, this has kept the bears in control of price action. Therefore, it is very likely in my view that the index is going to retreat further in the short-term, with last week’s low at just above 15700 being the next target, with the bears possibly also eying a break below the July low at 15450 at some point this week. Below this level is where the 200-day average comes into play, and where we may see the index try to form a base around.

Source: TradingView.com

Anyway, the long and short of it is that we are in a “risk off” environment, with stocks down and dollar up. So, try not to fight this trend until the charts say otherwise. DAX will need to climb above that 16K level on a closing basis to trigger a bullish reversal or form a key reversal pattern at lower levels first.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade