The month of June has been another brutal one for cryptocurrencies. Instead of signs of thawing, the latest crypto winter has intensified.

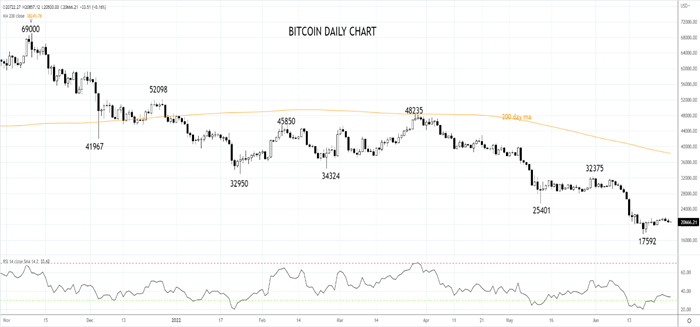

Bitcoin traded to as low as $17,592, a level it last traded in December 2020, and despite a modest recovery back above $20,000, it is still down almost 35% for the month.

Elsewhere, Ethereum recently traded to a low of $880, almost $4000 below its bull market high from last November, and despite rebounding back above $1150, it is down ~40% for the month.

The carnage in June has been attributable to two main events. Firstly, the release of higher-than-expected US inflation numbers on June 10, that was the catalyst for a break of the post-Terra crash lows and the Federal Reserve’s 75bp jumbo rate hike on June 16.

Secondly, rumours regarding the liquidity of Celsius, a major crypto borrow/lend platform and Three Arrows, a prominent crypto hedge fund. According to reports this morning, Three Arrows has defaulted on a loan worth more than $670 million to digital asset brokerage Voyager Digital.

Although there are concerns that the two names above are the tip of the crypto iceberg, the misadventures of these companies have now attracted buyer interest.

Goldman Sachs is said to be attempting to broker a $2 billion deal to buy the assets of Celsius. At the same time, Morgan Creek Digital is reportedly trying to raise $250 million to counter FTX’s proposed bailout of crypto lender Blockfi.

Would a deal trigger a crypto turnaround?

At this point, a potential deal like the two outlined above, would be viewed as an opportunity to buy beaten-up assets at distressed prices rather than signalling a turnaround in the digital asset space. A sustainable turnaround is not likely until the Fed pivot away from its aggressive rate hiking cycle.

What do the technicals say?

Evidence is lacking that Bitcoin and Ethereum have put in place tradable lows. Bitcoin needs to see a recovery back above resistance $29,000/30,000 to suggest the thawing of the crypto winter is underway. Ethereum needs to rebound above its Terra crash low of $1700.

Source Tradingview. The figures stated are as of June 28th 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.